8 Top-Performing Tech Stock Funds

Funds from Vanguard, Fidelity, and iShares have outperformed in a turbulent market for tech stocks.

After a brutal year for technology stock fund investors, 2023 has brought a revival and new momentum to the sector.

For the tech stock funds that have outperformed in recent years, a common theme has been an emphasis on higher-quality tech names and less exposure to the most volatile stocks in the sector. Two semiconductor funds rank among the best-performing stock funds, reflecting that industry’s strength, which has seen a big boost from the development of artificial intelligence. Within the Morningstar US Technology Index, semiconductor stocks have been the best-performing industry group over the last three years and second-best over the past five years.

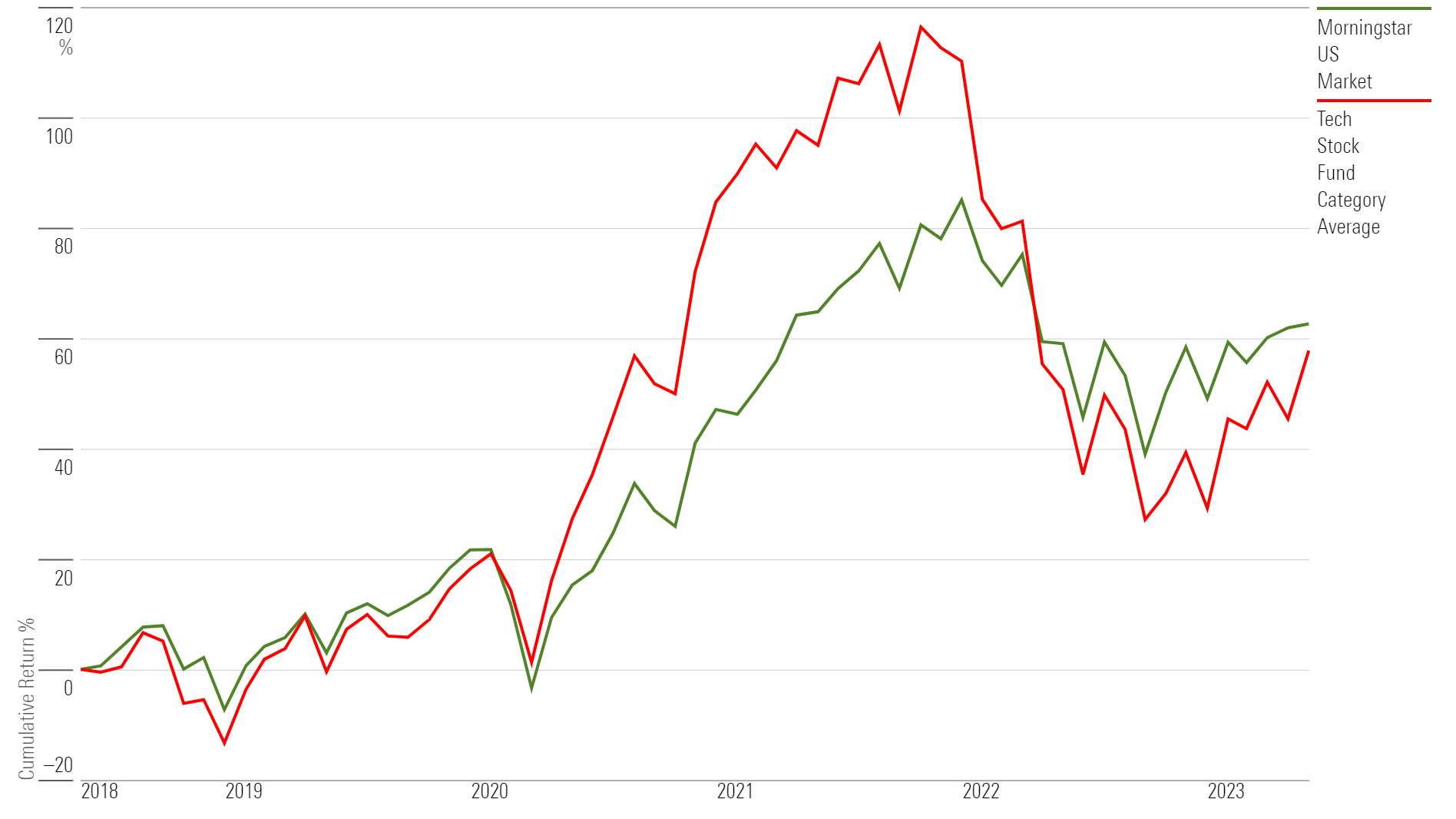

Relief for Tech Stock Fund Investors

Prior to 2022, technology funds significantly outperformed the overall stock market. However, that bull market led to many tech stocks trading an extremely high valuations by late 2021. As a result, when the bear market hit, tech stock funds took even more of a beating than the broad market. In 2022, the average technology fund lost 38.5%, while the overall stock market as measured by the Morningstar US Market Index lost 19.4%.

The beginning of this year, however, has been rewarding for tech fund investors, with the average tech stock fund having gained 23.6% so far in 2023. The stock market in comparison has gained 10.2%. That’s evened out the 12-month trailing returns as of June 2, 2023, with technology funds having gained 4.2% and the US Market Index rising 3.7%.

Tech Stock Funds vs. the U.S. Stock Market

8 Top-Performing Tech Stock Funds

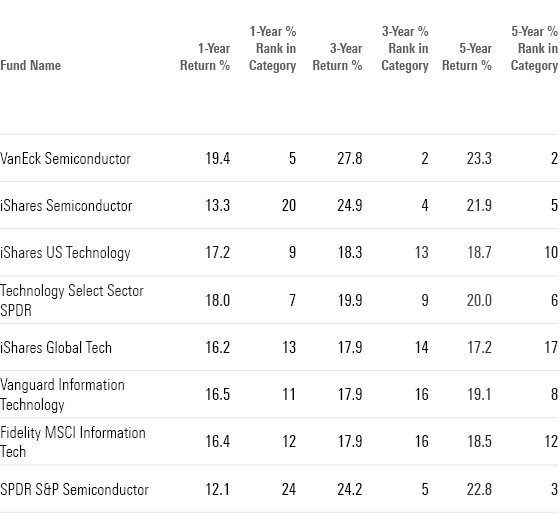

To screen for the best-performing tech stock funds, we looked for those that have posted solid returns across multiple time periods.

We first screened for funds that ranked in the top 25% of the Morningstar Category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with analyst-driven Morningstar Medalist Ratings of Gold, Silver, or Bronze on those share classes. We then excluded funds with less than $100 million in assets.

From this group, we’ve highlighted eight funds with the best year-to-date performance. All the funds in this list are index funds. A table with the funds’ returns can be found at the bottom of this article.

8 Top-Performing Tech Stock Funds

VanEck Semiconductor ETF

- Ticker: SMH

- Morningstar Medalist Rating: Silver

“The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS US Listed Semiconductor 25 Index.”

“On a 10-year basis, this share class beat the category index on an annualized basis by 3.6 percentage points. It has also come out ahead of peers by an annualized 8.6 percentage points, over the same 10-year period. One-year performance does not largely affect this share class’ rating. However, its impressive 8.9% return is worth mentioning, a 14.7-percentage-point lead over its average peer, placing it within the top 10% of its category.”

—Morningstar Manager Research

iShares Semiconductor ETF

- Ticker: SOXX

- Medalist Rating: Silver

“The investment seeks to track the investment results of the ICE Semiconductor Index composed of U.S. equities in the semiconductor sector.”

“The fund’s long-term absolute return track record is more convincing. On a 10-year basis, this share class beat the category index on an annualized basis by 3.8 percentage points. It has also beaten its average peer by an annualized 8.9 percentage points, over the same 10-year period.”

—Morningstar Manager Research

iShares US Technology ETF

- Ticker: IYW

- Medalist Rating: Silver

“The investment seeks to track the investment results of the Russell 1000 Technology RIC 22.5/45 Capped Index. The underlying index measures the performance of the technology sector of the U.S. equity market and as defined by FTSE Russell.”

“Over a 10-year period, this share class outpaced the category’s average return by 4.8 percentage points annualized. Despite the solid performance against its peers, it did not extend when compared to the category index, Morningstar US Technology Index, where it trailed by an annualized 26 basis points over the same period.”

—Morningstar Manager Research

Technology Select Sector SPDR ETF

- Ticker: XLK

- Medalist Rating: Silver

“In seeking to track the performance of the index, the fund employs a replication strategy, which means that the fund typically invests in substantially all of the securities represented in the index in approximately the same proportions as the index.”

“On a 10-year basis, this share class mirrored the category index. However, it has had superior performance compared to its average peer, outperforming by an annualized 5.1 percentage points over the same 10-year period. One-year performance does not largely affect this share class’ rating. However, its impressive 7.7% return is worth mentioning, a 13.6-percentage-point lead over its average peer, placing it within the top 10% of its category.”

—Morningstar Manager Research

iShares Global Tech ETF

- Ticker: IXN

- Medalist Rating: Silver

“The investment seeks to track the investment results of the S&P Global 1200 Information Technology 4.5/22.5/45 Capped Index composed of global equities in the technology sector. The index is designed to measure the performance of global equities in the information technology sector.”

“Over a 10-year period, this share class outperformed the category’s average return by 3.7 percentage points annualized. However, it was more difficult to outpace the category index, Morningstar US Technology Index, where it trailed by an annualized 1.3 percentage points over the same period. Although the overall rating does not hinge on one-year performance figures, it is notable that this share class returned 6.3%, an impressive 12.2-percentage-point lead over its average peer, placing it within the top 10% of its category.”

—Morningstar Manager Research

Vanguard Information Technology ETF

- Ticker: VGT

- Medalist Rating: Gold

“The investment seeks to track the performance of the MSCI US Investable Market Index/Information Technology 25/50. The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index/Information Technology 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the information technology sector.”

“The share class had a higher Sharpe ratio, a measure of risk-adjusted return, than the category index, Morningstar US Technology Index, over the trailing 10-year period. Often, higher returns are associated with more risk. However, this strategy hewed close to the benchmark’s standard deviation. Finally, the share class proved itself effective by generating positive alpha, over the same period, against the category group index: a benchmark that encapsulates the performance of the broader asset class.”

—Morningstar Manager Research

Fidelity MSCI Information Tech ETF

- Ticker: FTEC

- Medalist Rating: Silver

“The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Information Technology 25/50 Index. The fund invests at least 80% of assets in securities included in the fund’s underlying index. The fund’s underlying index is the MSCI USA IMI Information Technology 25/50 Index, and which represents the performance of the information technology sector in the U.S. equity market.”

“On a seven-year basis, this share class performed in line with the category index. But when expanding to a nine-year period, the fund outperformed the index by 20 basis points. However, despite its mixed performance against the index, it has outpaced its average peer by an annualized 5.8 percentage points over the nine-year period.”

—Morningstar Manager Research

SPDR S&P Semiconductor ETF

- Ticker: XSD

- Medalist Rating: Silver

“In seeking to track the performance of the S&P Semiconductor Select Industry Index (the “index”), the fund employs a sampling strategy. It generally invests substantially all, but at least 80%, and of its total assets in the securities comprising the index.”

“This share class surpassed the category index over the past 10-year period, outperforming by an annualized 3.6 percentage points. It has also led its average peer by an annualized 8.7 percentage points over the same 10-year period.”

—Morningstar Manager Research

Long-Term Returns of Top-Performing Tech Stock Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)