Morgan Stanley's Underappreciated Business

Wealth management and banking are the key earnings drivers.

The key drivers of

We've always seen Morgan Stanley's joint venture with Citigroup's C Smith Barney wealth management business in 2009 and eventual full acquisition in 2013 as a strong, proactive move that positioned the company well for new financial institution regulations. This was in contrast to skeptics at the time who focused on the lack of perceived synergies between investment banking and wealth management. Stable, high-return-on-capital wealth management has increased to nearly 50% of Morgan Stanley's net revenue from 25% as a result of the 2009 Smith Barney joint venture.

Wealth Management Offsets Regulations, Environmental Changes The majority of regulations that resulted from the financial crisis affected the trading operations of investment banks, not wealth management, underwriting, financial advisory, or asset management.

For example, under the Volcker rule, proprietary trading is prohibited, and principal investments in hedge funds and private equity funds are restricted to de minimis amounts. We believe freeing up capital that supports these activities should largely balance out the related lost future earnings.

Trading of certain standardizable over-the-counter derivative contracts are required to be done on swap execution facilities, and trades are to be reported to data repositories. The increased transparency may decrease the information and pricing advantages that accrued to large dealers when the market was more opaque. That said, trading velocity has historically increased with greater transparency and movement to electronic trading, so volume may make up for any pricing decline. Use of clearinghouses has also been strongly encouraged, which decreases the counterparty credit risk advantage that large banks possess.

Basel III rules significantly increased the amount of high-quality, loss-absorbing capital and liquidity that banks must hold. This has reduced bank balance sheet leverage and made it practically impossible to achieve historical return on equity levels. Lower leverage and higher balance sheet liquidity rules have had knock-on effects on capital-intensive business lines, such as fixed-income trading.

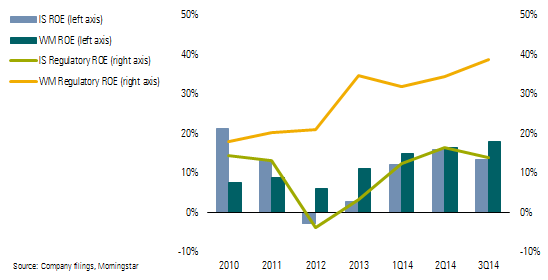

The significantly higher return on regulatory capital of Morgan Stanley's wealth management segment compared with its institutional securities segment demonstrates that management positioned the company well for regulatory changes when it initiated the Smith Barney deal.

Wealth Management Returns Are Multiples Higher Than Institutional Securities

We See Wealth Management as Primary Driver of Earnings After 2014, we forecast that more than 70% of Morgan Stanley's earnings growth through 2018 will come from its wealth management segment.

As wealth management is a people business, a decrease in financial advisor head count can be a red flag of declining business prospects. Reports of Smith Barney integration difficulties, such as the bumpy launch of a more unified technology platform in the second half of 2012, gave reason to believe that Morgan Stanley advisors were dissatisfied and departing. While some of this certainly occurred, metrics currently point to Morgan Stanley's wealth management being the strongest that it's ever been.

Over the past several years, financial advisor head count decreased by more than 2,000, to about 16,000. However, part of the decrease in advisor head count is attributable to office footprint rationalization. The percentage decline in head count is only approximately half the 30% decline in retail locations.

Productivity metrics show that Morgan Stanley didn't lose a material amount of strong advisors. The current cohort of wealth management representatives have more assets, generate more net revenue, and contribute more net income than the financial advisors at Morgan Stanley did before the financial crisis.

As an overall indication of the strength of the business segment, wealth management is more profitable now than during the last capital markets peak.

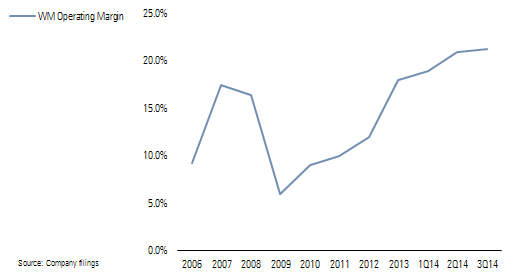

Wealth Management Operating Margins Higher Now Than at Previous Capital Markets Peak

Unique Net Interest Income Growth Opportunity Ahead The company's forecast growth in net interest income from a higher deposit base and mix shift to more loans is independent of a rise in overall interest rates and is unique to Morgan Stanley.

Morgan Stanley's more traditional banking business has had tremendous growth over the past decade. Banking deposits tripled from 2006 through 2009 as the company focused on building a more stable funding base. Deposits doubled again from 2009 through 2013 and should increase approximately 25% more through 2015. The additional high growth from 2013 through 2015 comes from the completed acquisition of Smith Barney and the contractual transfer of more than $50 billion of deposits. After 2015, further growth in deposits should largely track wealth management client asset changes.

Along with the buildup in Morgan Stanley's deposit base came an increased emphasis on originating loans from the wealth management business, such as residential real estate and securities-based. Loans held for investment have increased to slightly over $50 billion in the most recent quarter from $11.5 billion in 2006. We believe management's 2015 target of $75 billion in loans in 2015 is achievable and will mainly come from growth in wealth management segment lending.

Loans have a higher gross yield and net interest spread than the available-for-sale securities and cash equivalents that deposits otherwise fund, so as the proportion of bank assets in loans increases, the bank net interest margin will expand. While the pro forma increase in the net interest margin from 2013 through 2016 is barely perceptible on an absolute basis, as it moves from 0.81% to about 1.12%, it's a nearly 40% expansion of the net interest margin and should produce an equivalent 40% increase in bank net interest income. We currently don't see loans increasing to much more than 50% of bank assets, as that's in the ballpark of the proportion before the massive growth in the deposit base. Additionally, 50% would be in line with Morgan Stanley going from a wealth management lending penetration rate of approximately 5% to 10%, closing its gap with peers.

Eventual Rising Interest Rates More of a Boon to Morgan Stanley Based on a recent Morgan Stanley presentation that included indicative asset yields derived from the forward interest rate curve, we estimate that the gross yield on the company's bank assets would have been over 80% higher at around 2.5% using the 2013 asset mix.

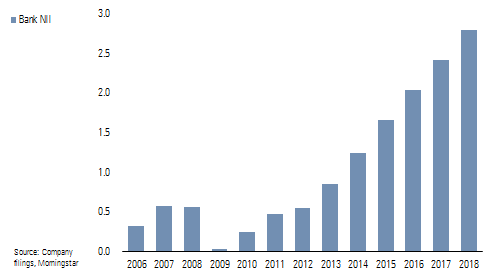

Accounting for the compounding effect of the build in deposits, banking asset mix shift, and eventual rise in interest rates leads to our projection of bank net interest income growing to approximately $2.8 billion in 2018 from $862 million in 2013.

We Project Bank Net Interest Income Increasing About $2 Billion by 2018

Adding in $2 billion of net interest income from nonbanking activities, such as margin lending and securities trading inventory, leads to our forecast of nearly $5 billion of companywide net interest income in 2018.

Cost Advantage Drives Operating Margin Expansion Wealth management operating margins have come a long way from around 9% when the Morgan Stanley-Smith Barney joint venture formed to an adjusted 21% in the most recent quarter. The lower end of management's 22%-25% operating margin target for the fourth quarter of 2015 looks well within reach, while the upper end is achievable over the medium term with the additional net interest income.

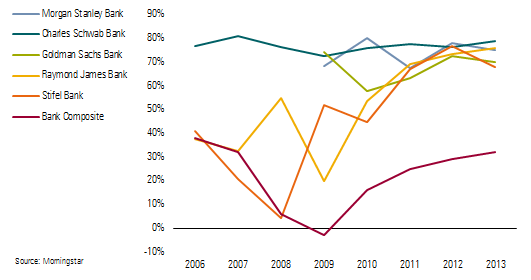

It's a mix shift to highly profitable net interest income, rather than an actual reduction in advisor compensation payouts, that will drive operating margins closer to 25%. The operating margins of banks associated with brokerages have hovered around 70% during the past several years compared with a traditional bank composite of 30%. The large difference in profitability can be explained by the material cost advantages that brokerage-associated banks derive from not having stand-alone bank branches.

Banks Tied to Brokerages Have Substantially Higher Operating Margins Than Traditional Banks

Many of the other U.S.-focused wealth managers, such as Raymond James Financial RJF and Stifel Financial SF, also have net interest income growth and operating margin expansion aspects. While we believe that all three of these wealth managers are modestly undervalued to fairly valued, we forecast that they all have material earnings momentum in the coming years.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)