Understanding Structured Products in 4 Charts

Our simple framework breaks down a subset of fast-growing but complex assets.

After a decade of near-zero interest rates smothering debt yields, a global pandemic that halted global supply chains, and a reopening that spurred red-hot inflation, investors would be forgiven for wanting to take some uncertainty off the table. Enter structured products: jack-of-all-trades, master of none. The instrument grew from humble beginnings to reach $1.5 trillion in new issuance in 2021, according to S&P.

Despite that tremendous growth, most people have never heard of structured products. Often they get conflated with securitized bonds, which is understandable—securitized bonds are sometimes known as structured financing arrangements. And they do have one thing in common with structured products, which is that they’re a form of debt, issued by a bank or financial intermediary (that’s where the structuring happens).

The similarities stop there, though. A securitized bond is collateralized, typically by a real asset like a house or an airplane. A structured product, meanwhile, is backed solely by the creditworthiness of the bank that issues it.

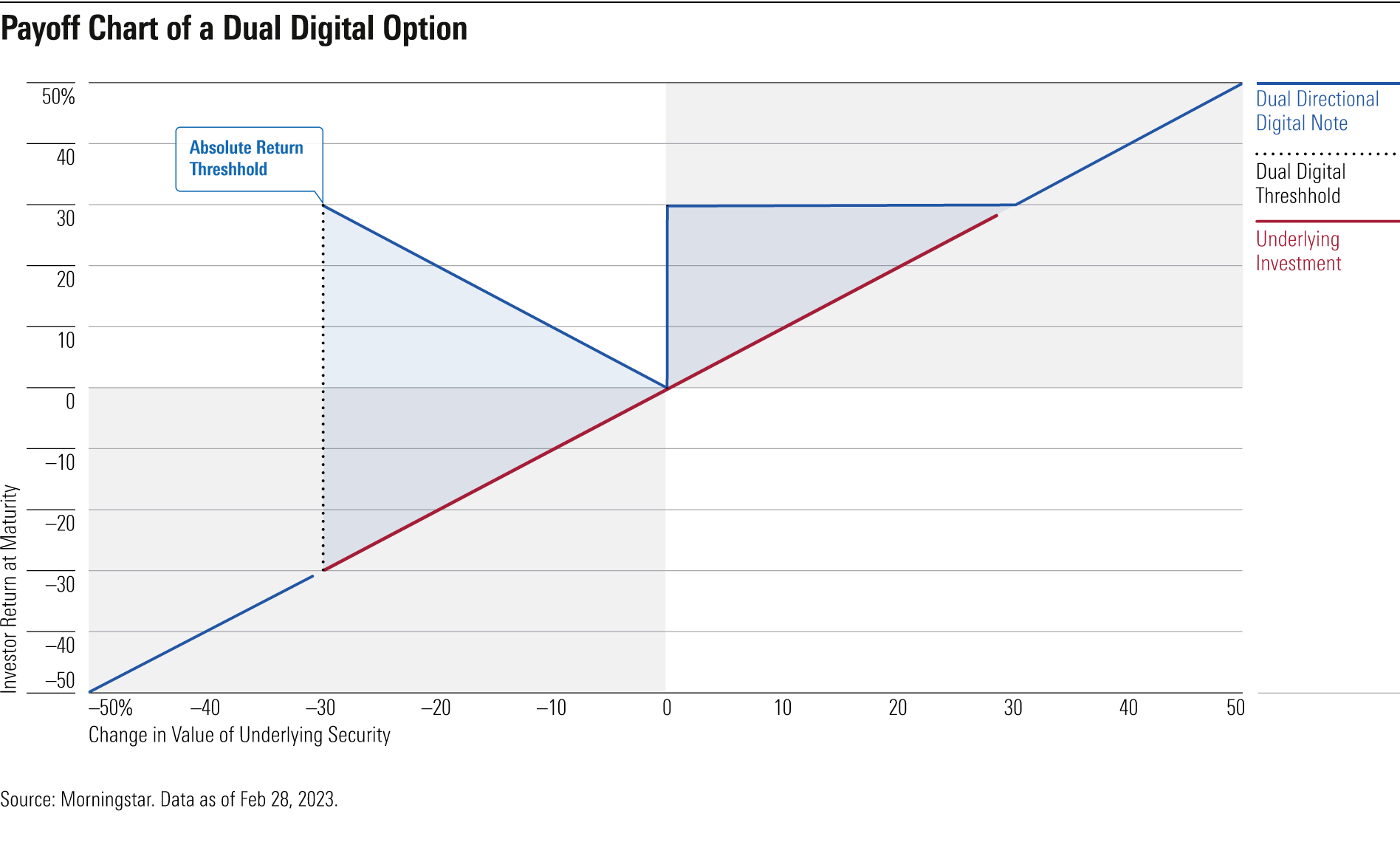

One other key characteristic of structured products is that the return an investor receives from a structured product is linked to the performance of a financial asset, like a stock, commodity, or index. But the link to the underlying investment is not straightforward. Instead, like Frankenstein’s monster, the component parts of structured products are sewn up into a note and reanimated—often with flashy payoff profiles borrowed from exotic exchange-traded option strategies.

Advantages and Disadvantages of Structured Products

The use cases for structured products are as diverse as the instruments themselves. Structured products have the ability to hedge against specific risks—such as interest-rate or currency fluctuations—or address more general objectives like ensuring income or enhancing returns. Although they often promise to damp market risk, structured products carry unique disadvantages.

- Combining elements of several financial instruments makes structured products tricky to monitor across changing market environments.

- Structured products are bespoke, so they are often tough to resell.

- Relative to exchange-traded options, these instruments have long time horizons, effectively locking up investors’ capital until their maturity date.

- Banks are the main providers of structured products, exposing investors to significant counterparty risks.

- The cost structure of these instruments is opaque. The vast majority are exorbitantly expensive.

In spite of these clear drawbacks, structured products do have one key advantage: flexibility. Issuers can tailor them to meet specific investor needs or behavioral preferences. For example, investors looking to protect against market downturns can invest in structured products that provide a guaranteed minimum return.

This flexibility has made structured products compelling for retail investors daunted by the ongoing maintenance required to hedge with exchange-traded options. Plus, structured products offer a higher yield than bonds. This boosted their popularity throughout the 2010s as rates trudged along at multidecade lows.

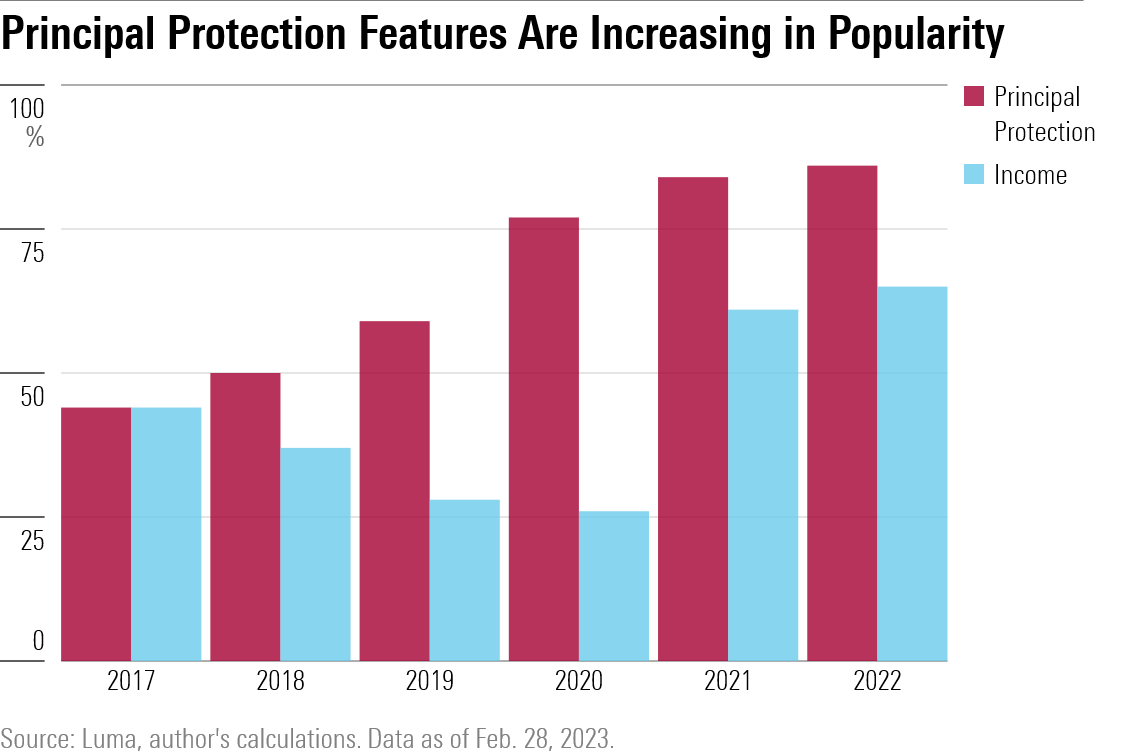

Rates have risen steadily since March 2022, though, and as of March 2023, a two-year T-bill yielded more than 5% annualized. Despite that, demand for structured products has shown no sign of abating. Why is that? Increased market volatility led to greater demand for a different flavor of structured products—ones that protect investors on the downside.

Structured products can be tweaked to provide different levels of protection, from capital guarantees to partial protection against market downturns. They are labeled based on the features that they offer, using terms so arcane and abstract that they might as well be fished from the back of a securities textbook. Terms like “cliquet,” “snowball,” and “dual directional” are difficult to decipher on their own, let alone when you find them in combination, as in “Capped Dual Directional Weighted Basket Buffer Note.” Labels that dense don’t effectively convey what the product is designed to do and may be misinterpreted even by sophisticated investors.

4 Types of Features Found in Structured Products

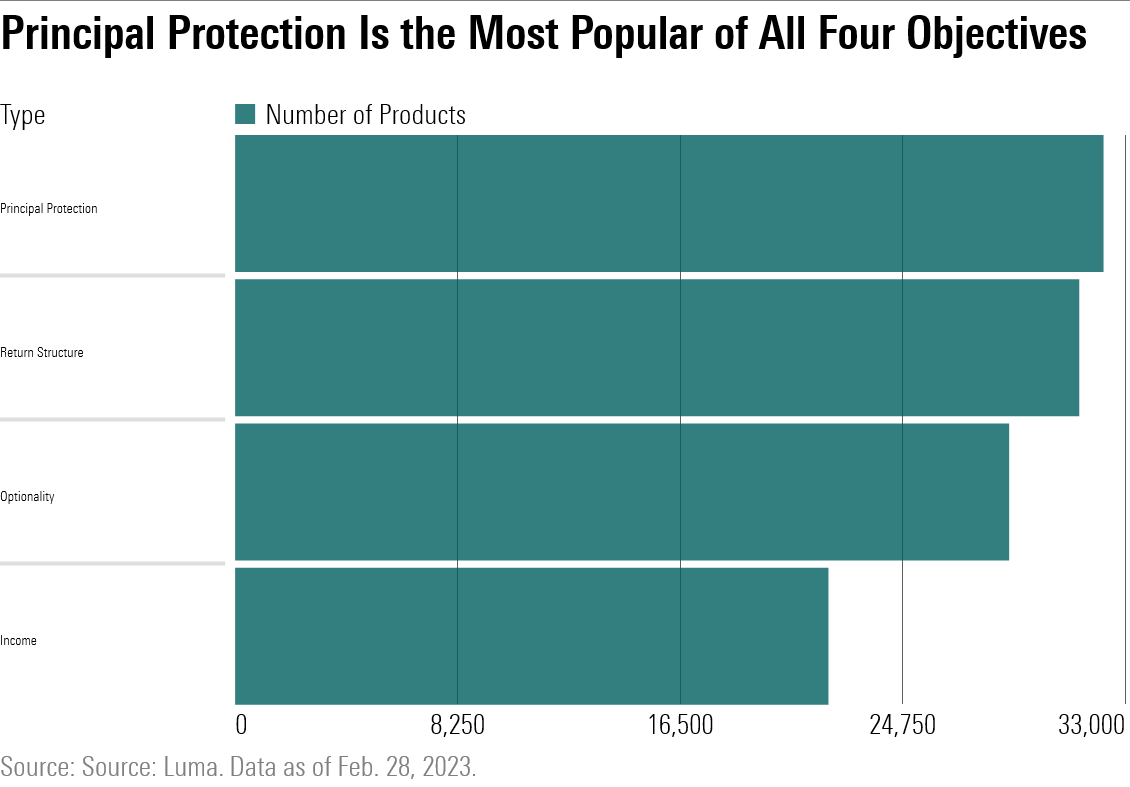

To help investors wade through the complex swamp of products and profiles, Morningstar has created a framework to help investors contextualize structured products’ continued momentum and classify these assets relative to the rest of their portfolios. We’ve bucketed the most popular features of structured products into four objectives: principal protection, income, return structuring, and optionality.

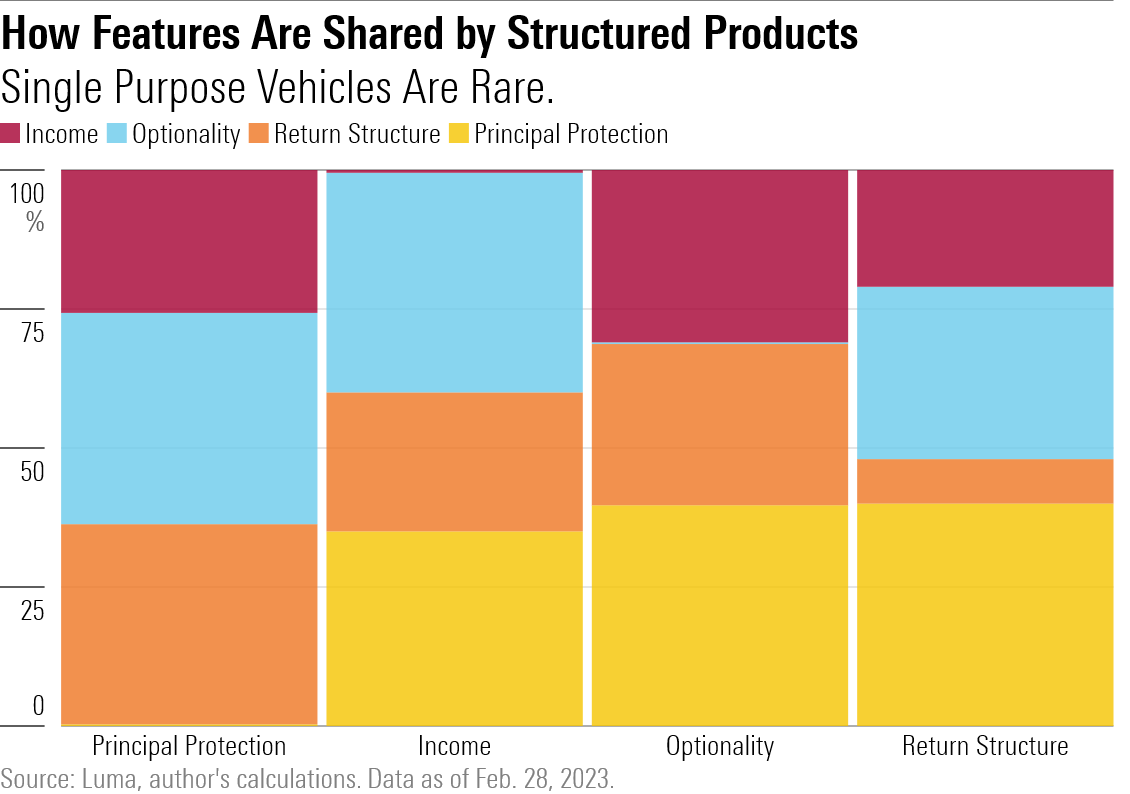

The objectives are nonexclusive, meaning a structured product may offer both principal protection and optionality, for example. That’s because structured products often cherry-pick features from different groups for maximum reach. By grouping these notes in this way, we can provide more explicit definitions for which goal each product is attempting to address. This will help investors better understand how their products are helping—or hurting—them.

The income bucket captures structured products designed to amplify or reshape the income delivered to investors. This includes products with fixed interest, contingent interest, or coupon memory. These notes are commonly used by investors seeking higher income from their investments, while still having some exposure to other assets like stocks or market indexes.

Structured products with return structuring aim to either transform the performance profile of the underlying asset or combine the performance of multiple assets. Many of these features artificially reduce volatility by changing how frequently returns are calculated. One feature unique to structured products is the “worst of” basket, where investors earn the return of the security that underperforms the most relative to a preselected bunch over the life of the product.

Structured products with optionality adopt the payoff profiles of derivatives in some way. This includes products that are capped, have digital returns, or lookback windows. Unlike exchange-traded call and put options, which always give investors more choices, in some cases the optionality embedded in structured products can actually work against investors. Take “autocallable” and “issuer callable” notes, for instance. These are products where the issuer receives a call option instead of the investment’s owner. The issuer can exercise the option if it so chooses, and in those cases, the contract would be terminated.

Finally, principal protection features are designed to protect the investor’s initial investment, either partially or fully. This bucket encompasses barrier notes, buffer notes, and minimum return products, among others. These products are particularly attractive to risk-averse investors, as they offer a level of downside protection.

Are Structured Products Worth It?

While our buckets may help demystify structured products, flashy investments like these are not a panacea. Investors working with a good financial advisor shouldn’t need fancy hedges to absorb market volatility, assuming their asset-allocation profile is aligned with their capacity to take risks. It’s our view that during rocky markets in particular, the price for structured products is generally too high for an investor to get any other benefit besides peace of mind.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)