Employment Report Fails to Pass the Sniff Test

But the economy is not all roses, either.

But the economy is not all roses, either.

This week, equity markets were remarkably calm, taking a dismal employment report in stride and still managing to show a 0.6% gain for the S&P 500. I suppose part of that neutral reaction to the jobs report was due to high hopes that just maybe the U.S. Federal Reserve's tapering program might be slowed, or even halted. At least, that's what the bond market seemed to think as the yield on the 10-year U.S. Treasury bond dropped from about 3% last week to 2.87% this week.

Given the Fed's Open Market minutes released earlier in the week, which expressed a lot of concern about the bond-buying program, I am not so sure that assumption is correct. I don't think the poor economic news is enough to cause a wholesale reversal of the tapering program. In other words, we might be stuck with a modestly weaker economy and a less generous Fed all at the same time--not a good prospect.

The news over the past two weeks has not been happy, with poor auto sales, a disappointing purchasing managers' survey for the services industry, a subpar retail holiday season, and now a crummy employment report. Even home price growth is beginning to slow down. Only the trade report was unequivocally good, though perhaps a little too good to be sustained.

This week's data generally support my view that the economy is not accelerating sharply. That said, I want to be quick to point out that inclement weather seemed to be at least partially the culprit behind this week's soft data. The gloomy news is that the weather certainly doesn't seem to be getting much better in January. But as the wintry weather lifts this spring, the economy could see a decent bounce, unlike the past two years when warm weather helped sales in the winter months, while normal spring rebounds were muted.

I should also note that the employment data, the most damaging of this week's reports, was riddled with many big swings and inconsistencies; it's hard to take it very seriously. The employment data is likely to be revised upward, or perhaps bigger gains are in store for the months ahead as some of the mystery jobs lost are found in later months.

I am, however, concerned that overproduction and inventory building in the auto industry are probably behind a great deal of the strength in the economy, at least before the December auto sales were released. I have long thought the ISM Purchasing Manager Report is unduly influenced by the auto industry, which has a tremendously long supply chain that stretches across almost every production category. Furthermore, a substantial amount of the inventory build that has helped the past two quarters of GDP growth is from the durable goods category, probably autos. If auto sales continue to be soft, auto manufacturers will have to choose between bigger discounts or reduced production.

Monthly Employment Report Highly Suspect; Averaged Annual Data Shows More Slow Growth

The December Employment Report was inconsistent within itself, with other employment reports, and with trends in business conditions, as detailed in this week's video.

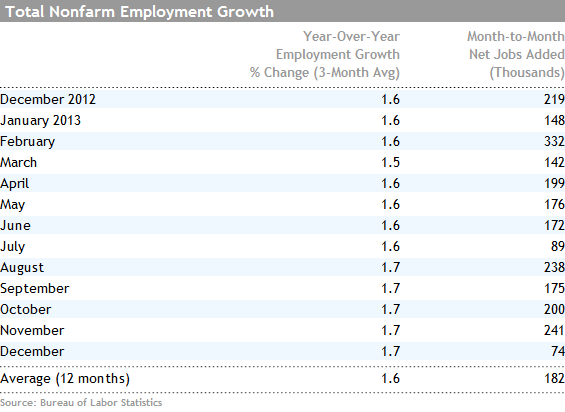

That said, the year-over-year data paints a picture of continued slow employment and economic growth. I think the most telling statement in the whole report was that on average, 183,000 jobs were added in 2012 and a very similar 182,000 jobs in 2013. That's hardly consistent with the rocket-ship, escape-velocity economy that so many are projecting for 2014. It looks an awful lot like another year of the same old gruel to me.

The year-over-year data for hours worked and average hourly wages were little changed from past trends, also indicative of more of the same for the year ahead. Remember, it's not only the increase in people working that counts toward economic growth, but also how much those already working are making per hour and how many hours they are working. The news here also continued to be more of the same sluggishness that we have seen for some time.

Including Government Workers Slows the Employment Growth Rate Considerably

The government sector was weak again this month and is really holding back short-term economic growth. I am going to stay out of the arguments as to whether this is good or bad for the economy in the long term, but it is indeed slowing the economy in the short run.

Using the nonfarm payroll data, instead of my private-sector metrics, demonstrates that total employment growth is growing much slower than the private sector, just 1.6% versus 2.1% for the private sector by itself. That makes sense given that the government is still shedding jobs and that the government (at all levels) still accounts for about 16% of all jobs. That 1.6% overall employment growth rate and the relatively stable month-to-month data is hardly consistent with the booms and busts we are seeing in the volatile GDP data, which has shown growth as high as 4.1%. Something seems amiss between the lackluster employment growth and slow retail sales, and this booming GDP data and forecasts for a sharply improved 2014.

Manufacturing Boomlet Seen in Purchasing Manager Data Isn't Doing Much for Job Growth

The ISM and Markit purchasing manager data has shown sharp improvement, and even year-over-year industrial production statistics are looking better. Yet all of this strength has led to whopping job growth of just 77,000 manufacturing jobs in all of 2013 (not per month, but the grand total for the year!). That compares with 154,000 manufacturing jobs added in 2012. For 2013, that's just 6,000 jobs a month. That's hardly enough to move the economic needle, even considering that these are good-paying, long-hours jobs.

December Employment Report Doesn't Add Up by Itself

Although the year-over-year data showed more of the same for employment, the headline numbers one could pull from the monthly report were close to dire. Job growth for the single month of December was less than half the annual average. The number of hours worked dropped, and hourly wage rates made one of their smallest increases of the year.

A Lot of Reasons for Revision

I don't know if it was the weather, changing seasonal factors, government furlough activity, or what, but the December report just didn't add up. For starters, I can't really believe we added 242,000 jobs in November, then December got really bad, and we added only 74,000 jobs. Averaging those two months together is probably a truer state of the world at about 150,000 jobs added, which still isn't exactly wonderful, but no cliff-dive, either. That 150,000 average looks a little more consistent with the household survey data that showed 140,000 jobs added. These two series often differ from month to month, but that gap usually closes over time.

The retail sector, which has seen soft sales for conventional brick-and-mortar stores, was the biggest gainer of the month, with 55,000 jobs added, one of its better performances of the year. That was despite the fact that retail probably had its worst holiday season since 2009. Worse, the weakest subsector, apparel retailing, was the best employment sector. I suspect this will mean a very poor retail employment number for January.

Then there is a long list of other nonsensical data: 30,000 accountant jobs lost in just one month, 13,000 local schoolteachers losing their jobs midyear, and falling construction employment when the ADP report showed a massive gain. So I feel a little queasy about spending much time on analyzing the month-to-month data in isolation.

Health Care and Education: No Job Growth at All

I am not putting much stock in the monthly data, but health-care and education employment growth continues to erode. There was no growth in either category for December, and the trend has been down for some time. This will create a tremendous headwind for the economy unless reversed quickly over the next several months. Since the employment recovery began in 2010, education and health care have accounted for 20% of all job growth, and now that has gone to zero. Maybe the Affordable Care Act will help early in the New Year, but I am not so sure I can count on that anymore with all of the sky-high deductibles that are now in place at many plans.

I Am Sticking With My Employment Growth Rate Forecast of 190,000 Monthly Jobs in 2014

I don't think the job market was nearly as bad as the headline 74,000 employment growth figure suggested. Some of our other key employment measures, including the ADP Report, the Challenger Gray layoff report, initial unemployment claims, and various purchasing managers' reports seem to indicate that December was relatively flat versus November in terms of employment, and maybe even a little better. Weather may have played a role, but that factor could even worsen in January. And retail is likely to be a negative in January, too. But beyond that, things should look a little better by spring, although negative trends in health care and education bear watching. Overall nonfarm employment growth would be about 1.7% if it hits my forecast, which would be consistent with GDP growth of just over 2%.

Limited Retail Sales Data Suggest a Soft Holiday Season, Still Scared Consumer

Although next week's formal government data will be the true arbiter of the holiday season results, preliminary data from other sources suggest a weak holiday season and poor consumer spending patterns. Poor weather conditions, a shortened holiday season, a reduced food stamps program, and a lack of have-to-own items all put a damper on results at brick-and-mortar stores, although Internet retailers probably did significantly better, despite some last-minute delivery snags.

With the exception of Costco (COST), most brick-and-mortar companies reporting monthly sales data (which isn't many anymore) had a rough December. The array of store types that missed expectations ranged from h.h. gregg (HGG) and J.C. Penney to Family Dollar and Bed Bath and Beyond .

The season started off with an acceptable Black Friday week rush followed by weeks of lethargy, followed by the last-week panic from time-strapped consumers and strong discounting from retailers. The last-minute push by both sides averted disaster and holiday sales weren't much off of expectations, although prices were lower. The International Council of Shopping Centers' monthly data suggests sales growth of 3% during the final two months of the year, matching expectations and bettering last year's results. The council noted that growth over the holiday sales period, at 3%, was in line with full-year same-stores sales growth of 3.3%.

CoreLogic Home Price Data Shows Little Change

Even though year-over-year home price data continues to show strong, but not accelerating, growth, the month-to-month data has stalled out. Prices are basically unchanged between June and November, following sharp acceleration in the spring. Given slipping affordability and higher mortgage rates, this pause may not be an all-bad thing. Still, those expecting a continued boom might be disappointed.

The prognosis for the next couple of months and most of 2014 is for more slowing, based on higher rates and new regulation. The pending data to which CoreLogic has access suggests that home prices were down about 0.1% in December, and the year-over-year growth rate slipped to 11.5%. Hardly a disaster, but the data suggests an early 2014 end to the double-digit increases in home prices.

Massive Decrease in Oil Imports Drives Trade Deficit Sharply Lower

The trade deficit has been an ongoing positive story for this recovery. Trade deficits generally expand, sometimes dramatically, as economic recoveries pick up steam and U.S. consumers demand more goods. However, strong oil and gas production has decreased energy imports and even increased the export of oil-based products, keeping the trade deficit under tight control. The data for November was no exception to the continued improvement, although the dramatic drop in oil imports smells of being way too good to be true. In fact, I believe it is likely to be reversed as early as the report for December. A huge drop in oil imports for November caused most of the deficit improvement. Neither slowing U.S. demand nor production increases can account for such a radical drop. It's more probable that it was timing or an accounting mismatch that caused the sharp one-month drop.

Long-Term Positive Trade Deficit Trends Intact, Though December Could Look Weaker

Still, the deficit for November was a stunningly low $34 billion, the lowest level since fall 2009, when the U.S. was still coming out of the recession. The November estimate bettered economists' forecast and the year-to-date average, which were both at the $40 billion level. The year-to-date deficit is down about 12% from a year ago, and full-year data is likely to show the second year in a row of deficit declines.

The continuing reduction in the deficit should improve the outlook for the dollar, which in turn will help keep inflation in check. A lower deficit is also generally beneficial to the GDP calculation. However, I wouldn't be boosting my December-quarter GDP forecast just yet. I bet the missing oil either turns up as hugely reduced inventories or massive imports in December, nullifying a lot of the gains that some analysts are now penciling in for the fourth quarter. I also note that the change in the inflation-adjusted trade deficit was about half the more widely reported non-inflation-adjusted data.

Retail Sales, Inflation, Housing Starts, and Industrial Production, on Next Week's Agenda

Retail sales data is due next week, and I am expecting an end to the trend of improving monthly sales. Weak auto sales and a poor holiday shopping season (at least for retailers, which were forced to take sharp discounts) are likely to weigh sharply on the retail sales report. Expectations are for growth of 0.2% versus the much stronger report of 0.7% for November. I think that is optimistic, and I expect that there will be no growth in overall retail sales. Even excluding autos, sales are likely to show meager growth of 0.3% or less for December. Given consumption is a key driver of U.S. growth, this is not good news for the economy. I hope I prove to be wrong.

Inflation is expected to move up a bit in December as a jump in gas and gasoline prices as well as food put a little upside pressure on the index. The consensus is for a 0.3% increase, more than it has been for several months and just enough to turn the year-over-year inflation rate up slightly from 1.1% to 1.2%. It will be interesting to see if health-care costs, which have remained under tight control for the past several years, remain so in December and beyond. I suspect apparel prices and auto prices may do more to reduce the index than some suspect, so I am thinking inflation might come in at 0.2% or lower, just below the consensus.

Housing starts had a huge jump in November to 1.09 million annualized units, driven largely by multifamily starts. The markets suspect things will back off a little in December to 0.99 million, still comfortably above the 0.9 million average for all of 2013. I do worry that, like autos and retail sales, weather issues could toss us a nasty surprise in December.

Industrial production is expected to grow a slower 0.4% in December versus a big jump of 1.1% in November, as the big gain in utility sales will be more muted. Also, given huge inventories and some planned production cuts at Ford (F), a slowing is definitely indicated. In reality, I think the 0.4% consensus estimate is too high, and we are more likely to see production growth of more like 0.2%. Slow employment growth in manufacturing announced on Friday is the basis for my statement. Again, poor weather at the end of the month, when many shipments are made, may also affect this data point.

Note: This article has been corrected since original publication. A subhead above originally referred to an "increase" in oil imports. It has been corrected to indicate a "decrease" in oil imports.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.