What to Think About Fund Company Mergers

Running through the numbers.

Running through the numbers.

Home Grown or Acquisition?

Yesterday's column looked at TIAA-CREF's recent purchase of Nuveen Investments from the perspective of the fund company. What motivated TIAA-CREF to make the acquisition, and would it turn out to be a sound investment? I expressed my doubts on both fronts.

Today's column flips the view. What should shareholders of TIAA-CREF and Nuveen funds think?

One answer comes from the performance of fund companies that developed organically versus those that relied on acquisitions. I took yesterday's list of the largest 15 U.S. fund companies (mutual funds and exchange-traded funds), sorted by those that were Home Grown and those that followed an Acquisition policy, and calculated the average 10-year percentile ranking, by category, for their mutual funds' total returns. (Skipping ETFs made sense for several reasons, not the least of which was that it made the task easier.)

The results are shown below. Both groups fared well, as expected, because assets follow performance. However, the Home Grown fund companies were stronger overall, with half posting an average percentile ranking of less than 30 (including Dodge & Cox at a spectacular 16, a score that can only be achieved by having a compact fund lineup). None of the Acquisition families, on the other hand, broke the 35 barrier. They were all fine, but none were excellent.

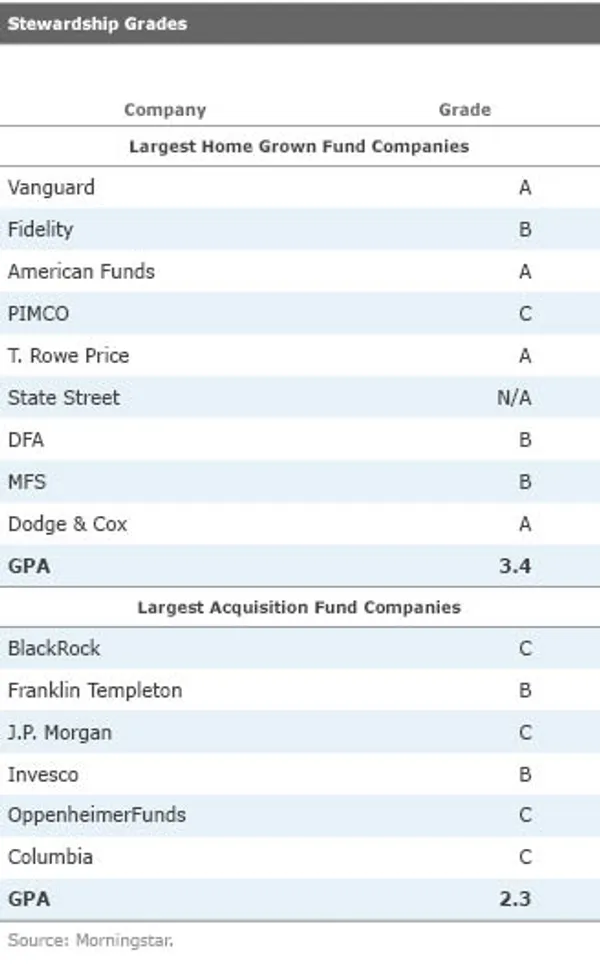

Morningstar's Stewardship Grades are another possible measure. Based on a fund company's experience with regulators, the structure of its boards of directors, its portfolio-manager incentives, its funds' fees, and, finally, its corporate culture, the Stewardship Grades are almost fully independent of the total-return rankings, as they only indirectly incorporate fund performance, and not much at that. Thus, if the Stewardship Grades show the same pattern as do the total-return rankings, that's a pretty solid indication of the superiority of the Home Grown approach.

They do. Indeed, Home Grown funds look even better by this measure, as they garner almost entirely grades of A or B, with only PIMCO registering a C. Their overall GPA is 3.4. The Acquisition companies, on the other hand, receive four C's and 2 B's, for an average GPA of 2.3.

Of course, there are many more than 15 fund companies. Thus, even though these companies account for most industry assets, these tables are scarcely the final word on the matter. However, these preliminary results line up with my anecdotal observations and with the opinions of most Morningstar fund analysts. Growing organically rather than through acquisitions seems to be generally better for three reasons:

1) Lower costs--The industry's lowest-cost mutual fund providers tend to be home grown. Examples include Vanguard, DFA, American Funds, Dodge & Cox, and, until this week, TIAA-CREF. (Most also are not publicly traded firms, or the subsidiary of larger company, but that topic is for a different column.)

2) Centralized portfolio management--It's hard for a fund company to achieve overall excellence if its investment management tasks are spread among multiple offices, often with portfolio managers who barely know employees at other offices. In such situations, performance tends to gravitate toward the mean, with strong performers in one location neutralized by weaker performers elsewhere.

3) Investment focus--The most valuable employees at companies that grow through acquisitions are those who excel at corporate strategy. In contrast, the most valuable employees at fund companies that grow organically are usually investment personnel--because those firms live or die based on their funds' performance.

In summary, fund-company acquisitions should please neither shareholders who own the acquiring company's funds nor those on the other side. There's little reason to suspect that there will be a future benefit for fund shareholders--and possibly, there will be slippage, as corporate managements get spread thin and, in some cases, fund costs rise.

Happy Thoughts

That said, the TIAA-CREF/Nuveen deal may end up being a relatively healthy deal for fund shareholders. Yesterday, I scratched my metaphoric head about the purchase's strategic value for TIAA-CREF. I realized that TIAA-CREF would enjoy the cash that flows from Nuveen's businesses, but so, too, I pointed out, would any acquisitor. One needn't be a mutual fund company to profit from owning Nuveen. The question, it seemed, was what would Nuveen bring to TIAA-CREF that it wouldn't bring to another acquisitor?

The answer, posits a reader who wishes to remain anonymous, is nothing. Per his theory, TIAA-CREF does not plan to integrate Nuveen's funds.

TIAA-CREF's press release stated, "Nuveen's revenue, generated through its long-standing client relationships, will help support our ability to pay higher crediting rates for participants in TIAA Traditional via the revenues flowing in the General Account--the financial engine underlying the TIAA Traditional Annuity."

Writes the reader, "I translate that to mean that TIAA sees Nuveen as a cash cow ... in other words, Nuveen is a 'portfolio investment in whole' like Warren Buffett would do with Berkshire Hathaway instead of an addition to the asset-management unit.

"It's strange when you think about it at first, then it makes sense--the General Accounts of most insurance companies are struggling under a low interest-rate environment and they are trying to find ways to increase that rate or maintain it ... by purchasing more risky, but perhaps cash-flow positive businesses. It's a General Account purchase, not an Asset Management purchase."

Aha. That could well be. It would certainly explain why I can't figure out the strategic fit. That also would be consistent with Nuveen's history, as it was held in a similar, stand-alone fashion by The St. Paul Companies from 1974-2007. (Presumably, TIAA-CREF's management, like Buffett, believes that it is better off buying a single attractively priced risky asset than it would be owning a pool of securities--for example, an indexed portfolio.)

If that is the case, that would seem to be relatively good news for TIAA-CREF and Nuveen fund investors. In such a circumstance, TIAA-CREF's funds are unlikely to be affected at all. With Nuveen, the funds would be managed as before, but it's possible that fees would be hiked as TIAA-CREF looks to extract more milk from the cow. (Such things have been known to happen after fund-company purchases.) As such increases require shareholder approval, there shouldn't be any hidden surprises.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.