Our Ultimate Stock-Pickers’ Top 10 High-Conviction and New-Money Purchases

Several funds see value in financial services and healthcare.

For the past decade, our primary objective with Ultimate Stock-Pickers has been to uncover investment ideas that both our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain value. In cross-checking the most current valuation work of Morningstar’s own arsenal of stock analysts against the actions of some of the most recognizable equity managers in the business, we look to uncover good ideas each quarter that will be of interest to investors. With 24 of our Ultimate Stock-Pickers having reported their holdings for the first quarter of 2023, we now have a good sense of the stocks that piqued their interest during the period.

While looking at our Ultimate Stock-Pickers’ buying activity, we concentrate on high-conviction purchases and new-money buys. We think of high-conviction purchases as occasions when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the portfolio’s size. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers’ decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of January, so the prices paid by our managers could be substantially different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on a multitude of factors, including our valuation estimates along with our moat, stewardship, and uncertainty ratings.

Since 2020, headwinds created by the pandemic obstructed the markets and sidelined a multitude of industries as governments across the globe instituted lockdowns and imposed restrictions. And just as the market was looking to slowly recover as pandemic restrictions were lifted, the Russian invasion of Ukraine threw another wrench into the global economy, elevating energy prices and creating inflationary pressures that have impacted food and energy markets. The first quarter of 2023 has been defined by continued uncertainty, including inflationary pressure and lingering fears of a potential recession. The Fed enacted 0.25 of a percentage point interest rate increases in February, March, and May, a contrast from the 0.5 and 0.75 percentage point hikes in December and November 2022, respectively, as inflation appears to be moderating. The current benchmark rate of 5.00% to 5.25% is now a stark contrast to the near-zero levels that were in place since the early days of the pandemic. In turn, higher interest rates pushed bond prices down and increased the unrealized losses on the banking industry’s securities portfolios, particularly pressuring banks with the most duration risk. In the aftermath of Silicon Valley Bank’s announced capital raise, depositors fled at-risk banks, leading to the failure of Silicon Valley Bank SIVBQ, Signature Bank SBNY, and First Republic Bank FRCB. Although federal regulators stepped in to thwart any contagion throughout the banking system, concerns still loomed, prompting investors sell off shares in the sector. Despite continued market headwinds, Ultimate Stock-Pickers still looks to find value in individual stocks during a period of volatility and uncertainty.

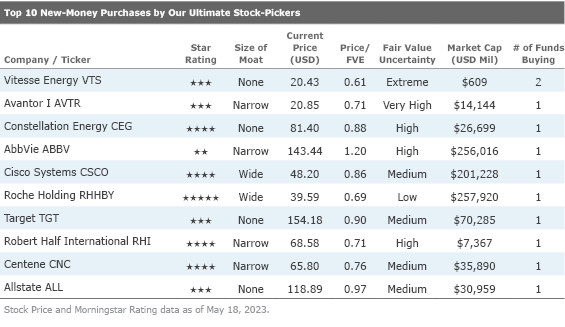

In the top 10 high-conviction purchases list, the buying activity was mostly concentrated in the financial services and healthcare sectors, consisting of eight of the 10 purchases, along with purchases in the communication services and technology sectors. All 10 of the 10 companies on the high-conviction purchases list and five of the 10 companies on our new-money purchases list received at least a narrow economic moat rating from Morningstar analysts, keeping in line with trends we have witnessed over the past several years. Given the recent banking turmoil, the three names we find most interesting on the high-conviction purchases and new-money lists are Charles Schwab SCHW, Bank of America BAC, and Wells Fargo WFC—all wide-moat-rated firms by Morningstar analysts.

There was no crossover between our two top 10 lists this period, after just one company appeared on both lists in the fourth quarter of 2022. This quarter, Charles Schwab and Bank of America led the way with nine and six high-conviction purchases from our manager list, respectively. Both companies have wide economic moats and are trading at discounts to their fair value estimates, which indicates that money managers are looking to take advantage of the banking selloff and looking beyond the sector’s recent hurdles. More specifically, we recognize that investors continue to place an emphasis toward blue-chip stocks such as these in a period of uncertainty. This especially appears to be the case in the banking sector as we find investors are placing greater favor with banks that are essentially too big to fail.

Wide-moat Charles Schwab, which attracted the most high-conviction purchases during the first quarter of 2023, currently trades at about $52, well below Morningstar analyst Michael Wong’s fair value estimate of $70.

Charles Schwab operates in the brokerage, wealth management, banking, and asset management businesses. The company runs a large network of brick-and-mortar brokerage branch offices, a well-established online investing website, and has mobile trading capabilities. It also operates a bank and a proprietary asset management business and offers services to independent investment advisors. The company is among the largest firms in the investment business, with over $7 trillion of client assets at the end of December 2022. Nearly all its revenue is from the United States.

Wong posits that Charles Schwab has enough access to cash and capital that it can weather the storm in the financial sector that was unleashed after the collapse of Silicon Valley Bank. While Charles Schwab is best known for its retail investor and registered investment advisor platforms, he notes that Charles Schwab Corporation is a savings and loan holding company that had over $300 billion of deposits at the end of 2022. The company has access to the Federal Reserve’s Bank Term Funding Program that can provide the firm upwards of $200 billion of cash to deal with any potential deposit withdrawals from clients. It also had about $40 billion of cash on its balance sheet at the end of 2022, over $50 million of cash inflows projected in 2023 according to his calculations, and other sources of liquidity, such as commercial paper and inflows from certificates of deposits. Therefore, meeting any deposit outflow requests should not be a problem for Schwab.

On the regulatory capital front, Wong points out that Charles Schwab had a very healthy common equity Tier 1 capital ratio of 21.9% and a healthy 7.2% Tier 1 leverage ratio at the end of 2022. He admits that it’s true that the company’s capital ratios would look worse if they included unrealized losses on securities holdings. However, Wong believes Schwab shouldn’t ever have to change those unrealized losses into realized losses by selling the securities because it has so much access to cash. The unrealized losses are also related to the high interest rate environment (they’re not losses from bad credit quality), and essentially all the unrealized losses should reduce to $0 when the fixed-income securities mature.

While Wong contends that Schwab is fine from a liquidity and capital perspective, he acknowledges the firm’s earnings power will be stifled, as it accesses higher-cost funding sources and its deposit base shrinks. Wong believes there will likely be some loss of deposits that Schwab will replace with high-cost CDs or loans from the Federal Reserve. Assuming that interest rates stay relatively high compared with the previous 10 years, more clients may hold money market funds or fixed income instead of leaving their cash in Schwab bank accounts. To account for this added earnings pressure, Wong reduced his fair value estimate for Schwab to $70 from $87, but even taking into account these added pressures, he still sees shares as undervalued today.

Six of our money managers made high-conviction purchases of Bank of America, a wide-moat company currently trading at a discount to Morningstar analyst Eric Compton’s fair value estimate of $37.

Bank of America is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does U.S. Trust private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily U.S. focused.

In response to the current environment, Compton states that the bank has greater rate sensitivity than most, which could hurt if rates start to decline. Based on management’s 2023 outlook, it doesn’t appear that the bank will get much more of a boost from higher rates going forward, either. He believes that the bank is caught in a tough spot when it comes to earnings catalysts. Even so, he thinks the less demanding valuation today helps offset some of that risk. To compare, Compton doesn’t see quite as much mispricing for Bank of America as he does for Citigroup C or Wells Fargo, but for investors who want to stick to the “non-turnaround” names, he thinks Bank of America makes more sense from a valuation standpoint than JPMorgan JPM. As investors size up their relative positioning in the Big Four, he thinks they should take this into account. In Compton’s opinion, Bank of America remains a solid franchise with a wide moat rating and is one of the largest banks in the country. Its GSIB status should limit deposit flight issues, with the bank recently seeing deposit inflows. The bank scores worse than average when it comes to unrealized losses, but he merely views this as an earnings issue (lower-yielding securities stuck on the balance sheet) and not a capital issue.

Ultimately, Compton believes Bank of America has emerged as one of the preeminent U.S. banking franchises. It now has one of the best retail branch networks and overall retail franchises in the United States, is a Tier 1 investment bank, is a top four U.S. credit card issuer, is a top three U.S. acquirer, has a solid commercial banking franchise, and owns the Merrill Lynch franchise, which has turned into one of the leading U.S. brokerage and advisor firms. Compton suspects that scale and scope advantages are increasingly important as the role of technology in banking grows. Bank of America is seeing increasing mobile adoption, has access to data on millions of customers, and has one of the largest tech budgets in the industry. Given the scalability of these platforms, he believes these factors will only matter more as the industry progresses.

Our Ultimate Stock-Pickers also made five high-conviction purchases in wide-moat Wells Fargo. Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

Wells Fargo currently trades at a discount to Morningstar analyst Eric Compton’s fair value estimate of $58. According to Compton, Wells Fargo had a great 2021. It outperformed the sector, was one of the top performers in Morningstar’s banking coverage, and its shares even touched his fair value estimate in early 2022. With the shares having fallen once again in 2022 and into 2023, Compton is starting to see some opportunity reemerge. He calculates Wells Fargo has more rate risk than most peers (earnings are more sensitive to increases or declines in interest rates), roughly tied with Bank of America. Without the ability to expand its balance sheet and with the ability to keep its deposit pricing so low for the current rate cycle, the bank has benefited from higher rates as well as any bank Morningstar covers. Any reversal here will hurt, according to Compton. Even so, he thinks the shares are more than pricing in a reversal in earnings as rates fall—he is already looking for net interest income to fall in 2024 and again in 2025.

The main catalysts Compton sees in the near future will be 2024 expense guidance (he’s hoping for another year of flat to down expenses while peers are set to see growth) and any progress with regulators. In Compton’s opinion, the asset cap is unlikely to be lifted in 2023, but he is leaning toward it being lifted in 2024. It remains very difficult to know for sure when the cap will be lifted, but with the “multiyear” language having started in the first quarter of 2021, along with some of the other progress the bank has made over the last two years (plans approved by the Fed, other consent orders dropped, and the latest settlement with the Consumer Financial Protection Bureau), it doesn’t seem impossible for 2024 to be the year, according to Compton’s research.

Compton notes that Wells Fargo has years of expense savings related projects ahead of it as the bank attempts to get its efficiency ratio back under 60%. He also sees a multiyear journey of repositioning and investing in the firm’s existing franchises, including growing its middle market investment banking wallet share, investing in the cards franchise, and revitalizing a wealth segment that has lost advisors for years. These tasks take on increased importance for a bank that has been on defense for years after its fake accounts scandal broke in late 2016. Compton noted that he is already starting to see glimpses of the transition to offense from defense with the launch of multiple new card products, the advisors not declining for the first time in years in fourth-quarter 2022, and the $2.2 billion of incremental internal investments in 2023 (a step up from the $1.7 billion goal from 2022). Even so, while the bank is making progress, he expects a multiyear journey remains.

Disclosure: Ari Felhandler has an ownership interest in Citigroup. Verushka Shetty and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)