Our Outlook for the Economy

U.S. economic volatility is not what the headlines would have you believe.

U.S. economic volatility is not what the headlines would have you believe.

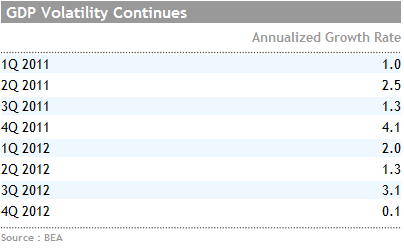

The U.S. economy continues to grow at a slow but steady pace, despite the volatility of the headline economic indicators. One could not be faulted for believing we are in a highly volatile, ever-changing world just based on real GDP growth rates, which have been highly volatile from quarter to quarter.

However, that data includes a lot of ups and downs from inventory changes as well as government spending that just represent accounting timing shifts and not changes in real demand. The data also includes a lot of measurement and seasonal-adjustment issues that are currently befuddling many statisticians.

A Look at Real World Data Suggests Much Less Volatility

Private sector year-over-year employment growth has been steady at 2% for almost two years, while retail sales growth (adjusted for inflation and excluding autos and gasoline) has been in the 2%-3% range for almost as long. Even U.S. manufacturing data, while trending back to norm, haven't been particularly volatile, especially if weather events are removed. Of the Big Four economic indicators, only real disposable income has been very volatile. And most of that volatility is due to ever-shifting inflation rates (with only food and energy showing much volatility) and changes in government tax policy, not changes in wages.

The Big Four Indicators Indicate a Stable, Growing Economy

Given all the fiscal scares, Hurricane Sandy, volatile gasoline prices, and new taxes, the U.S. economy is doing surprisingly well, according to the economic Big Four (the NBER uses a variation of these four to measure recessions). The economy is moving along at a moderate but sustainable pace. The data look consistent with an economy that is growing right in the middle of my 2.0%-2.5% GDP forecast range.

Although manufacturing and exports were important factors early in the recovery, these factors are receiving a lot more attention than they deserve now. That said, manufacturing usually slows at least some as the economic recovery proceeds. The table below shows that typical slowing, but manufacturing Industrial production is still running above the 2.6% long-term average.

Although the data above support my thesis that the manufacturing economy is slowing, purchasing manager and order data suggest that significant improvement is just around the corner. (The supporting purchasing manager data appear near the end of this report.) An improving manufacturing sector could turn out to be one of the biggest surprises of 2013. Much of that improvement could be housing related.

Aggressive Fed Policy Being Offset by a Stiff Fiscal Headwind, More Certainty

It was a relatively busy quarter for fiscal and monetary policy, but these actions just about canceled each other out. However, a lot of fiscal issues were at least temporarily "settled" (and a few were kicked down the road, too), helping to reassure both consumers and businesses.

The fiscal cliff negotiations ended with $235 billion in deficit reduction for 2013, mainly in the form of higher taxes. However, the March sequestration led to another $80 billion in spending cuts. Just last week, the sequester was basically codified with a surprise Congressional agreement on a continuing spending resolution for the rest of 2013.

So the total deficit reduction for 2013 is now slated at over $300 billion, compared with $200 billion of reductions in 2012. That brings the deficit down from $1.4 trillion at the peak to just over $800 billion, or just over 5% of GDP for fiscal year 2013, which represents a very strong fiscal tightening. That is a real headwind and has shown up as falling government employment since 2010.

The Fed, on the other hand, continues with a relatively loose monetary policy. In its most recent release, the FOMC assured investors that interest rates would remain low and bond buybacks would continue as long as the economy remained weak (greater than 6.5% unemployment) and inflation remained low (under 2.5%).

As loose as the Fed has been, it has ring-fenced the monetary punch bowl with some very tight restraints on bank lending. Higher capital reserves at banks have further limited the effect of some of the aggressive monetary policy. Although I am not a huge fan of all the open-ended easing (primarily because of resulting commodity price inflation), I have to admit it worked. The policies were largely responsible for jump-starting the housing market and providing at least a small boost to the stock market.

Despite Some Early Headwinds the Consumer Is Finally Getting a Few Breaks

The consumer continues to drive the economy, constituting about 70% of GDP. Unfortunately, the consumer hit a trifecta of negative news early in 2013, with soaring gasoline prices, a higher payroll tax, and delayed tax refunds.

Nevertheless, consumers also have a lot going for them, including lower inflation in many categories, better employment prospects, sharply higher home prices and related construction activity, and a much higher stock market and related wealth effects. Data so far seem to indicate that the positive consumer news is winning out over the negative. While consumer spending is not as robust as it once was, it is clearly not falling apart in the middle of all the economic headwinds, either.

GDP Growth Rate Forecast Intact at 2.0%-2.5%

I continue to believe that GDP will grow at a 2.0%-2.5% rate in 2013, very similar to 2011 and 2012. While this growth rate may not be terribly satisfying, it is sustainable for many more years, in my opinion. Although growth has been slow this time, some of the economy's prior rapid-spurt recoveries were already over by now. In fact, of the 10 post-World War II recoveries, five of them were already over by now in terms of duration. And while many have fond memories of higher growth rates, GDP growth since 1960 averages just 3.1%, and population growth was substantially higher earlier in that period.

I would note that the 2000s is the one period in the table when a major recession was just ending, depressing that period. As for 2010-, I would note that the decade is far from over. In fact the recovery in housing, the number-one driver of economic recoveries, is just beginning to pick up steam. The improving housing thesis has played a pivotal role in my economic forecasts for both 2012 and 2013.

As the table below suggests, the housing recovery is really beginning to catch fire. I had been somewhat fearful that more normal winter weather and typical seasonality might temporarily slow the improvement, but so far in 2013, things look good.

My only real worry about the housing recovery is a shortage of builders, a shortage of available land, and supply-chain bottlenecks, which could depress housing starts. However, that will tend to cause existing home prices to rise, which is also an exceptionally good thing for homeowners and consumer confidence.

No More Rocket Ships in My Economic Forecasts, Either

Perhaps one of the more embarrassing moments in my five-year stint as an economist here at Morningstar was including a rocket ship blasting off in my forecasting slide deck in 2009 and 2010. I believed that our massive economic decline would lead to a massive recovery.

Although the auto industry did exhibit a rocket-like performance, not many other sectors did. Housing improvement didn't get rolling until mid-2012. And the government sector continues to shed employees, something we have seldom seen before. Both of these factors have held back the recovery. The housing sector is now a real contributor. On the other hand, the government is unlikely to turn the corner anytime soon, with potentially more cuts in the works, at least on the federal level. This will hold back future growth potential.

Furthermore, just as housing get betters, the growth rates in the auto industry are bound to slow, as it is quickly approaching pre-recession shipment levels. A recession in Europe and slower growth in China will also hold back the export sector.

The U.S. Economy Has a Lot Going for It

As slow as the U.S. growth rate is, the U.S. economy is better positioned and growing faster than many other developed economies. Some of those factors may provide a longer-term advantage, including new-found supplies of oil and gas, low electricity prices, more available land for building, and an improving auto industry, as well as the benefits Boeing (BA) provides to the U.S. manufacturing industry.

The data below show the relative strength of the U.S. manufacturing economy and Europe's dismal position.

Obviously some of that improved performance is already reflected in current U.S. stock prices. U.S. stocks were some of the best performers in the world in 2012. That is slowly beginning to change in early 2013.

Morningstar Analysts Remain Cautious

This quarter's sector outlooks aren't bullish or bearish. Many did note relatively high valuations and a lack of cheap stock ideas, but there aren't a lot of egregious overvaluations, either. The most negative factor mentioned by our analysts was Europe. Unfortunately, that situation isn't getting better, even when one excludes the effects of the Cyprus situation.

The credit team did note that U.S. interest rates appeared to be rising some and that credit risks, especially in the banking sector, were beginning to pick up, especially for anyone with exposure/connections to Europe. There were also mentions of a volatile Chinese economy that seems to have bottomed; however, several noted that Chinese growth will likely be meaningfully lower than the previous peaks. Furthermore, some of that growth is likely to be consumption based and less focused on infrastructure, which just might keep some pressure off of commodity prices.

A lot of the sector reports also highlighted excess corporate cash and the potential for both acquisitions and stock buybacks. Lackluster growth is contributing to the interest in both buybacks and acquisitions, which could prove to be an engine for further stock market appreciation.

Corporations Beginning to Invest for Growth Again

One other theme that bubbled up with many different names was a greater willingness for corporations to invest in themselves. In some sector reports, it was labeled as innovation, in others capital spending, and others still renovation, and in some cases acquisitions.

For the past several years, corporations have been more interested in cutting employees and minimizing spending of any kind, and a lot of cash has built up on their balance sheets. Corporations seemed more interested in insuring their financial future than growing a business. An ever-evolving list of crises and uncertainties didn't help.

Now I sense that some of that attitude is changing. Retail stores, in particular, seem to be throwing in the austerity towel to invest in new concepts for product, store designs, electronic commerce, and even employment. Part of the additional spending is for growth and part of it is designed to fight off Amazon (AMZN) and other electronic retailers.

Other than a few employment reports and some limited capital expenditure data, this phenomenon hasn't fully shown up in the economic statistics.

More Quarter-End Outlook Articles

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.