Our Outlook for the Market

The market looks increasingly dear, but bargains can still be had.

The market looks increasingly dear, but bargains can still be had.

The market looks increasingly dear to us today, after rising roughly 5% since our last quarterly review. That increase has run a little ahead of the mixed, but generally upward revisions to our earnings projections and fair value estimates. However, we still see attractive values in individual industries and firms and, in particular, among wide-moat companies. That's the basic message in our latest quarterly review.

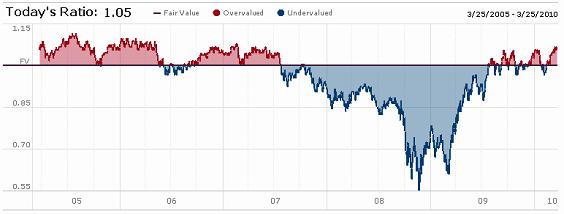

Morningstar equity analysts cover about 1,700 companies, and we develop sector and overall market outlooks on a quarterly basis. One way to get a read on our collective take is with Morningstar.com's market fair value graph. This tool tracks the median price/fair value ratio of our coverage universe over time and allows you to drill down to see our assessments across moat, uncertainty, sector, and industry categories. You can couple that with our in-depth sector discussions below, which include a review of the individual stocks our equity research teams have identified as some of the best values in the market right now.

At the date of our last quarterly review, in December 2009, the median price/fair value ratio for our overall coverage universe was 1.02. Today, that ratio is up to 1.05. It has basically been fluctuating around 1.0 since late 2009, after the significant market rally that began about a year ago.

The median price/fair value estimate ratio increased in the last quarter in all three of our economic moat rating categories, but we still see greater opportunity in the smaller, wide-moat category. This category includes those firms we deem as possessing significant competitive advantages and the potential for superior returns on capital. The median price-fair value ratio for these 160 companies is at 0.96, below the median ratios for the narrow (1.01) as well as no-moat (1.14) buckets.

We still don't have much in the way of sector-wide calls right now, at least at the higher levels of aggregation. Our health-care team was relatively bullish last quarter, but even there, we are seeing fewer attractive values these days.

| Median Price/Fair Value Ratios | |

|  |

| Business Services | 1.00 |

| |

| Consumer Goods | 1.07 |

| |

| Consumer Services | 1.11 |

| |

| Energy | 1.02 |

| |

| Financial Services | 1.03 |

| |

| Hardware | 1.17 |

| |

| Health Care | 0.98 |

| |

| Industrial Materials | 1.08 |

| |

| Media | 1.08 |

| |

| Software | 1.17 |

| |

| Telecom | 0.99 |

| |

| Utilities | 1.04 |

| |

| All | 1.05 |

| |

| Data as of 03-25-09 |

Our market valuation graph allows you to poke around in all the industry groups underlying these sectors, supplementing our sector discussions (including our best individual stock ideas) below.

For example, our "industrials" category includes firms we identify in the "general building materials" and "residential construction" categories. Hammered in the recession, stocks in these groups have been relatively dormant amid a developing economic recovery. We have yet to see a significant housing recovery, to be sure, but the price/fair value ratios in those industry groups are among the lowest in our coverage universe right now.

A notable industry at the pricey end of the scale is staffing and outsourcing services, where stock prices have had a significant run in recent months. If that market reaction augurs well for stronger labor markets, a better housing recovery could be on the cusp as well, supporting our take on housing-related stocks.

You can learn more about the opportunities, trends, risks, and performance drivers identified by our analyst research groups in the articles listed below:

Our Outlook for Basic Materials Stocks

Our Outlook for Business & Financial Services Stocks

Our Outlook for Consumer Stocks

Our Outlook for Health-Care Stocks

Our Outlook for Industrials Stocks

Our Outlook for Tech & Telecom Stocks

Our Outlook for Utilities Stocks

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.