Can You Be Too Young to Invest in a Roth IRA?

The vehicle is tops for tax-free compounding, but young investors need their own income to qualify.

One of the best gifts you can give a young person is an investment to help them benefit from the market’s long-term growth. And if you want to supersize the compounding effect, a Roth IRA is an attractive wrapper for that investment. There’s no tax break on contributions, but once the dollars are in the account, all future growth will escape taxation, assuming the account owner follows the Ps and Qs governing Roth IRA withdrawals.

As attractive as that tax treatment is, not every young adult can take advantage of a Roth IRA. And if the young investor in question hasn’t yet reached the age of majority, they won’t be able to select and manage the assets; the account will need to have a custodian, such as a parent, to do so. Finally, it’s worth noting that because of strictures on withdrawals of investment gains, a Roth IRA usually won’t make sense for goals that are close at hand, such as a young person’s college fund.

The Benefits of Using the Roth IRA Wrapper

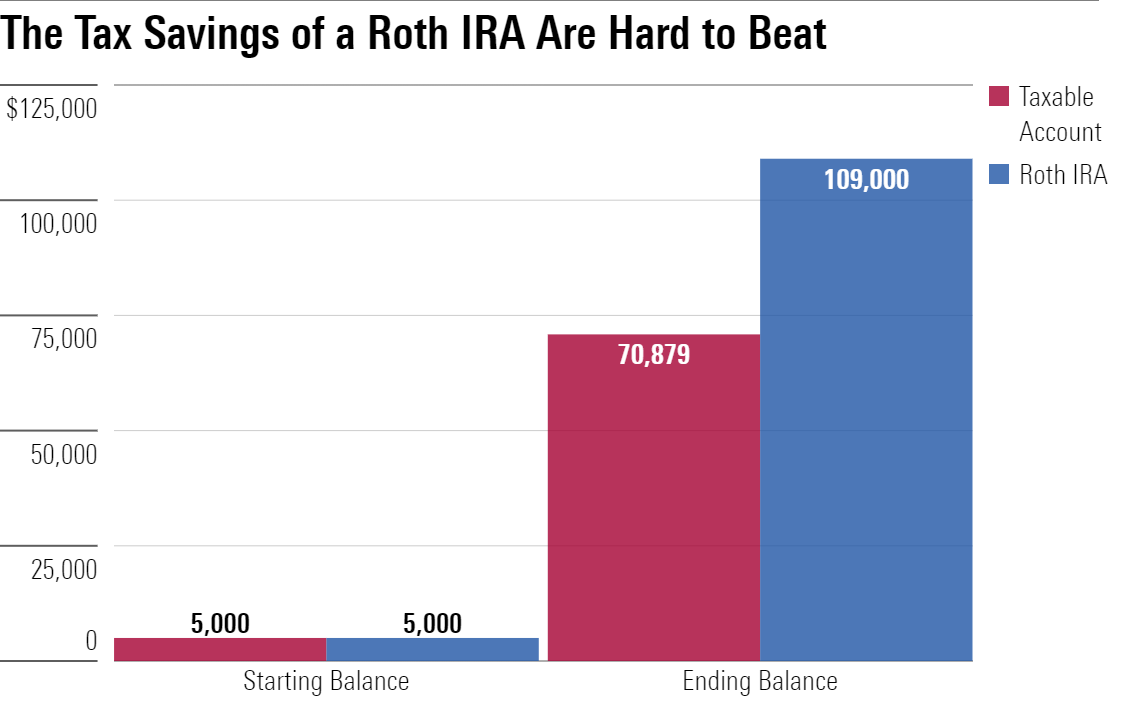

To give a simple illustration of how investing in a Roth IRA can beat investing in a plain old taxable account, let’s assume you want to make a $5,000 investment in Vanguard Total World Stock ETF VT for a 21-year-old recent college graduate. In both cases, the funds go into the account on an aftertax basis (that is, there are no tax breaks on the contribution).

If we assume that both accounts earn an 8% annualized return over the next 40 years, the taxable account would have grown to about $83,000 at the end of the period. Meanwhile, the Roth account would have grown to roughly $109,000. The difference is the ongoing drag of taxes on the taxable account. Vanguard Total World Stock ETF isn’t terribly tax-inefficient, but taxable shareholders get docked for any dividend or capital gains distribution the fund makes. (Its 10-year tax-cost ratio is 0.74%.) With the Roth account, there’s no tax on an ongoing basis.

The funds in the Roth also escape taxation upon withdrawal, whereas the taxable investor will owe capital gains tax on the appreciation. Assuming a capital gains rate of 15% on the $77,505 in gains brings the taxable account balance down to $70,879 for the taxable investor withdrawing funds. That’s fully $30,000 less than the Roth accountholder would have, and the full $109,000 would be fully tax-free to the Roth accountholder after age 59 1/2.

What about a traditional IRA? There are no age limits on traditional IRA contributions, either, and both traditional and Roth IRAs shield their owners from taxes as long as the funds remain inside the account. But traditional IRAs will generally be less attractive for young people because they offer a tax break on contributions, rather than withdrawals. That means that the contributor earns a deduction early in their life, when they’re likely in a low tax bracket, but they’ll owe taxes on their distributions, when their tax rate will likely be higher. Roth IRAs are generally a better deal for younger investors because the tax break occurs when the funds come out of the account, when the account owner will likely be in a higher tax bracket.

Earned Income May Be a Hurdle to Getting a Roth IRA

The natural takeaway might seem to be “Roth accounts for all!” But a key consideration if you’re making a Roth IRA (or any IRA) investment in a young person’s name is that said young person needs to have enough earned income to cover the contribution amount. What counts as earned income? Earned income from a job, mainly. Other types of income, such as alimony income, also count. Gifts don’t.

Yet the earned income requirement doesn’t mean the young person needs to use their own funds to make the contribution; the income from work could be long gone and you could still make a contribution from your coffers. It doesn’t matter where the funds come from; what matters is that they had earned income that’s equal to or greater than the contribution in the year that the contribution is made.

And a Few More Caveats

In addition, it’s important to note that if the young person is considered a minor, they can’t select investments and manage the account on an ongoing basis. Instead, they’ll have to use what’s called a custodial IRA. The account is still the property of the young adult, but it will also need to have a custodian (usually a parent) to oversee the assets until the child reaches the age of majority (18 or 21, depending on the state). Once the child reaches the age of majority the account must be converted to a conventional Roth IRA and the young person will be fully in charge of the assets. (In this way, the Roth IRA functions much like a UGMA/UTMA brokerage account, though those accounts lack the tax benefits of Roths.)

Finally, it’s worth noting—and worth reminding the young gift recipient of the Roth IRA—that there are strictures around taking tax-free withdrawals. If the account owner withdraws earnings from a Roth IRA before age 59 1/2 (or even if the account owner is 59 1/2 or older but hasn’t held the account for five years including conversions), they’ll will pay taxes at their ordinary income tax rate as well as a 10% early withdrawal penalty. In other words, they’ll effectively negate the prodigious tax benefits that come along with the Roth account. That said, account owners can avoid the 10% penalty—but not the tax owed on the earnings portion of the account—if they’re using the funds for certain expenses, such as qualified education or first-time home purchases (up to $10,000—a lifetime limit).

That said, Roth IRAs do offer a nice escape hatch in case the account owner needs the funds prior to age 59 1/2. All contributions (not any investment earnings) can be withdrawn tax-free at any time and for any reason. That flexibility makes a Roth IRA perfect for multitasking young people. Ideally they’d leave the funds in the account until retirement. But if they need the funds sooner—for an emergency expense or even a “nice-to-have” outlay like a home down payment—any contributions into the account are theirs for the taking.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)