To Hedge or Not to Hedge?

There are important trade-offs to consider when taking the foreign-currency exposure out of your international-equity ETF.

This is an updated version of an ETF Specialist originally published on Feb. 19, 2014.

Currency-hedged exchange-traded funds have come into vogue of late in the United States. Investor interest was first piqued by the performance of the oldest and largest of them all:

Back to Basics: Return, Risk, and the Practicalities of Putting a Currency Hedge in Place In simple terms, a domestic investor's local-currency-denominated return in a foreign security (or a portfolio of them) is equal to the foreign security's (or portfolio's) return plus the foreign currency return, plus the product of the foreign security return and the foreign currency return. The last part of this equation accounts for the interplay between the two, and as it is the product of these two figures, its contribution to the overall return will grow as either the foreign asset return or the foreign security return grows larger.

Domestic Currency Return = Foreign Security Return + Foreign Currency Return + (Foreign Security Return x Foreign Currency Return)

The effect of fluctuating exchange rates can either help or hurt returns. In the case of U.S. investors holding Japanese stocks, the yen's depreciation hurt the U.S. dollar return for unhedged investors in 2013, as evidenced in part by the iShares fund's relative underperformance versus the WisdomTree offering. In another extreme example, the 34% appreciation of the Brazilian real contributed to the 124% calendar-year return posted by

It's also important to consider currencies' effect on the risk of a portfolio of foreign securities: The expression for the variance (the square root of which is the standard deviation) of a foreign security or portfolio's returns is as follows:

σ2$ = σ2LC + σ2S + 2σLCσSρLC,S,

where

σ2$ = the variance of the foreign asset returns in U.S. dollar terms;

σ2LC = the variance of the foreign asset in local-currency terms;

σLC = the standard deviation of the foreign asset in local-currency terms;

2S = the variance of the foreign currency;

σs = the standard deviation of the foreign currency;

ρLC,S = the correlation between the returns of the foreign asset in local-currency terms and movements in the foreign currency.

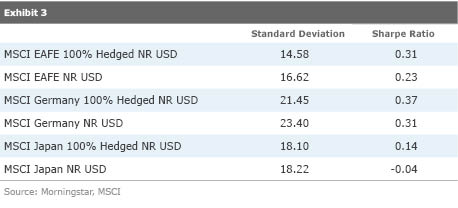

This expression demonstrates that the volatility of a foreign asset in domestic-currency terms is directly related to the volatility of the asset in local-currency terms (the first term in the expression) and the volatility of the foreign currency (the second term). It also shows that the higher the correlation between the foreign asset in local-currency terms and movements in the foreign currency, the greater the variance will be in local currency terms. (Again, take the square root and you'll get the standard deviation.) Hedging away currency exposure will reduce risk, as measured by standard deviation--as can be seen in Exhibit 3 below.

How does currency hedging work in practice? Most currency-hedged ETFs will use currency forward contracts to reduce their foreign-currency exposure. A currency forward contract is an agreement between two parties to buy or sell a prespecified amount of a currency at some point in the future (typically one month out in the case of currency-hedged ETFs) at an exchange rate agreed upon between the two parties. Because the value of the forward contract is fixed ahead of time, and the value of the fund will fluctuate during the course of a month as asset prices and cash flows into and out of the fund fluctuate, the forward may not be a perfect hedge. It's also important to note that these hedges come at a cost, though their price tag typically amounts to just a few basis points in the case of developed-markets currencies in stable interest-rate environments.

FX Effects It is useful to look at historical data to frame the effects of currency hedging on investment performance (for U.S. investors in this case). There are two key elements to consider when assessing the effects of currencies on equity portfolios: their contribution to return (as covered above) and their contribution to risk.

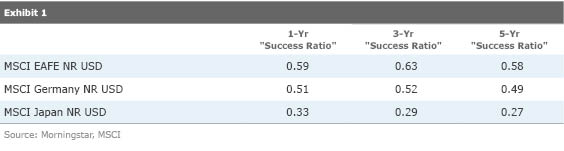

Exhibit 1 shows "success ratios" for a trio of MSCI benchmarks over the 20-year period ended Jan. 31, 2015. These benchmarks are all tracked by one or more currency-hedged (and unhedged) ETFs. The success ratio represents the portion of the overlapping monthly rolling one-, three-, and five-year periods over these two decades during which the unhedged version of the index outperformed its fully hedged counterpart. For example, the MSCI EAFE Index outperformed its fully hedged counterpart in 59% of these overlapping rolling one-year periods over this 20-year span. In hindsight, in the case of the MSCI EAFE and MSCI Germany benchmarks, the winner could have been predicted by the flip of a (mostly) fair coin. The story is different when it comes to the MSCI Japan Index, where "getting the yen out" has clearly paid off more often than not.

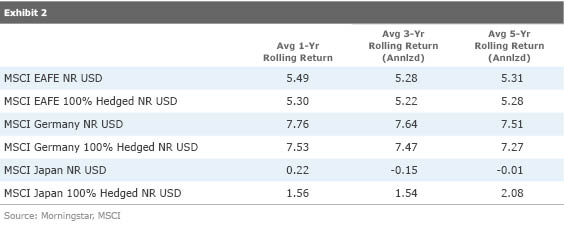

Exhibit 2 contains the annualized average returns for each benchmark across each of the overlapping monthly rolling one-, three-, and five-year periods dating back 20 years from the end of January 2015. The differences in relative performance vary between the hedged and unhedged versions of these indexes depending on the length of the measurement period. The MSCI Japan Index is again a unique case, as evidenced by the yawning performance differential between its hedged and unhedged versions.

What about risk? Currency risk is a significant contributor to overall risk in the context of a foreign-equity portfolio. Exhibit 3 shows the trailing 20-year annualized standard deviations and Sharpe ratios for the same benchmarks featured in the first two exhibits. In the case of all three benchmarks, it is clear--as evidenced by the difference in Sharpe ratios between the U.S. dollar and hedged versions of the indexes--that currency exposure is a meaningful source of risk, currency hedging can serve to mitigate this risk, and it may ultimately result in superior risk-adjusted performance.

To Hedge or Not to Hedge? The best answer to the question of whether it makes sense to hedge the currency exposure of an international-stock portfolio is this: It depends. By hedging foreign-currency exposure, investors can mitigate a source of risk--but at the expense of a potential source of return. The trade-off between the two is important, and investors' decisions will depend on a variety of factors, including but not limited to their return requirements, risk tolerance, investment horizon, and the costs associated with hedging currency exposure.

Disclosure: Morningstar, Inc.’s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)