5 Top-Performing Large-Value Stock Funds

Vanguard and Oakmark are among the value-stock strategies with the top returns.

The past 12 months have let the top-performing large-value stock funds finally step out of the shadows of growth stock funds, even if 2023 has been underwhelming for the group. A common theme over the past five years has been a willingness to own technology stocks that aren’t considered cheap by some conventional measures.

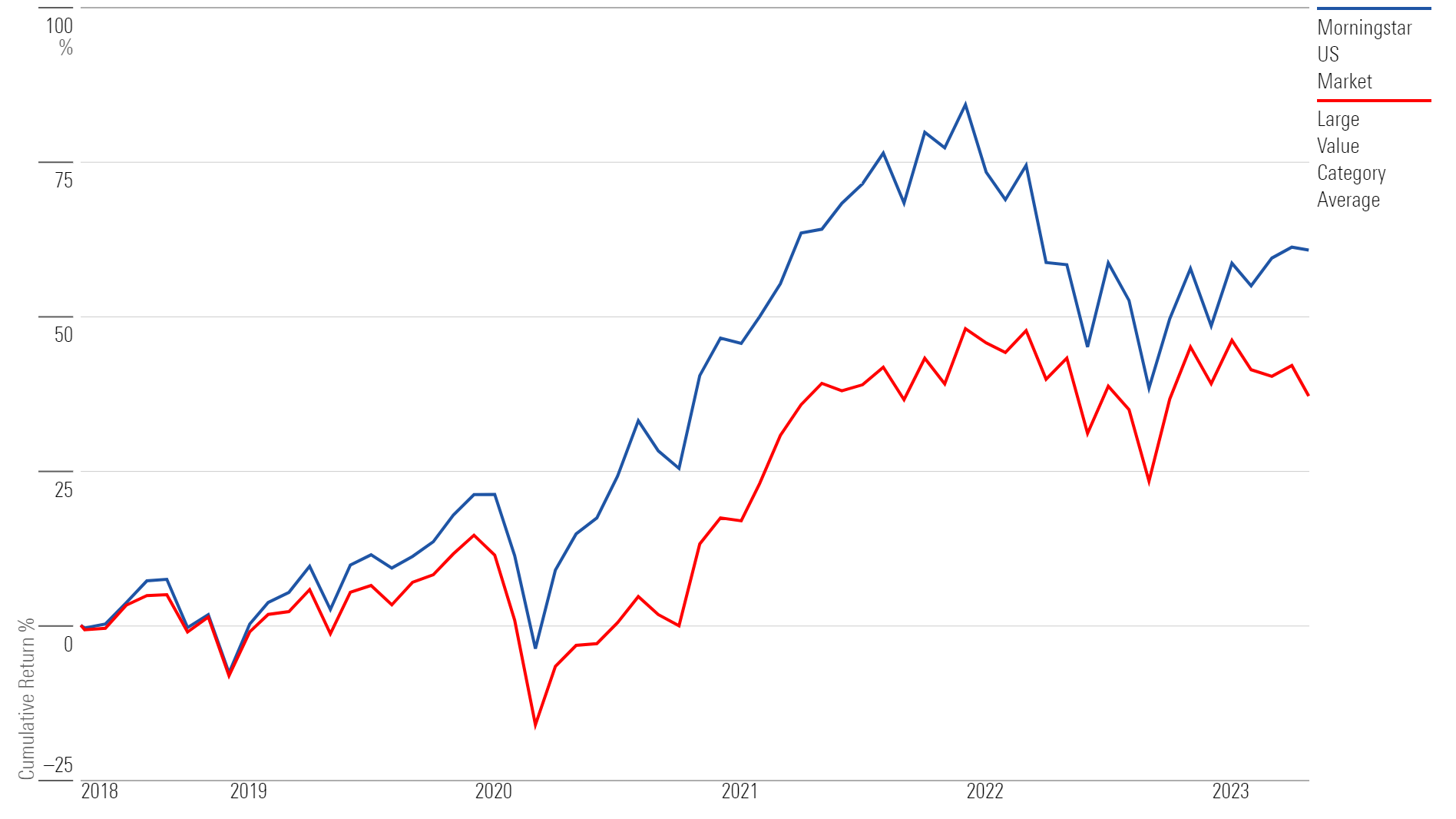

A Revival, and Then a Fade, for Large-Value Stock Funds

Prior to 2022, many large-value funds performed worse than the overall market. Deep-value funds that focused on the most undervalued names especially performed far below the market index.

This changed in 2022. During the bear market, funds with exposure to higher-price technology stocks and other growth stocks took a big hit, while deep-value funds (especially those with big stakes in energy stocks) were more buoyant. While the average large-value fund lost 6.0% in 2022, that was significantly better than the 19.4% loss for the overall stock market as measured by the Morningstar US Market Index.

After the rebound in 2022, this year has been gloomy for many large-value funds so far. The tide has again turned to favor tech stocks, though this includes some names held by top-performing value managers. The average large-value fund has lost 1.2% in 2023, while the Morningstar US Market Index has gained 8.3%.

Large-Value Funds vs. the U.S. Stock Market

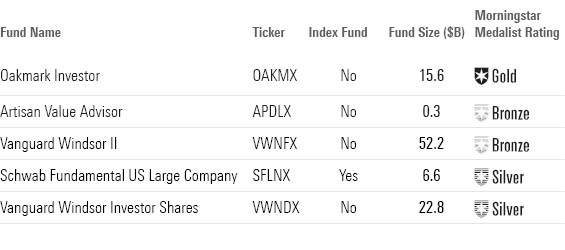

5 Top-Performing Large-Value Stock Funds

To screen for the best-performing large-value funds, we looked for those that have posted solid returns across multiple time periods.

We first screened for funds that ranked in the top 25% of the Morningstar Category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with analyst-driven Morningstar Medalist Ratings of Gold, Silver, or Bronze on those share classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted five funds with the best year-to-date performance. The list includes four actively managed funds and one index-tracking fund. A table with the funds’ returns can be found at the bottom of this article.

Top-Performing Large-Value Funds

Oakmark

- Ticker: OAKMX

- Morningstar Medalist Rating: Gold

“Manager Bill Nygren and his Harris Associates team have a tempered view of what makes for a cheap stock. On one hand, they like stocks trading at least 30% below their estimate of a company’s true worth. Dying companies sometimes trade at those levels, though, so to avoid them the Harris team focuses on firms that can still increase their per-share value with effective leadership. This agility has let them pick up familiar growth stocks such as Alphabet GOOGL and Amazon.com AMZN at potentially opportune times in recent years.

“Nygren’s 23-year record at Oakmark shows what can happen if investors have patience. From his March 2000 start through April 2023, its investor shares’ 10.2% annualized gain handily beat the Russell 1000 Value Index’s 7.1%, the S&P 500 prospectus benchmark’s 6.6%, and the typical large-value Morningstar Category peer’s 6.3%.

“That strong overall record includes flashes of brilliance and lengthy stretches when the strategy languished. It fared quite well in 2001-03 after the dot-com bubble burst, after the 2007-09 global financial crisis, and in the rally after the peak of the COVID-19 pandemic. But it slogged through the mid-2000s and the early 2010s. From January 2018 through March 2020, the strategy badly lagged the S&P 500, as it held little in the mega-cap tech names such as Apple AAPL and Microsoft MSFT, which increasingly drove the index’s returns. Indeed, the challenges of growth-led markets have meant that Oakmark beat its prospectus benchmark in only half of rolling three-year periods under Nygren.”

—Tony Thomas, associate director

Artisan Value

- Ticker: APDLX

- Morningstar Medalist Rating: Bronze

“Artisan Value’s contrarian process delivers a portfolio of financially strong companies, but after a generational change in leadership, the team needs to prove itself.

“The portfolio typically reflects the strategy’s aims of financially strong companies at attractive prices. It sports quality metrics, such as average returns on equity and assets higher than those of the Russell 1000 Value Index. It holds more stocks with wide and narrow moat ratings than its benchmark, and net profit margins tend to be competitive. Valuation metrics such as average price/earnings and price/cash flow track those of the benchmark, and low portfolio turnover demonstrates a patient long-term approach.

“A contrarian approach and active sector weights can cause this fund to sharply lag the index at times. The managers are willing to be patient with beaten-down names if they believe their theses still hold. They have posted positive stock-picking over most periods. But loss-making sector divergences—the product of bottom-up stock-picking—have been more meaningful at times, while fees on the cusp of the highest quintile haven’t helped either.

“Since Dan Kane, Craig Inman, and Tom Reynolds took the helm in February 2021 through year-end 2022, the fund’s institutional shares delivered an 8.2% gain—0.2% shy of the Russell 1000 Value Index and 1.3% below the typical large-value peer. Risk-adjusted returns were worse.”

—Drew Carter, analyst

Vanguard Windsor II

- Ticker: VWNFX

- Morningstar Medalist Rating: Bronze

“On Dec. 16, 2019, Vanguard shifted this fund materially. For years before the change, the fund’s returns were lackluster but not terrible. The admiral shares’ 9.3% annualized return from Jan. 1, 2013, through the end of 2018 lagged the Russell 1000 Value prospectus benchmark’s 10.0% gain. The firm eventually fired longtime lead subadvisor Barrow Hanley (which ran about 40% of assets), hired Aristotle Capital to run 20% of assets, and raised Lazard’s portion from 25% to 40%.

“The change has worked so far in lifting relative returns. From Dec. 16, 2019, through Nov. 30, 2022, the fund’s 10.9% gain trounced the benchmark’s 7.9%, as well as the typical large-value category peer’s 8.7%.

“Lazard runs a relative value approach with roughly 50 stocks, ranging from those that are fairly cheap based on historical cash flows to ones that will be quite cheap should cash flows improve. The firm uses the S&P 500 as its benchmark for its strategy.

“Aside from style, some other qualities make the fund easy and attractive to own. It holds roughly 180 stocks, which is well-diversified but allows overweightings in benchmark constituents such as Alphabet, Medtronic MDT, and Elevance Health ELV that can differentiate returns.”

—Todd Trubey, senior analyst

Schwab Fundamental U.S. Large Company Index

- Ticker: SFLNX

- Morningstar Medalist Rating: Silver

“Schwab Fundamental U.S. Large Company Index takes a contrarian approach, fundamentally weighting its portfolio holdings and following a strict rebalancing schedule. Its broad reach, low turnover, and demonstrated ability to excel when valuations mean-revert make it an attractive option.

“The Russell RAFI US Large Company Index, which underpins this fund, weights constituents by their fundamentals, breaking the link between stocks’ prices and portfolio weights. When the index rebalances, it effectively doubles down on stocks whose prices declined relative to their fundamentals and trims exposure to those on the rise. This buy-low tack positions the fund to capitalize on mean-reversion in stock valuations. However, it can extend too much rope to floundering firms and prematurely cut ties with winners.

“Leaning into stocks that look cheap steers this fund into value territory, but it mines the full value-growth spectrum. The fund boosted stakes in highflyers Meta Platforms META and PayPal Holdings PYPL at its March 2022 rebalance, for example, after both firms sputtered over the prior 12 months. This broad scope is attractive compared with the Russell 1000 Value Index, which mechanically excludes the more richly valued half of the market. Growth-friendly environments have been kind to this fund.”

—Ryan Jackson, analyst

Vanguard Windsor

- Ticker: VWNDX

- Morningstar Medalist Rating: Silver

“Wellington Management Company runs the bulk of assets (70%) and has subadvised the fund since its 1958 inception, predating Vanguard itself. Wellington’s approach serves as the foundation here, and Pzena Investment Management (which manages 30%) adds deep-value stock-picking that focuses intently on stocks that are very cheap statistically. This 70/30 split works well because while Wellington’s sector weightings stay fairly close to those of the Russell 1000 Value Index, Pzena can diverge quite a bit. Giving Wellington more assets smooths out the fund’s sector tilts so that stock selection can drive results.

“The two processes for picking those stocks start in similar places but then diverge. Wellington manager David Palmer’s team screens for large- and mid-cap companies that have recently underperformed, while Pzena focuses on firms that look especially cheap relative to their normalized earnings. Both then do fundamental analysis to avoid value traps and find firms that can return to the market’s favor.

“From Jan. 1, 2019, through Jan. 31, 2023, the fund rose 16.6% annualized—roughly 4% more per year than the Russell 1000 Value Index and among the top 3% of large-value category funds. According to attribution analysis, 90% of this lead over the index came from stock selection.

“Funds that outperform by big margins are often volatile, as this one has tended to be. Its 21.4% standard deviation during the current regime was above the Russell 1000 Value Index’s 19.7%. But while that number exceeds the category’s norm, it ranks below the most volatile quintile. So, relative to its returns, its risks have been palatable.”

—Todd Trubey, senior analyst

Long-Term Returns for Large-Value Stock Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)