15 Exceptional Large-Company Funds

Most investors can find a good match for their portfolios among these Gold-rated funds.

Tomato sauce and pizza. Aaron Rodgers and the Green Bay Packers. Patience and marriage. Each of the parts is key to the success of the whole.

In much the same way, large-company funds are central to many investment portfolios. No matter your investing goal--a retirement that's under way or years away, college saving, and so on--large-company funds likely constitute a significant portion of your portfolio.

Just as a bland sauce can ruin a pizza, a banged-up Aaron Rodgers can lead to a Packers loss, and a short fuse can cause marital strife, so too can subpar investment returns from large-cap funds derail your portfolio's overall performance.

Of course, one year of lackluster returns doesn't mean you have a chronic underperformer on your hands. Check out this piece to learn how to more effectively benchmark your large-cap funds. But if you find that you do have a laggard large-cap holding, here are some ideas you might swap into.

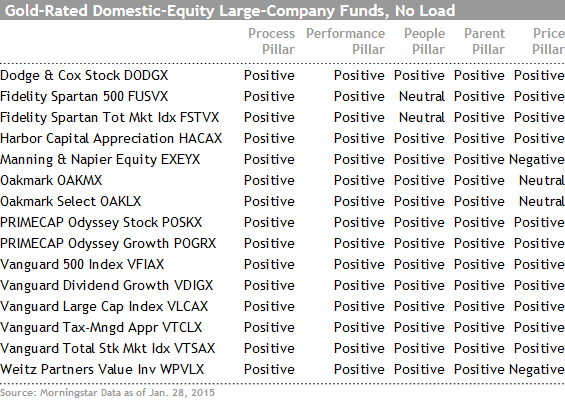

The funds listed below are domestic-equity large-cap funds earning

of Gold. All are no-load and unconditionally open to new investors. Premium Members can access a complete list of Gold-rated domestic-equity large-cap funds

.

Six of the 15 funds pursue passive strategies. That's no surprise, for a couple of reasons. First, given that Price is one of our Five Pillars when evaluating funds, it's no wonder that so many low-cost passive funds made the grade. In addition, indexing has been an effective method of investing in domestic large-company stocks over time: As of this writing, the lowest-cost index funds in the large-value, large-blend, and large-growth categories have outperformed two thirds of their peers during the trailing three-, five-, and 10-year periods.

So, should you scuttle all of the proceeds from your underperforming large-cap funds into passive choices? Frankly, there's a strong case to be made for doing just that, especially if you are investing via a taxable account. As Christine Benz has noted, index funds are generally tax-efficient and should remain so due to their passive approaches. As a result, the index funds on this list are compelling low-maintenance choices for filling the large-cap portion of a portfolio--especially a taxable one.

However, the active funds from this list would be fine choices for tax-sheltered accounts, or for investors seeking to fill specific roles in their large-cap allocations. Let's take a look at the five actively managed funds from the list that earn positive marks on all five Morningstar Pillars--Process, Performance, People, Parent, and Price--and discuss who they might work for.

For the Dividend Investor: Vanguard Dividend Growth

Subadvised by Wellington Management--which also guides the superb

.

Over the long term, however, this fund has delivered exceptional returns, outperforming 97% of its large-blend category peers over the trailing 10-year period as of this writing.

For the Traditional Growth Seeker: Harbor Capital Appreciation

HACAX

If you're seeking a "traditional" large-cap growth fund--one that focuses on companies with solid fundamentals that are growing faster than the S&P 500--Harbor Capital Appreciation is a superior choice. The management team, led by long-tenured Sig Segalas, emphasizes unit sales growth and de-emphasizes valuation. Over time, that has led to significant overweightings in the tech, consumer cyclical, and health-care sectors. The fund has outperformed its category peers and the S&P 500 during the trailing 10-year period. For investors who have the investable assets, we prefer the fund's Institutional shares, which require a $50,000 minimum investment but carry a modest 0.65% expense ratio. The fund also offers Investor shares requiring a minimum investment of $2,500 and levying a 1.02% expense ratio.

For the Contrarian Growth Seeker:

Primecap Odyssey Growth

POGRX or

Primecap Odyssey Stock

POSKX

Primecap's management team, which just received Morningstar's 2014 Domestic-Stock Fund Manager of the Year award, takes a different approach to growth stocks. The team looks for former rapidly growing stocks that have the potential to continue to grow in the future but have temporarily hit a speed bump--and they will wait patiently for prices to recover. Both funds are excellent choices, but Odyssey Stock is better suited to more-conservative investors. Granted, the funds have delivered back-to-back years of remarkable returns that may not be repeatable. But with reasonable expenses, legendary managers, and terrific 10-year returns, these funds are excellent core choices for long-term investors.

For the Patient Value Enthusiast: Dodge & Cox Stock

DODGX

The team at Dodge & Cox Stock practices a bottom-up approach to finding large-cap stocks trading at attractive valuations across a number of measures. While these companies may have good growth potential, strong management, and competitive advantages, they are out of favor for some reason. The Dodge & Cox team will patiently await the turnaround (more often than not, the fund's turnover rate is in the teens), and is unafraid to bulk up in particular sectors. Although the fund has suffered bouts of underperformance due to those sector concentrations, its long-term trailing returns are among the best in the large-value category. Shareholders who can sit tight during the inevitable bouts of underperformance are rewarded.

NOTE: This article has changed since original publication. Primecap Odyssey Growth has been added to the list of funds, both in the table and in the text.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)