Ultimate Stock-Pickers: 10 High-Conviction and New-Money Purchases

The continuing U.S. stock market rally has diminished the number and similarity of purchases across these top managers.

The continuing U.S. stock market rally has diminished the number and similarity of purchases across these top managers.

By Greggory Warren, CFA | Senior Stock Analyst

Despite the increased volatility in the global equity and credit markets that kicked off near the end of the third quarter, the U.S. markets (as represented by the S&P 500 TR index) still rose more than 1% during the period, and were up more than 8% for the first nine months of 2014. For much of this year we've sensed that the domestic markets, which rose more than 30% during 2013, have been looking for a reason to sell off. And on several occasions since the start of 2014, concerns about growth and currency stability in emerging and developing markets have provided the spark. While the sell-off that started midway through September continued into October, the markets rallied enough to lift the S&P 500 TR Index more than 2% for the month. Market gains have continued since the end of October, with the index likely to close out 2014 with another double-digit gain. This has kept investor flows into equity funds (primarily index funds and ETFs) on par with what was seen during 2012; however, if flows improve dramatically during November and December, we could come close to matching 2013 levels.

That said, we and our Ultimate Stock-Pickers continue to note a persistent undercurrent of concern about where the markets are headed from here. While investors have been willing to increase their appetite for risk over the last year or so, as evidenced by the amount of capital that has flowed into equity funds overall during that time, our view that we are in the midst of a risk-aversion cycle (which has permeated since the 2008-09 financial crisis) has not changed. In this type of environment, investors are willing to gradually increase their risk appetite during stable and expanding markets, but tend to pull back dramatically during market declines. We've seen this scenario play out more than a handful of times, on both the equity and fixed-income sides of things, during the last five-plus years. Our top managers started voicing concerns about equity valuations as early as the third quarter of last year, and yet the markets (even with the pullbacks that we've seen so far during 2014) have risen more than 15% from the end of September 2013 to the end of the third quarter of 2014. With all of that in mind, we found the following comments from Timothy Hartch and Michael Keller, the managers of BBH Core Select of interest:

Our broader perspectives on the current business climate and capital market environment remain cautious, as they have for the last few quarters. One of our primary concerns continues to be that financial asset price inflation has far outpaced underlying economic performance and capital creation, creating a potentially large and systemic valuation distortion in equities as well as fixed income. We believe that excess liquidity provision by global central banks has been the major driver of this distortion. We have little confidence that these regulatory bodies fully comprehend all of the downstream impacts of their policies, or appreciate the difficulties that could accompany the normalization of such policies.

In sustained market rallies, history has shown that investors tend to chase returns and sacrifice safety in order to obtain extra yield. We believe that current manifestations of such behavior are evident in growth stock multiples, yield spreads on risky debt, margin lending levels and loosening credit terms. At best, this process results in future investment returns being consumed in the present. A more negative scenario, however, is that the prevailing sentiment could change and investors would quickly seek to de-leverage or de-risk their portfolios, resulting in a sharp correction. This is not an explicit prediction on our part, but we are clearly alert to the possibility. At a minimum, we believe that conservative investors should not assume further increases in trading multiples or bullish sentiment.

It has been against this particular backdrop that our Ultimate Stock-Pickers have been managing their portfolios, and explains why over the last five calendar quarters our top managers (many of whom have been more cautious in their approach to the markets) have generated some of the lowest levels of buying and selling that we've seen from them since the market rally started in March 2009. It also explains the growing cash balances at some of our top managers, primarily those that are not constrained by investment mandates requiring them to be fully invested at all times. While the group of 22 fund managers included in our investment manager roster had an average cash balance of 8% (and a median cash balance of 5%) at the end of the most recent period, the unconstrained funds had an average cash balance of 11% (and a median cash balance of 8%). This compares with an average cash balance of less than 5% for all U.S. stock funds tracked by Morningstar.

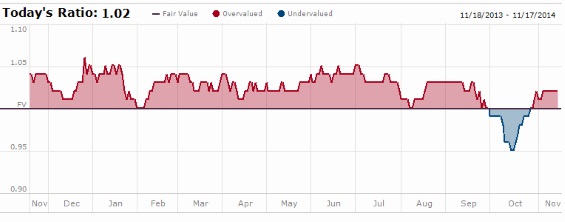

Market Fair Value Based on Morningstar's Fair Value Estimates for Individual Stocks

Despite the heightened level of risk aversion that we continue to see from some of our Ultimate Stock-Pickers, many of our top managers continue to put money to work in firms with economic moats--particularly those with wide economic moats--when they are able to find high-quality businesses trading at discounts to their estimates of intrinsic value. Unfortunately, the number and similarity of purchases and sales across our top managers has dwindled as the market has continued to move higher, making it increasingly difficult to find strong buy and sell signals across multiple managers. It should also be noted that when we look at the buying activity of our Ultimate Stock-Pickers, we tend to focus on both high-conviction purchases and new-money buys. We think of high-conviction purchases as instances where managers make meaningful additions to their existing holdings (or make significant new-money purchases), with a focus on the impact these transactions have on the portfolio overall. It also pays to remember that when looking at this buying activity, the decision to purchase the highlighted securities could have been made as early as the start of July, with the prices paid by our top managers different from today's trading levels. As such, investors should assess the current attractiveness of any security mentioned here by looking at some of the measures our stock analysts' research regularly produces, like the Morningstar Rating for Stocks and the price/fair value estimate ratio. This is especially important right now, with the S&P 500 trading at/near record highs and the market as a whole looking modestly overvalued, with Morningstar's stock coverage universe trading just above our analysts' estimates of fair value at the end of last week.

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

Company Name Star Rating Size of Moat Current Price (USD) Price/ FVE Fair Value Uncertainty Market Cap (USD Mil) # Funds Buying eBay EBAY 3 Wide 54.36 0.86 High 67,523 4 Comcast CMCSA 2 Wide 54.1 1.2 Medium 139,882 2 Glencore GLEN 2 None 5.13 1.49 High 67,632 2 Accenture CAN 3 Wide 84.64 1.04 Medium 55,613 2 Honeywell HON 3 Narrow 96.79 0.92 Medium 75,557 1 Oracle ORCL 3 Wide 40.84 0.97 Medium 181,508 1 Perrigo PRGO 2 Narrow 154.46 1.29 Medium 20,548 1 Hershey HSY 3 Wide 96.06 1.09 Medium 21,089 1 MchlKors KORS - - 72.06 - - 15,115 1 GoldmnSchs GS 3 Narrow 189.98 1.14 High 82,632 1Stock Price and Morningstar Rating data as of 11-14-14.

A quick glance at the high-conviction purchases our Ultimate Stock-Pickers made during the third quarter of 2014 underscores the weaker buying environment our top managers continue to face in this market. Just four of the top 10 high-conviction purchases that were made during the period had more than one of our top managers involved. This compares with periods prior to the first quarter of 2013, when more than half of our list of top 25 high-conviction purchases were made by more than one manager, and the top half of our list of top 10 high-conviction purchases in any given period tended to have four or more of our Ultimate Stock-Pickers making meaningful purchases in each security. That said, the top four names on our list this time around did have multiple managers buying, and nine of the top 10 high-conviction purchases were also new-money buys during the most recent period. EBay (EBAY), in particular, was the target of two new-money purchases (and four high-conviction purchases) during the third quarter (and first part of the fourth quarter). Todd Ahlsten at Parnassus Core Equity (PRBLX) said this about his fund's addition of the firm:

We bought the stock in July after it dropped primarily due to investor concerns regarding sales growth at its core eBay.com business. Another overhang at the time was the unexpected departure of the head of PayPal, which is a valuable subsidiary of eBay. When we bought the stock, the risk-reward seemed favorable due to the company's sustainable competitive advantages, exposure to fast growing end markets and reasonable valuation.

The stock jumped in late September when eBay announced plans to make PayPal an independent company in the second half of 2015. The spin-off should make it easier for PayPal to extend its payments platform to other marketplaces, such as Amazon and Alibaba, and thereby boost its growth prospects. Meanwhile, eBay's core business should continue to benefit from the overall growth in e-commerce spending.

While we did not see much commentary from the other new-money purchaser of the stock-- FMI Large Cap (FMIHX)--or from the other high-conviction buyers of the name-- Dodge & Cox Stock (DODGX) and ASTON/Montag & Caldwell Growth (MCGIX)--the managers at BBH Core Select did lay out the following thoughts on their eBay holdings:

EBay rose sharply on the last day of the quarter after it announced that it plans to pursue a separation of eBay and PayPal into two publicly traded companies. For several years, the company's perspective had been that the businesses should remain together based on the mutual benefits of scale, customer crossover, and data sharing. These are valid points, but given the competitive intensity of the e-commerce and payments industries, we also felt it could potentially be better to have each company operate with a pure-play perspective and a keenly focused leadership team.

The business separation will be accompanied by a management transition in which John Donahoe (eBay's current CEO) and Robert Swan (CFO) will leave their operating roles and join the board of directors at one or both companies. Dan Schulman, an experienced payment industry executive, will join PayPal as President and will become CEO upon the business' separation, which is planned for late 2015. Our intrinsic value model and sum-of-the-parts analysis corroborate one another and jointly suggest a reasonable amount of remaining potential upside in the stock.

EBay's management team has been historically reluctant to separate its Marketplaces operations and PayPal. However, Morningstar analyst R.J. Hottovy believes that it may now be appropriate to unwind the two businesses due to evolving commerce and payment environments and PayPal's decreasing dependence on Marketplaces (less than 30% of payment volume today and potentially less than 15% within three years). Hottovy has left his wide moat rating on the firm unchanged, noting that each of the two entities possesses a strong enough stand-alone "network effect" advantage to warrant a wide economic moat (the inference is that PayPal will have a wide-moat rating once it is spun off from eBay). While he previously had been concerned that a split could disrupt the combined network effect of the two businesses, he now believes that shared services agreements should help to preserve data-sharing and customer acquisition synergies, while also allowing the leadership of each unit to pursue new relationships that would further enhance their respective networks.

Hottovy's current fair value estimate of $63 per share for eBay is comprised of stand-alone valuations of $32 per share for PayPal, $27 per share for Marketplaces/eBay Enterprise, and almost $4 per share in net cash. At current trading levels, the stock does appear to be reasonably priced (trading at 86% of Hottovy's fair value estimate), but also requires a slightly wider margin of safety given the high uncertainty rating that has been applied to the valuation of the company's shares.

The next three names on our list of top 10 high-conviction purchases-- Comcast (CMCSA) , Glencore (GLEN), and Accenture (ACN)--were bought not only with conviction by more than one of our top managers, but were the targets of new-money activity as well. However, the level of commentary on these purchases was slight. That said, the managers at Oakmark (OAKMX) and Oakmark Equity & Income (OAKBX) were both buyers of Glencore, and Oakmark made a meaningful new-money purchase of Accenture. The managers at Oakmark--Bill Nygren and Kevin Grant--discussed their purchase of Glencore, which they considered to be a "well-managed, high-quality" business "selling at average or below-average valuation levels," with the following passage in their fund's quarterly comment letter:

Glencore PLC (GLEN-LON - $5) -- Glencore was formed 40 years ago as a physical commodities trader, and over the years [the firm's] value-focused management team has grown the company into one of the largest miners in the world. After decades of being run as a private company, Glencore went public in May 2011 at a price of $8.57. Like many companies in the mining sector, Glencore's share price has fallen over the past few years as commodity prices have weakened due to a glut of new supply. We believe the market has overly discounted the effects of lower commodity prices and has provided us with an opportunity to buy Glencore at a compelling discount to value. After giving the company credit for the expected ramp-up in production from large current investments, the company is trading at less than 9 times earnings – too low considering that approximately a quarter of those earnings come from the very high-return trading segment and the rest come from long-lived and well-run mining assets. Couple this low valuation with Glencore's smart and highly incentivized management team (the senior leaders own billions of dollars of stock and many only receive nominal salaries), and we find Glencore to be an attractive addition to the Fund.

We saw nearly identical commentary from Clyde McGregor, the manager of Oakmark Equity & Income, about his fund's new-money purchase of the name, so there's little need to replicate those thoughts here. McGregor did, however, note the following about the stock's price:

At the current price of $5.56, we believe the market has overly discounted the effects of the lower commodity price environment, giving us an opportunity to buy Glencore at a compelling discount to our estimate of intrinsic value.

While the shares are trading much closer to 332 GBX (or $5.19) per share right now, they are still well above our current fair value estimate of 220 GBX (or $3.45). Unlike the folks at Oakmark, Morningstar analyst Daniel Rohr believes that the market has yet to fully discount the effects of lower commodity prices on companies like Glencore, believing that weaker prices for most of the firm's key commodities will continue over the next several years. While Rohr thinks that Glencore's globe-spanning network of traders and logistics assets generates significant economies of scope, the company's key commodities continue to be copper and coal. This has left the firm exposed to the growth of China, which accounts for 40%-50% of the global consumption of both commodities (which have basically seen flat demand from the rest of the world over the past decade). Going forward, Rohr expects lower Chinese GDP growth, and a rebalancing away from the commodity-intensive infrastructure and construction-led growth model the country has employed, to weigh on Chinese demand growth, with prices and profit margins that miners had recently grown accustomed to unlikely to be restored.

As for Accenture, Bill Nygren and Kevin Grant noted the following about Oakmark's new-money purchase of the name in their fund's quarterly comment letter:

Accenture PLC (ACN - $80) -- Accenture is one of the largest consulting and outsourcing companies in the world with over $30 billion of net revenues. Accenture is one of very few companies that can serve customers in both capacities globally, with scale, and across most industry verticals. As a result, roughly 60% of revenue is from projects where Accenture is the sole service provider from conception through completion, and more than 90 of Accenture's top 100 customers have been clients for more than 10 years. Management has a long track record of disciplined capital allocation, having reduced the share count by nearly one-third over the past decade, and it recently initiated a fairly generous dividend. Accenture sells for less than 15x EPS, net of more than $7 per share of cash on the balance sheet. We believe this is an attractive price for such a high-quality and well-managed franchise.

Accenture is not quite as overvalued as Glencore, with shares currently trading at 104% of our fair value estimate. Morningstar analyst Andrew Lange expects the firm to outperform the broader IT services industry over the long run, despite a highly competitive and fragmented market, due to the advantages provided by the meaningful switching costs and intangible assets embedded in its business. Lange notes that Accenture works with the largest and most progressive multinational corporations in the world, providing it with early insight into the biggest challenges facing businesses and keeping it in a market-leading position when it comes to solutions. He expects developments in mobile, social, cloud, and analytics to be important growth drivers for the IT services industry, with Accenture playing an important role in transitioning corporations from legacy platforms to new delivery models given its services expertise. As for valuation, the stock was trading closer to $76 per share (or about 94% of our fair value estimate) back in mid-October, having traded off in the week following its annual analyst day meeting, but has since rallied back to a slightly overvalued position. For long-term investors, Lange notes that the company produces a substantial amount of free cash flow, and expects healthy shareholder distributions from the firm for the foreseeable future.

Top 10 New-Money Purchases Made by Our Ultimate Stock-Pickers

Company Name Star Rating Size of Moat Current Price (USD) Price/ FVE Fair Value Uncertainty Market Cap (USD Mil) # Funds Buying Alibaba BABA 2 Wide 115.1 1.28 High 286,750 3 eBay EBAY 3 Wide 54.36 0.86 High 67,523 2 Glencore GLEN 2 None 5.13 1.49 High 67,632 2 Honeywell HON 3 Narrow 96.79 0.92 Medium 75,557 2 Oracle ORCL 3 Wide 40.84 0.97 Medium 181,508 1 Comcast CMCSA 2 Wide 54.1 1.2 Medium 139,882 1 Perrigo PRGO 2 Narrow 154.46 1.29 Medium 20,548 1 Hershey HSY 3 Wide 96.06 1.09 Medium 21,089 1 GoldmnSchs GS 3 Narrow 189.98 1.14 High 82,632 1 Goodyear GT - - 25.62 - - 7,088 1Stock Price and Morningstar Rating data as of 11-14-14.

With five of the remaining six high-conviction purchases-- Honeywell (HON), Oracle (ORCL), Perrigo (PRGO), Hershey (HSY), and Goldman Sachs (GS)--also representing new-money purchases on the part of our top managers, we thought we'd focus more on those names than any of the others; the remaining firm, Michael Kors Holdings (KORS), we do not currently cover. We note that the purchase of Alibaba Group Holding ADR (BABA) by three of our top managers-- Morgan Stanley Institutional Growth (MSEGX), Oppenheimer Global (OPPAX), and Vanguard PRIMECAP (VPMCX)--was in response to the initial public offering of the Chinese company's shares in mid-September. While none of these managers offered much insight into the decision to purchase the shares, Morningstar analyst R.J. Hottovy was out there early with his assessment of the firm, noting before even a single share traded in the U.S. that Alibaba had a wide economic moat around its operations, driven largely by a strong network effect (among the rarest of the five sources that Morningstar uses to assess a company's economic moat and one of the most powerful, as it can often result in a multidecade period of excess economic returns). Hottovy thinks that Alibaba's network effect is unusual, having been established in an industry (China e-commerce) that is at a relatively early stage in its life cycle. He also noted that many of the other companies to which Morningstar has assigned network-effect moat sources participate in more mature industries. While his original fair value estimate of $90 per share represented a meaningful opportunity when compared with the offering price of $68 per share, the stock has rocketed to $115 per share in just two months' time (the shares actually closed at $94 per share on the first day of trading). With the stock trading near 130% of our fair value estimate, it is difficult to get excited about the name right now.

Of the five other new-money purchases on our list this time--Honeywell, Oracle, Perrigo, Hershey, and Goldman Sachs--there was no commentary available about the purchases of either Honeywell or Hershey, but we did get insight from the managers buying the three remaining names. Oracle, in particular, was purchased with conviction by the managers at BBH Core Select, who noted the following about the firm in their quarterly letter to fund investors:

During September we purchased a new position in Oracle Corp., which has been on our investment "wish list" for several years. Oracle is the world's largest enterprise software company, holding the leading market share position in databases and enjoying strong competitive positions in middleware, application software, cloud-based software, specialized IT hardware, and services. We have long been attracted to Oracle's business model based on several enduring and powerful attributes, including (1) the foundational nature of its infrastructure software, which engenders high switching and search costs for substitutes, (2) the loyalty of its customer base (retention rates well above 90%) which drives significant amounts of recurring maintenance and subscription revenue (approximately 58% of total sales), and (3) the high degree of operational maturity and scale we see in its direct sales force and productive Research and Development (R&D) organization. We believe that enterprise software is an attractive category in the global technology sector, benefiting from favorable secular growth trends such as the growing prominence of specialized software for mission-critical infrastructure and applications, exponential data growth and global enterprises' desire to harness the power of all forms of data to gain their own competitive advantages. Despite current concerns regarding slower license revenue growth, the long-term prospects remain attractive in our view given the strong tailwind of data and user growth as well as Oracle's strong commitment to developing faster and more scalable technologies to take advantage of these market dynamics. Through organic and inorganic means, the company has been broadening its business mix across vertical and departmental software categories, thus widening the channels through which larger quantities of infrastructure software can be sold in the future. With its capable and experienced management team, we believe Oracle exhibits a long-term oriented approach that can sustain and grow revenue, earnings, and free cash flow per share over time.

The drug manufacturer Perrigo was purchased with conviction by the managers of Parnassus Core Equity, which had the following to say about its fund's purchase of the name:

Perrigo [is] a leading producer of over-the-counter (OTC) and generic prescription drugs. Perrigo's strategy is designed to benefit from two powerful long-term trends: 1) an aging population that will increase drug usage over time, and 2) pressure from governments and consumers to reduce overall healthcare spending. These secular tailwinds, coupled with the company's durable competitive advantages, give us confidence in Perrigo's long-term business prospects.

Owning shares of Perrigo fits into our overall investment strategy for the health care sector, which we consider to be a barbell approach. On one end of the barbell are Gilead and Allergan, two portfolio companies that market novel therapies for large patient populations. These companies invest heavily in scientific research, in an effort to develop highly-differentiated therapies. On the other end, we're invested in companies that make healthcare more affordable, such as drugstore and pharmacy benefits manager (PBM) CVS Health. Perrigo fits into the second category, as its low-priced OTC and generic prescription drugs provide consumers with outcomes identical to those offered by expensive branded drugs.

Clyde McGregor, the manager of Oakmark Equity & Income, said the following about his fund's new-money purchase of Goldman Sachs during the period:

Founded in 1869, Goldman Sachs is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base. Large financial institutions are still viewed skeptically by investors who fear regulation and litigation will impair profits indefinitely. Goldman is further suffering from a severe slow-down in trading that will dampen profits for the second straight year in the company's largest business segment. We believe that Goldman's franchise remains strong, and despite the current cyclical lull in trading, returns are still well above the cost of capital. We trust that over time, Goldman's management team will improve returns while continuing to allocate capital effectively. Trading near tangible book value, Goldman offers an attractive price for a business that earns a significant amount of revenue from high return asset management and underwriting and advisory services.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.