ETF Flows Set a Fresh Record in 2014

Both iShares and Vanguard have their strongest flows ever.

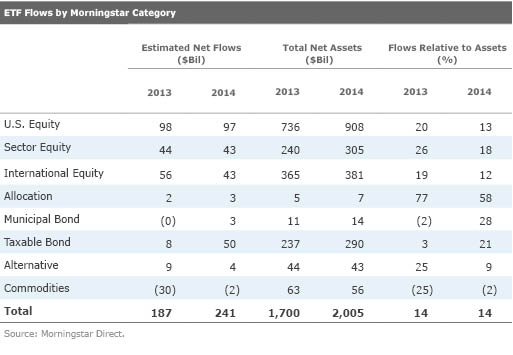

The $241 billion of inflows into U.S. exchange-traded funds in 2014 were the strongest ever and topped the $190 billion inflow in 2012. Strong flows and market appreciation helped push assets to $2 trillion, and that milestone comes just four years after hitting $1 trillion.

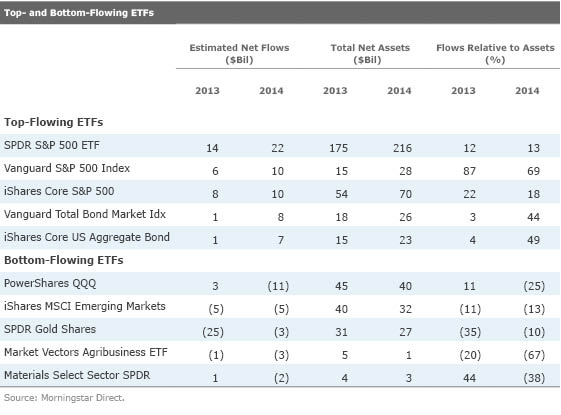

Investors showed a strong preference for U.S. equity funds in 2014. The three ETFs with the largest inflows in 2014 were those tracking the S&P 500 Index.

While equity funds received the strongest flows in absolute dollar terms, bond funds had stronger flows relative to their size. Taxable-bond ETFs were likely a beneficiary of Bill Gross' decision to leave PIMCO. Outflows from

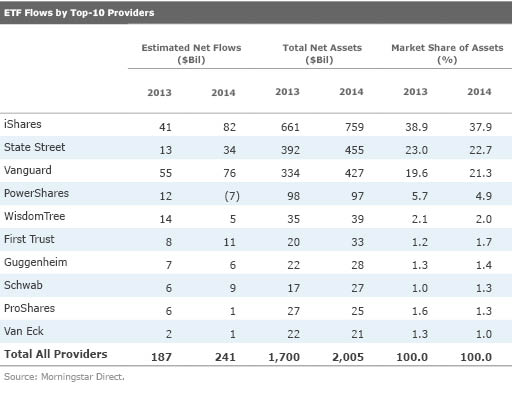

At the firm level, iShares wrested the flows crown from Vanguard, attracting $82 billion compared with Vanguard's $76 billion. Yet Vanguard continued to take market share from both iShares and State Street. Of the three largest ETF providers, Vanguard is the only one that has been able to increase market share during the past three years. This comes despite efforts by both iShares and State Street to reduce fees and launch new products. While iShares has had some success with its "Core" series of low-cost ETFs, growth has not come fast enough to maintain market share. In addition, some new funds may have cannibalized assets at existing products. For example, the relatively new

Outside of the big three ETF issuers, First Trust and Schwab were big winners again in 2014. While they both enjoyed success, their ETF lineups are quite a bit different. First Trust ETFs are generally high-cost (by ETF standards) strategic-beta funds, many of which have a sector or niche focus. In contrast, Schwab's funds tend to be plain-vanilla market-cap-weighted portfolios and are typically the lowest cost in their respective categories. The success of both firms is largely due to their adoption by advisors. For Schwab, it is the advisors using the firm's brokerage platform, while First Trust has seen strong flows from both independent and wirehouse financial advisors, as well as ETF managed-portfolio providers such as F-Squared.

Despite a 19.1% return,

The continued growth of ETFs, and passive investing in general, stands in contrast to the trend in active funds. Mutual fund data through year-end was not available as of this writing, but through the first 11 months of the year, active funds had flows of $78 billion (representing growth of 1% relative to their assets at the beginning of the year) compared with $347 billion for passive funds (10% growth relative to assets at the start of the year). While much of the flows to passive funds were concentrated among the top issuers, the percentage of passive funds with inflows was higher than it was for active funds. Including both mutual funds and ETFs, 23% of passive funds had inflows of more than $100 million in 2014, compared with just 5% with outflows greater than $100 million. Among active funds, 15% had inflows of more than $100 million, while 13% had outflows larger than $100 million.

Indexes were hard to beat in 2014. The S&P 500 Index's 13.69% return beat 83% of large-blend mutual fund share classes. After the S&P 500 posted a 32.40% return in 2013, managers who turned defensive or those holding a lot of cash had a hard time keeping up with the strong returns in 2014. Any manager who was underweight

Bond managers also had a difficult time. The Barclays U.S. Aggregate Bond Index's 5.97% return beat 73% of mutual fund share classes in the intermediate-term bond Morningstar Category. At the end of 2013, the conventional wisdom held that interest rates were going higher and there would be a rotation out of bond funds and into stock funds. But long-term rates actually declined in 2014. One strategy that active managers can usually rely on to beat an index--holding higher-risk securities not included in the index--would have backfired in 2014. International and small-cap stocks underperformed the S&P 500 Index, while lower-credit-quality bonds underperformed the Aggregate Index.

While passive funds were a clear winner in 2014, so too were strategic-beta ETFs, which combine elements of both passive and active investing. Assets in strategic-beta ETFs hit $402 billion and had inflows relative to assets of 19% compared with 13% for non-strategic-beta ETFs.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)