Our Outlook for the Credit Markets

Corporate bonds rally as the Federal Reserve's purchases reduce the supply of other fixed-income securities.

Corporate bonds rally as the Federal Reserve's purchases reduce the supply of other fixed-income securities.

Monetary Largesse Lifts Credit Market as Policymakers Work Overtime

Corporate credit spreads tightened dramatically since the beginning of July. Quarter-to-date through Sept. 14, the average credit spread in the Morningstar Corporate Bond Index tightened 50 basis points to +155, the tightest credit spread indicated by the index since July 2011. In the near term, corporate bond credit spreads appear poised to modestly tighten further; however, at this point the preponderance of credit spread tightening is likely to have run its course. The tightest average spread of the index since the 2008 credit crisis was +130 in April 2010, just prior to when Greece admitted its public finances were much worse than previously reported, thus beginning the European sovereign debt crisis. Over a longer-term perspective, since the beginning of 2000, the average credit spread within our index is +177, and the median credit spread was +164.

From a technical perspective, the outlook for corporate bond spreads couldn't look any better. Demand for corporate bonds remains especially strong as investors continue to pour new money into the fixed-income markets. The new-issue market has been active but unable to keep pace with investor demand, and dealer inventory in the secondary market remains near its lows. As the Federal Reserve ramps up its purchases of mortgage-backed securities (under its latest version of quantitative easing) and long-term Treasury bonds (under Operation Twist), investors will have increasingly fewer fixed-income assets to choose from, which will likely force credit spreads tighter as the supply of available fixed-income securities constricts and the new Fed-provided liquidity looks for a home. Unfortunately, this action will further penalize savers as the Fed artificially holds down long-term Treasury rates and as fixed-income securities that trade on a spread basis clear the market at levels that are tighter than would otherwise occur.

Although technical factors have dominated in the current environment, over the long term fundamental considerations will eventually hold sway. From a fundamental risk perspective, we see a number of domestic and global factors that could adversely affect issuers' credit strength during the fourth quarter. In the United States, the outcome of the presidential elections and negotiations to mitigate the fiscal cliff will affect numerous sectors with health care and defense being the most directly affected. Globally, we are concerned that slowing growth in the Chinese economy and Europe sliding into a recession could pressure cash flows for those issuers with global operations. Gauging the economic outlook of any economy is tough enough, but it's especially difficult for China. As such, our basic materials team monitors hard data to gauge the resilience of capital infrastructure spending in China (the largest contributor to economic growth). One of the most concerning indicators of a potentially rapid slowdown is the dramatic decrease in the spot price of iron ore. Iron ore has dropped from $150 per ton earlier this year, to as low as $88.50 per ton before rebounding recently to $106.50 as of Sept. 17. In Europe, even though the European Central Bank's Outright Monetary Transactions, or OMT, program appears to limit near-term sovereign default risk, Spain and Italy are suffering the brunt of the recession, and their sovereign credit metrics continue to decline which could call into question their long-term sustainability.

Corporate Bond Investors Appear to Be Fading the Rally

Since the beginning of August, the financial-services sector has been far and away the best-performing sector in the Morningstar Corporate Bond Index. Considering the sector had been the hardest-hit by the sovereign debt crisis and credit spreads were especially wide for the credit rating, this was no surprise. However, based on the movements within the corporate bond index, it appears that portfolio managers are fading the rally. Among the nonfinancials sectors, the credit spread movements within our index suggest that investors have been rotating out of the more cyclical sectors such as basic materials, retail, and technology and into traditionally defensive areas such as consumer products and telecom, as well as favoring sectors with hard assets such as energy and real estate. In addition, the both the A and BBB components of our index have tightened equally, whereas we would expect greater tightening in the lower-quality BBBs in a typical rally. Anecdotally, some investors are reportedly decreasing the duration of their portfolios. A number of traders we've spoken with recently have mentioned that they have seen better sellers of 30-year bonds and redeployment of the proceeds into the five- to seven-year range. Even a number of insurance companies, who are the natural buyers of 30-year bonds, have been swapping out of the longest-dated paper and into the 15- to 20-year maturity area.

With credit spreads at the tight end of their longer-term trading range, we think this is a prudent course of action. Currently, the market as a whole appears to be driven more by monetary policy as opposed to individual company fundamental analysis. In this environment we advise investors to be cautious in selecting which bond offerings they participate, lest they be plagued with buyer's remorse if/when the market takes a turn for the worse.

Fed to Flood the Markets With More Liquidity

The Fed launched quantitative easing, open-ended, or QEOE, by pledging to purchase monthly an additional $40 billion of agency mortgage-backed securities which will effectively inject more money into a market already awash with liquidity. The intent of the Fed is to support the housing market by reducing the rate on mortgages by keeping both long-term interest rates low and reducing the spread on mortgage-backed bonds. By keeping mortgage rates low and supporting the housing market, the Fed believes its monetary policy will transmit into the broader economy as homeowners refinance into lower-rate mortgages, freeing up disposable income and support home prices by improving affordability for new buyers. The Fed's premise is that as housing prices stabilize and rise, banks will become more willing to extend credit and consumer sentiment will improve as household net worth increases.

The Federal Open Market Committee neither placed an end date nor a cap on the amount of mortgage-backed securities it would buy, but they will continue to make these purchases until the labor market improves substantially. In addition, the FOMC left open the door to making additional purchases of Treasury securities if the QEOE program is not enough to have an impact on the labor market. The FOMC also stated they expect that a "highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens." The Fed will also maintain its policy of extending the average maturity of its holdings and reinvesting principal payments from existing holdings. Altogether, these actions will increase the Fed's holdings of longer-term securities by $85 billion per month. The committee also anticipates keeping the federal funds rate at essentially zero until at least mid-2015. Considering zero interest-rate policy, or ZIRP, was launched in December 2008, that target would entail six and a half years of ZIRP. With inflation ranging from 1.5% to 2.0%, real interest rates are negative through the 10-year Treasury, resulting in considerable financial repression for savers.

On an annualized basis, $40 billion per month of purchases equates to $480 billion of quantitative easing. The Fed did not give a target as to where unemployment would need to fall to before it discontinues these purchases; however, we suspect that the Fed may wish to reach the top of the range for its projection for longer-run central tendency of unemployment. That would equate to a little over 6%, and according to the Fed's projections, that could be reached by the end of 2014. Assuming the Fed purchases $40 billion per month during this period, that would equate to about $1 trillion. If it takes until the end of 2015 to reach an unemployment rate of slightly more than 6%, then the total amount of purchases could reach approximately $1.5 trillion. Considering the total amount of outstanding agency mortgage-backed securities is about $7 trillion, the Fed could end up owning about 15% of the total agency MBS market. With such an outsized position, it will be extremely difficult to exit its position without significantly influencing the market. Realistically, once the market is aware that the Fed is a seller, it will immediately push bonds prices down, thus pushing mortgage bond spreads wider and effectively making mortgages more expensive.

One aspect of the FOMC's announcement that has been mostly overlooked is that the committee reduced its projections for real GDP growth in the United States for 2012 to a range of 1.7% to 2.0% from its June projection range of 1.9% to 2.4%. The Fed shifted this growth to 2013 and lifted its projection for real GDP growth to a range of 2.5% to 3.0%. However, this projection assumes that fiscal policymakers will come to an agreement to mitigate the effects of the fiscal cliff by the end of this year. If the government is unable to formulate and agree to a plan to moderate the fiscal cliff, Bernanke plainly stated that he does not believe that the Fed has the tools to fully offset the negative economic impact the fiscal cliff would have in the short term. The Fed also increased its projections for 2012 Personal Consumption Expenditure inflation (its preferred measure of inflation) to a range of 1.7% to 1.8% and slightly raised the bottom of its 2013 PCE range by 0.1% to 1.6%.

ECB Seeks to Enhance Monetary Policy Transmission; Effectively Eliminates Near-Term Sovereign Default Risk

With the ECB’s new OMT program, it appears that the bank has begun to morph from a secured lender of last resort to the banking system into an unsecured lender of last resort to sovereign nations. As long as a country formally requests assistance and accepts the conditions attached to a European Financial Stability Facility or European Stability Mechanism program, this new plan effectively eliminates sovereign default risk in the near term. This plan will not purchase debt directly from individual countries, but will purchase bonds of up to three-year maturities to reduce interest rates to levels that the ECB deems appropriate. The EFSF or ESM programs would be utilized to intervene in the primary markets as needed.

Spain is scheduled to auction bonds several times through the end of October as it needs to raise enough money to fund both its deficit and a few large bond maturities. Although Spanish bond prices have ripped higher and yields have plunged, it remains to be seen if instituting this new program will be enough to entice investors to purchase the volume of new bonds that the country needs to issue, or if Spain will have to formally request aid under this program. We expect that Spain will delay until the last minute requesting assistance under this program in order to negotiate as much leeway under the conditionality provisions as possible. This new program places the European Union/ECB and Spain in difficult negotiating positions as it appears that failure of either party to reach an agreement brings about an implosion in the eurozone, a form of mutually assured financial destruction.

Although the ECB has announced that bond purchases made under the OMT will be pari passu with other existing bondholders, we harbor our doubts. If push comes to shove, we think the ECB would still be treated differently than other creditors. As we've seen in past examples, when governments are involved in restructurings and defaults (think General Motors and Chrysler) not all creditors are necessarily treated equally.

One final concern about this program was that the ECB's decision was not unanimous. Germany's Bundesbank president Jens Weidmann voted against the bond-buying program. In a press release, it stated, "He regards such purchases as being tantamount to financing governments by printing banknotes." In addition, he argued that this program could have the effect of taking the pressure off of struggling countries from instituting necessary, but painful, reforms in the near term as well as transferring credit risk of those nations onto the taxpayers of the other EU member countries. If this program is insufficient to halt the sovereign debt crisis in Europe, this discord may be indicative of the first real cracks evolving among the eurozone members that could lead to further disunity in the future.

Finally, one aspect of the news that has been overshadowed by the OMT program is that the ECB has reduced its forecasts for real GDP growth in the eurozone for 2012 to a decline of 0.2% to 0.6% and lowered the midpoint of its 2013 forecast to 0.5% from 1.0%. The ECB also raised its forecasts for inflation by 0.1% to a range of 2.4% to 2.6%. As the economies deteriorate, it will place added pressures upon sovereign credit metrics and lead to higher losses among the banks that are already struggling with rapidly increasing nonperforming loans.

Market Implied Inflation Soars

Market implied inflation expectations soared higher subsequent to the FOMC announcement. Intraday on Sept. 14, the five-year, five-year forward inflation break-even rate spiked as high as 3.01%, before settling at 2.86%, 33 basis points higher since the end of August. We estimate that this intraday peak was the highest market implied forward inflation rate since the Treasury began issuing Treasury Inflation-Protected Securities. For those of you who are not familiar with the five-year, five-year forward inflation break-even rate, it is the average annual inflation rate expectation for five years, five years in the future (that is years 6 though 10). It is calculated by stripping out the inflationary rate embedded in five-year TIPS from the inflationary rate embedded in 10-year TIPS.

Global Economic Pressures Will Likely Adversely Affect Those Issuers with Greater Reliance on Europe

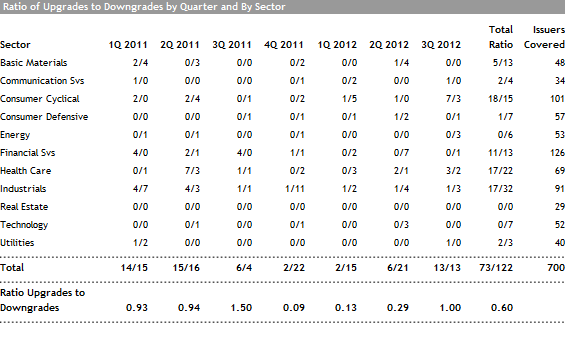

During the third quarter, the upgrades of our issuer credit ratings evenly matched downgrades. The sustained--albeit modest--economic rebound in the U.S. led to upgrades among several domestically focused issuers whose business prospects have improved; however, those upgrades were offset by issuers who either are facing specific deterioration in their business models, such as J.C. Penney (JCP, rating: BB-) and RadioShack (RSH, rating: CCC); made specific capital-allocation decisions to reward shareholders with debt-financed share buybacks, such as Illinois Tool Works (ITW, rating: A); or funded increased capital-expenditure programs with debt, such as Noble (NE, rating: BBB).

For the fourth quarter, we expect that individual issuer credit risk for domestic issuers will mostly emanate from companies that look to financial engineering (that is spin-offs, acquisitions, and debt-funded share-buyback programs) to enhance shareholder value. Leveraged buyouts will likely be few and far between as both domestic and European banks are more interested in preserving capital as opposed generating fees from financing leveraged transactions. However, among European issuers and those issuers with greater global exposure, we expect credit risk will generally increase with cyclical sectors experiencing the brunt of the continentwide economic slowdown. Several European countries are already in a recession, and several other European economies appear to be heading in the same direction.

source: Morningstar

>> Click here to read our sector-by-sector outlook for the credit markets

More Quarter-End Outlook Articles

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.