The Impact of Energy Prices on High-Yield Bond Funds

Positioning within the high-yield energy sector will differentiate managers in 2015.

In the years coming out of the credit crisis, high-yield bonds were hard to beat. As global credit markets recovered and the U.S. economy enjoyed a period of steady, if moderate, growth, the high-yield Morningstar Category earned an annualized 16% return between 2009 and 2013. Default rates fell sharply after 2009 and remained low; with the exception of a brief stretch in 2011, funds that took the most credit risk ranked among the category's top performers. Many expected more of the same in 2014 with managers citing relatively solid credit metrics and a generally supportive economic environment. However, 2014 had a surprise in store. Energy prices started to tumble in July and had fallen about 50% from their June peak by the end of the year.

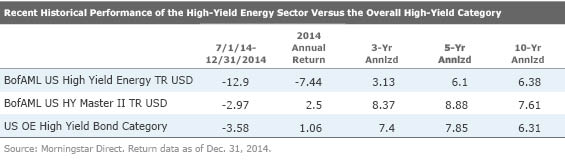

Few asset classes have been as directly affected by the energy market as high-yield bonds. High-yield bond funds returned a paltry 1.1% on average in 2014, the category's worst year since 2008, thanks to a rough second half. As shown in the table below, most high-yield bond funds declined in the second half of 2014, wiping out gains from the earlier part of the year. Interestingly, while BB rated bonds generally held up better than lower-quality fare in 2014--not surprising given that these bonds have stronger credit metrics and are also more sensitive to changes in broad market bond yields, which fell during the year--there was a wide dispersion of returns by sector, with energy sharply lagging the rest of the market. The category declined 3.6% during the last six months of 2014, with a 13% decline in the high-yield energy sector driving losses.

The Energy Tail Wagging the High-Yield Dog Energy companies borrowed heavily following 2008's financial crisis, taking advantage of new drilling opportunities, high oil prices, and low interest rates. According to data from J.P. Morgan, more than $1.9 trillion of new high-yield bond issuance occurred between 2008 and 2014. Of this, just more than 15%, or $290 billion, was issued by companies in the energy sector. As a result, the high-yield energy sector grew from 10% of the Bank of America Merrill Lynch High Yield Master II Index at the end of 2007 to near 15% at its peak in 2014. In comparison, the energy sector made up 8.4% of the S&P 500 as of Dec. 31, 2014.

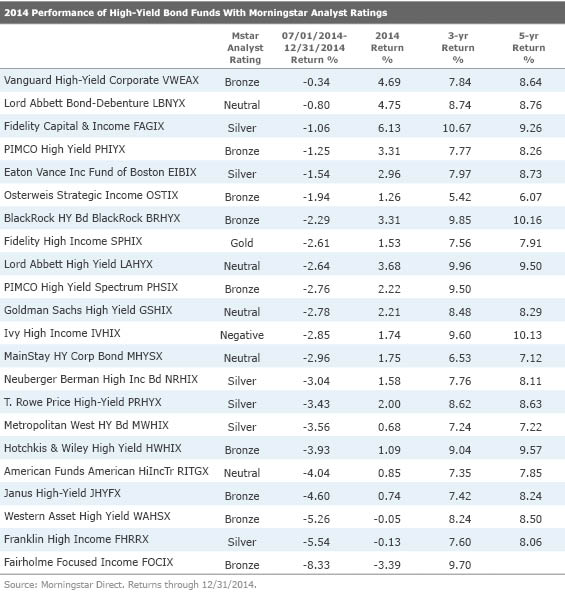

Not surprisingly, for junk-bond funds, performance in 2014 largely came down to the size and makeup of a fund's energy weighting. Across the 22 U.S.-domiciled open-end high-yield bond funds rated by Morningstar Manager Research analysts, many of the top performers for all of 2014 and the second half of the year benefited from a combination of an underweighting in the energy sector relative to the market and strong security selection within the sector. As shown in the table below, funds that performed relatively poorly last year were mostly affected by overweightings in energy-related holdings.

A few funds stand out for their strong relative performance in the second half. Several historically more conservative funds did particularly well.

Several funds that fall closer to the middle or more-aggressive end of the high-yield fund universe also navigated 2014's waters skillfully. The team that runs

Given the growth of energy as a component of the high-yield market, many funds held sizable positions within the sector. As energy firms were the largest issuers of high-yield debt in recent years, it was relatively easy for portfolio managers to put inflows to work by purchasing new-issue energy bonds. Many managers also considered energy as a relatively conservative play within high yield because of the asset-rich nature of these firms' balance sheets.

Funds with higher energy exposure included

Morningstar analysts are paying close attention to the approach that portfolio managers take toward the high-yield energy market, and that can have an impact on a fund's Process Pillar rating. While we do not maintain a house view on the direction of oil prices, we do expect investment teams to be thoughtful and realistic about oil prices. Even if long-term expectations call for higher prices, investors should be careful not to anchor on historical prices. Investments in the sector should, at a minimum, include realistic base-case scenarios that assume oil prices stay below $50 per barrel.

Positioning within the energy sector was the primary driver of performance in 2014 and will continue to differentiate high-yield bond managers in 2015. With an increase in distressed names within the sector and/or the probability of a pickup in defaults, this will also provide managers with a visible opportunity to prove their credit-picking chops.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)