Where Are Top Go-Anywhere Managers Going?

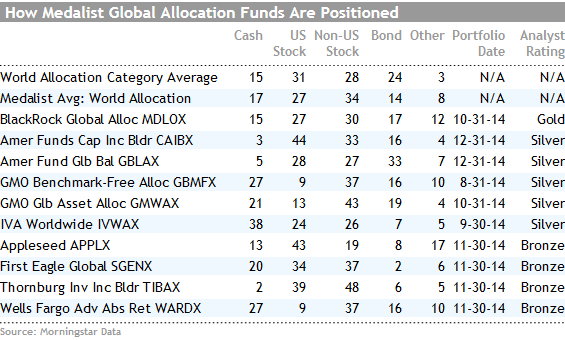

Several Medalist funds are holding large cash stakes, giving U.S. stocks a wide berth.

The outlook for global growth isn't rosy. Bond yields are low. Stocks aren't especially cheap, at least not in aggregate. Given that gloomy backdrop, where are top go-anywhere investors placing their bets?

To help answer that question, I took a look at funds with Morningstar Analyst Ratings of Gold, Silver, and Bronze within the world-allocation category. Funds in these categories pursue a broad range of strategies but typically have the latitude to invest in stocks and bonds across the globe.

Cash Isn't Trash In general, the cash holdings among funds that land in the world-allocation category--15% on average--tend to be higher than is the case for pure-bond and pure-equity categories. However, world-allocation funds' cash weightings also tend to be higher than other allocation categories. The typical conservative-allocation fund currently has a cash weighting of 10%; the average moderate- and aggressive-allocation funds hold 6% in cash, currently.

Morningstar Medalist funds within the world-allocation group like cash even more. The average medalist fund in the world-allocation group has a 17% allocation to cash, currently. That may be an outgrowth of the fact that many of the Morningstar world-allocation medalists employ valuation-conscious approaches; many such managers would rather stick with cash than invest in overpriced assets.

Charles de Vaulx and Chuck de Lardemelle at

Various funds managed by the firm Grantham, Mayo, Van Otterloo & Co., including

U.S. Stocks? Not So Much The fact that many of the medalist world-allocation funds employ valuation-conscious strategies has also contributed to fairly light stakes in U.S. equities as they've rallied. U.S. stocks have generally outperformed foreign and, in fact, compose more than half of the global market capitalization today. The FTSE Global All Cap Index consists of 52% U.S. equity exposure and 48% in companies domiciled overseas. On average, world-allocation funds precisely mirror that U.S./foreign weighting within their equity stakes. But Morningstar Medalist funds favor foreign stocks over U.S.: Within their equity weightings, the funds have 44% in U.S. equities and 56% overseas.

Here again, the GMO-managed funds are helping to drive the light average allocation to U.S. equities for medalist funds. GMO has been forecasting negative real returns for U.S. equities, so it's not surprising that the three GMO medalist funds all maintained light positions in U.S. equities--less than 15%--as of their most recently available portfolios.

Morningstar's sole Gold-rated world-allocation fund,

The Bronze-rated

It's also worth noting that two Gold-rated go-anywhere funds that happen to land in a different but similarly wide-ranging category--

. Meanwhile, as of year-end 2014, U.S. equities didn't even appear on the list of "top strategies" within PIMCO All Asset All Authority, which gives Arnott free rein over the portfolio's asset-class exposures. That positioning has hurt the two funds over the past few years, though both retain Gold ratings.

However, it would be a mistake to suggest that all medalist fund have been downplaying U.S. equities.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)