Navigating Risky Bond Sectors When They Are Cheap

Lower valuations might be tempting, but it’s important to proceed with caution.

Bond investors struggled across all fixed-income classes in 2022. The worst-performing sector, long-term U.S. Treasuries, dropped by nearly 30 percentage points for the year. Even the best-performing sector, leveraged loans, lost 80 basis points. By the end of 2022, investors had pulled more than $500 billion out of bond funds as a result.

The meltdown came with a silver lining: Bond prices are currently cheaper than they’ve been in years. While higher-quality bond sectors avoided major outflows, riskier subsectors still have not recovered from 2022 outflows. Contrarian investors might be tempted by the lower valuations in riskier corners of the market, but it’s important to proceed with caution. This article evaluates pockets of opportunities in sectors that were abandoned en masse in 2022: high-yield and emerging-markets bonds.

High Yields, Low Prices

Corporate bonds were broadly hit by a double whammy of rising interest rates and widening credit spreads, and high-yield bonds suffered disproportionately from heightened expectations of default. The option-adjusted spread on high-yield corporate bonds increased by 176 basis points (more than 50%) between January and December 2022. By comparison, the spread on investment-grade bonds rose by only 41 basis points (around 42%) during the same period. The average high-yield bond currently trades just below 90% of its face value, with an average yield of nearly 8%. While these valuations might be tempting for some investors, it pays to be cautious in the high-yield market.

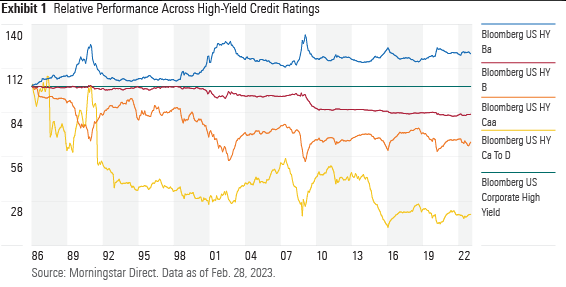

The risk/reward profile of high-yield bonds is highly asymmetric, with default spreads widening exponentially as investors go further down the credit-rating spectrum. Exhibit 1 displays the historical performance of high-yield bonds by credit rating relative to a broad high-yield benchmark, the Bloomberg US Corporate High Yield Bond Index. It’s immediately clear that not all risks are compensated equally. Over the 37 years from January 1986 through February 2023, bonds rated B and higher have consistently outperformed bonds rated CCC and lower, with much less volatility. This phenomenon can be attributed to high issuer-specific risks among the lowest-rated issuers, as well as investors’ yield-chasing behavior, which artificially inflated prices on the highest-yielding bonds.

It is generally advisable for passive investors to stick with higher-quality junk bonds. Higher-quality issuers tend to issue more debt than those among the lowest-rated rungs, meaning a market-value-weighted high-yield index should already tilt investors toward bonds with higher credit quality. As of January 2023, most broad, market-value-weighted high-yield bond indexes allocated over half of their portfolios to bonds rated BB, more than most peers in the high-yield bond Morningstar Category. Cautious investors can also turn to funds targeting only bonds rated BB for extra insurance, though quality comes at the expense of yield.

Investors looking for a more strategic play in high-yield bonds can also look at “fallen angel” bonds. These are high-yield bonds that previously received an investment-grade rating but were then downgraded to junk status. These issuers often fall in the higher rungs of high-yield credit ratings, most commonly BB. This means fallen-angel indexes typically have a quality tilt compared with broader high-yield indexes.

But newly minted fallen angel bonds come with negative credit-rating momentum and may not cruise through credit shocks better than other high-yield bonds. Financial advisors and portfolio managers may not be allowed to hold high-yield bonds, so they may be forced to sell out of fallen angel bonds when they’re downgraded to below BBB. This could exacerbate the downward price pressure on a bond, causing fallen angels to underperform similarly rated bonds at the onset of their downgrade. This can distort their true value. Investors buying fallen angel bonds shortly after a downgrade can benefit from their artificially low price, especially given the potential for substantial demand should the issuer be upgraded back to investment-grade.

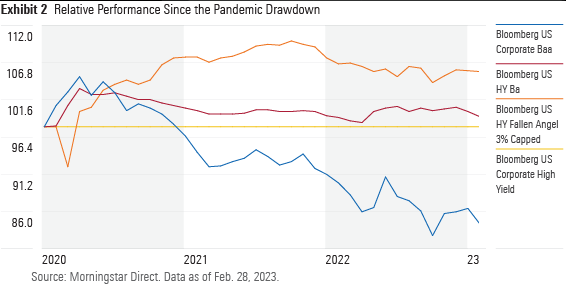

From its 2005 inception through February 2023, the Bloomberg US High Yield Fallen Angel 3% Capped Index outperformed the Bloomberg US Corporate High Yield Index by 2.3 percentage points annualized with slightly higher volatility. Fallen angels shone during the recovery phases after major stresses, such as the pandemic-driven drawdown. Exhibit 2 compares the postpandemic relative performance of fallen angels and bonds rated BBB and BB against the broader high-yield market. While the fallen angels index suffered the most during the trough of the drawdown, it came out on top by September 2020. A wave of downgrades added 31 issuers and $169 billion of debt to the fallen angels market in the wake of the drawdown.[1] A number of these issuers graduated back to investment-grade by the end of 2021, to the benefit of their investors. Despite a wave of upgrades, the current fallen angels market still tilts more toward bonds rated BB than it did prior to the pandemic.

The impact of rising interest rates has shaved off some of the excess return in 2022; fallen angels often carry higher duration than high-yield peers from their days as investment-grade bonds, since the return of principal is a larger portion of their total income stream. While a detractor in 2022, a longer duration can provide more upside when rates eventually taper off.

Emerging Markets, Submerging Valuations

Emerging-markets bonds present another downtrodden bond sector. These funds shed nearly $9.7 billion in 2022, or nearly one fifth of the assets in the emerging-markets bond category. The JPM EMBI Global Diversified Index category benchmark lost 17.8% for the year. Fleeing investors left prices free-falling and pushed yields to levels not seen since the 2008 global financial crisis. While geopolitical tensions in Europe have not fundamentally improved, all is not lost for emerging-markets bonds.

Most emerging-markets economies managed to weather 2022 despite poor macroeconomic conditions, like inflation, a rising dollar, and a closed Chinese economy. Responsive central banks acted swiftly to contain inflation, most notably in Latin America.[2] In addition, many governments took advantage of the low-rate environments in recent years to shore up their balance sheets and foreign reserves. Coming into 2023, China finally relaxed some of its zero-COVID policies, which reinvigorated the outlook for commodity producers and trade partners.

Unlike the U.S. bond market, idiosyncratic risk has and will continue to be a major pain point for this asset class. This could be managed in two ways: using a strong active manager with ample local research and resources or leveraging the power of diversification to dull the impact of poor performance by individual issuers.

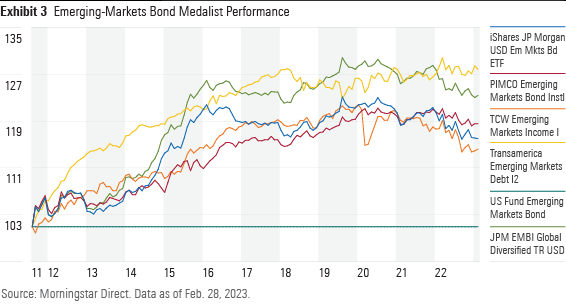

Exhibit 3 plots the outperformance of funds with Morningstar Medalist Ratings of Bronze, Silver, and Gold in the emerging-markets bond category against the category average, alongside the category index. Aside from iShares JPMorgan USD Emerging Markets Bond ETF EMB, all three other funds are active offerings. These funds benefit from deep benches of experienced portfolio managers and analysts, strong risk-management processes, or both. On the other hand, EMB’s success is a testament to the benefit of diversification, particularly in an asset class rife with idiosyncratic risk. A broad scope and sensible weight constraints rein in the impact of single-country or issuer risk, keeping the fund away from outsize bets that might fall through.

The strong performance of the category index should be viewed with skepticism. Several operational challenges stand in the way of index funds fully capturing this performance, especially with a broad index that’s spread across various geographical markets. Index fund managers must employ a high degree of sampling to strike the right balance between index replication and transaction costs. In addition, they often cannot replicate the same withholding tax treatment that index providers assume in index calculations. As a result, the returns on emerging-markets bond indexes are more of a guidepost than a destination.

Investors looking to bet on the recovery of emerging-markets bonds should always proceed with caution. Nonetheless, the funds in Exhibit 3 outperformed the average of their category peers and present well-constructed, investable options.

[1] Barclays. 2021. “Fallen Angels during Covid-19: Business as Usual?” Jan. 27, 2021.

[2] Lazard Asset Management. 2023. “Outlook on Emerging Markets.” https://www.lazardassetmanagement.com/research-insights/outlooks/emerging-markets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)