Do These Comeback Kids Have Long-Term Prospects?

A closer look at a dozen resurgent U.S.-stock funds.

A closer look at a dozen resurgent U.S.-stock funds.

This year's rising stock market has buoyed a lot of funds whose relative returns had sunk over the past five years.

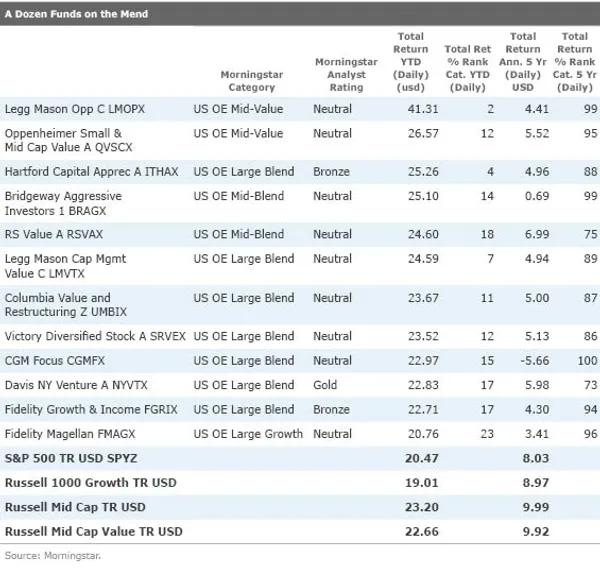

The domestic-equity funds we examine below still carry five-year returns ranking in the bottom fourth of their categories, but they have surged to the top quartiles of their peer group so far this year.

What's the long-term potential of these comeback kids?

The Wild Bunch

He's back--but for how long? Bill Miller, who beat the S&P 500 15 years in a row and then fell off a cliff, is on top again this year at Legg Mason Opportunity (LMOPX). The fund's nearly 44% year-to-date gain through Aug. 5, 2013, beats 98% of its mid-blend peers and is about 20 percentage points ahead of the Russell Mid Cap Value Index and the S&P 500. Much larger than average helpings of mortgage insurers MGIC Investment (MTG) and Radian Group (RDN), as well as digital entertainment names Netflix (NFLX) and Pandora Media have propelled this fund's resurgence. Each stock has more than doubled this year, but they have something else in common: Not long ago, for different reasons, investors held each of them in lower esteem than Congress.

Such is the pattern with Miller and this fund. He was an aggressive contrarian investor with a taste for ugly, unpopular, and unconventional stocks during his very public rise and fall at Legg Mason Capital Management Value Trust (LMVTX), and he remains so at this more wide-ranging fund. Results have been extreme. In the past decade, Opportunity has finished as many years in the bottom fourth of its category as it has in the top. The fund's performance should remain fickle due to its larger than average stakes in companies that, according to Morningstar equity analysts, lack clear competitive advantages and that, on average, have higher debt/capital ratios. It hard to confidently say this fund won't suffer another reversal.

The same could be said for Miller's successor Sam Peters at Legg Mason Capital Management Value Trust. Like its sibling, the performance of some aggressive stock picks, such as Celgene and Groupon (GRPN), have helped that fund so far this year. Like Miller, Peters has an appetite for lower-quality fare and that has resulted in erratic performance since he became comanager in 2010 and lead manager in 2012. His record at Legg Mason Capital Management Special Investment (LMSAX), which he has managed since 2006, also is lacking. So, there's not much to go on here.

CGM Focus also is too mercurial to call. As we have written before about this omnivorous, high-turnover fund, its only consistent attribute is its inconsistency. As long as Ken Heebner is at the helm, it will veer from one end of the performance tables to the other. Investors who have bought this fund at one of its many tops have often been disappointed. Through the end of July the fund had lost more than 6% annualized over the past five years, but according to the fund's investor returns, which factor in shareholder purchases and sales, the typical investor here lost more than twice that--more than 14% annualized--by buying high and selling low. This has been an especially difficult fund to use effectively.

Yes, No, Maybe So

Relatively short track records for the current managers make it difficult to say whether Fidelity Magellan (FMAGX) and Oppenheimer Small & Mid Cap Value A can keep up their improved pace.

Fidelity Growth & Income (FGRIX) has a relatively new manager, too; but Matt Fruhan has shown stock-picking skill both at this fund since 2011 and at his other assignment, Fidelity Large Cap Stock (FLCSX), since 2005. So, there's hope its streak can continue.

Whether Columbia Value and Restructuring maintains its ranking or not may be moot. It looks like it's headed for a merger with Columbia Contrarian Core (LCCAX) because new Value and Restructuring managers Guy Pope and Nick Smith are running the two funds virtually identically.

Victory Diversified Stock (SRVEX) has seasoned management and a consistent process that has put up good long-term returns. But Victory Capital Management just bought itself from its parent company, bank KeyCorp (KEY), with the help of a private equity firm, which creates a bit of uncertainty. It should be in good shape as long as managers Paul Danes and Larry Babin remain.

RS Value (RSVAX) has an appealing philosophy and some experienced managers and analysts. The team members view themselves as buyers of good businesses at good prices rather than traders, and they aren't afraid to invest with conviction. The team has tweaked its process in the past year or so, though, and seen some recent personnel changes. It remains to be seen how all that will work out.

Bridgeway Aggressive Investors 1 (BRAGX) also is just two years from a review and overhaul of the quantitative models that underpin the fund's strategy. It needs more time to prove itself, too.

Similarly, the Wellington Management subadvised Hartford Capital Appreciation (ITHAX) should be all right. But it too is changing. Gradually a new manager of managers will take over the bulk of the duties at this fund from long-time manager Saul Pannell, turning it into a more wide-ranging portfolio built by multiple stock-pickers working independently.

You're Gonna Make It After All

Davis New York Venture (NYVTX) is back near the top of the large-blend category this year, but it has thrown head fakes before. It bounced back from an awful financial crisis with a top-quartile performance in 2009, then retreated again because it eschewed Apple (AAPL) during the computer and smartphone maker's run-up to the fall of 2012 and stuck with Hewlett-Packard (HPQ), Bank of New York Mellon (BK), and Canadian Natural Resources (CNQ) as those companies struggled.

Like the Legg Mason funds, some speculative picks, such as Netflix, have helped New York Venture snap out of a long funk during which it trailed its peers and benchmark in five of the past six calendar years. Netflix is a small position, however, that the fund has been trimming on the way up. Indeed, the fund's longtime mainstays, such as American Express (AXP), Berkshire Hathaway (BRK.A), Wells Fargo (WFC), and Bed Bath & Beyond , have driven its recent comeback. Holdings like Hewlett-Packard and Bank of New York also have done better than the broader market so far this year. That shows the managers Chris Davis and Ken Feinberg didn't ditch their process in the throes of their slump, which is good because the duo still have a strong 15-plus year record with the approach. Those are reasons to think this fund's next six years will be better than the past six.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.