January Analyst Rating Downgrades

Manager transitions and deteriorating performances are behind these lower Analyst Ratings.

A manager's full record is the best way to evaluate his or her skill, even though emotionally we tend to judge based on performance when we are in the fund. While we place the greatest emphasis on that full record, we aren't ignoring shorter time periods either. If a fund hasn't met expectations during the past five years, we want to understand why, and if we aren't satisfied, that may lead us to lower a fund's Morningstar Analyst Rating. It depends, of course, on the fund's strategy and whether the market climate has been friendly to that strategy. This theme runs through a few of the key ratings changes we made in January.

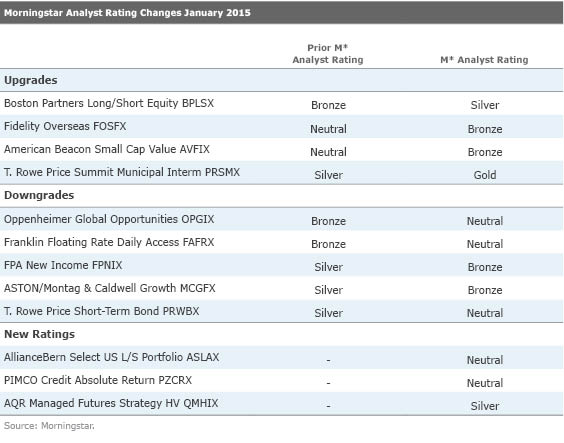

I'll highlight a few, and you can see the whole list of changes in the table below. To understand the whole story, though, please click on the individual fund links to read our complete analysis, as space doesn't allow us to fully lay out the case here.

T. Rowe Price Short-Term Bond PRWBX

In January 2015, T. Rowe Price Short-Term Bond's longtime lead manager Ted Wiese was tapped to lead both the firm's fixed-income group and the fixed-income steering committee after the group's former head, Mike Gitlin, left for Capital Group. Though Wiese remains on this fund's management team, Mike Reinartz was named co-portfolio manager and will succeed Wiese once he officially leaves the fund. This change comes amid a middling record despite the fund's relatively diverse tool kit, which includes corporate bonds, securitized assets, and unhedged foreign bonds. Though Wiese navigated the fund through 2008's market crash with peer-beating returns, the fund's risk/reward profile hasn't looked all that appealing since. This and the change at the top are the primary reasons for the fund's Analyst Rating downgrade to Neutral from Silver.

FPA New Income FPNIX

This is a fund you expect to run to the cautious side, so we cut it some slack for recent underperformance. But even given that, the fund hasn't made many opportunistic moves to buy depressed debt since the great sell-off in 2008. In addition to performance concerns, the fund lost a key team member when Melinda Newman left in January. Newman had been head of corporate credit for FPA and was the most seasoned team member and someone we thought of as a potential successor to manager Tom Atteberry. These twin challenges led us to lower the fund's Analyst Rating to Bronze from Silver.

Oppenheimer Global Opportunities OPGIX

Oppenheimer's foreign funds tend to be manager-driven vehicles. They generally don't have big support teams but have managed to perform pretty well despite that. This presents a challenge for managing asset growth and for handling transitions. It's the latter that worries us for this fund. Frank Jennings is nearing his 70s, but there's no clear successor on the horizon. Equity funds are meant to be held for 10 years or more, so when you buy a fund with a manager nearly in his 70s, you know you are getting his successor as part of the deal. That lack of clarity led us to lower the fund to Neutral from Bronze. We don't know if the next manager will be as skilled as Jennings or even if the next manager will invest in a similar fashion.

Aston/Montag & Caldwell Growth MCGFX

High-quality funds like this one have been out of favor in recent years, so this is a fund we tend to cut some slack. But again, its record has eroded to the point where it is running out of slack. Thus, we have lowered our Analyst Rating to Bronze from Silver. We still like the firm, which has been a model of stability. It only does one thing and does it well. Montag & Caldwell also provided clarity on succession, as Andrew Jung will be a comanager at the end of February. Jung has been a key contributor and is steeped in the firm's style. So, we at least know that the fund's strategy won't change if he becomes lead manager down the line.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)