5 Stock Funds That Protected Investors in the Bear Market

These funds outperformed their benchmarks by the widest margin during the market’s decline.

With investors still nursing losses more than a year into a bear market for stocks, some funds have done a much better job than others in staying ahead of their corner of the market.

For the most part, these funds have remained more buoyant by holding more cash, or by concentrating on more business with stronger balance sheets than other funds.

It’s one thing for a fund to do well during a bull market, but over the very long term, one of keys to outperformance is to lose less for investors during steep market declines.

At the same, by the very nature of stock investing, some strategies are going to be inherently more or less volatile than the overall market. Assessing how well a fund does in protecting investors against a steep downdraft requires comparing that fund to an appropriate benchmark.

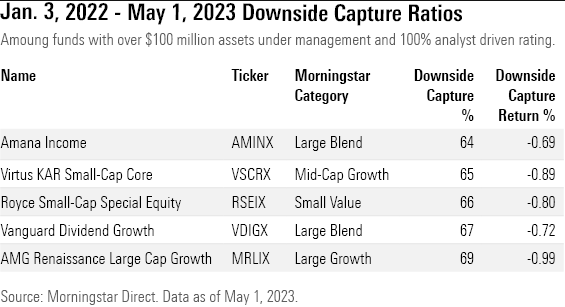

One measure of performance is a fund’s downside capture ratio, which measures a strategy’s performance in down markets relative to an index. For example, if a fund’s downside capture ratio is 50%, it declined half of what the index did; if its downside capture is 150%, it declined 50% more than the index.

To see which funds did the best during market declines, we looked at performance from the U.S. stock market peak on Jan. 3, 2022, through May 1, 2023. Using Morningstar Direct we calculated downside capture ratios for U.S. equity funds with more than $100 million in assets and that have a 100% analyst-driven Morningstar Medalist Rating, For this article, the index used is the fund’s Morningstar index assigned to its Morningstar Category, which allows for an equal comparison between similar funds.

(A fund’s historical downside capture ratio since its inception is shown on the risk tab of its Morningstar page.)

From this group we’ve highlighted the five funds with the best downside capture ratios.

Among the funds that have proved more buoyant are dividend-focused strategies.

Stocks that tend to pay dividends typically have healthy balance sheets and can be more resilient in downturns.

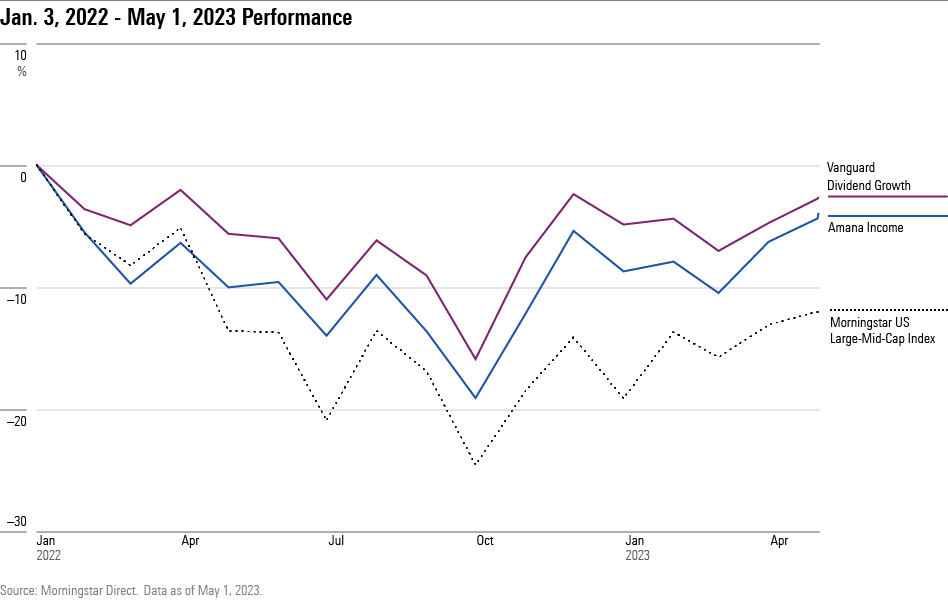

The dividend-focused $1.6 billion Amana Income AMINX captured only 64% of the Morningstar US Large-Mid-Cap Index’s decline in down markets. Senior analyst David Kathman points out that the fund isn’t allowed to own any financials, which buoyed performance in 2022. Meanwhile it owns double the category average stake in healthcare stocks.

“The fund can’t own companies that are too leveraged, which generally helps it in down markets,” he says.

Another dividend focused fund, $52.3 billion Vanguard Dividend Growth VDIGX, captured less than the Morningstar US Large-Mid-Cap Index’s fall. “The fund has been resilient in prolonged downturns,” writes analyst Paul Ruppe. However, “the fund’s well-capitalized dividend-payers, on the other hand, often lag when more-speculative fare surges,” he adds.

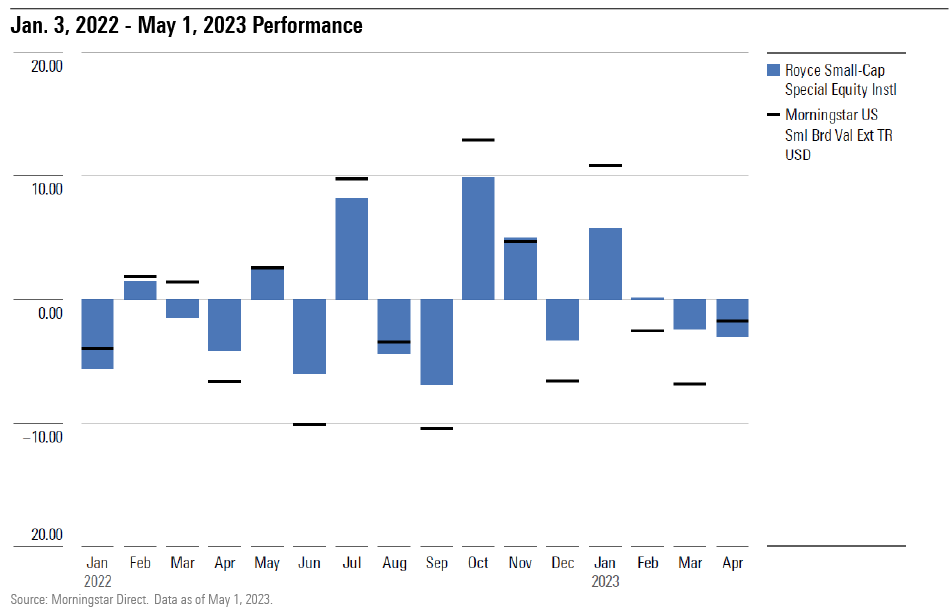

A larger cash stake helped $747 million Royce Small-Cap Special Equity RSEIX capture only 66% of the Morningstar US Small Extended Index’s declines. The index has fallen 17% since Jan. 3, 2022, while the fund is down only 6%.

Around 18% of the fund’s portfolio has sat in cash over the past year. Director Dan Culloton points to the fund’s large cash stake and the portfolios better profitability and quality metrics for why it held up better than the index and its peers. “Charlie Dreifus and Steve McBoyle only own profitable companies with clean accounting and will let cash build if they can’t find candidates that meet their criterion,” he says.

“The fund did well last year without any help from 2022′s best performing sector: energy,” says Culloton.

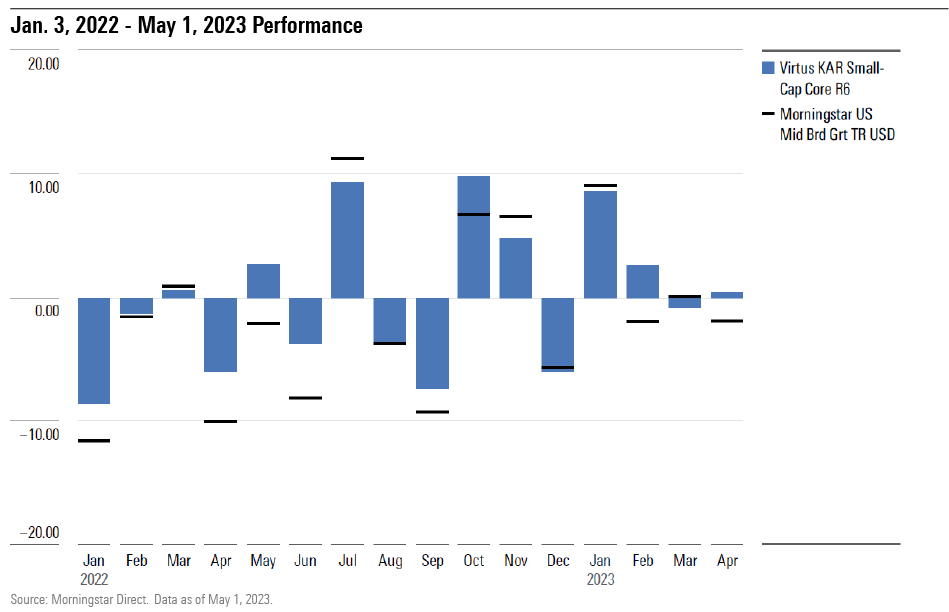

The $1.7 billion Virtus KAR Small-Cap Core VSCRX lost only 65% against the Morningstar US Mid Broad Growth Index’s declines as the index has fallen 22% since Jan. 3, 2022. The fund’s style is hard to pin down, says analyst Anthony Thorn, but it lost less than both the Morningstar Mid Broad Growth Index and the Morningstar US Small Cap Extended Index.

“The managers have a strong preference for quality and this usually helps them protect well during most down markets,” says Thorn, but he adds, “strong stock selection led the majority of the fund’s outperformance last year. Some of the top picks include Aspen Technology AZPN, EMCOR Group EME, and FTI Consulting FCN.”

Growth funds experienced the largest losses as U.S. stocks entered a bear market but $127.6 billion AMG Renaissance Large Cap Growth MRLIX captured only 69% of the Morningstar US Large Broad Growth Index’s declines.

The portfolio is generally underweight in the index’s biggest names, so it tends to perform better in periods when the top holdings of the benchmark underperform relative to the rest of the index,” writes senior analyst Jack Shannon. The fund lost 10% from the peak on Jan. 3, 2022, while the Morningstar US Large-Mid Cap Broad Growth Index fell 21.4%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)