Robo-Buffett Funds on the Cheap

State Street's newly launched MSCI Quality Mix exchange-traded funds offer good value.

State Street's newly launched MSCI Quality Mix exchange-traded funds offer good value.

This article was published in the July 2014 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

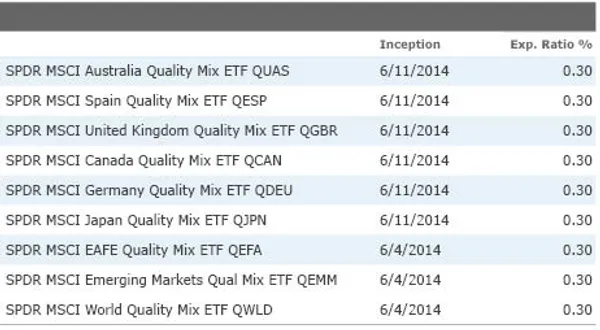

In early June, State Street launched a series of foreign-equity SPDR exchange-traded funds tracking MSCI's Quality Mix, or QM, indexes. The funds charge 0.30%, making them the cheapest or near cheapest options in their respective categories.

The QM index rides on the coattails of AQR researchers Andrea Frazzini, David Kabiller, and Lasse Pedersen's paper "Buffett's Alpha," which argues that the returns of Buffett's public equity portfolio, estimated from quarterly 13F filings, can be explained by exposure to value, quality, and low-volatility (or, more precisely, betting against beta) factors. While I don't believe they've completely distilled Buffett's essence into a set of mechanical rules, they've captured enough of it.

The QM index doesn't replicate Frazzini et al.'s procedure; rather, it equal-weights MSCI's Value Weighted, Quality, and Minimum Volatility indexes, rebalanced semiannually.

Here's how each works:

The Value-Weighted Index weights each stock based on a composite of book, sales, earnings, and cash earnings. It's a virtual clone of the Research Affiliates Fundamental Index.

The Quality Index scores each stock on return on equity, five-year earnings variability, and debt/equity ratio. Stocks with high ROE, low earnings variability, and low debt/equity are assigned higher scores, and the ones with the highest composite scores make the cut and are weighted by their composite scores multiplied by market cap.

The Minimum Volatility Index estimates the factor loadings of each stock and uses an optimizer with constraints to minimize portfolio volatility.

The fact that the QM index is nothing more than an equal-weight strategy of three existing MSCI factor indexes was probably a consideration in State Street's not launching a U.S. QM fund. IShares already offers U.S. Value-Weighted, Quality, and Minimum Volatility ETFs for 0.15% each. State Street wouldn't have been competitive.

With MSCI claiming intellectual lineage from Frazzini et al., I checked to see whether the MSCI USA Quality Mix Index exhibited loadings to the quality, value, and low-volatility factors as defined by the AQR researchers, using monthly returns from May 31, 1988, to March 30, 2012 (the latest date for which the betting against beta factor data is available). The procedure revealed a moderate loading to quality, a modest loading to value, and no loading to betting against beta. You are getting something like the robo-Buffett strategy described by Frazzini et al., just not much of it.

MSCI indexes are designed with a lot of capacity in mind so their tilts are diluted. When you equal-weight three already diluted indexes, you end up with a light tilt. However, I don't mind funds with modest tilts if their fees are commensurately low.

The U.S. QM index's loadings were very close to the loadings displayed by another quality-plus-value fund, Vanguard Dividend Appreciation VIG, which tracks the NASDAQ US Select Dividend Achievers Index. Because quality and value strategies tend to produce negatively correlated excess returns, combining them produces steadier outperformance (at least in back-tests).

The chart below shows the cumulated wealth of the MSCI USA QM index divided by the cumulated wealth of the MSCI USA index. When the line slopes up, the QM index is beating the vanilla index. As you can see, the QM index mostly keeps up with the market during boom times and realizes its relative advantage when the market turns down. The biggest periods of outperformance came during the aftermath of the dot-com bubble, the financial crisis, and the eurozone crisis. The same pattern holds with the EAFE and emerging-markets QM indexes' back-tested returns, too.

Interestingly enough, the EAFE and emerging-markets QM indexes show higher and more consistent returns than the U.S. version. This pattern is consistent with the hypothesis that foreign-equity markets are less efficient and less integrated than the U.S. market.

The QM index is broadly diversified, owning stocks with opposing characteristics. Value stocks tend to be dogs, while quality stocks are darlings, so mixing the two produces marketlike portfolios that don't seem to deviate much from the index. One might ask how you expect such a strategy to consistently outperform. I think of the QM index as an inverted strategy: Rather than owning only fantastic stocks, it reduces exposure to the minority of truly terrible stocks that don't have the capacity to suffer with grace. Low-quality stocks ride high during bull markets, easily outpacing their stodgy peers, but do terribly during downs. And--this is key--they don't fully recover in bull markets, because their fundamental unsoundness is revealed in the face of adversity. Metals and mining firms come to mind.

MSCI describes its quality and value strategies as exploiting systematic risk factors and repeatedly calls them risk premiums. Many investors describe these quantitative trading strategies as somehow exploiting rational market forces. I couldn't disagree more. It's hard to see how quality and value represent distinct risks. Lower drawdowns and volatilities, higher returns--if this is risk, I'll take as much of it as I can get. A more plausible explanation is these trading strategies exploit investors doing dumb things.

If you accept the behavioral explanation, then you can't expect these strategies to continue to perform as well as they have in the past. A lot of money is piling into these low-cost factor funds. They seem to be in vogue among European pension funds. Don't expect the QM index to thrash the market. A reasonable and conservative expectation is marketlike returns and lower-than-market drawdowns.

Summary

The SPDR Quality Mix funds offer outstanding value for non-market-cap-weighted funds.

MSCI's QM index equal-weights MSCI's value, quality, and low-volatility indexes, a strategy that can be described as robo-Buffett-lite.

In back-tests the QM index tends to slightly lag during bull markets and greatly outperform during bear markets.

The QM index is more of an inverted strategy that greatly reduces exposure to expensive, leveraged, unprofitable, volatile stocks.

Because the QM strategy--in my opinion, mind you--exploits dumb investor behavior, don't expect it to replicate its back-tested record. I'd be happy if it kept up with the market with lower drawdowns.

| ETFInvestor Newsletter | ||

| Want to read more about ETF investing? Subscribe to Morningstar ETFInvestor for fresh ideas for income and total return plus a bird's-eye view of valuations around the globe, portfolio construction advice, and data on the biggest and most popular ETFs. | One-Year Digital Subscription 12 Issues | $189 Premium Members: $179 Easy Checkout |

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.