ETF Flows Break Records in 2012

ETFs now make up 13% of total ETF and open-end fund assets.

ETFs now make up 13% of total ETF and open-end fund assets.

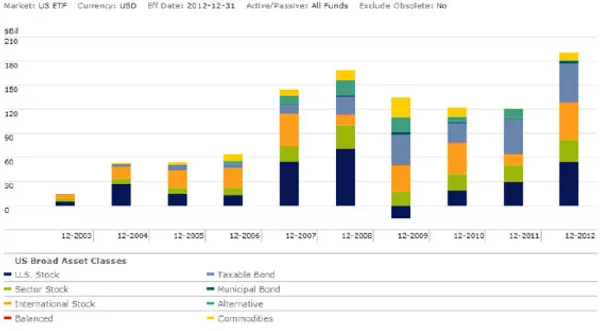

Exchange-traded fund flows reached a record $191 billion in 2012, surpassing the $169 billion flow in 2008. Unlike that year, which was dominated by strong flows into U.S. stock ETFs, 2012 saw record flows into international, fixed-income, and sector stock ETFs. Flows were pushed past the record by a strong showing of $37.7 billion in flows for the month of December.

Strong flows and market appreciation allowed total assets in U.S. ETFs to hit $1.35 trillion. ETFs now account for 13% of total ETF and mutual fund assets, excluding money market funds. ETF assets have more than doubled since the end of 2008, in part due to particularly strong flows into fixed-income ETFs. Taxable bond ETF assets hit $225 billion up from $53 billion four years ago.

After two years of trailing Vanguard, iShares took back the fund flows crown with nearly $61 billion in 2012 flows. Vanguard, which offers a series of low-priced, portfolio building-block ETFs has consistently gained market share, from 7% five years ago to 18% today. Meanwhile, iShares has seen its market share drop from 53% five years ago to 41% today. In response, the firm launched a new strategy in October that centers on a "core" series of low-priced, portfolio building-block ETFs. The launch was accompanied by an aggressive global marketing campaign. In absolute numbers, the 10 "core" ETFs represent less than 4% of iShares' lineup of 280 U.S. funds. However, after the October announcement, these 10 ETFs have accounted for more than 25% of the firm's total net inflows.

SPDR S&P 500 ETF (SPY) brought in more new cash than any other ETF, with $20 billion in flows, most of which came in December. Due its hyper-liquidity and the ability to trade SPY at low costs, traders tend to use it to rapidly place market bets, so flows into SPY are a good barometer of market sentiment.

PIMCO Total Return ETF (BOND) was the most successful new launch of the year, gathering just shy of $4 billion in flows. It is closely watched by the industry because it is the largest active ETF and has an expense ratio that undercuts the cheapest retail share class of the PIMCO Total Return (PTTRX) mutual fund.

| | ETFInvestor Newsletter | |

| Want to hear more from our ETF strategists? Subscribe to Morningstar ETFInvestor to find out what they're buying—and selling—in their portfolios. | One-Year Digital Subscription 12 Issues | $189 Premium Members: $179 Easy Checkout |

|  |  |  |  |

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.