Markets Brief: Why Vanguard Sees a Brighter Outlook for Investors’ Portfolios

While stock valuations are stretched, higher bond yields make for better return expectations.

Check out our weekly markets recap—including a look at stocks making some of the week’s biggest moves—at the bottom of this article.

Despite a bounce in the stock and bond markets in early 2023, optimism has been in short supply on Wall Street.

Ongoing concerns about a potential recession, ripples from the regional bank crisis, and weak corporate profits have many analysts skeptical that the stock market can significantly extend its recent gains in the coming months.

In addition, most forecasters say that in the absence of the extremely low landscape for interest rates engineered by the Federal Reserve in the wake of the 2008 financial crisis and the COVID-19 pandemic, stocks are unlikely to repeat the above-trend double-digit returns seen in the decade leading up to the 2022 bear market. Even if the Fed does lower interest rates next year, they’ll probably hold closer to long-run historical levels than they were for most of 2008-21.

But that same regime of higher interest rates—in the form of higher yields—is bringing more attention to the bond market. The bond market is also a big part of the reason that Vanguard Group’s long-term investment return forecasts offer investors some good news.

“The outlook for investors is brighter today than it was a year ago,” says Todd Schlanger, senior investment strategist at Vanguard’s Investment Strategy Group.

Bond Market Outlook

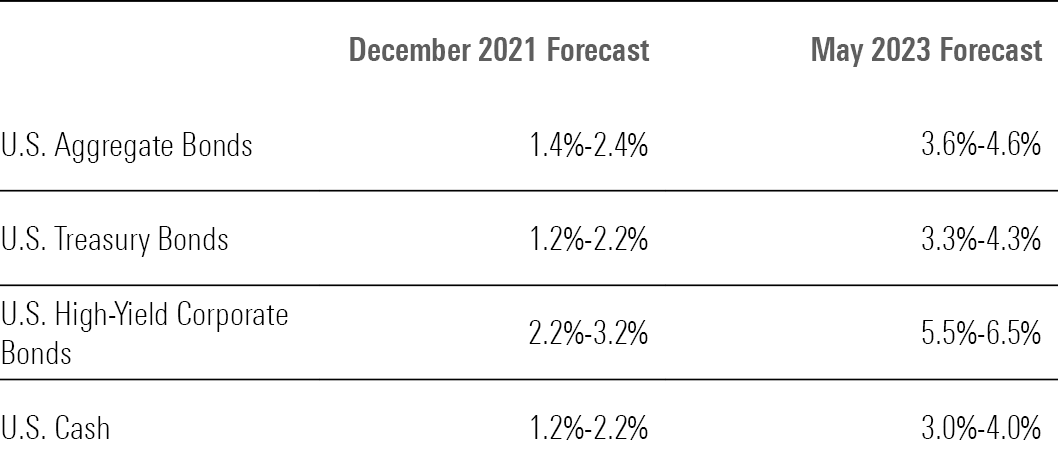

In Vanguard’s most recent update of its asset-class forecasts, it estimated that a core bond portfolio—as measured by the firm through the Bloomberg U.S. Aggregate Bond Index—would return 3.6%-4.6% a year over the next 10 years. That’s down slightly from an estimated range of 4.1%-5.1% in its December 2022 report.

But more importantly for investors, current expectations contrast significantly with the kinds of returns investors could have expected in December 2021. At that point, an investor putting money to work in a core bond strategy was estimated to earn 1.4%-2.4% a year for the next decade.

Vanguard's Long-Term Fixed-Income Return Forecasts

Underlying the expected higher returns is the better starting point in terms of bond yields (and lower prices, which move in the opposite direction of yields).

This shift in the landscape has important implications for investors, Schlanger says. “In the 10 years since the global financial crisis, the primary reason to hold high-quality fixed income, such as government bonds, was diversification, because they tend to offer the greatest counterbalancing relative to equities,” he says. “But now they also meaningfully contribute to the return of the portfolio.”

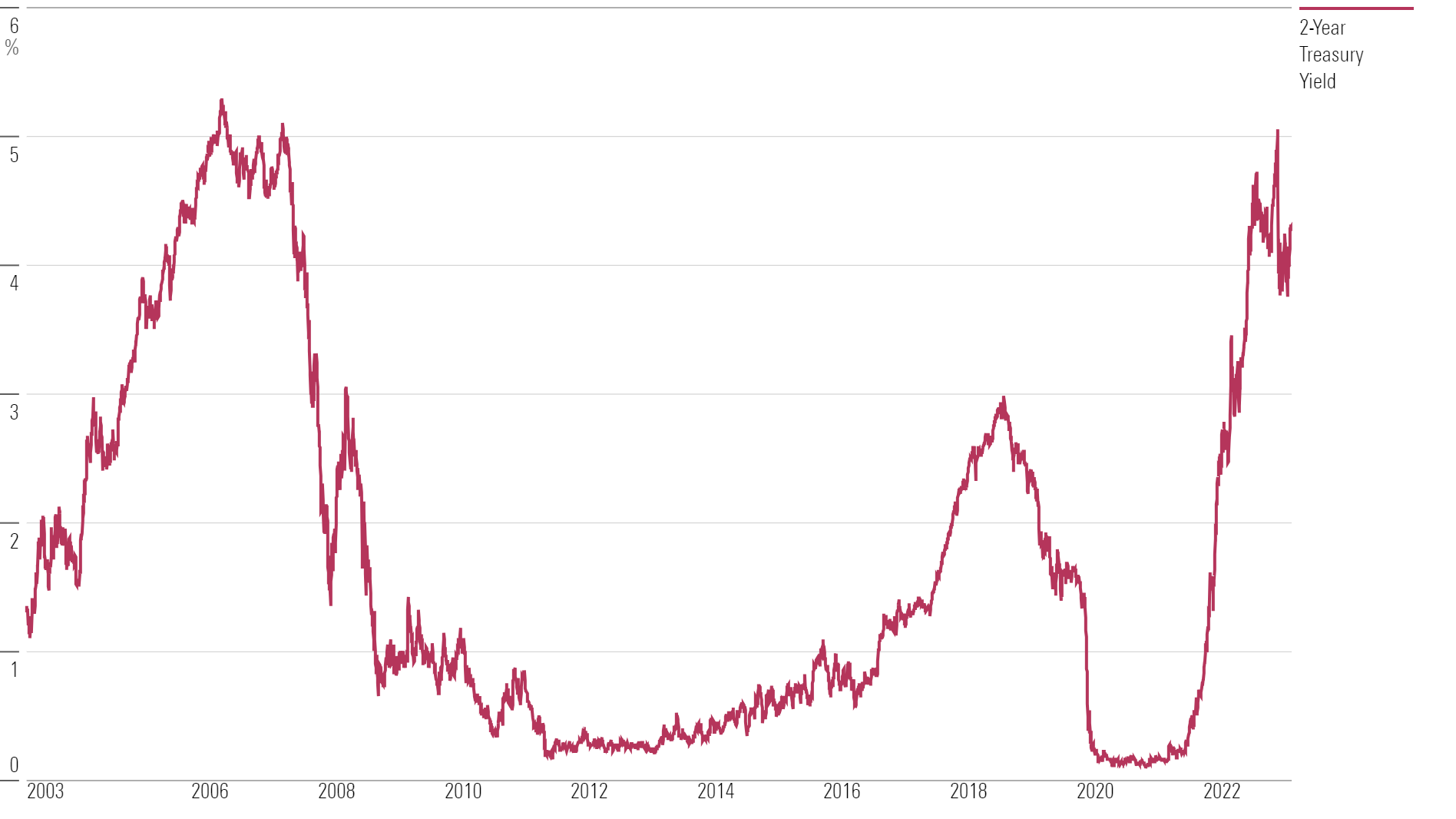

Another difference for investors from recent years is the higher yields available on relatively safe U.S. government bonds. For example, the U.S. Treasury two-year note is yielding 4.3%—levels last seen before the 2008 financial crisis.

U.S. Treasury 2-Year Note Yields

Here too there are implications for building a portfolio. Until recent months, investors looking to earn those kinds of yields would have to venture into riskier investments, such as high-yield corporate bonds or stocks.

“If you have a specific goal around returns within your portfolio—on a nominal basis, meaning without inflation—the amount you’re allocating to equities versus fixed income could be a more conservative portfolio relative to a year ago to meet that objective,” Schlanger says. Or putting it another way, “if you have a specific return target, fewer equities would be required this year than last year.”

Stock Market Outlook

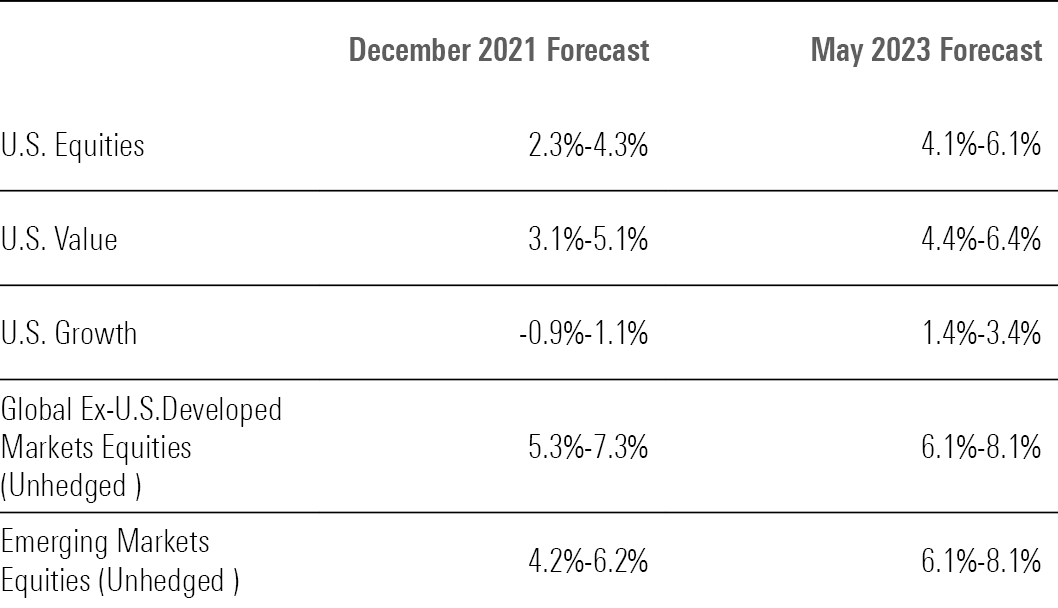

The picture is more mixed for stocks. On the one hand, the return outlook is improved from before the bear market, when Vanguard estimated the 10-year average annual return on U.S. stocks to be 2.3%-4.3%. The most recent forecast is for returns of 4.1%-6.1% per year.

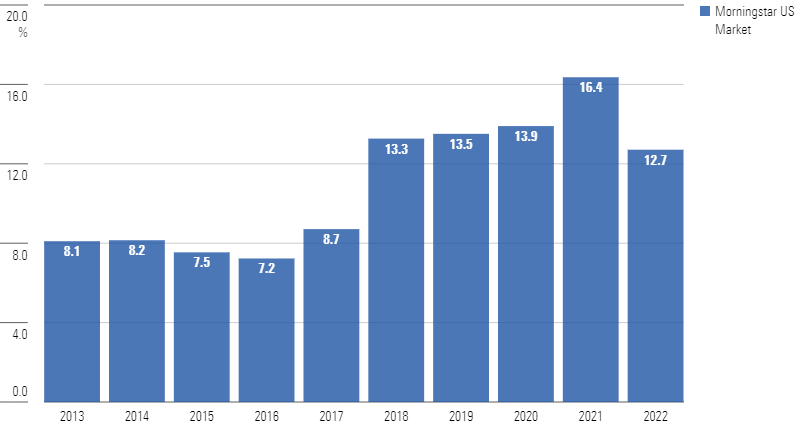

But compared with the gains investors had been enjoying on U.S. stocks before the bear market, that outlook represents a significantly lower pace of returns. For the 10 years ending December 2021, the Morningstar US Market Index returned an average of 16.4% per year.

In addition, the current range of expectations is below Vanguard’s long-term target expectations for returns on U.S. stocks of just over 8%, Schlanger says.

U.S. Stocks Rolling 10-Year Average Annual Returns

While higher interest rates are bad for expected stock returns, valuations constitute the main reason for lower returns forecasts.

By Vanguard’s calculations, valuations on U.S. stocks were at expensive extremes at the end of 2021. The firm placed valuations on the market at the 98th percentile when compared with history. (Vanguard uses a cyclically adjusted price/earnings ratio to assess valuations.)

During the bear market, stocks fell to the 49th percentile. Most recently, the U.S. stock market clocked in at the 79th percentile, Vanguard says. At that level, U.S. stocks are “still at what we’re calling stretched valuations,” says Schlanger, although it’s more reasonable than before the bear market.

Non-U.S. stocks are considered fairly valued, along with U.S. bonds. “U.S. equities are the only one that we’re calling stretched,” Schlanger says. “So across-the-board improvement, which is why the outlook is a lot brighter for a balanced portfolio.”

Vanguard's Long-Term Stock Return Forecasts

Events Scheduled for the Coming Week Include:

- Monday: Markets closed in observance of Memorial Day.

- Wednesday: Salesforce CRM, CrowdStrike CRWD, Okta OKTA, and Nordstrom JWN report earnings.

- Thursday: Broadcom AVGO, Dell Technologies DELL, Macy’s M, and Lululemon Athletica LULU report earnings.

- Friday: May U.S. employment report.

For the Trading Week Ended May 26:

- The Morningstar US Market Index rose 0.3%.

- The best-performing sector was technology, up 5.3%

- The worst-performing sectors were consumer defensive, down 3.1%, and basic materials, down 3.0%.

- Yields on 10-year U.S. Treasuries rose to 3.80% from 3.69%.

- West Texas Intermediate crude prices rose 1.6% to $72.67 per barrel.

- Of the 850 U.S.-listed companies covered by Morningstar, 289, or 34%, were up, and 561, 66%, declined.

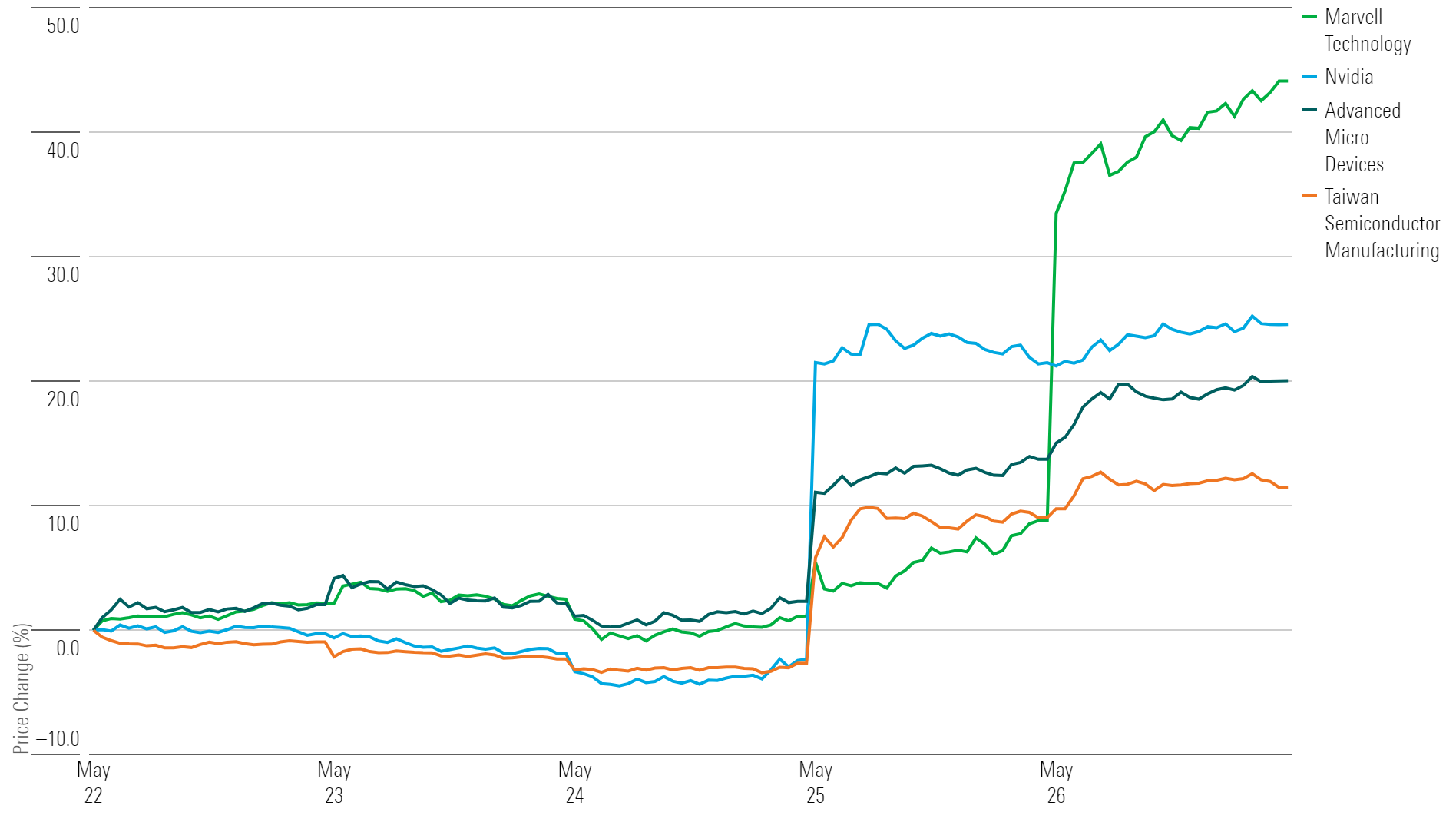

What Stocks Are Up?

Marvell Technology MRVL stock surged as the company provided “bullish long-term commentary” regarding demand for artificial intelligence. “Marvell quantified targets for artificial intelligence-derived revenue for the first time, which include a quadrupling of sales over the next two years,” says William Kerwin, Morningstar equity analyst. “While we already saw large-scale cloud demand as nearly insatiable, we believe AI takes it to another level and makes Marvell’s new targets achievable.” Kerwin increased Marvell’s fair value estimate to $61 per share from $54.

Nvidia NVDA stock surged after the company not only posted first-quarter results that beat FactSet estimates but also announced guidance for the second quarter that far exceeded market forecasts. Nvidia set revenue for the second quarter to land between $10.78 billion and $11.22 billion, ahead of former analyst mean estimates of $7.17 billion.

“The uplift is primarily driven by unsatiated demand for Nvidia’s latest H100 data center [graphics processing unit],” says Morningstar strategist Abhinav Davuluri, who raised his fair value estimate for the company to $300 per share.

Nvidia stands to benefit from the race to build powerful artificial intelligence solutions, which would train with the use of thousands of GPUs like the H100, says Davuluri.

“We believe the data center segment will be the primary driver of management’s rosy second-quarter revenue outlook of $11 billion. Specifically, we think the robust demand for its H100 GPUs will drive second-quarter data center revenue to $7.6 billion, which would be up 100% year over year.”

Competitor Advanced Micro Devices AMD stock also rallied on rising demand expectations for data center GPUs. Taiwan Semiconductor Manufacturing TSM—the primary manufacturer of high-end processors designed by Nvidia and AMD—also saw its shares jump.

Highlighted Advancers

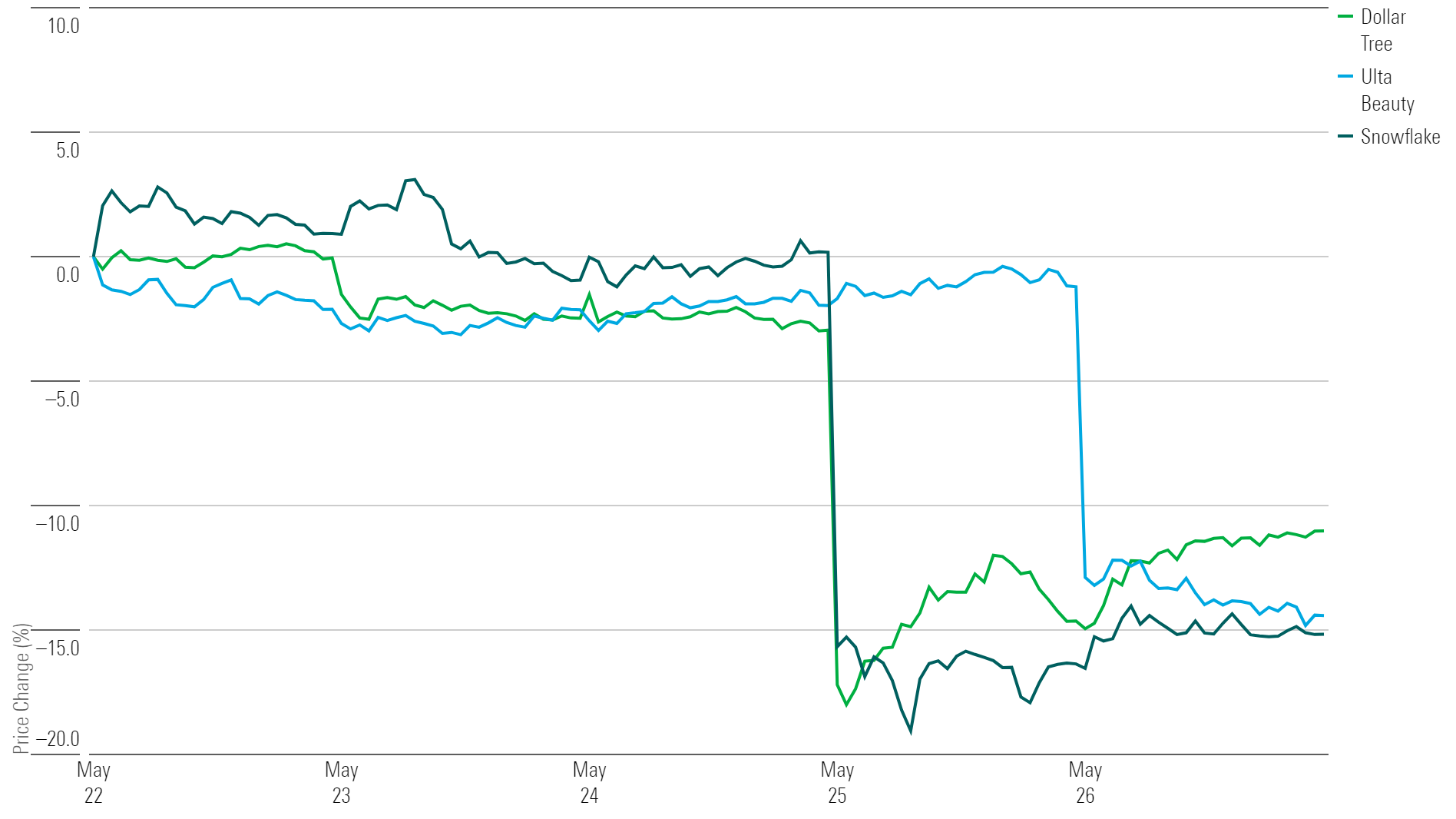

What Stocks Are Down?

Data warehousing company Snowflake SNOW saw its stock fall as it announced guidance for second-quarter revenue to be between $620 million and $625 million, below previous FactSet estimates of about $691 million. Morningstar equity analyst Julie Bhusal Sharma cut the company’s fair value estimate to $231 per share from $258, as “existing customers are slowing spending growth, which is informing our fair value cut, as we think this will moderate longer-term growth,” she says.

Dollar Tree DLTR fell after the firm showed signs of pressure from consumers shifting their spending away from higher-margin products to less-lucrative fare. The firm also lowered earnings guidance for 2023 to an EPS of $5.73-$6.23 versus a previous midpoint of $6.55.

Ulta Beauty ULTA stock slid after its first-quarter results showed signs of dwindling margins and lower consumer spending on beauty products. The firm lowered its guidance for full-year 2023 operating margins to 14.5%-14.8% from a previous range of 14.7%-15.0%.

“Ulta’s first-quarter selling, general, and administrative expenses increased 22% from last year … While there were some unusual circumstances, including delayed spending in the first half of 2022, the firm does face higher wage and store costs,” says Morningstar senior equity analyst David Swartz.

Highlighted Decliners

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)