Is Your 529 College-Savings Plan Charging Too Much?

Morningstar does a deep dive on fees.

Morningstar does a deep dive on fees.

Age-based options are some of the most popular 529 college-savings plan investments, so their costs have an impact on millions of college savers nationwide. These investments automatically adjust the asset allocation of your savings, becoming more conservative as your child or grandchild gets closer to starting college. The options' simplicity makes them understandably appealing, but their fees are harder to assess. These options can be actively managed, entirely indexed, or a blend of the two. Some plans require you to enroll on your own, while others are sold through financial advisors. All of these factors affect the price you pay, making it hard to compare fees and know whether you're paying a fair price.

Slicing and Dicing

Morningstar sorted 529 age-based options into six buckets to better understand whether the age-based options were competitively priced relative to peers with similar investment strategies and distribution. We categorized these options as either passively managed, actively managed, or a blend of the two. We defined passive as having more than 80% of assets in index funds, and active as having more than 80% in non-index funds. Blend options have more than 20% but less than 80% of assets in index funds. We also split up advisor-sold and direct-sold investments to get six groups total. To keep the data manageable, we only looked at the investments targeted for 10-year-olds.

Age-based options tend to have a mix of stocks and bonds, but the mix isn't the same across plans, and some plans have several choices for 10-year-olds, each with its own asset allocation. Generally, more bond- and cash-heavy investments for older children cost less, while more equity-heavy investments for younger children cost more.

Among the advisor-sold plans, where plans typically offer a variety of share classes, we only looked at A-shares. These usually carry a front-end load, a sales charge that college savers pay when they first invest.

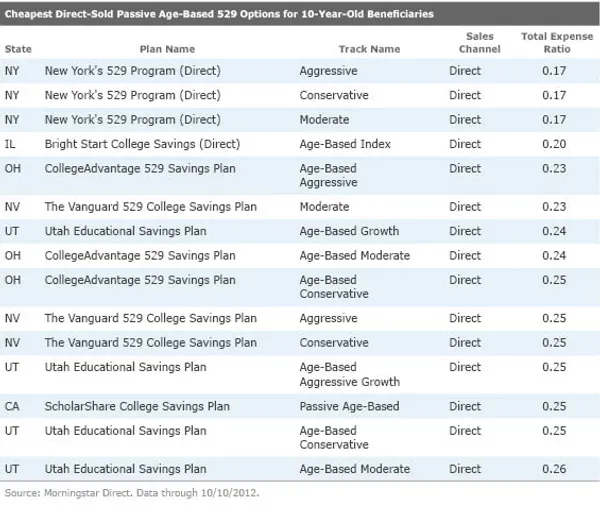

As the table below shows, we found some huge ranges in price within our groupings. In some cases, the range between the cheapest and the most expensive options in a group was over 1.00%. This difference is important because asset-based expenses eat into college savings every year, so the less you pay the larger your college-savings nest egg becomes.

Passive Doesn't Always Mean Cheap

Although the 529 industry's many direct-sold passively managed investments have similar underlying holdings, their prices vary dramatically. The cheapest passive age-based option, from New York's 529 Program (Direct), costs 0.17%. (Even cheaper options have arrived more recently: Since we ran our study, South Carolina's Future Scholar cut the fee on its indexed age-based options aimed at 10-year-olds to as low as 0.11%.)

North Dakota's College SAVE plan is the most expensive passive age-based option, charging 5 times as much as New York's 529 Program (Direct) at 0.85%. North Dakota's age-based option is expensive not because of the underlying fund fee, which totaled 0.07%; rather, the option's program management fee is a painful 0.68%. Typically, plan management fees tend to be higher for smaller plans that have fewer economies of scale, and that's certainly the case with North Dakota. That plan only has a little over $300 million in assets under management, compared to over $11 billion in New York's plan. We've included the most expensive quartile of passive age-based options below, again, only considering investments directed at 10-year-olds.

The Inside Track

Among actively managed advisor-sold plans, we found that simple architecture and a home-state bias frequently meant lower fees. Several of the cheapest actively managed plans tended to invest within the same fund family. For example, Illinois Bright Start Advisor's age-based option is one of the cheapest actively managed advisor-sold tracks, and it almost exclusively features Oppenheimer or Oppenheimer-affiliated funds. Meanwhile, in Rhode Island, the state's 0.45% share classes are only available to residents.

The most expensive advisor-sold active age-based tracks feature both open- and closed-architecture portfolios. In the direct-sold market, several open-architecture tracks from Fidelity make the "most expensive" list, suggesting that mixing managers from different firms can get pricey for investors.

What About Blended Options?

As passive management has become increasingly popular and plans have looked for ways to trim costs, the 529 industry has introduced even more age-based tracks that blend both active and passive management. As a reminder, we defined "blend" as having more than 20% of assets passively managed but less than 80% of assets passively managed. That's a big range, but it's hard to find several tracks with similar active/passive splits to do more-granular comparisons.

With the blended options at the extreme ends of the ranges, it's good to compare the option within the blend group as well as do a gut check against the price ranges for active or passive plans. If a blended plan has only 30% of assets in index funds, for instance, comparing it to the cheapest active plans could be helpful. Likewise, if a blended plan has only 30% of assets in active funds, it's useful to see how it stacks up against the average passive option.

As you might expect, the blend options that lean more toward active management tend to be more expensive than the broader peer group. As such, college savers should be on the lookout for these types of outliers. The Maryland College Investment Plan, T. Rowe Price College Savings Plan, University of Alaska College Savings Plan, the Texas LoneStar Plan, and New York's Advisor-Guided 529 plan have just over 20% of assets in index funds in this phase of the age-based track, while the moderate-track Alabama's CollegeCounts Advisor Plan has slightly over 30% in index funds. When we compare these costs to those for the active group, the options for T. Rowe Price College Savings Plan, Maryland College Savings Plan, and University of Alaska College Savings Plan are well below the median for direct-sold active options. The Texas Lonestar age-based track, however, is still more expensive than the median advisor-sold active plan.

While this article only breaks down asset-based fees, college savers should keep an eye on dollar-based fees as well. Several plans charge annual fees, frequently around $20 per account, which can seem modest but significantly increase the annual cost of the plan in asset-based terms.

Dollars and Sense

College savers are only helped when they're smart and informed about the relative cost of their 529 plan. There are many benefits to going with an inexpensive plan, but there's good reason not to abandon a pricier plan, especially for families who would abandon local tax benefits if they went elsewhere. Laura Lutton's article explaining 529 tax benefits lays out what states have the most generous benefits. And while price is important, it's only one thing to consider when picking the best college savings plan for your family. Morningstar's Analyst Ratings for 529 college-savings plans incorporates price, the quality of underlying managers, stewardship, investment process, and performance history into a single rating to help college savers reach their goals. The ratings on 63 of the largest 529 plans are based on a comprehensive analysis of the plans and are designed to identify the ones that will help college investors meet their savings goals.

Click here for the full list of 529 age-based options aimed at 10-year-olds.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.