Improved Business Mix Sparks Moat Upgrade

Dominion is uniquely positioned to invest in high-ROIC energy infrastructure.

We assign a wide Morningstar Economic Moat Rating to

Marcellus and Utica shale gas production growth in Dominion's core territory is driving most of the firm's wide-moat gas pipeline and liquefied natural gas investments. These include expansion or modification of Dominion's existing natural gas infrastructure to bring this gas to domestic and international markets. We also give the management team an Exemplary Stewardship Rating for its ability to generate shareholder value. Dominion recently sold its no-moat retail electric business and has been selling or retiring its no-moat merchant power plants for the past several years, enhancing its enterprisewide competitive advantage.

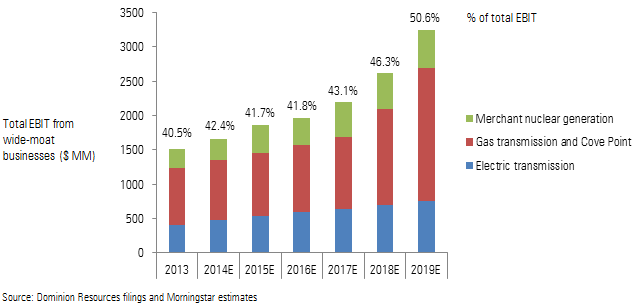

Strong Earnings Growth from Wide-Moat Businesses

Cove Point Likely to Be Only East Coast LNG Export Facility Cove Point is currently a LNG import/regasification and storage facility on the Chesapeake Bay near Lusby, Maryland. It also owns 136 miles of natural gas pipeline that connects the facility to interstate natural gas pipelines. The facility generates revenue and earnings from annual reservation payments for regasification, storage, and transportation contracts with a portfolio of creditworthy counterparties that include BP, Royal Dutch Shell, and Statoil. These contracts begin rolling off in 2017.

In September, Dominion began building a natural gas export/liquefaction facility on land on the existing site after receiving final approval from the Federal Energy Regulatory Commission. Liquefaction is the process by which natural gas is converted to LNG, which can be loaded into oceangoing LNG vessels for worldwide transportation. U.S. exports of LNG are expected to dramatically increase during the next decade, driven by the supply of shale gas and projected growth in worldwide demand.

The liquefaction facility cost is estimated at $3.4 billion-$3.8 billion. It is expected to be placed in service in late 2017 and export approximately 4.6 million metric tons per annum (0.66 billion cubic feet equivalent per day). Half of Cove Point's capacity has been contracted with a joint venture of Sumitomo and Tokyo Gas, the largest natural gas utility in Japan. The remaining 50% is contracted with a wholly owned indirect U.S. subsidiary of GAIL, one of the largest government-linked natural gas companies in India. The 20-year agreement with each of these creditworthy counterparties begins on the in-service date and has a fixed fee that covers all operating and capital costs, including profit. Natural gas is supplied by the counterparties. Thus, Dominion takes no commodity or volume risk.

Financial details of the agreements have not been released, but given the favorable economics of sourcing natural gas in the U.S. and liquefying and transporting to Europe and Asia, we suspect the returns for Cove Point are well above Dominion's cost of capital for at least the 20 years of the two agreements. Because of the difficulty in siting a new LNG export facility on the U.S. East Coast, we believe the primary source of Cove Point's wide moat is the intangible asset category. Thus, we believe the wide moat could last well beyond the initial 20-year export agreements, protecting Cove Point's wide moat for a very long time.

Dominion Expanding Wide-Moat Gas Transmission System Natural gas transmission pipelines are arguably the best illustration of wide moats due to efficient scale. Transporting natural gas produced from the Marcellus shale gas play to utilities in Virginia and North Carolina is an excellent example of the dynamics of the efficient scale moat source. Once a pipeline is constructed, there is little incentive for competitors to enter; the pipeline is efficiently scaled to the market. Pipelines have the added benefit of not needing to rely on potential entrants to be rational. The pipeline industry is heavily regulated because of environmental and safety concerns and eminent domain considerations. In addition, regulators prevent new pipelines from being built unless there is a demonstrated economic need to do so. Because of the monopoly status of many interstate pipelines, the FERC regulates the rates pipelines can charge but generally allows companies to earn an adequate return on their capital.

The historical and projected spread between return on invested capital and weighted average cost of capital for pipeline/midstream companies is positive. Although ROIC is only about 11%-12%, it is well above the typical pipeline company's weighted average cost of capital. WACC is low because investors appreciate the monopoly position of the pipeline companies and the favorable FERC regulatory framework. However, for our economic moat framework, Morningstar believes it is the sustainability of excess economic profits that matters, not the size of the spread between ROIC and WACC. Because pipeline companies generally secure long-term contracts with their customers, and because there is little risk of technological disruption, these economic profits are probably sustainable.

In September, Dominion announced it had formed a joint venture to build the Atlantic Coast Pipeline, a 1.5 bcf/day (expandable to 2 bcf/day) natural gas transmission line from West Virginia to North Carolina, passing through Virginia. The owners of the $4.5 billion-$5 billion pipeline are Dominion (45%), Duke Energy (40%), Piedmont Natural Gas (10%), and AGL Resources (5%). The 550-mile pipeline is expected to be completed in late 2018. The pipeline's owners and SCANA's Public Service North Carolina will sign 20-year contracts to be customers of the pipeline. Many times pipeline owners have agreements with gas producers to move gas out of the Marcellus and Utica shale regions. The fact that the ACP's contracts are with more creditworthy utilities further supports its wide moat. Dominion will construct, operate, and manage the ACP.

Associated with the Atlantic Coast Pipeline but wholly owned by Dominion is the $500 million Supply Header Project, which will provide access from five delivery points to the ACP. Similar to ACP, we believe the Supply Header Project is a wide-moat business. The pipelines will match the capacity of the ACP and will increase access to additional Marcellus and Utica natural gas supplies for ACP customers and other producers. The project is also expected to be in service in late 2018.

Electricity Demand and Security Drive Electric Transmission Investment Similar to natural gas transmission, we believe high-voltage electric transmission regulated by the FERC is a wide-moat business. We expect Dominion's $650 million of annual investment in high-voltage electric transmission through 2019 to support 10% average annual earnings growth from this business. The investments are driven by more than 100 growth and reliability projects in Virginia. The state has the highest concentration of technology workers per capita in the nation, resulting in more than 50% of U.S. Internet traffic passing through Loudoun County on a daily basis. This has driven data center growth in Virginia Electric Power Company's service territory, and Dominion estimates that electric demand growth from these centers will increase more than 135% to 1,100 megawatts by 2018. Because of the security concerns of these facilities and the large number of military installations served by VEPCO, the security of the transmission system is of critical importance. Dominion estimates that it will spend roughly $300 million-$500 million over the next 5-10 years upgrading substation security. This is an additional driver increasing transmission investment, and we expect annual capital expenditures above the current $620 million guidance.

Expanding Solar Generation, Exiting No-Moat Businesses Dominion is expanding its utility-scale solar generation investments with projects in California, Tennessee, and Utah totaling 324 MW by 2015 year-end. We expect this to increase based on management's recent comments. We believe these projects warrant a wide economic moat for two reasons: First, they are or will be anchored by long-term contracts with creditworthy counterparties. Second, they provide up-front tax credits, and Dominion has the tax liabilities to use these credits immediately.

Also supporting Dominion's wide moat rating is management's decision to exit no-moat businesses and sell no-moat assets. During the past few years, the company has sold or retired virtually all of its merchant power plants with no competitive advantages. In 2013, Dominion sold Brayton Point (coal), Kincaid (coal), and its 50% ownership in Elwood (gas). Also in 2013, Dominion retired the Kewaunee nuclear power plant in Wisconsin when it could not sign an offtake agreement that offered a sufficient return. In 2012, Dominion sold Salem Harbor (coal) and retired State Line (coal).

Its remaining merchant power plants are two large, low-cost natural gas-fired power plants and the Millstone nuclear plant in the Northeast. The locational advantage in the power-constrained Northeast enhances these plants' competitive advantages. As with all U.S. nuclear plants, we consider Millstone a wide-moat asset based on its ability to produce the lowest-cost reliable source of electricity. The gas plants produce consistently strong returns and have positive moat trend characteristics. We think spark spreads will widen and returns will rise as cheap gas flows into New England in the coming years and public policy goals lead to a larger share of intermittent renewable generation in the Northeast.

In 2014, Dominion exited the no-moat retail electric business. In 2007 and in 2010, this same management team sold its oil and gas exploration and production business for pretax gains totaling more than $6 billion. All of these moves taken together demonstrate management's commitment to creating long-term shareholder value.

VEPCO Holds Promise We believe VEPCO's utility business, which we estimate will represent 43% of consolidated earnings in 2019 excluding transmission, has among the best fundamentals of any regulated utility. We expect VEPCO's earned returns will remain near its allowed returns for the foreseeable future. Its attractive retail electric rates will remain frozen through 2019, and we expect VEPCO will continue to benefit from a favorable regulatory environment in Virginia based on recent legislation. We continue to believe Virginia offers one of the most attractive regulatory frameworks for utilities in the country.

Mild weather and the write-off of development costs related to a third unit at the North Anna nuclear station will likely mean that VEPCO won't exceed the 10.7% upper end of the return on equity dead band range in the 2013-14 biennial regulatory review. Since VEPCO has to overearn for two biennial review periods in a row before rates can be lowered, current rates are frozen until at least 2019. We consider this a positive, since we estimate that annual sales growth, approximately 1%, will more than cover operations and maintenance escalation and increased capital costs not recovered through rate riders.

The Virginia State Corporation Commission does not weather-normalize in the biennial review analysis. Therefore, the mild 2014 summer weather will benefit VEPCO with respect to the analysis. In addition, Virginia legislation passed in April will allow VEPCO to recover 70% of the development costs related to North Anna. The remaining costs have been or will be taken as charges totaling approximately $250 million aftertax during 2014. These costs will also be included in the biennial review analysis for 2013-14.

In July, Virginia passed legislation that will allow recovery of costs associated with relocating high-risk electric distribution lines underground in a separate rate rider. Rate riders reduce regulatory lag since electric rates reflect investments faster than when a utility is required to file a general rate case. Although the rate rider is subject to Virginia SCC approval, the legislation provided management the confidence to include the $175 million per year in its November growth plan update. Virginia continues to provide VEPCO with numerous rate riders for new generation facilities, and the rate rider for undergrounding distribution facilities is further confirmation that the regulatory framework should continue to be constructive for utility investors.

MLP Will Not Affect Moat The initial public offering of Dominion Midstream Partners was launched in October and raised almost $400 million. The offering was well received by the market, and the 3.3% yield was a record low for any master limited partnership IPO. Dominion's economic interest after the IPO is 68.5%. Dominion has entered into a right-of-first-offer agreement with the MLP that includes additional interests in Cove Point, Blue Racer Midstream, and the ACP assets.

Although Dominion will drop down these assets over time, probably at attractive valuations, we do not believe this will have a material impact on its wide moat. We suspect the initial drop-down assets will be ownership interest in Blue Racer. We believe this midstream joint venture is a no- or narrow-moat business. Thus, drop-downs will not affect Dominion's wide moat. We suspect additional ownership interest in Cove Point and the ACP will be a few years away and when these projects are in service.

In addition, it is likely that Dominion will drop down acquisitions or other growth projects before it drops down additional interests in Cove Point and ACP. This is demonstrated by the Dec. 16 announcement that Dominion is acquiring Carolina Gas Transmission from SCANA for $493 million. CGT owns 1,500 miles of FERC-regulated interstate natural gas pipeline in South Carolina and southeastern Georgia. Dominion plans to contribute this asset to the MLP following the closing in the first half of 2015.

/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)