What Morningstar’s Jon Hale Learned About Sustainable Investing Over 40 Years

A great sustainable-investing analyst retires from Morningstar.

It was the presidential campaigns of 1968 and his family’s new color TV that ignited the young Jon Hale’s interest in government and its possibilities. Later, Hale acquired a doctorate in political science and taught the subject at Virginia Tech and the University of Oklahoma. Hundreds of miles separated him and his wife, another political scientist, who was teaching in Chicago. During one visit, Hale scoured the Chicago want ads and landed at Morningstar as a fund analyst in 1995. At Morningstar, he grew interested in what was then called “socially responsible investing”—new investing options that could help investors express their values—that had the potential to help solve societal challenges.

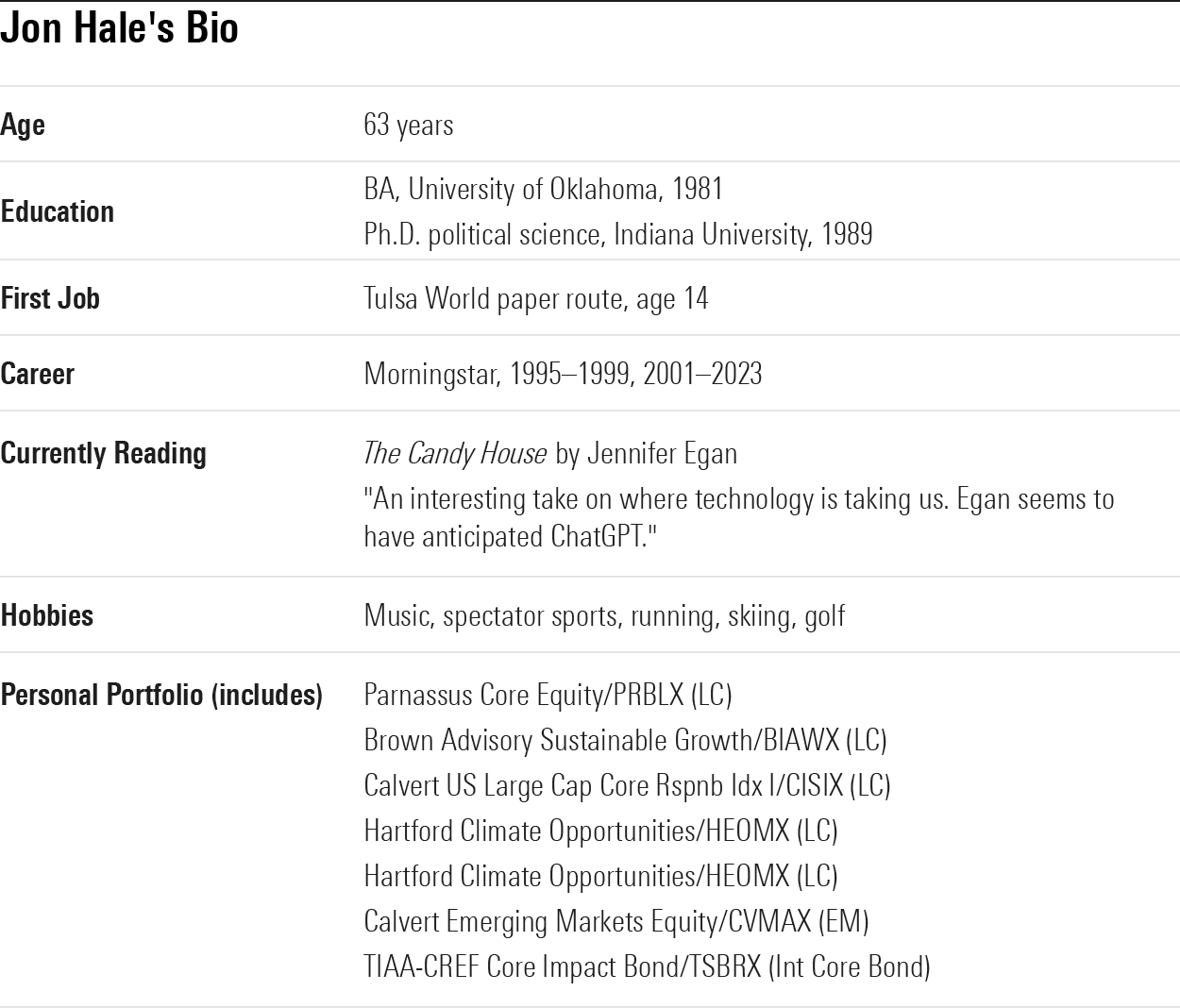

Hale never looked back. He has been Morningstar’s lead commentator on sustainable investing and was instrumental in developing the Morningstar Sustainability Rating, or “globe rating,” for funds as well as its carbon risk score. Hale is now retiring from Morningstar, although he’ll continue to write regularly about sustainability and to work on special projects. As he stepped down, we asked him to reflect on his career and the landscape for sustainability. Keep reading the following edited excerpts for more. (You can also see a list of funds he owns in the nearby table.)

Sustainability Then and Now

Norton: How has sustainable investing changed since you first began covering it?

Hale: It’s more complex, and more investors are interested in it.

In the 1990s, its precursor was called socially responsible investing, practiced via excluding certain kinds of businesses and trying to engage with companies about mitigating pollution and other issues.

ESG, or environmental, social, and governance analysis, came along in the early 2000s, more concerned with “value” than “values.” ESG issues represent longer-term material risks and opportunities that companies face that aren’t easily illuminated in traditional financial analysis. It’s data, information that investors can use to identify companies that are likely to be sustainable, meaning profitable and purposeful for the long term.

Most asset managers today use ESG to help them make informed decisions. In addition, there is greater demand for funds that seek to deliver sustainable outcomes alongside risk-adjusted returns. As a result, we’ve seen an explosion in the number of sustainable funds available to investors. And companies are now much more receptive to investor engagement.

Norton: How do you describe sustainability and sustainable investing to a novice investor?

Hale: Sustainability is about being mindful about one’s impact on the environment and other people, present and future, when making decisions and taking action. A sustainable business is managed with a view to the long term that generates profits alongside positive results for other stakeholders.

If you are sustainability-minded, it’s easier than ever to invest that way. Just like conventional funds, sustainable funds seek to deliver competitive returns, but in so doing, they also seek better outcomes for people and planet.

Norton: What has surprised you the most about the evolution of ESG?

Hale: How quickly it’s taken hold in both the investment and corporate worlds. In the investment world, ESG raises issues related to how a company manages its environmental impact and its operations, its people, and the supply chain, and on best practices in corporate governance.

ESG data providers collect this information so that investors can have a more holistic picture. Most asset managers have embraced the idea that ESG helps them make better decisions. Even most skeptics think there’s nothing wrong with having this kind of information, although they may not see it as a key factor as often as ESG proponents do.

On the corporate side, a decade or so ago, companies started publishing sustainability reports and talking about this broad concept of sustainability. Very recently, they’ve embraced ESG because it gives them a framework for addressing the most-relevant ESG issues for their business rather than talking generally about sustainability.

Business, Politics, and Sustainability

Norton: Are ESG and sustainability the same thing?

Hale: The terms are related and often used interchangeably. I see ESG issues as useful indicators of sustainability, but just because a company does well on the material ESG issues affecting its business doesn’t mean it has a business model that will last into the future that can generate profits for shareholders along with positive results for people and planet. That said, it’s a good sign from a systemic standpoint that no company today wants to be seen as an ESG “laggard.” Not so long ago, most companies wouldn’t have cared.

Norton: Sustainable investing has been subjected to a great deal of criticism by some influential Republicans. How much damage has this done?

Hale: Some Republicans don’t like it that so many companies are addressing their ESG risks. Companies are taking on issues like their environmental impact, their climate impact, and diversity in the workforce because they connect to the bottom line. These are just facts of corporate management today.

But when companies say “here’s our path to net-zero emissions,” some Republicans see it as progressive ideas taking root in companies. Of course, there’s not some organized leftist campaign to get companies to do this. More companies understand the need to transition to renewable energy and are taking steps toward doing it, even in the absence of regulation.

The American workforce is as diverse as it has ever been and will become even more so in the future. Nothing can change that. Employment policies that reflect and respect diversity are just a fact of life for corporate America as companies compete for talent.

Norton: How do you see things playing out?

Hale: Efforts to limit the freedom of investors to consider ESG information have been modestly successful in some Red states, mostly pertaining to the management of state pension funds. But there’s no turning back. Companies are not going to ignore facts on the ground. And the number of individual sustainable investors is only going to grow because younger people are the most sustainability minded.

Norton: Is it time to retire the term “ESG” and only use the term “sustainability?”

Hale: It’s easier for those who oppose the whole concept of sustainability to use “ESG,” a set of initials with no inherent meaning, to try to scare people. So, it’s possible that the negative usage of the term “ESG” will spur more asset managers and companies that actually practice “sustainability” to use that term instead.

Learn From the Experts

Norton: Are active or passive approaches better for sustainable investors?

Hale: I think ESG data is more useful for an active manager who wants to put together a holistic picture of an investment’s risks and opportunities. But it is easy to use ESG data in a passive setting—say, by taking a conventional index and screening or tilting it based on ESG scores.

An actively managed strategy has greater ability to emphasize the broader concept of sustainability than a passive ESG strategy has. But sustainable-investing performance is pretty similar to the broad investing space in that it’s difficult for active managers to outperform passive strategies on a regular basis. There are some really good active investors in the sustainable space that have been able to do that.

Norton: Who are the Warren Buffetts of sustainable investing?

Hale: With the success of passives, the era of the Great Manager is over. I’m looking to the next generation of sustainable investors to evolve and innovate. They’ll be less encumbered by the preexisting investing paradigm that I think has been fundamentally skeptical of sustainable investing.

But in terms of giants who deserve mention: Amy Domini, who with Peter Kinder and Steve Lydenberg created the first index that screened out companies based on certain objectionable activities and also created the first ESG data firm. They proved that an ESG index could perform on par with, if not outperform, a conventional index and at the same time pioneered the field of ESG data and analytics. [Ed.: Hale briefly worked with Domini as an analyst in 2000.] And then there is Tim Smith, who recently retired from Boston Trust Walden. He has been at the forefront of shareholder engagement efforts since the 1970s.

Norton: What do investors still misunderstand about sustainable investing?

Hale: The biggest myth out there, by far, is the idea that ESG or sustainable investing must underperform. The claim is that if you limit an investable universe based on nonfinancial criteria, then almost by definition, you’re going to underperform. There might be times when that happens, but diversification and the use of portfolio optimization techniques can overcome it. And even more to the point, a focus on material ESG issues is certainly not irrelevant to performance. Over the trailing five years on an annualized basis (through April 2023), two thirds of sustainable funds available to U.S. investors have outperformed their Morningstar Category peers.

Another common misimpression is that a sustainable fund is about sustainability first and investment return second. Not true! The main purpose of a sustainable investment is to provide competitive risk-adjusted returns just as it is for a conventional investment.

Norton: How does one get started in sustainable investing?

As an investor, you have to ask, “Is this sustainable fund likely to deliver the risk-adjusted returns that I need from this investment?” That’s why you’re purchasing it. But out of all the funds to choose from, if you are sustainability-minded, you can choose the one that also seeks to deliver better outcomes for people and planet.

You can construct an entire portfolio with sustainable-investment options today: U.S. large-cap, bonds, international stocks, etc. If you are already an investor and typically use passive funds, you can invest in passive sustainable-investment portfolios.

Norton: What if your only investments are in a 401(k) or other retirement savings plan that doesn’t contain sustainable funds?

Hale: If there are no ESG or sustainable funds in the lineup, you can look at the funds’ Morningstar Sustainability Ratings to see if there are any 4- or 5-globe funds. That doesn’t mean they have a mandate to invest sustainably, but the portfolio has reasonably low levels of ESG risk.

Second, many plans have a brokerage window option, which allows many different sustainable-investment choices.

If that route is too complicated for you, then definitely talk your 401(k) plan administrators. They often respond to participant requests. It will take a while for a request to be approved, but it’s the way that a lot of 401(k) plans have added sustainable funds to their lineup. Now that the Department of Labor has made it easier for 401(k) administrators to add sustainable options to plans, I expect more funds will be available in 401(k) plans in the not-too-distant future, including sustainable target-date funds. And if you have an IRA, you should have plenty of sustainable funds from which to choose, including ready-made asset-allocation multistrategy funds.

Norton: Tell us the biggest mistake that sustainable investors make. How to avoid it?

Hale: Not fully understanding the sustainability features of their investments. If it’s only focused on making sure every stock in the portfolio meets a certain ESG standard, you may be disappointed if you’re expecting exposure to companies that deliver impact through solutions to sustainability problems. It’s really important to understand the specific approach or set of approaches the fund is taking so you can set your expectations. You can find this information in the fund prospectus and other materials.

It’s important for sustainable funds and asset managers to publish impact reports, which give you a sense of what the manager considers to be the broader impact of the strategy beyond financial returns. It’s an important read for the advisor who’s recommending a fund or for end investors. It’s a red flag if you can’t find that level of information from a sustainable fund.

Norton: Any sustainable-investing trends we should look out for?

Hale: We’ll see a greater emphasis on impact, because we’ve gotten enough feedback from end investors that understanding the broader impact of their investments resonates with them. If a sustainable fund not only tries to deliver competitive risk-adjusted returns but also has a net positive impact on people and planet, how do you measure that and express that?

Related to this is making sure that the fund is very clear about its approach. The pending SEC names rule and ESG disclosure rules, if they come to fruition, will give regulatory impetus to funds to do better on that.

We’re starting to see more ESG data that directly tries to measure impact. So within a portfolio strategy, we’ll likely see more of an emphasis on a company’s impact on the world rather than just how well it’s handling its ESG risks.

Finally, I think we’ll see more specifically climate-focused strategies, which focus on companies meeting emissions reduction commitments or creating climate-related solutions.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)