Seeking Small-Cap Moats: Monro Muffler Brake

Monro's acquisition strategy is creating a virtuous cost-advantage cycle, but shares don’t come cheap at the moment, writes Morningstar’s Todd Wenning.

A few weeks ago, one of our 2002 Jeep's power windows failed and slid down into the door panel--in subzero Chicago weather, no less. Dreading what I knew would be an expensive repair, I thought, "Hey, I can hold the window up with some duct tape. It won't look that bad." My wife, clearly my smarter half, rejected that solution. So off to the repair shop I went.

No one likes expensive repairs and maintenance for a depreciating asset, but with the average age of cars on American roads climbing steadily higher to an estimated 11.7 years by 2017, according to IHS Automotive, we should expect to spend more time and money at the shop. Despite this apparent tailwind for the auto repair industry, the number of service bays has decreased in recent years due to dealership closures and fewer gas stations doing general repairs.

Still, the U.S. auto repair and maintenance industry remains a highly fragmented one, with many independent operators dotting the landscape. Some consolidation has already taken place, however, particularly on the "do it yourself" and commercial autoparts side of the business, led by large-scale retailers like

According to Morningstar analyst Liang Feng, this consolidation has enabled the autoparts retailers to capitalize on a denser distribution network, allowing them to "minimize the transportation costs of frequent store replenishment and increase capacity utilization of nearby distribution points." In other words, these cost advantages made it much more difficult for smaller competitors to keep up.

The much larger "do it for me" (DIFM) side of the automotive aftermarket business appears to be in the earlier stages of consolidation, and Monro Muffler Brake MNRO--the largest chain of company-operated undercar care facilities--is leading the charge in the eastern half of the U.S., having made 11 acquisitions consisting of 159 stores in fiscal 2013 and 2014. Indeed, the company's executive chairman and former CEO, Robert Gross, recently told investors he thinks the company's store count could nearly triple in size without needing to expand its current geographic footprint.

Here are some quick facts about Monro Muffler Brake (as of Jan. 23):

- Market cap: $1.8 billion

- Number of stores: 1,017 (all company-owned)

- Dividend yield: 0.9%

- Insider ownership: 4.6%

- Service mix: tires (41%), maintenance (28%), brakes (17%), steering (10%), exhaust (4%)

Like the benefits that accrued to the autoparts companies through consolidation, Monro is gaining cost advantages over smaller DIFM competitors by having greater store density, which helps drive down distribution and advertising costs that can be spread across a greater number of locations. The company's expertise in pursuing M&A opportunities has been developed over 15 years and across 30 deals. This experience provides Monro’s management team with a fairly good idea of what sort of value it can extract from each potential deal. Further, Monro's acquisition strategy creates a virtuous cycle--as it gains cost advantages, smaller competitors will be unable to keep up and will be more likely to be acquired.

In addition, unlike many of its competitors that purchase parts from the aforementioned autoparts retailers, Monro primarily buys direct from manufacturers and manages the logistics between its own warehouses and stores. Each Monro store can view the inventory of the closest 14 Monro stores, allowing them to internally source the needed parts rather paying full retail prices.

Most of Monro's major direct competitors are privately owned or are subsidiaries of larger companies (e.g., TBC Corporation, Firestone Complete Auto Care, and Meineke Discount Mufflers), making apples-to-apples margin comparisons difficult, but Monro management says its closest competitor's operating margins are about two thirds of its own, which are around 12%.

Even though Morningstar doesn't cover Monro Muffler, and the company hasn't been vetted by our moat committee to produce an official Morningstar Economic Moat Rating, I'd argue that it has established a narrow economic moat based on a low-cost advantage gained primarily through its distribution network.

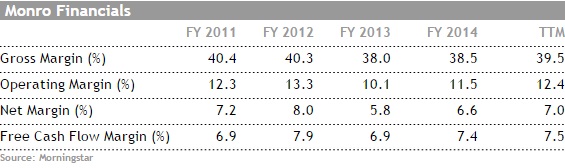

Risks and Financials Monro's acquisition strategy seems very disciplined, with the company focused on deals in a tight valuation range of 7.0 to 7.5 times EBITDA. Therefore, investors should keep an eye on the details of the company's future acquisitions to ensure that management's standards aren't loosened to drive growth for growth's sake. Investors should also grow cautious if Monro makes a large acquisition on the West Coast before it achieves its store density goals across its current footprint of 25 states, 24 of which are east of the Mississippi River. If it did make an acquisition that's further afield, it may take a number of years for the deal to deliver acceptable returns on capital.

Amid numerous acquisitions in recent years, I’m encouraged that Monro has been able to generate consistent free cash flow and protect margins.

Monro's balance sheet looks pretty solid, and it has a $250 million credit line with an interest rate of only 1% (not a typo) that's good through December 2017, which should allow it to pursue further tuck-in acquisitions with attractive financing terms.

Management's annual bonuses are based on pretax income, which I consider to be an appropriate metric for this line of business. I'm not enthusiastic about the board's option to determine "outstanding performance" using alternative metrics in the event that the company falls short of its pretax income targets. Having this discretion mitigates the importance of the original metric. It should be noted that this option does not apply to the executive chairman or CEO bonuses, which can only be based on pretax income.

Additionally, given the company's acquisition and expansion plans, I'd like to see a return on invested capital or economic value added (EVA) metric included in the firm's bonus formula. This way, management would be rewarded only if its acquisition strategy were creating shareholder value.

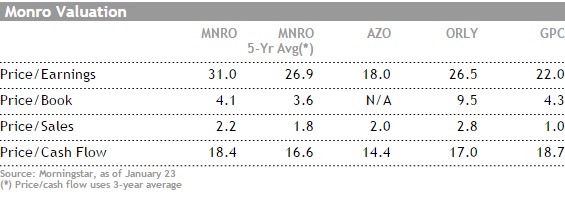

Valuation Like most companies with attractive long-term growth prospects and improving competitive positions, Monro shares don't come cheap at the moment.

With current prices near $60, investor growth expectations are high. If the company can continue consolidating the East Coast DIFM market and if U.S. auto owners open their wallets a bit after years of deferring needed maintenance, today's prices might be justified. I'd look to start a position closer to $50 to obtain a slightly larger margin of safety.

Favorite Ideas As of Jan. 23, here are my top five watchlist candidates:

Culp CFI. Management of this textile company is making the right capital-allocation decisions--including a recent 20% dividend increase--and the balance sheet is solid, with a net cash position of $33 million.

Douglas Dynamics PLOW. The company's acquisition of Henderson Products expands its reach into the heavy-duty truck snow removal market. Income-minded investors should like its 4% dividend yield, as well.

Winmark WINA. John Morgan and team are an impressive group of capital allocators, taking the cash flow from the retail operations and reinvesting it in its growing leasing business.

Natus Medical BABY. If this company can repeat what it did in neurology and build a dominant position in new niche markets in the health-care industry, today's share price may prove to be a long-term value.

Raven Industries RAVN. It's probably going to be a rough year or two with a down cycle in agriculture equipment demand. If you're going to own shares, you need to be patient.

Previous installments of this series:

- Natus Medical

- Tumi Holdings

- Winmark

- Douglas Dynamics

- WD-40

- Raven Industries

- Sun Hydraulics

- John Bean Technologies

- Exponent

- Culp

- Badger Meter

- Latchways

- US Ecology

- 2014 Annual Review

The next article in this series will be published Feb. 25, 2015.

Todd Wenning, CFA, owns shares of Sun Hydraulics, WD-40, and Raven Industries. You can follow him on Twitter at @toddwenning.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)