Broken?

Another look at Shiller P/E.

Another look at Shiller P/E.

A version of this article was published in the January 2014 issue of Morningstar ETFInvestor. Download a complimentary copy here.

The Shiller price/earnings measure, which averages 10 years of inflation-adjusted earnings, is under attack. The pseudonymous Jesse Livermore delivers the most devastating broadside to the measure I've read yet. It's cogent and a hell of a read. (I encourage you to read the post at his blog, Philosophical Economics.)

The controversy is hugely important. Most bonds are relatively easy to value--you can reasonably expect to earn their yield. Equity valuation, on the other hand, is much more unsettled in the minds of many. It's also arguably more important than bond valuation because equities are the main driver of many portfolios' real returns.

I have a dog in this fight: I'm a fan of Shiller P/E. But rather than look for reasons to dismiss Livermore, I looked for reasons to accept his arguments, albeit without such an open mind that my brains leaked out. I did so to fight the mind's natural tendency to look for reasons to confirm its closely held beliefs. I went a step further and tried to understand the contours of the debate, specifically Wharton professor Jeremy Siegel's long-standing objections.

The most common line of criticism of the measure relates to changes in accounting standards, or generally accepted accounting principles. For most of its history, GAAP required firms to record their assets at historical cost. Any gains or losses to earnings arising from asset price changes were recorded only when they were realized on sale. Starting with Statement of Financial Accounting Standards 115, or FAS 115, in 1993, GAAP has increasingly required firms to employ fair value accounting, in which assets or liabilities are marked to some measure (preferably market-based) of current value.

Critics emphasize FAS 142 and FAS 144, promulgated in 2001, which require firms to test intangible and long-lived assets annually for impairment. If an asset is found to be less valuable, the firm is required to mark down its value and take a hit to earnings. Otherwise, the asset must be held at historical cost. The test is asymmetric--appreciated assets aren't marked up and reported as additional earnings, at least not until they're actually sold.

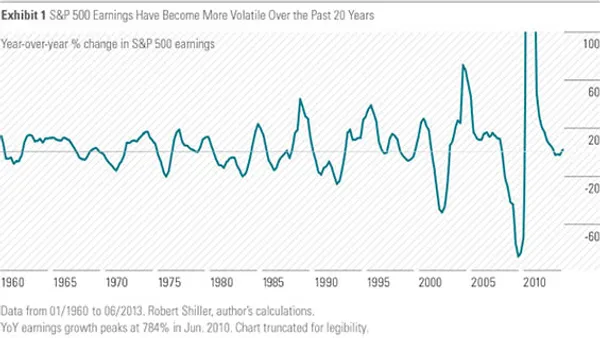

As critics rightly note, the move to fair value accounting was a big deal. It injected a lot of volatility into earnings. Exhibit 1 shows that year-over-year GAAP earnings of the S&P 500 have begun fluctuating more widely over time, especially during the 2000s, when firms were required to record massive losses in the aftermath of the dot-com bubble and the financial crisis.

In my view, greater volatility strengthens the case for smoothing earnings, as both peak and trough earnings move further away from the market's "natural" earnings power.

Of course, this is not the critics' argument. They observe--correctly--that applying mark-to-market accounting in an asymmetric manner--forcing losses to be booked immediately but deferring gains until realized by sale--pushes earnings into the future, thereby biasing Shiller P/E down.

To visualize it, look at Exhibit 1 again. Imagine Shiller P/E calculated at the nadir of the financial crisis, when earnings took a pummeling due to mark-to-market losses. Shiller P/E averages a huge earnings hole, one that would not have been as deep prior to fair value accounting.

The corrective critics propose to use is operating earnings, which exclude "one-off" items as determined by whoever's calculating the measure. This mitigates the downward bias introduced by GAAP earnings. Operating earnings gained prominence in part because GAAP earnings can be so volatile.

However, managers have ample incentive to categorize garden-variety losses as extraordinary and extraordinary gains as par for the course. As a consequence, the S&P 500's operating earnings have almost always been higher than as-reported earnings. The last time operating earnings lagged as-reported earnings was the first quarter of 1995. And since 1988, when S&P's operating earnings series begins, there has never been a rolling one-year period in which operating earnings were lower than as-reported earnings. The median percentage advantage quarterly operating earnings have had over as-reported earnings is 10%.

As I noted before, fair value accounting makes as-reported earnings more volatile, meaning the highs and lows are further away from "true" earnings. The fact that operating earnings are still higher than as-reported earnings during boom times--when earnings are temporarily juiced by firms realizing one-off gains--strongly suggests to me operating earnings in aggregate are persistently overstated.

Even so, nothing in principle stops operating earnings from being a less biased measure of normalized earnings if we compare operating earnings against history. The problem is that earnings quality--operating and as-reported--has declined over time.

Warren Buffett, a keen observer of the financial markets, noted this trend in his 1998 letter to shareholders of Berkshire Hathaway (BRK.B):

"It was once relatively easy to tell the good guys in accounting from the bad: The late 1960s, for example, brought on an orgy of what one charlatan dubbed 'bold, imaginative accounting' (the practice of which, incidentally, made him loved for a time by Wall Street because he never missed expectations). But most investors of that period knew who was playing games. And, to their credit, virtually all of America's most-admired companies then shunned deception. "In recent years, probity has eroded. Many major corporations still play things straight, but a significant and growing number of otherwise high-grade managers--CEOs you would be happy to have as spouses for your children or as trustees under your will--have come to the view that it's okay to manipulate earnings to satisfy what they believe are Wall Street's desires. Indeed, many CEOs think this kind of manipulation is not only okay, but actually their duty."Academic studies have linked declining standards with the rise of the cult of shareholder value in the 1980s. This boardroom cultural shift led to increased equity-based compensation for executives, which in turn gave them incentive to "manage" earnings to consistently meet or beat Wall Street expectations. Studies have documented the rise of discretionary accruals from the 1980s onward. Moreover, they've found a strong link between equity-based compensation and the use of earnings management techniques.[1]

According to surveys and interviews with CFOs, most earnings management is done to manipulate earnings up, though it's not clear whether the aggregate effect is to overstate earnings.[2]

Another problem is that the very definition of operating earnings has been inconsistent over time and inconsistent with as-reported earnings. S&P has operating earnings for the S&P 500 only starting in 1988. Some Shiller P/E critics have spliced as-reported and operating earnings series to come up with adjusted Shiller P/Es, which show no overvaluation or even undervaluation. The cure is far worse than the disease.

My overall sense is that GAAP does bias earnings down, but not to the extent argued by those who would rather use operating earnings.

Nowhere in this debate, however, have I seen the point made that fair-value accounting may actually bias earnings persistently up due to declining interest rates. Let me explain. All assets are priced in relation to risk-free Treasuries. When interest rates decline, future cash flows become more valuable, leading to immediate capital gains. Since the early 1980s, interest rates have persistently fallen, creating big one-off gains for financial assets.

The torrents of new wealth created by broad asset richening spurred many firms to enter the finance business. For example, General Electric (GE) under Jack Welch transformed from a staid industrial firm to a bank that happened to have an industrial arm. Over the past 30 years profits attributable to the financial sector have ballooned.

However, discount rates can't fall forever. At some point asset price increases must be justified by faster-growing or larger cash flows. Arguably the U.S. economy has hit the point where interest rates can't fall much more, depriving corporations of gains spurred by secular asset richening. If interest rates experience a sustained rise, resulting in capital losses, corporate America's earnings will likely be hurt. Given this reality, it's not all that obvious to me that operating earnings provide a fairer picture of corporate America's intrinsic earnings power than the slightly downward-biased Shiller earnings.

NIPA Profits

Critics like to cite the aftertax corporate profit series in the National Income and Product Accounts produced by the Bureau of Economic Analysis as a superior alternative to GAAP earnings. The definition of NIPA profits is consistent through time, because the BEA will recalculate past figures to match current methodology. The definition is also "cleaner" because NIPA profits are from current production, obviating any upward bias from asset richening. And finally, there's no incentive for managers to game NIPA profits, because data are only reported in aggregate, with a long lag.[3] In principle, I agree NIPA profits are superior to GAAP.

Siegel claims that when GAAP earnings are replaced with NIPA earnings, the stock market shows no overvaluation. The problem with this argument is that NIPA profits include the profits of all U.S. corporations, whereas public stock-market earnings exclude private C corporations and S corporations. According to the BEA, profits from S corporations grew fivefold from 1988 to 2003 and in 2008 accounted for 27% of total corporate profits.[4] NIPA profits, without the right adjustments, will overstate earnings attributable to public corporations. It's not clear how Siegel has adjusted his NIPA-based measures.

This Time It's Different

A common mistake critics and advocates of Shiller P/E alike make is failing to distinguish between the measure itself and the average against which to compare it. There's no rule that states one must use the 130-year average. But by default, many cite the 130-year average, because that's how much data Robert Shiller has assembled.

Critics contend this is a mistake. They argue equity valuations have achieved a permanently higher plateau because circumstances have changed for the better. The U.S. is no longer an emerging power, but a superpower. Fiscal and monetary policy have moderated the economy's gyrations. Financial information is more accurate and timely. Firms are better run. Transaction costs and taxes have fallen. Liquidity is more ample. In short, investing is safer, cheaper, and easier. All of these factors point to a lower cost of capital, say the critics.

I wholeheartedly agree. Comparing today's Shiller P/E with its 130-year average will likely lead you astray. I confess I've put too much weight on the 130-year average in the past. Some investors think the past 50 or 30 years are more representative of what fair equity valuations look like.

The right window is a judgment call. A wide range of values could plausibly be used as the average toward which valuations gravitate. Someone with a bullish bias could use the past 30 years. Someone with a bearish bias could use the past 100 years. I can't say with precision what the "fair" Shiller P/E should be given the factors I've identified above, but I'm confident it's higher than the 130-year mean. I think equilibrium could plausibly be anywhere from 20 to 25, though I'm inclined to think it's on the lower end.

So what can be said about Shiller P/E? It's imperfect, but the alternatives are worse.

[1] Daniel Bergstresser and Thomas Philippon. "CEO Incentives and Earnings Management." Journal of Financial Economics, 2006.

[2] Ilia D. Dichev, John R. Graham, Campbell R. Harvey, and Shiva Rajgopal. "A Guide to Earnings Quality." Social Science Research Network, Oct. 30, 2013.

[3] Ilia D. Dichev. "Quality Earnings: Insights from Comparing GAAP to NIPA Earnings." Working paper, Sept. 19, 2013.

[4] U.S. Bureau of Economic Analysis. "FAQ: How are S Corporations Reported in the NIPAs?" Aug. 14, 2006.

| ETFInvestor Newsletter | ||

| Want to hear more from Sam Lee? Subscribe to Morningstar ETFInvestor for fresh ideas for income and total return plus a bird's-eye view of valuations around the globe, portfolio construction advice, and data on the biggest and most popular ETFs. | One-Year Digital Subscription 12 Issues | $189 Premium Members: $179 Easy Checkout |

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.