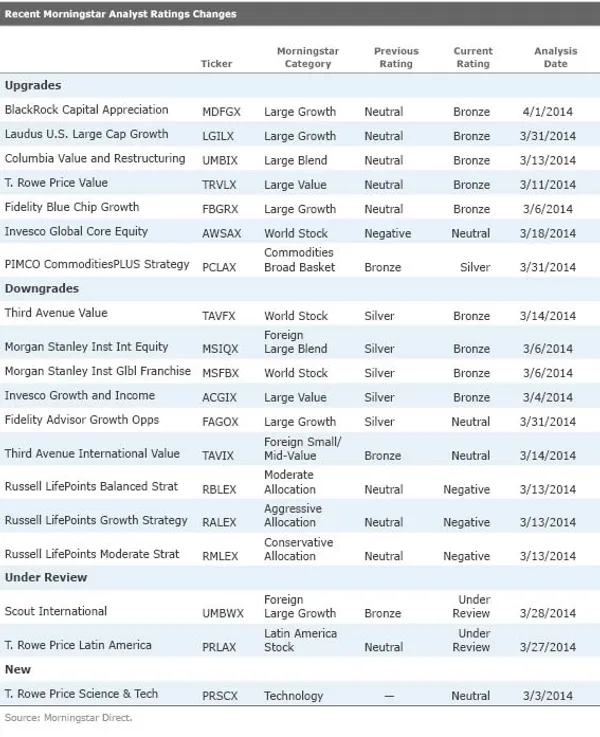

Recent Morningstar Analyst Rating Upgrades and Downgrades

A review of last month's ratings changes.

A review of last month's ratings changes.

It's not unusual for Morningstar to drop a mutual fund's Analyst Rating to Neutral when it gets a new manager, especially if the change is abrupt or takes the portfolio in a new direction, or if the fresh leader lacks a long track record. How long does it take for the latest chiefs to prove themselves? It depends, but in the case of two recent ratings upgrades, three to five years of solid results helped. In this installment of Morningstar's regular look at ratings activity, we'll review those two examples as well as other changes from March.

Proven

T. Rowe Price Value (TRVLX) had been rated Neutral since 2011. At the time, Mark Finn had a short track record, having taken the fund over in 2010. Since then, he has consistently executed his relative-value process and has beaten peers and the S&P 500 Index during his tenure with a mix of out-of-favor and out-of-benchmark picks. The fund now gets a Bronze rating.

Similarly, Fidelity Blue Chip Growth's (FBGRX) Analyst Rating moved to Bronze from Neutral as manager Sonu Kalra proved he could fulfill his approach of pursuing fast but sustainable growth stocks since taking over in July 2009. A rising stock market has helped. But Finn and Kalra have done well on a risk-adjusted basis, too. Kalra also now has nearly a decade-long track record running diversified large-growth funds if you count his 2005-09 stint at Fidelity OTC (FOCPX).

Other Upgrades

Long-suffering Invesco Global Core Equity (AWSAX) is starting over. The fund, whose trailing returns through April 1, 2014, are in the bottom half of the world-stock category, got a new management team and strategy in February. The reboot for this formerly Negative-rated fund also boosted its rating to Neutral. With a new manager, strategy, and cast of analysts, it still has some proving to do.

The ramifications of Mohamed El-Erian's resignation as PIMCO CEO and co-CIO has dominated discussions about the firm recently and led Morningstar to drop the family's Parent pillar grade to Neutral. That didn't stop PIMCO CommoditiesPLUS Strategy's (PCLAX) rating from increasing to Silver from Bronze. Since its 2010 inception, the fund's well-resourced management team has proved adept at adding value with a mix of quantitative and fundamental research.

A manager change from more than a year ago has improved two funds from different families. Lawrence Kemp left Laudus U.S. Large Cap Growth's (LGILX) subadvisor UBS for BlackRock in 2012 after a decade of strong returns. The move triggered other manager changes at the fund, cast doubt on its prospects, and dropped its Analyst Rating to Neutral. Meanwhile, Kemp rebuilt his team at BlackRock with a mix of former UBS colleagues and new faces as he remade the formerly Neutral-rated BlackRock Capital Appreciation (MDFGX). In October 2013, Laudus' parent, Schwab, replaced UBS as Laudus U.S. Large Cap Growth's subadvisor with Kemp's reformulated BlackRock crew. That seven-member group includes four UBS veterans--counting Kemp--that can lay claim to much of the Laudus fund's strong long-term track record. Laudus U.S. Large Cap Growth is cheaper, but it and BlackRock Capital Appreciation now deserve Bronze ratings because they share a seasoned management team and proven process.

This is not your father's Columbia Value and Restructuring , but that's OK. It got a Neutral Analyst Rating when Guy Pope took over from longtime manager David Williams in 2012, and Pope gradually transformed the fund from an idiosyncratic value portfolio that preferred companies in the midst of spin-offs and restructurings into a near clone of Columbia Contrarian Core (SMGIX). It's different, but not all bad. Pope has a built a consistent record at the Bronze-rated Contrarian Core since 2005 and intends to run Value and Restructuring in the same manner. It makes sense to rate it Bronze, too. Don't be surprised if these funds merge, though.

Downgrades

Personnel changes at Third Avenue Funds have led to a couple of downgrades. Third Avenue Value (TVFVX) slipped to Bronze from Silver and Third Avenue International Value dropped to Neutral from Bronze after Amit Wadhwaney, who has led Third Avenue International Value since its 2001 inception, announced his plans to leave in June 2014. Wadhwaney's announcement came in the wake of other departures, as three analysts and one portfolio manager have left the firm during the past year. Matthew Fine, who has comanaged International Value since 2012 and has been an analyst on it since 2003, will take over that fund, but this will be his first solo gig. Those departures don't have a direct impact on Third Avenue Value, but they're still a loss to the firm.

Invesco Growth and Income (ACGIX) comanager Mark Laskin, who had been at the fund since 2007, left this management team in 2013. There still is a capable team in place, but the departure raised enough concerns to move its rating to Bronze from Silver.

Who's watching the watchers at the Russell LifePoints Balanced (RBLAX), Russell LifePoints Growth (RALAX), and Russell LifePoints Moderate (RMLAX) strategies? Things keeps changing at these funds of multimanager funds. That, along with high fees and underwhelming results, pushed these funds' ratings to Negative from Neutral. They've had two different managers since 2011, and there's a lot of manager turnover in the underlying funds, too. The portfolios invest in up to 14 Russell multimanaged funds, which themselves use three to 12 subadvisors each and churn them frequently. Less would be more here.

Morgan Stanley Institutional International Equity (MIQBX) and Morgan Stanley Institutional Global Franchise (MSFBX) dropped to Bronze from Silver because they will lose manager Peter Wright to retirement in December 2014. He has been the team's co-leader since 1999. Talented managers remain, but the team now will have lost three veteran skippers in the past two years.

Under Review

Longtime manager Jim Moffett of formerly Bronze-rated Scout International will step aside at the end of 2014, leaving current co-lead manager Michael Stack and comanager Michael Fogarty in charge, so the fund's rating is Under Review. So is the heretofore Neutral-rated T. Rowe Price Latin America (PRLAX), whose manager Jose Costa Buck left in March.

A New Rating

Ken Allen has done well in rising markets at T. Rowe Price Science & Technology (PRSCX) since taking over in 2009, but this fund gets a Neutral rating because Allen has yet to be tested by a bear market.

For a list of the open-end funds we cover, click here.

For a list of the closed-end funds we cover, click here.

For a list of the exchange-traded funds we cover, click here.

For information on the Morningstar Analyst Ratings, click here.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.