529 Tax Benefits: How Does Your State Stack Up?

The answer can influence whether an education saver should stay in-state or shop around.

Tax benefits from 529 education savings plans depend on many factors, such as annual income and contribution levels, which can be quite different across investors. For this reason, tax benefits aren’t an explicit input to Morningstar Medalist Ratings for 529 Plans. However, it behooves investors to consider their unique tax profiles before selecting an option. If your home state provides tax benefits, and if you plan to start early, the compounding effect of tax savings can make it worthwhile to invest in-state.

This article outlines how those tax benefits work. At the end, it offers education savers a checklist to consider when deciding whether to choose an in-state 529 plan or shop around.

529 Federal Tax Break

Tax benefits at the federal level are straightforward. Money invested in 529 plans grows tax-free, and investors do not pay capital gains taxes if they spend that money on qualified education expenses.

The amount of capital gains tax savings is a function of the accountholder’s taxable income. Say a married couple regularly put money into an investment account over several years, and that amount appreciated by $10,000 by the time the beneficiary needed to take withdrawals. In a taxable account, this $10,000 would be reduced by the 15% long-term capital gains tax ($1,500 in this case) for married couples who earn between $89,251 and $553,850 and file jointly in 2023. Families that made over $553,850 would have saved $2,000 (their long-term capital gains tax rate is 20%). Families who earned less than $89,251 would not have been liable for taxes on capital gains and therefore would not have benefited from this federal tax break.

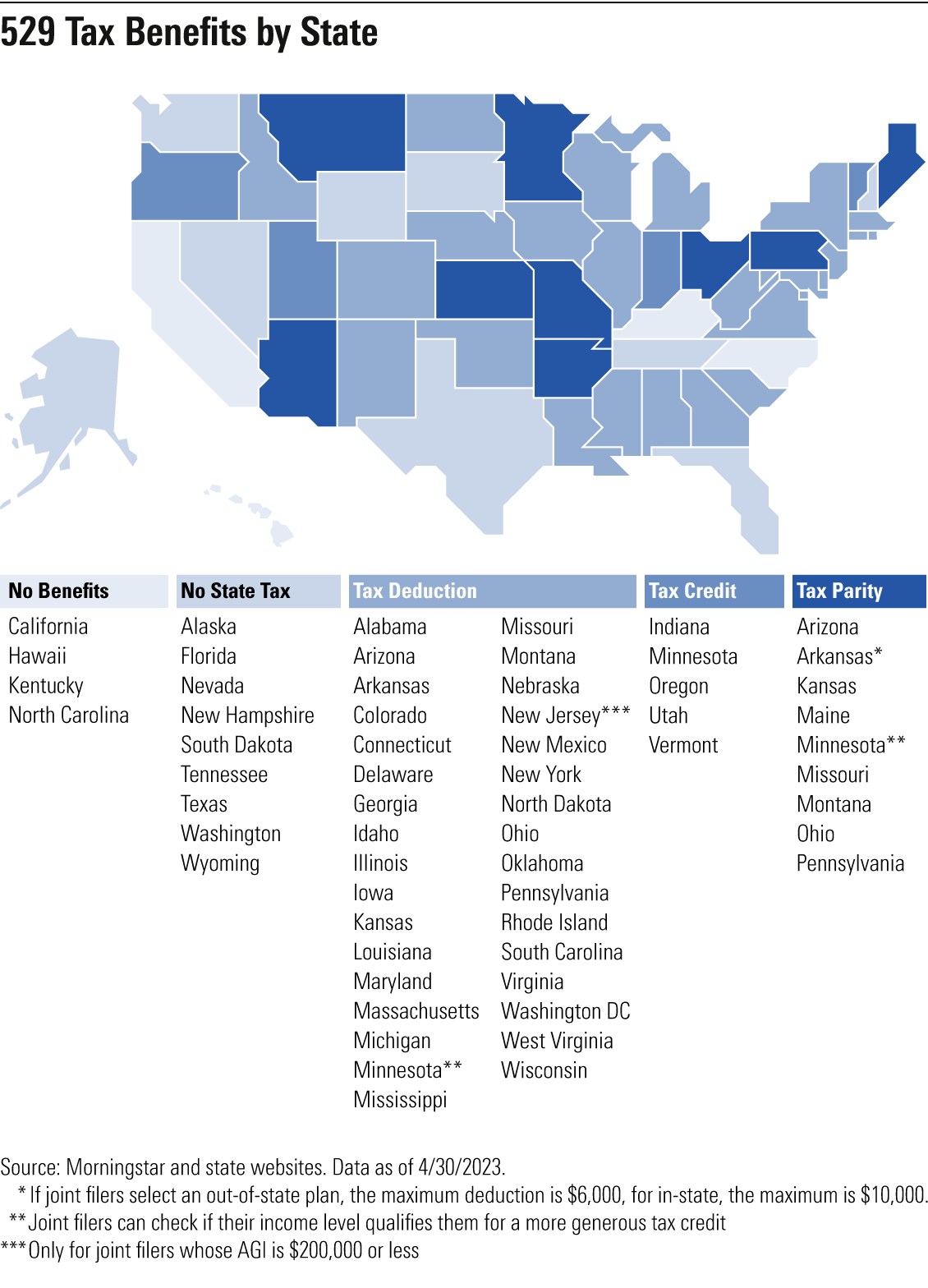

529 State Tax Benefits

Tax benefits at the state level are more complicated but worth understanding. Depending on the state, the benefit can come in the form of a tax deduction or tax credit. Below we outline each benefit.

Tax Credits

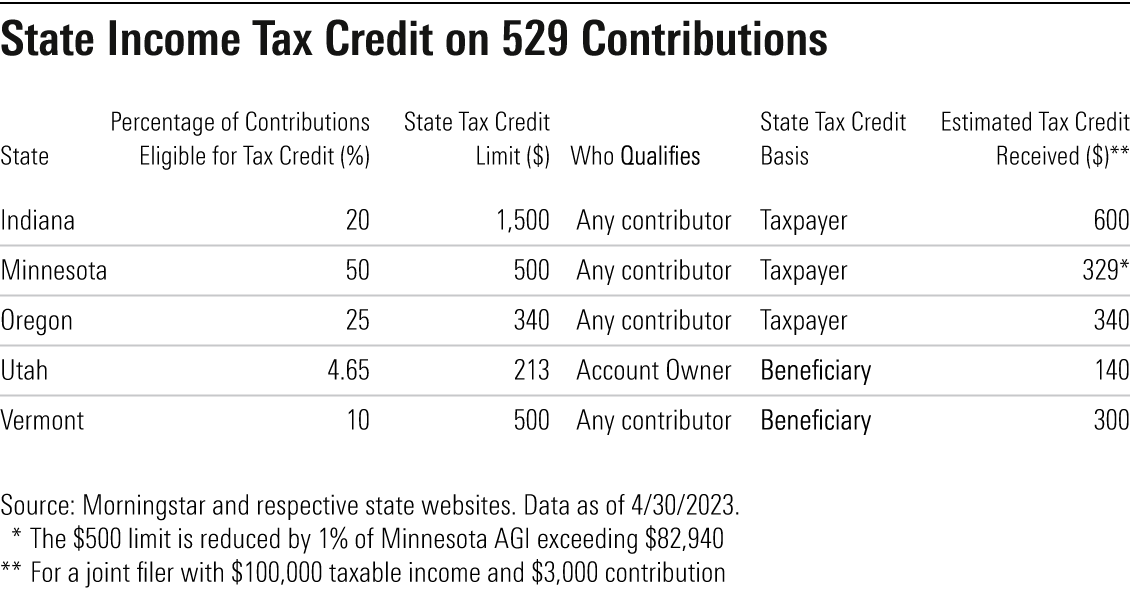

Five states provide tax credits, which families can use to offset their state income taxes. These credits, on average, offer greater tax savings to a broader range of families than deductions do.

Below is a list of those five states. The estimated tax credit (rightmost column) assumes a joint filer with an adjusted gross income of $100,000 who contributes $3,000 a year.

For our hypothetical investor, being an Indiana resident would have brought the largest tax credit. Although Indiana counts less of the contributions for tax credit than Minnesota or Oregon, the credit limit of $1,500 means that aggressive savers in Indiana will ultimately receive more back from the state. On the other hand, Utah employs a relatively low 4.65% of contribution to calculate the tax credit, so a $3,000 contribution would result in a tax credit of $140.

The three other states also offer solid tax benefits. Oregon’s maximum tax credit for joint filers is $340, which can be met with a relatively low contribution of $1,360. For those earning $100,000, the percentage of contribution eligible for the tax credit is 25%, but this percentage is higher for families with lower incomes (and the percentage is lower for families with higher incomes). Minnesota also offers larger benefits to families earning less, as it offers the option of a deduction or a more generous credit. Like Oregon, the tax credit calculation is adjusted by income level. For those earning $82,940 or less, the maximum credit of $500 can be earned with a relatively low contribution of $1,000 (where 50% of the contribution can be taken as a tax credit).

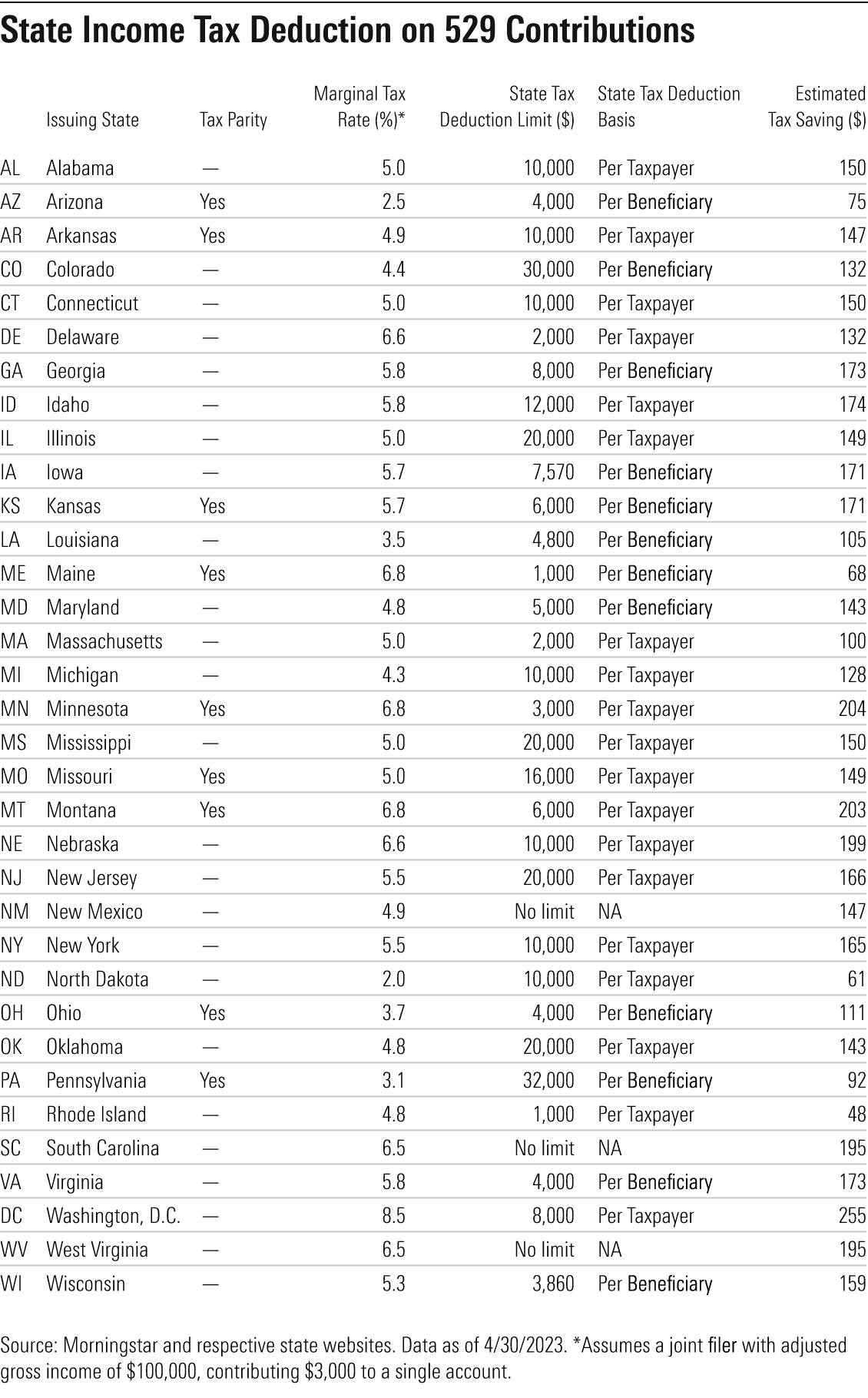

Tax Deductions

More than 30 states, and the District of Columbia, allow families to deduct their 529 contributions from their taxable income calculation. Again, for simplicity, let’s consider a couple filing jointly with an annual income of $100,000 who deposits $3,000 a year (or $250 a month) into one beneficiary’s 529 account. Using each state’s personal marginal income tax rate for this hypothetical couple, the annual estimated tax savings range from $48 to $255.

There are nuances to this tax savings figure. The District of Columbia and Nebraska offer large estimated annual tax savings for our hypothetical couple, but that is because those states have among the highest marginal tax rates. On the other hand, states like Arizona and North Dakota offer lower tax savings for our example, but the states have lower marginal tax rates. Moreover, these states offer deductions per beneficiary, meaning if a family is saving for more than one child, their deductions will be much higher than what’s shown in the example. Some places look unambiguously unattractive, though, such as Rhode Island, whose low tax deduction limit of $1,000 leads to a 529 investor saving just $48 a year.

Certain states provide highly generous tax benefits for aggressive savers. New Mexico, South Carolina, and West Virginia have no deduction limits. If the same family earning $100,000 saves $5,000 a year for each of their three kids, they can deduct $15,000 from their income, resulting in tax savings between $735 and $975. Six states (Colorado, Illinois, Mississippi, New Jersey, Oklahoma, and Pennsylvania) have relatively high deduction limits of $20,000 to $32,000. Eight states (Arizona, Georgia, Iowa, Kansas, Louisiana, Maryland, Ohio, and Virginia) have deduction limits of $4,000 to $8,000, but this is per beneficiary, so the maximum is applied per child, not per taxpayer. So, a family with three beneficiaries can take maximum deductions of $12,000 to $24,000, depending on the state. Pennsylvania and Colorado are by far the most generous, as they offer the highest deduction limits of $32,000 and $30,000, respectively, per beneficiary.

The nine states with no income tax and thus no 529 deductions are Alaska, Florida, New Hampshire (income tax only applies to interest and dividends income), Nevada, South Dakota, Tennessee, Texas, Washington (income tax only applies to capital gains income of high-earners), and Wyoming. Four states charge income tax but do not have a 529 state tax deduction: California, Hawaii, Kentucky, and North Carolina.

Bonus: Tax Parity

Nine states—Arizona, Arkansas, Kansas, Maine, Minnesota, Missouri, Montana, Ohio, and Pennsylvania—offer tax parity, which means that investors can deduct their taxable income on contributions made to any plan in the United States (most states only allow you to take a deduction if you invest in the state-sponsored plan). Arkansas offers a lower $6,000 state tax deduction limit if a family invests out of state (the maximum is $10,000 when investing in-state), but the remaining six make no distinction between investing in or out of state.

Should You Shop Around for a 529 Plan?

You might want to pick a high-quality plan outside your home state if one or more of the below apply to you:

- Your home state doesn’t have income tax.

- Your home state charges income tax yet doesn’t provide any tax incentives.

- Your home state offers tax parity.

- You save less than $2,000 a year overall.

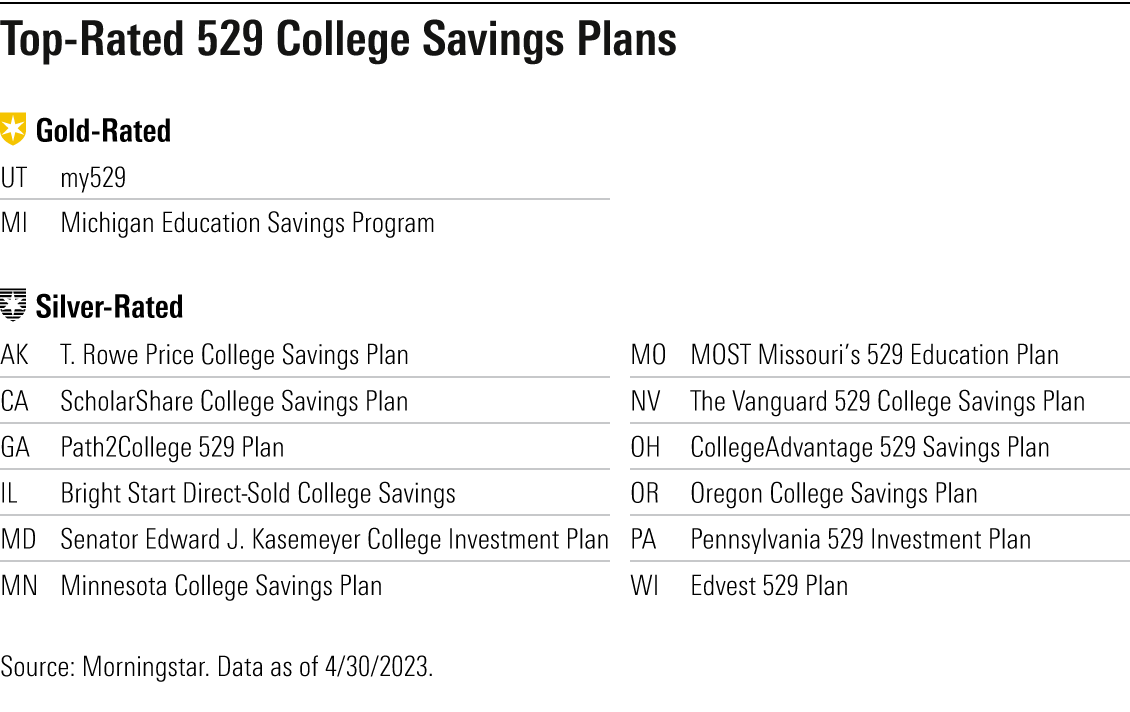

For the first three cases, your tax situation will be the same regardless of the plan you choose. It will be worthwhile spending some time researching the best plan that will meet your investment preferences (such as fees and types of funds offered). Morningstar Medalist Ratings can point these investors to the best options. Currently, 14 plans receive top marks of Gold or Silver. Subscribers to Morningstar.com can access our 529 plan reports from the 529 Plan Center map.

As for the last case (those who contribute smaller amounts to college savings plans), you may find the tax savings less appealing, even when your home state offers generous tax benefits. If the tax benefits of investing in your home state’s 529 plan aren’t substantial enough to make a difference in your ability to finance your beneficiary’s education, it’s worth shopping around. This is especially true if your home state’s direct-sold plan carries a Neutral or Negative rating and/or relatively high fees.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/9e407e19-2c9a-4686-b59c-2dc342d81fdd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9e407e19-2c9a-4686-b59c-2dc342d81fdd.jpg)