Is Tesla Stock a Buy After Earnings?

Cost reductions could result in higher profit margins for long-term investors.

Tesla TSLA released its first quarter earnings report on April 19 after the close of trading. Here’s Morningstar’s take on what to think of Tesla’s earnings and stock.

Key Morningstar Metrics for Tesla

- Fair Value Estimate: $215

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

Fair Value Estimate for Tesla

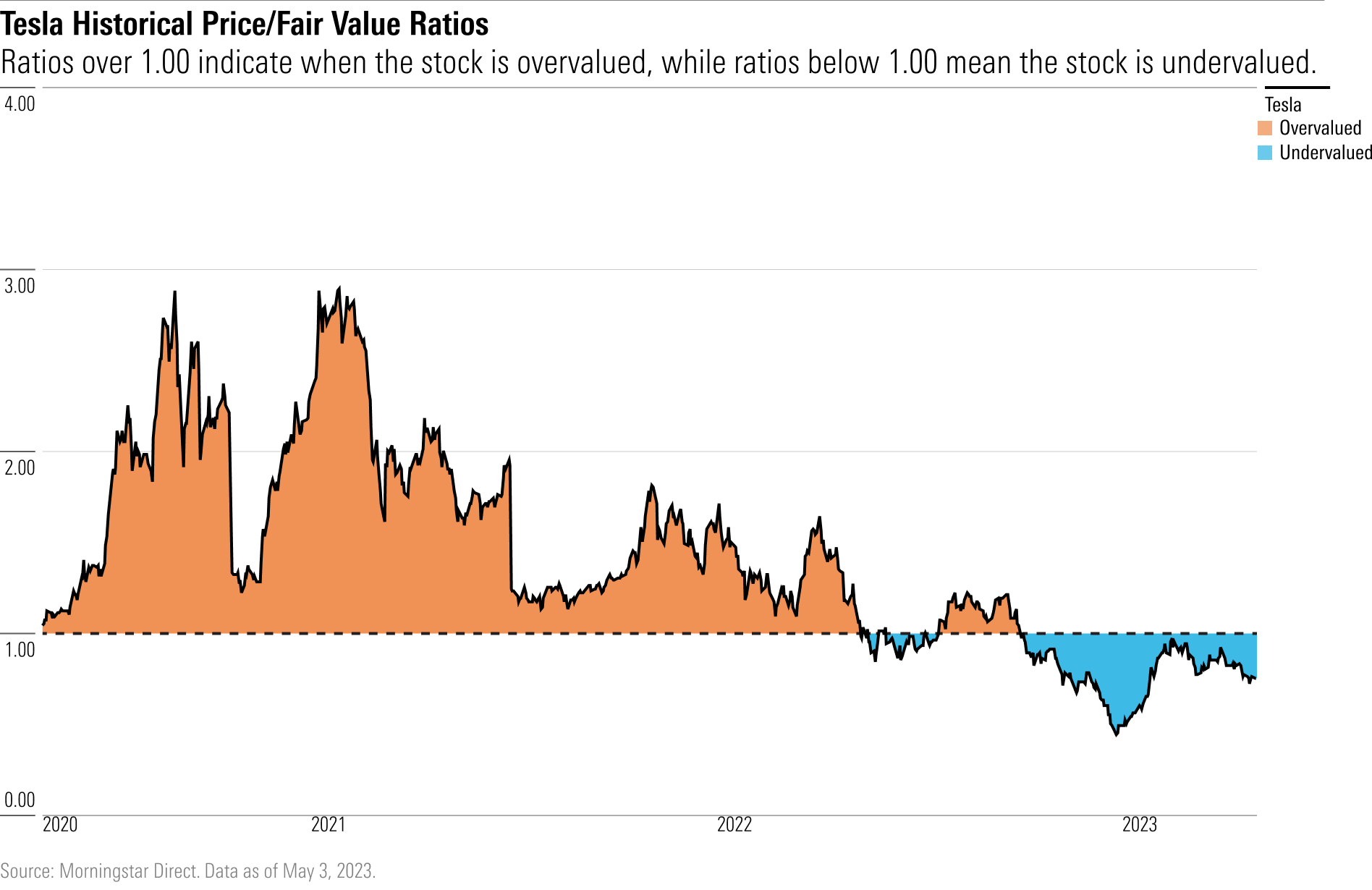

With its 4-star rating, we believe Tesla stock is undervalued when compared with our fair value estimate.

Our fair value estimate for Tesla stock is $215 per share. In the near term, we forecast that Tesla increases its annual total vehicle delivery volume to a little over 1.8 million in 2023, or roughly 37% versus 2022. However, because of price cuts far exceeding cost savings, we forecast automotive gross margin contraction in 2023 to 22% from the 29% achieved in 2022. Longer term, we assume Tesla delivers around 5 million vehicles per year in 2030. This includes fleet sales, an expanding opportunity for Tesla. We think Tesla will be successful in continuing to reduce its manufacturing costs on a per vehicle basis. Additionally, we assume Tesla’s overhead expenses continue to decline as a percentage of sales as the company benefits from operating leverage as deliveries increase.

Read more about Tesla’s fair value estimate.

What We Thought of Tesla’s Q1 Earnings

- Tesla’s gross margin and operating margin declined further than what the market was expecting as price cuts weighed heavily on profits. The stock fell on the earnings report as a result.

- We view the profit margin decline as temporary. While Tesla will likely see lower margins over the next couple of years, eventually the cost reductions that Tesla laid out at its investor day in March will reduce the unit production costs, boosting long-term profit margins.

- Market sentiment may weigh on Tesla in the near term, but we still see strong profit growth over the long term, which should drive shares closer to our $215 per share fair value estimate.

Economic Moat Rating

We award Tesla a narrow moat rating. Tesla’s moat stems from two of our five moat sources: intangible assets and cost advantage.

- Intangible Assets: Tesla’s brand cachet is not likely to be impaired anytime soon as other automakers move into the battery electric vehicle space because we expect the company to keep innovating to stay ahead of startup and established competitors. Tesla has a more high-tech vehicle with the ability to do drivetrain updates and other updates via Wi-Fi or a cellular connection, and customers do not have to visit a store for many service needs. Tesla’s proprietary technology contributes to its intangible asset-driven competitive advantage.

- Cost Advantage: We think Tesla benefits from a cost advantage in electric vehicle production thanks to its manufacturing scale. Tesla’s total vehicle volume has grown from just over 100,000 in 2017 to over 1.3 million deliveries in 2022. We think Tesla’s combination of intangible assets and cost advantage will persist in the future and allow the firm to generate excess returns on capital.

Read more about Tesla’s moat rating.

Risk and Uncertainty

We assign Tesla an Uncertainty Rating of Very High as we see a wide range of potential outcomes for the company. The automotive market is highly cyclical and subject to sharp demand declines based on economic conditions. As new lower-priced EVs begin selling, Tesla may be forced to continue to cut prices, reducing the firm’s industry-leading profits. Tesla faces environmental, social, and governance risks. As an automaker, Tesla is subject to potential product defects that could result in recalls, including its autonomous driving software. Another risk involves employee retention. If Tesla is unable to retain key employees, such as CEO Elon Musk, its favorable brand image could decline. Additional ESG risks include potential patent litigation as the company relies on new technology to improve its EVs and energy storage systems.

Read more about Tesla’s risk and uncertainty.

TSLA Bulls Say

- Tesla has the potential to disrupt the automotive and power generation industries with its technology for EVs, autonomous vehicles, batteries, and solar generation systems.

- Tesla will see higher profit margins as it reduces unit production costs over the next several years.

- Through the combination of its industry-leading technology and unique supercharger network, Tesla offers the best function of any EV on the market, which should result in its maintaining its market leader status as EV adoption increases.

TSLA Bears Say

- Traditional automakers and new entrants are investing heavily in EV development, which will result in Tesla seeing a deceleration in sales growth and being forced to cut prices due to increased competition, eroding profit margins.

- Tesla’s reliance on batteries made in China for its lower-priced Model 3 vehicles will hurt sales as these autos will not qualify for U.S. subsidies.

- Solar panel and battery prices will decline faster than Tesla can reduce costs, resulting in little to no profits for the energy generation and storage business.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)