Morningstar Names Best 529 College-Savings Plans for 2014

Twenty-nine plans earn medals from Morningstar analysts.

Twenty-nine plans earn medals from Morningstar analysts.

In an annual review of the largest 529 college-savings plans, Morningstar identified 29 plans that rose above their typical peers, awarding those plans Gold, Silver, and Bronze Morningstar Analyst Ratings for 2014.

These forward-looking, qualitative ratings signal Morningstar's conviction in the plans' abilities to outperform their relevant benchmark and peer groups on a risk-adjusted basis over the long term. Morningstar evaluates college-savings plans based on five key pillars--Process, Performance, People, Parent, and Price. Gold- and Silver-rated plans are those that our analysts consider the most appealing to college savers, with reasonable fees, strong investment options, and capable oversight. Analysts award Bronze ratings to those plans that also have attractive features, although these plans don't garner as much conviction as the Gold- and Silver-rated plans.

In addition to these top tiers, Morningstar also assigned 32 Neutral ratings, a reflection of the team’s belief that while these plans are unlikely to deliver standout risk-adjusted returns, they are also unlikely to significantly underperform. These plans may have shorter track records or untested components. Relatively expensive plans with meaningful state benefits may also earn a Neutral rating, as while these plans' price tags will continuously drag on results, they could have appeal for in-state residents.

Only three plans earned Negative ratings, an indication that the plans have one or more significant flaws that are likely to hold them back over the long term. In general, the 529 industry has taken great strides to improve its offerings over the years, and it's rare to see plans with weak underlying investments or extremely high fees.

This year, Morningstar upgraded five plans and downgraded 10, compared with seven upgrades and one downgrade in 2013. Although more plans moved down than up this year, those on the rise lowered expenses or increased the quality of their investment lineups. Meanwhile, the downgraded plans' investment options either had deteriorated or were unproven.

2014 Morningstar Medalist 529 College-Savings Plans

Gold Medalists

The list of 529 plans receiving a Gold rating is unchanged from recent years, as these plans continue to lead the industry and represent some of the best options available for college savers. Maryland College Investment Plan and Alaska's T. Rowe Price College Savings Plan, both overseen by program manager T. Rowe Price, continue to offer some of the most compelling actively managed investments among direct-sold plans. While many direct-sold plans offer less-expensive passively managed options, these two plans' fees are reasonable given their active approach. The plans' underlying funds have been strong performers, which contributes to the plans' attractive risk-adjusted results.

Nevada's The Vanguard 529 College Savings Plan is Vanguard's hallmark plan. Although a number of states have also adopted the same set of low-cost and broad-based Vanguard index funds used here, the size of the plan creates savings from economies of scale that are continuously passed along to college savers in the form of fee cuts. As fees are one of the strongest predictors of future performance, especially among index-based investments, Vanguard's commitment to keeping costs in check gives this plan an edge and makes it a fantastic choice for cost-conscious investors.

The final Gold medal was awarded to the Utah Educational Savings Plan, a leader in creating customizable options. This plan also features low-costs Vanguard index funds, which form the base of its age-based and stand-alone investment options, but it also provides college savers with a large suite of investments that can be combined into an age-based track of the account-holder's choosing, offering flexibility at an affordable price.

Silver Medalists

Silver-rated plans are also a compelling group and include our highest-rated advisor-sold plan, Virginia's CollegeAmerica. At nearly $47 billion in assets, this plan is the nation's largest by a wide margin. It features an attractive menu of actively managed funds from program manager American Funds. These strategies are stand-alone options as well as components of relatively newer age-based options. American Funds has consistently demonstrated that it is a strong steward of investor capital, and its options are among the least expensive advisor-sold choices, especially for those providing active management.

Virginia's direct-sold plan, Virginia529 inVEST, also earned a Silver-rating, an upgrade from 2013's Bronze rating. This plan offers a suite of active and passive investments from several talented investment firms, such as Vanguard, American Funds, and Aberdeen. Its diversified portfolios, strong underlying funds, and recent fee reduction helped lift the plan's rating this year.

Two other Silver medalists maintained their ratings. With both an all-index age-based track and an age-based track that blends index and actively managed funds, Ohio's CollegeAdvantage offers a breadth of options at generally attractive prices. Elsewhere, the Michigan Educational Savings Program's age-based options feature a suite of index-based funds from program manager TIAA-CREF, providing broad exposure at an affordable price.

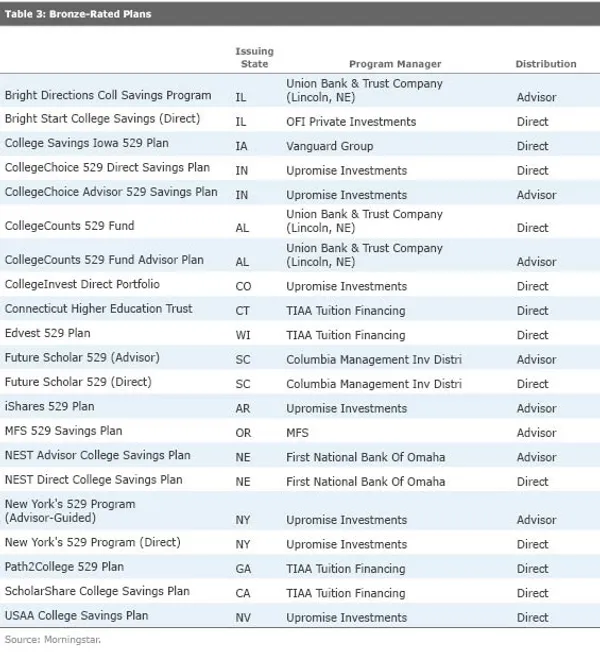

Bronze Medalists

The list of Bronze medalists contains an appealing mix of plans, including both direct- and advisor-sold programs, featuring actively managed and mostly passively managed investment options. Occasionally, very generous state tax benefits will boost a plan's overall rating to Bronze, as is the case with Indiana's College Choice 529 Direct Savings Plan and College Choice Advisor 529 Savings Plan; Indiana offers residents a 20% tax credit on contributions to the state's 529 plan, a benefit that can reduce a college saver's tax bill by up to $1,000 each year.

Three new plans also joined the Bronze-rated grouping this year. Alabama's CollegeCounts 529 Fund Advisor Plan received an upgrade based on a boost in its Parent rating. The plan has multiple layers of competent, transparent oversight, which has led to a quality lineup. Wisconsin's EdVest 529 Plan also was added to the Bronze-rated cohort, as it continued to add strong underlying funds to its well-priced suite of investment options. New York's advisor-sold plan also joined the Bronze group this year, as its relatively new investment manager, J.P. Morgan, continues to show its commitment to and competency with multiasset, goal-based investments.

Neutral Ratings

The most-issued Morningstar Analyst Rating for 2014 was Neutral. The 32 plans earning this rating are not seriously flawed, but in Morningstar's view, they're unlikely to outperform over a full market cycle. College savers who choose a Neutral-rated plan should expect returns near their peer-group norms over the long term--a reasonable outcome. But for those living in states with no local tax benefits, it may be worth upgrading to a top-rated plan.

Lagging Behind

Morningstar's analysts identified three plans this year that lag the rest of the industry. Kansas' Schwab 529 College Savings Plan continues to carry some of the most expensive options among direct-sold plans. Without any meaningful improvement in fees from previous years, it lags an increasingly competitive industry and continues to receive a Negative rating.

The remaining two plans with Negative ratings were downgraded in 2014. Like the Schwab plan in Kansas, South Dakota's CollegeAccess 529 is held back by egregious fees. While in-state residents have access to lower-cost share classes, out-of-staters--which represent the majority of investors in this plan--have a significant fee hurdle to overcome. Leadership disruptions at PIMCO, a wholly owned subsidiary of program-manager Allianz and a prominent asset manager featured in this plan, also detract from the plan's appeal.

The other newcomer to the Negative list, Arizona's Ivy Funds InvestEd 529 Plan, also has seen its share of disruption at program manager Waddell & Reed. Several high-level managers have left the firm in recent months, stretching too thin an already-slim investment team. Elsewhere, college savers can find plenty of stronger, more stable, and less-expensive options to choose from.

Analyst Rating Inputs

Since 2012, ratings for 529 plans use the same scale as the Morningstar Analyst Rating for mutual funds. Both Analyst Rating methodologies consider the same five factors to arrive at the final rating, though the 529 ratings reflect the quality of the entire plan--not a single investment, as is the case for the fund rating. To arrive at an Analyst Rating for 529 plans, analysts consider:

In 2011, the Morningstar Analyst Rating for 529 plans employed the same methodology, but the overall rating was expressed as Top, Above Average, Average, Below Average, and Bottom.

-----------------------------------------------

Want to learn more about your plan’s strengths and weaknesses? Go beyond the Morningstar Analyst Rating and read detailed analyses of 64 of the largest 529 plans. Click here to try a Premium Membership, free for 14 days.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.