6 Top-Performing Large-Growth Funds

These funds have delivered for investors through a difficult market for large-growth stocks.

The past year has provided a trial by fire for the top-performing large-growth funds. Before then, investors in such funds had the wind at their backs, far outperforming the market. That was especially the case during 2021, when growth stock funds—particularly the larger ones—performed significantly better than the broader stock market.

But then came 2022. As the Federal Reserve aggressively raised interest rates, funds focused on growth stocks consistently performed worse than the overall market. The average large-growth fund lost 29.9% in 2022, while the Morningstar US Market Index finished the year down 19.4%.

Relief for Large-Growth Stock Fund Investors

However, the start of 2023 has brought some relief for investors in large-growth funds. So far this year, the average large-growth fund is up 15.3%, while the Morningstar US Market Index has risen 9.3%. Thanks in large part to the gains posted in 2023, the average large-growth fund was up 10.8% for the 12 months ended May 19, 2023, while the Morningstar US Market Index was up 8.4%.

6 Top-Performing Large-Growth Stock Funds

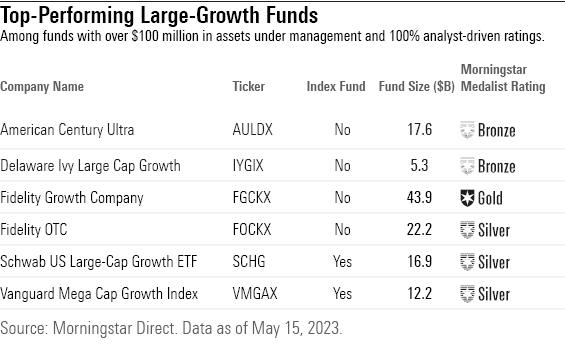

To screen for the best-performing large-growth funds, we looked for those that have posted solid returns across multiple time periods.

We first screened for funds that ranked in the top 25% of the Morningstar Category using their lowest-cost share classes over time frames of the past one, three, and five years. In addition, we screened for funds that carry analyst-driven Morningstar Medalist Ratings of Gold, Silver, or Bronze on those lowest-cost share classes. (An explanation of how Morningstar’s fund ratings work can be found here.) We also excluded funds with less than $100 million in assets.

From this group we’ve highlighted six funds with the best year-to-date performance. The group includes four actively managed funds and two index-tracking funds.

American Century Ultra

- Ticker: AULDX

- Morningstar Medalist Rating: Bronze

“Co-lead managers Keith Lee and Michael Li bring a wealth of experience and stability to this strategy. Both managers have ties to the fund going back to the early 2000s and became lead managers here in 2008. Lee and Li work with Jeff Bourke, who joined the firm in 2007 and became a manager in August 2013. While one experienced supporting analyst/manager departed the firm in September 2022, the managers still draw on seven managers/analysts. Most have been with the team for at least 10 years.

“The team has built a holistic approach to uncovering opportunities by running three charges, each offering different degrees of growth exposure. This strategy focuses on finding names with a history of high profits and good prospects, companies whose competitive advantages can deliver steady growth, or businesses with improving fundamentals.”

—Stephen Welch, senior analyst

Delaware Ivy Large Cap Growth

- Ticker: IYGIX

- Morningstar Medalist Rating: Bronze

“Delaware Ivy Large Cap Growth’s disciplined investment approach likely won’t lead to thrilling relative results, but it has a good chance of adding value over time by losing a bit less than its rivals during market pullbacks. This fund’s leadership capably manages the risks of its mandate. It embraces high price multiples but keeps volatility in check by emphasizing companies with ample profitability and growth that are protected by their competitive advantages.

“Those features have helped it protect capital during market drawdowns. That included 2022′s first half, when the large-growth universe’s most severe price declines were felt by stocks with above-average apparent risk. This strategy has little appetite for such fare and instead prefers financially healthy companies with relatively mild stock-price volatility. But while it tends to slightly outperform during market flights to safety, its relative results often look pedestrian when riskier assets—such as cyclicals, small-cap companies, or high-volatility stocks—are in favor. That mostly explains its lackluster performance in 2020, when the fund’s gain lagged those of most peers. But in any environment, the fund’s similarity to the Russell 1000 Growth Index (as measured by its tracking error and active share) makes it unlikely to perform substantially better or worse than the index.”

—Robby Greengold, strategist

Fidelity Growth Company

- Ticker: FGCKX

- Morningstar Medalist Rating: Gold

“Steve Wymer has run this fund for more than 25 years, earning a place not just as one of the industry’s longest-tenured large-growth managers, but also one of its best. Despite the strategy’s huge asset base of over $110 billion, Wymer has executed his process without missing a beat. The strategy has been among the large-growth category’s best performers over the past three, five, and 10 years, while handily beating relevant passively managed index funds and exchange-traded funds. The overall rating upgrade has more to do with the distribution of ratings among rivals in the category.

“This strategy is among the category’s more aggressive. Wymer’s willingness to invest heavily in profitless firms that he thinks possess exceptional growth potential—notably in the biotech industry—often lands it in the high-growth section of the Morningstar Style Box and can subject it to steeper drops than the Russell 1000 Growth Index (the category’s benchmark) during market pullbacks. Indeed, in 2022 through November, the fund slid 27%—further than the category’s 25% loss and the index’s 23% loss—as value stocks were far more resilient than growth stocks amid steep rises in consumer prices and the onset of tighter monetary policy.”

—Robby Greengold, strategist

Fidelity OTC

- Ticker: FOCKX

- Morningstar Medalist Rating: Silver

“This strategy plays to manager Chris Lin’s strengths. By prospectus, it invests at least 80% of its assets in stocks from the Nasdaq Composite Index or over-the-counter markets, meaning it tilts heavily toward traditional growth sectors such as technology and healthcare, where Lin made previous stops as an analyst. It also works to the strategy’s advantage that the firm’s growth-oriented analyst teams, which Lin draws upon for insights, remain capable.

“Lin’s risk-conscious approach to growth investing is sound. He looks for durable growth stocks trading at reasonable valuations. He typically anchors the bulk of the strategy’s assets in resilient mega-caps and invests bite-size helpings across many companies with measly current earnings, relatively high price multiples, and rapid growth expectations.

“Lin has implemented his process well since joining the strategy in late 2017. Through precise bet-sizing and incremental trading, he has made the portfolio less vulnerable to market selloffs by increasing its share of stocks with relatively high returns on invested capital while curbing its exposure to the market’s most volatile equities. He’s also whittled down the number of holdings so that stock-picking, rather than style tailwinds or momentum, can better determine the strategy’s fate. Meanwhile, he has distinguished the portfolio through modest allocations to off-benchmark assets such as non-U.S. equities and private holdings.”

—Paul Ruppe, analyst

Schwab U.S. Large-Cap Growth ETF

- Ticker: SCHG

- Morningstar Medalist Rating: Silver

“Schwab U.S. Large-Cap Growth ETF is an excellent large-growth fund. It charges a razor-thin fee for a market-cap-weighted portfolio that captures the full opportunity set available to active large-growth investors.

“The Dow Jones U.S. Large-Cap Growth Total Stock Market Index, which this fund fully replicates, absorbs stocks representing the faster-growing half of the U.S. large-cap market and weights them by market capitalization. Stocks in the index tend to earn lofty valuations that reflect their durable competitive advantages and sunny outlooks. These firms often deserve the market’s adulation, but the steep expectations embedded in their stock prices raise the hurdle for them to outperform.

“The fund’s market-cap weighting channels the market’s perspective on each holding’s relative value. This is a sound approach; large-cap stocks tend to be priced reasonably accurately because they attract widespread investor attention. Its market-cap weighting also helps curb turnover and the associated transaction costs, with help from comprehensive index buffers.”

—Ryan Jackson, analyst

Vanguard Mega Cap Growth Index

- Ticker: VMGAX

- Morningstar Medalist Rating: Silver

“The fund tracks the CRSP U.S. Mega Cap Growth Index, which captures the faster-growing side of the mega-cap market. The index selects its constituents from a pool of stocks representing the top 70% of U.S. market capitalization and holds the growth-oriented stocks of this pool. Generous buffers around capitalization and growth bounds contribute to a stable portfolio, while investor-friendly trading practices mitigate market-impact costs.

“The index’s narrow scope results in heightened firm-specific exposure and pronounced sector biases compared with the broader market and large-growth Morningstar Category. The technology sector is severely overweight compared with the category average, while energy, industrials, and healthcare are notably underweight.

“While this strategy is certainly top-heavy, overall diversification is aided slightly by the inclusion of a few value and blend names at the bottom of the allocation. The fund shares 11% of its holdings with its value twin, Vanguard Mega Cap Value Index VMVLX. Weaving some value-leaning names into the mix may help this strategy endure through periods when growth is out of favor.”

—Zachary Evens, associate analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)