Europe Rolls out Economic Artillery

The ECB's stimulus measures should help, but the questions remain, when and how much?

The ECB's stimulus measures should help, but the questions remain, when and how much?

This was a big week for U.S. economic data, which was almost entirely positive with strong auto sales and decent employment growth leading the way. I have been pooh-poohing the manufacturing sector for some time, but this week's ISM Purchasing Managers' reports were the latest in a several-month string of positive reports in the sector. It's hard to deny that manufacturing has made some kind of turn for the better. Too bad it's not a bigger part of the economy.

But strong actions out of the European central bank were the real fireworks and market drivers this week. Although everyone and his brother were anticipating some relatively strong actions, the central bank managed to underpromise and overdeliver. Myriad rates were cut, negative interest rates were implemented for bank reserves, new low-cost lending programs were rolled out, and it promised to put in place the tools for a U.S.-like quantitative easing program (using central bank funds to purchase longer-term debt securities to drive long-term rates lower). However, there was no definitive quantitative easing program just yet. All of this should stimulate the European economy and depress the euro, which would aid European exports.

Equity markets around the world reacted well to the ECB news, with U.S. markets up about 1.4%, European markets 1.2%, and emerging markets 2.4%. (Easy money policies help emerging markets, and the potential for a stronger export market in Europe provided a double dose of good news.) Commodities were about flat, and U.S. bonds fell on stronger economic news and the anticipation of the European news the prior week.

Overall, I am still forecasting 2.0%-2.5% GDP growth for all of 2014, as I have been for the past nine months. Near-term results will be even better, in my opinion. I will continue to keep last week's rose-colored glasses out of their case for now.

European Central Bank Rolls out the Big Artillery

Sagging economic growth and falling inflation finally forced the ECB to take decisive action to head off a Japan-like bout of deflation. The ECB is the last of the major regions to take some sort of strong monetary effort to revive the economy. The United States, China, and Japan have been on this path for some time already. German and European central bank officials had been somewhat reluctant to act because their mandates are very narrowly defined to maintain price stability, regardless of what happens in labor markets. This is in contrast to the U.S. Federal Reserve, which has an official mandate to maintain price stability and employment growth. They can now use the imminent threat of deflation (a negative form of price instability) as a fig leaf for taking action. That deflation threat is real, as European inflation dropped to a mere 0.5% in May, as reported earlier this week.

The ECB actions were also quite real. It dropped its main lending rate from 0.25% to 0.15%, the so-called emergency/overnight rate from 0.75% to 0.4%, and the rate to banks on reserve deposits from 0% to negative 0.1%. That's not a typo. It is a small negative rate.

By putting a negative rate on deposits, the central bank hopes to force banks to lend more cash, which might generate more economic activity. With negative rates banks will get back less than a euro for each euro they deposit, which should encourage banks to be more generous in lending out funds. In addition, other programs were put in place to offer banks low-cost funds (with proper collateral) if those funds are lent to nonfinancial, nongovernment businesses. That could amount to over $500 billion of additional lending.

Banks are a much more important source of capital in Europe than in the United States, which has a much stronger bond and asset-backed security market. Therefore, these actions are particularly important. In addition, central bank president Mario Draghi offered the mantra "we are not finished yet," this year's follow-up to last year's promise, "we will do what it takes." This was a thinly veiled promise to begin direct quantitative easing (using central bank funds to purchase long-term bonds and other financial instruments). While implemented in many parts of the world, Europe has been more reluctant to directly implement QE.

The table below shows that Europe is indeed behind the United States in bringing rates down. In fact, the United States has started actions to move rates higher. Those increases may not stick, though, now that Europe is reducing its rates and causing investors to view U.S. Treasuries in a more favorable light. Indeed, part of the reason U.S. 10-Year Treasury rates have dropped so much over the past month or two was anticipation of some type of European action.

The combination of these programs is meant to increase economic activity by lowering borrowing costs and almost forcing banks to become more aggressive in their lending. Also, lowering rates might decrease the value of the euro and encourage more European exports. It will also make European prices move higher as the price of imports moves up because of a weaker currency.

These programs should all help, but the questions remain: when and how much? Although the market is excited about these measures, I am at least a little more skeptical. First, everyone is fighting to get their currency value down, and because everyone is acting more or less together, no one is making a lot of headway. Second, easy bank money can't stimulate underlying growth that just isn't there. Very low population growth puts a real lid on growth potential. And there are still structural and tax issues that cheap money won't solve. Third, lower European homeownership and stock holdings mean that an American-style asset reflation, which QE is meant to stimulate, is less effective.

In This Case, Boring Really Isn't Bad

I have characterized this month's jobs report as boring because the data came very close to expectations, there were few and very minor revisions to past months, and the numbers weren't much different from recent averages. I'll take boring any day. The economy added 217,000 total jobs in May compared with the 12-month average of 194,000 jobs. Private sector jobs grew about 2.05% year over year, and the nonfarm payrolls, which add government to the mix, grew 1.72%. Both of those numbers are consistent with GDP growth in the 2.0%-2.5% range.

Hourly wages grew about 0.2% and some of the poor results of the past several months were revised slightly higher. Still, the numbers look anemic. That just doesn't match the stories I am hearing from friends, neighbors, and business associates who are clearly seeing some signs of wage pressures. It doesn't square with the general decline in the unemployment rates over the past year. The year-over-year data doesn't look quite as bad but still doesn't show the increased tightness I have been hearing about. Hours worked were unchanged month to month. So wage growth (employment growth, hourly wage growth, and hours worked) for the month was hitting hard on two out of three cylinders.

Employment Market Finally Recaptures All the Jobs Lost in the Recession

Total employment finally made a new all-time high and recaptured every job lost during the recession. It only took just under six and a half years, the longest recapture period in the post-World War II era. And that politely ignores the fact that the population is quite a bit greater than it was over six years ago. The performance has been very uneven, too, with many, many industries still operating below peak levels.

Of the 12 individually reporting sectors (counting government as one sector and excluding the comprehensive Goods, Service, and Total counts), just four are up. Construction jobs are still an astounding 1.4 million below their level of January 2008 (it's an even more daunting 1.7 million if one picks the absolute high for this category that occurred in 2007, well before the other categories). Government is still down over 500,000 jobs and still isn't really reporting any signs of life. Only professional and business services (a combination of white-collar jobs and temp jobs), health care, and leisure and entertainment (restaurant and hotel jobs) have made much progress. So keep those corks in the champagne bottles for now.

Auto Sales Looking Great, but Likely Too Good to Be True

Morningstar's auto team did a great job summarizing the May auto report:

Automakers reported strong U.S. auto sales for May on June 3. The seasonally adjusted annualized selling rate (SAAR) came in at 16.8 million, up from 15.45 million in May 2013. It was the best May SAAR since 2005 and the highest SAAR since 17.16 million in July 2006. Total sales rose 11.3% from May 2013 to about 1.6 million. We are pleased to see continued recovery in U.S. auto demand, but we are leaving our expectation of 2014 sales of 15.9 million-16.2 million. May’s acceleration from early spring is good news, but the month had five Saturdays, a major holiday, an extra selling day, and included deliveries through June 2; so there's no guarantee that the high SAAR continues into June. May might also reflect more consumers finally buying a vehicle after deferring purchases in early 2014 because of severe winter weather.

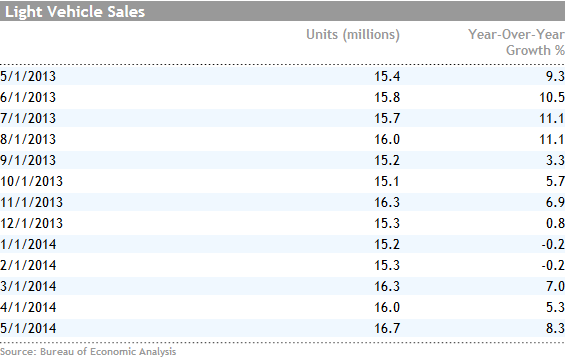

Auto data from the BEA (versus the Automotive News reports) also show the same pattern of stronger monthly growth. The year-over-year data below is single-point data and isn't averaged. Note the short-term pickup in year-over-year growth. Trucks, SUVs, and crossover vehicles saw the highest growth rates.

Autos continue to benefit from freely available credit, unlike the tight credit conditions still facing the housing industry. Many firms noted that more and more consumers are taking out car loans of six or seven years versus more conventional three- to five-year terms. However, it did not appear that auto makers went wild with incentives in May, either.

I view the strong auto sales as a sign of improving consumer confidence. I was somewhat fearful that the strong bounce in March numbers and small slump in April might mean mediocre auto sales in May. Instead we got a recovery record, which is another reason to pull out those rose-colored glasses that I talked about last week. I might also have to take back some of my criticism of the auto industry for building large inventories over the winter months in anticipation of a spring boomlet. I still caution that the calendar could not have fallen in a more favorable way, as our auto team mentioned above. So, June sales might not be as strong.

Purchasing Manager Index Shows Another Increase

This month's ISM Purchasing Manager Index for the United States increased from 54.9 to 55.4. This number reflects the percentage of purchasing managers reporting monthly improvements plus a portion of those reporting no change in business conditions.

The correct interpretation of numbers over 50 is that they reflect more firms reporting increases versus those reporting decreases. However, a review of historical data shows that it takes a dip below 45 to trigger a recession. Small moves in the 50s range or even the high 40s don't really provide much help to economists and investors.

The metric is useful when forecasting economic turns in the middle of a recession, and the ratio merely begins trending up again. The PMI has a nearly perfect track record on this front, which is why it is so popular. It's less useful in predicting economic tops as it often provides a lot of false signals. That said, it is very difficult to have a recession without this index dropping well below 50. So at 55.4, the metric isn't telling us much, despite all the attention it gets. Furthermore, manufacturing accounts for just 9% of total U.S. employment, so manufacturing in the United States isn't as much of an economic driver as it is in the rest of the world.

The good news is that the metric is above 50 and has been trending up for four consecutive months, which certainly seems to be a sign that manufacturing is improving. Recent expansions in industrial production also confirm the progress, as shown above.

The underlying portions of the report were excellent. The report indicated 17 of 18 industries showed improvement, which indicates the broad-based nature of the recovery. It's not the two-trick pony of autos and airliners anymore. (At least, according to the ISM.) Just as important, the new order subcomponent jumped to 61, a huge improvement and a very high absolute level. That subcomponent is really important because good orders eventually turn into more production, more employment, and finally shipments several months down the road. The current Production Index for May was also unusually strong, which should mean an improved industrial product number later this month. About the only disappointment was that the Employment Index slipped from 54.7 to 52.8. That relatively slower performance turned up later in the week with poor employment growth in manufacturing, as reported by the Bureau of Labor Statistics.

Although never a key to my forecasts, manufacturing appears to be making some real improvement. Durable goods orders, capital goods orders, industrial production, and now the ISM data are all pointing toward at least some modest improvement in the months ahead, at least if bad weather doesn't intervene again.

Trade Data Falters Again

The news on the trade front was not good, although I caution that monthly data can be highly volatile. The trade deficit for April was $47.2 billion, its highest level in the past two years and higher than the upwardly revised $44.2 billion for March. The widening deficit was a combination of a 0.2% decline in exports and a 1.1% surge in imports. Unfortunately, the data mean further downward potential in the first-quarter GDP estimate and even more pressure on the second-quarter report, which no one was anticipating. Hopefully, this proves to be a one-month fluke, but the poor March and April numbers combined make it nearly impossible for net exports to make any kind of positive contribution to the second quarter.

Some of the numbers seemed a little squirrelly, so there is at least some hope in the months ahead. On the import side, cell phone imports jumped a huge $1.2 billion. I can't figure why the surge occurred now, months before the next iPhone release. Turning to auto imports, the underside of strong May auto sales is that at least some of those increased units were imported, as auto imports surged almost $0.9 billion. Telecom and computer equipment imports surged over a billion dollars combined. On the export side, soybean exports shrunk by $0.6 billion.

Federal Budget Data and Retail Sales the Only Two Reports of Consequence

In my feast or famine world of economics news, not much is happening after this week's deluge. The Treasury report will lay out the May deficit, but May is not a big month for collections, so it won't tell us too much. Still, revenue growth recently has been on the disappointing side. With slim government employment growth in May, I am not expecting much of a gain in spending.

The retail sales report will be more important, especially given that spending was anemic in the consumption report for April. Expectations are for retail sales to be up 0.6% for May, helped along by the recently announced auto sales. That is a lot better than the measly 0.1% gain in April. With shopping center data improving sharply and the large auto bump, I am hopeful that retail sales can meet, or more likely, exceed a strong 0.6% growth rate expectation.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.