Is Ford Stock a Buy After Earnings?

It’s a question of weighing the automaker’s 5% dividend against its struggles with costs and a possible recession.

Ford F released its first-quarter earnings report on May 2. Here’s Morningstar’s take on what to think of Ford’s earnings and stock.

Ford Stock at a Glance

- Fair Value Estimate: $19

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

What We Thought of Ford’s Earnings

- The market was very let down by Ford’s fourth-quarter 2022 results, so it was nice to see some sequential improvement in the first quarter of 2023. The total company operating margin was at 8.1%—up 2.3% from the previous quarter and up 1.4% year over year. That said, there was probably some disappointment in the market that Ford did not raise its 2023 guidance, unlike General Motors GM a week earlier. But we’re not surprised; GM’s profit metrics have been significantly bettering Ford’s margins for some time, and that will continue this year. Ford still has costs to get out of its system, such as those related to warranty and labor, and this year the company is projecting that it will lose $3 billion on its Model e electric vehicles segment.

- Ford’s first-quarter results didn’t alter our belief that the company has room to improve on costs and will continue to focus on its bestselling and (fortunately for them) most lucrative internal combustion engine vehicles, like the Bronco and F-Series. Ford seeks to fund an eventual transition to being an all-EV maker and reach its goal of annualized EV production of 2 million by the end of 2026. While the company restructures, the question for investors becomes whether to wait it out. They’ll be paid for that wait with a dividend yielding over 5% as of May 17, plus perhaps more special dividends over time.

- 2023 has two key uncertainties that management has limited to no control over. The first is the outcome of the United Auto Workers talks this summer. Labor costs will almost certainly go up under the new contract (the current one expires in mid-September), but it remains to be seen whether the increases will be severe enough to rattle the market. We believe Ford can handle labor cost increases, but this could be another headwind working against near-term stock price appreciation.

- The other major uncertainty is the possibility that the United States will enter a recession. We think that in such a scenario, any damage to sales would be short-lived. U.S. auto sales have effectively been in a recession for most of the time since March 2020. Ford has outstanding liquidity even without using its credit lines, its dividend is stable, and it’s unlikely to experience any major financial distress in a downturn this year. But a recession and auto stocks don’t go well together in the short term, and negative sentiment could outweigh any positive earnings surprises later in 2023.

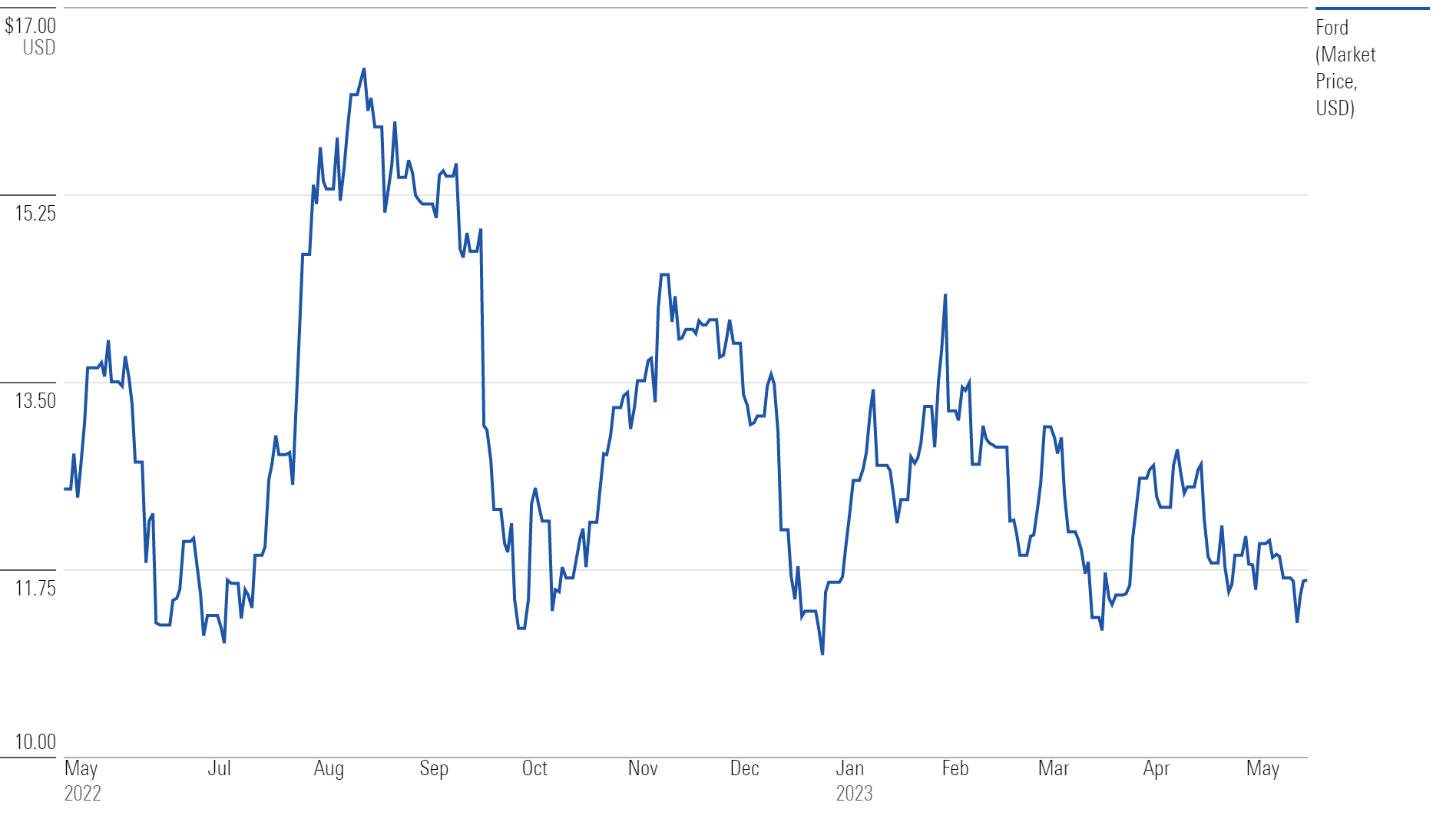

Ford Stock Price

Fair Value Estimate for Ford Stock

After Ford’s analyst day on May 22, we’ve lowered our fair value estimate to $19 per share from $20. We assume higher capital spending in our model after Ford gave a capital expenditure projection for 2024 of $10 billion-$11 billion, an increase from as much as $9 billion in 2023. Previously, we assumed $8 billion-$9 billion in capital spending for 2024-27, but we’ve raised that projection to $11 billion in 2024 and $10 billion a year thereafter through 2027.

This increase assumes capital expenditure after 2024 will remain close to 2024 levels to capture the incremental spending needed for electric vehicles and software as Ford transforms itself from a traditional automaker. We think buying Ford’s stock may require investor patience for management to restructure the Ford Blue segment while scaling up the Ford Model e business. Most of the scale in the Model e segment may not occur until after a battery electric vehicle plant in Tennessee opens in 2025.

We value Ford Credit at its 2022 year-end book value of $11.9 billion. Our fair value estimate could change dramatically, given the extreme sensitivity of our discounted cash flow model to inputs such as North American light-vehicle sales, midcycle margins, and a weighted average cost of capital of about 10%. We’re uncertain about when improvement may occur, as some variables—such as commodity and materials costs, interest rates, and the semiconductor shortage—are mostly beyond management’s control.

Read more about Ford’s fair value estimate.

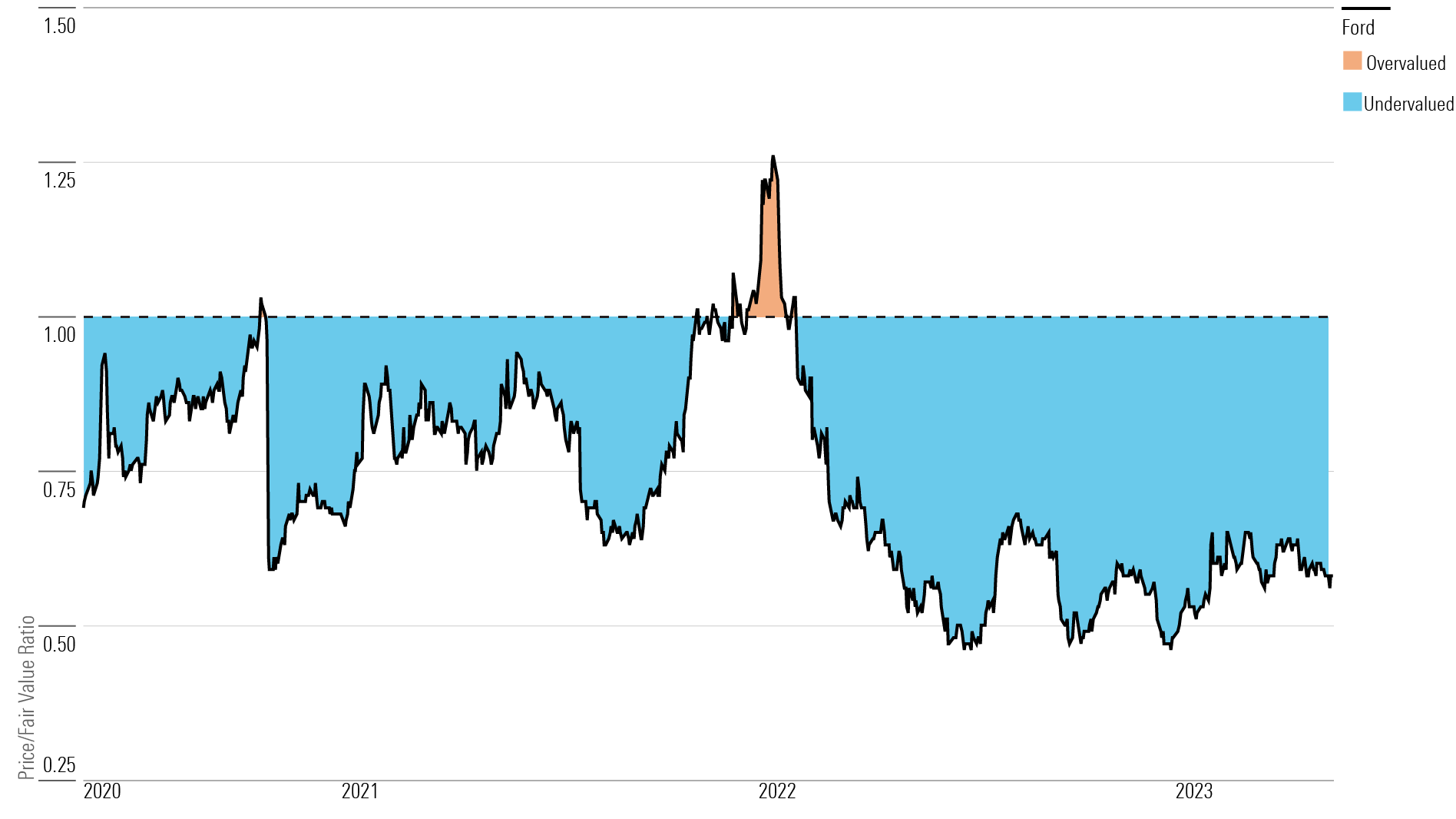

Ford Price/Fair Value Ratio

Economic Moat Rating

Ford does not have a moat, and we do not expect that to change. Vehicle manufacturing is a very capital-intensive business, but barriers to entry are not as high as in the past. The industry is already full of strong competition, so it is nearly impossible for one firm to gain a durable advantage over another. Automakers from China and India may soon enter developed markets such as the U.S., and Tesla and South Korea’s Hyundai and Kia have become formidable competitors. Furthermore, the auto industry is so cyclical that in bad times even the best automakers cannot avoid large declines in return on invested capital and profit. Cost-cutting helps ease the pain, but it does not restore all lost profit.

Read more about Ford’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Ford is High. The semiconductor shortage brings more uncertainty to the timing of a recovery. Barriers to entry are declining as a growing global market reduces fixed costs as a percentage of sales for new entrants. The company operates in a very cyclical industry, and there is massive uncertainty around the timing and magnitude of demand recovery following COVID-19. Macroeconomic conditions, rising interest rates, commodity prices, and trade agreement changes in key markets (like the U.S., Europe, and China) can quickly derail management’s plans and guidance. Additionally, significant disruption is on the horizon as vehicles become more high-tech and autonomous. One large environmental, social, and governance risk we see with Ford is the increasing regulatory scrutiny on combustion vehicles. But we think management is planning for the change, and electric vehicles such as the Mach-E and F-150 Lightning show Ford is serious about switching away from combustion.

Read more about Ford’s risk and uncertainty.

F Stock Bulls Say

- Ford’s turnaround will take lots of time due to many restructuring projects around the world, but so far the international business seems to be getting better.

- Ford is focusing its investments where it gets the best return, which is why we believe that mostly exiting North American car segments and production in South America is the right move.

- Ford has tried to remove some administrative layers, and we like CEO Farley’s aggressive moves into electric vehicles, which the company was slow to do in the past.

F Stock Bears Say

- The auto industry is very cyclical, and until recently, Detroit automakers had been losing significant U.S. market share to foreign automakers for years.

- Long-term profitability could be hindered by unions, which have traditionally wanted their share of the pie. The nonunionized import automakers in the U.S. do not have this problem.

- Ford’s stock can sell off heavily on macroeconomic fears, even if the company itself is doing well. Furthermore, it takes significant investment to fund growth in the auto industry, which limits potential margin expansion.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio, through Morningstar Investor. Learn more and start a seven-day free trial today.

Correction: May 26, 2023: A previous version of this article included an incorrect fair value estimate for Ford stock. It is $19 per share.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)