The Young Investor's Model Portfolio: Getting Started With ETFs

Beginning the investing process doesn't have to be intimidating. From start to finish, we've constructed easy-to-execute ETF portfolios for new investors.

Investing can be a daunting prospect for a novice, but it doesn't have to be. Exchange-traded funds are straightforward, comprehensive products that can help simplify the investing process for the uninitiated, particularly those in their twenties who have aftertax investable assets for the first time, perhaps from diligent savings or from a year-end bonus. While retirement accounts (401(k), Roth IRA) have their merits, we recommend young investors hold some money in a taxable brokerage account to keep it accessible for potential large expenses, like buying a house or going to grad school. This article explores how new investors can use ETFs to create a balanced portfolio without stress or confusion. We'll discuss what a target asset allocation should be, and how it can be implemented using ETFs on various trading platforms.

Laying the Groundwork When starting out, new investors should follow two important rules of thumb: keep it cheap, and keep it simple. With a relatively small amount of money to invest, every penny you keep after expenses counts. There's no need to pay a high expense ratio and no reason to rack up costly commissions from your broker by frequently trading stocks. Multiple studies by Morningstar have shown that a fund's expense ratio is a reliable predictor of future success. For the cost-conscious investor, ETFs are the perfect vehicle: on average, ETFs charge a lower expense ratio than mutual funds, and none of the ETFs recommended in our model portfolio cost more than 0.20% a year. At that price, a $5,000 investment would incur $9 in annual fees.

Our model portfolios for young investors involve just four or five ETFs, and all are index products. The basic argument for index investing is that the average person is not a masterful stock picker and unlikely to beat the market. Instead of trying to pick winners, investors can purchase funds that track indexes covering a broad range of companies within an asset class--such as domestic equities, international equities, or bonds. Most ETFs fall into this "passive" indexing category, allowing investors to buy comprehensive and diversified swaths of the market in a single package.

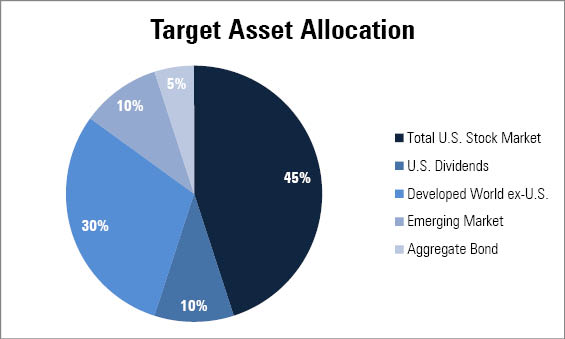

The Model Portfolio Appropriate asset allocation is another important component of good investment practices. Investors allocate a specific percentage of their portfolio to each asset class and maintain that percentage through regular rebalancing--this helps prevent investors from selling positions during a down period. Regular rebalancing moves capital from asset classes that have done well into asset classes that have done poorly--in other words, buying low and selling high. Asset diversification also reduces the risk of a large loss by spreading capital across different sectors.

These portfolios are appropriate for a holding period of at least 10 years. Research by Morningstar indicates that investors with an expected 50 or more years until retirement should allocate aggressively to equity: 95% stock and no more than 5% in bonds. As investors come closer to retirement age, their portfolio should incorporate more fixed income and inflation hedges. Young investors can take on more risk because they have time to ride out market volatility and downswings.

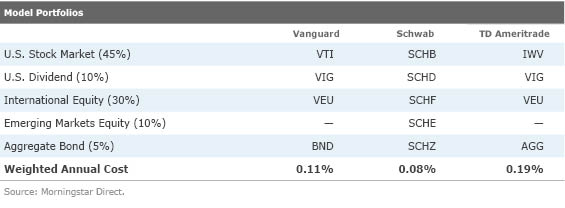

We selected three different brokerage accounts and created a model portfolio for each that executes the target asset allocation as cheaply as possible. The portfolios below are extremely simple and inexpensive, but powerful. Forty-five percent has been allocated to a core United States equity ETF:

Vanguard Total Stock Market ETF VTI,

Schwab U.S. Broad Market ETF SCHB, or

iShares Russell 3000 Index IWV. These ETFs replicate the entire U.S. stock market and offer broad coverage by owning over 2,000 stocks, about 20% of which are mid-cap stocks and 9% small- and micro-cap firms. Historically, these ETFs have been slightly more volatile than the S&P 500 but outperformed by about 0.5% a year. We've also allocated 10% to U.S. dividend funds:

Vanguard Dividend Appreciation ETF VIG or

Schwab U.S. Dividend Equity ETF SCHD. VIG buys stocks that have increased their dividends in each of the last 10 years, and its index also uses a variety of proprietary screens to weed out less-desirable companies. SCHD is a younger and smaller fund that uses a similar methodology. We've included these dividend-focused ETFs because the rationale behind dividend investing is rigorously supported by research. From 1900 to 2010, almost 70% of the U.S. stock market's real growth came from dividends, and there's a strong correlation between high dividend payouts and future earnings growth. VIG and SCHD allow investors to buy quality companies at a very low cost.

International equity's 40% allocation is represented by

Vanguard FTSE All-World ex-US ETF VEU, or a combination of

Schwab International Equity ETF SCHF and

Schwab Emerging Markets Equity ETF SCHE. VEU tracks stocks from 46 countries in the developed world (excluding the U.S.) and emerging markets. SCHF only includes the developed world, so we've added SCHE.

Rounding out the portfolios is a 5% allocation to the aggregate U.S. bond market.

Vanguard Total Bond Market ETF BND, Schwab US Aggregate Bond ETF SCHZ, and

iShares Core Total US Bond Market ETF AGG have performed almost identically over time.

Keeping costs low also means picking your broker carefully. Many brokers offer commission-free trades of some ETFs, but not all. Every ETF we've selected trades commission-free on its respective platform.

-

Vanguard offers over 60 ETFs, and investors with Vanguard brokerage accounts can trade them all commission-free. For any other securities, the commission is $7 for the first 25 trades, and $20 after. Vanguard's brokerage account is not appropriate for investors who plan to frequently trade outside the firm's family of funds.

Schwab offers its 15 proprietary ETFs commission-free, as well as over 100 ETFs from other providers. Other trades cost $8.95. Because Schwab's ETFs are newer, they haven't had years to grow in size like their competitors. The Schwab portfolio's weighted annual cost is the cheapest, at a rock-bottom 0.079%.

TD Ameritrade lets investors buy 101 ETFs from various providers without commission. All other trades cost $9.99, which is the most expensive fee of the group. If you expect to branch out beyond the model portfolio, particularly to buy individual equities, this account may prove expensive.

Because your ETFs will trade commission-free, you can rebalance quarterly without incurring additional charges. Remember to not sell out of your position if the market enters a down period--you have ample time to wait out the volatility. Happy investing!

Disclosure: Morningstar, Inc.'s investment management division licenses indexes to financial institutions as the tracking index for an investable product(s) sponsored by the financial institution (for example, exchange-traded fund). The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click on

for the identity of and information on those investable products currently using a Morningstar index as the tracking index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)