Investing in Times of Climate Change 2023

Investors increasingly recognize climate change as both a risk and an opportunity for their portfolios.

Climate finance has gained significance in recent years as nations around the world grapple with the impacts of climate change.

According to the latest Intergovernmental Panel on Climate Change report, there is sufficient global capital to rapidly reduce greenhouse gas emissions if existing barriers are reduced. Governments and regulators, through public funding and clear signals to investors, are key in reducing these barriers.

Investors increasingly recognize climate change as both a risk and an opportunity for their portfolios.

There are transition risks associated with the shift to a low-carbon economy, such as changes in regulation, technology, and consumer behavior. There are also physical risks, which refer to the vulnerability of a company’s supply chain, operations, and assets owing to increasing frequency of extreme weather events such as flooding or hurricanes.

At the same time, more and more investors are increasingly seeking to capitalize on opportunities arising from the transition, including investments in companies that develop innovative solutions to mitigate climate change, such as clean energy, electric vehicles, and carbon capture and storage.

Asset managers are responding to this demand by launching new funds with climate-related mandates and repurposing old strategies. At the end of 2022, there were a record 1,206 mutual funds and exchange-traded funds globally with a climate-related mandate, up from about 950 at the end of the previous year.

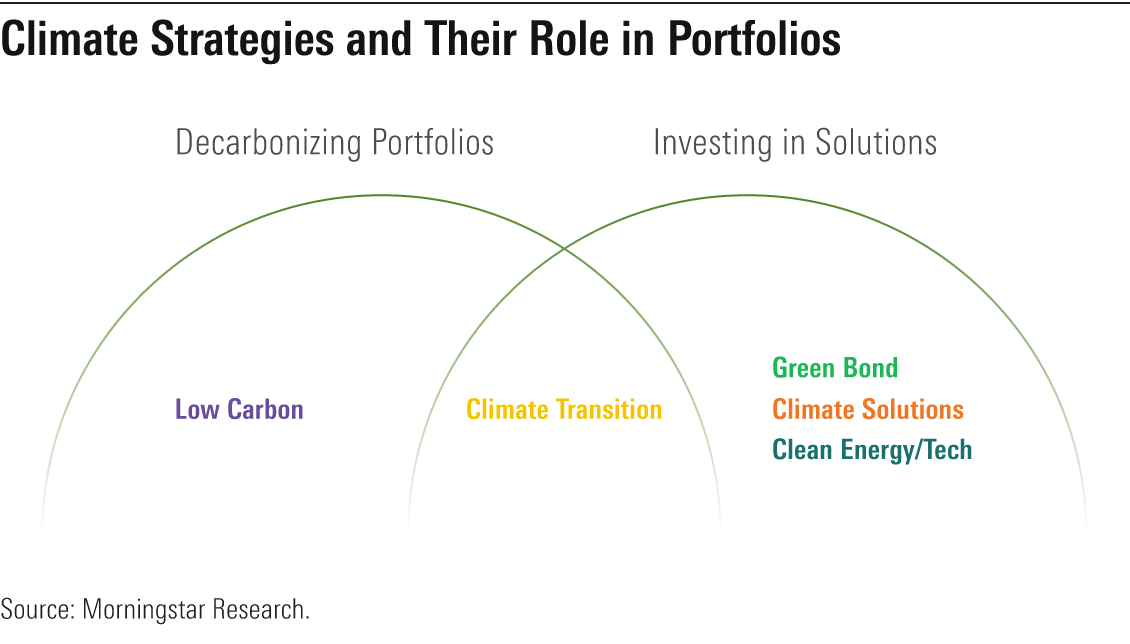

This universe of climate funds comprises a wide and growing range of strategies that aim to meet different investor needs and preferences. To help investors navigate what can be a confusing mix of offerings, we break down the universe into five mutually exclusive categories, as shown in the exhibit below. (Note the new climate transition category, which was previously known as climate conscious.)

Global Assets in Climate Funds Hold Up, Supported by Europe

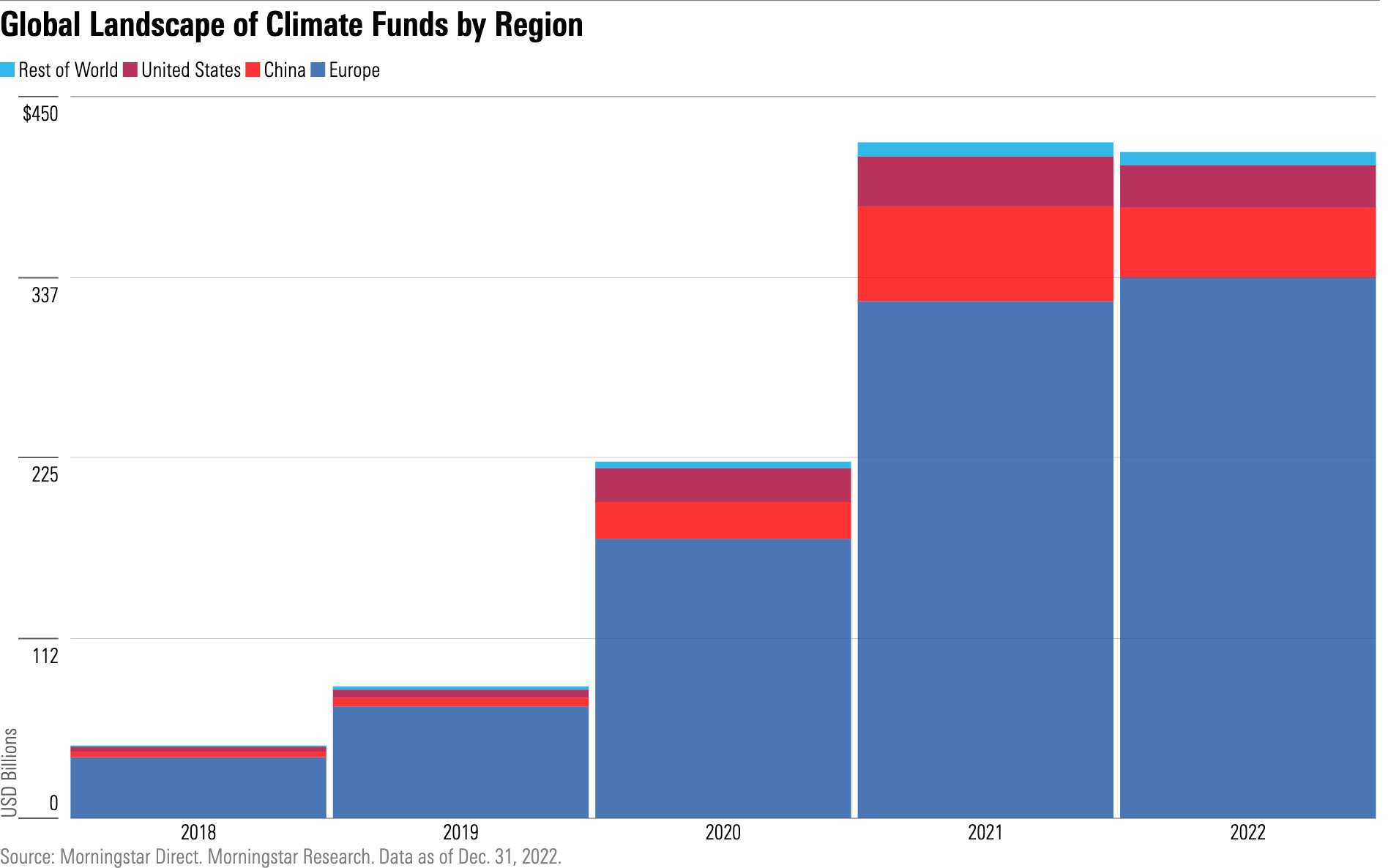

On a global scale, as of December 2022, we identified 1,206 funds that fit our definition of a climate-related strategy (defined in our April 2022 report, “Investing in Times of Climate Change”). These funds had collective assets under management of $415 billion. Global climate fund assets declined slightly from $421 billion in 2021, as shown in the chart below.

Climate funds were not immune to the challenging macro environment of inflationary pressures, rising interest rates, lingering recession fears, and the conflict in Ukraine. But climate funds exhibited resilience when compared with the performance of the overall fund market, where global fund assets shrunk by 18% in 2022. Climate fund assets held up better thanks to continued fund flows and an accelerated pace of product development.

Unsurprisingly, given its greater commitment to a climate agenda, Europe remains the largest and most diverse climate funds market, followed by China, which two years ago overtook the United States as the second-largest climate funds market.

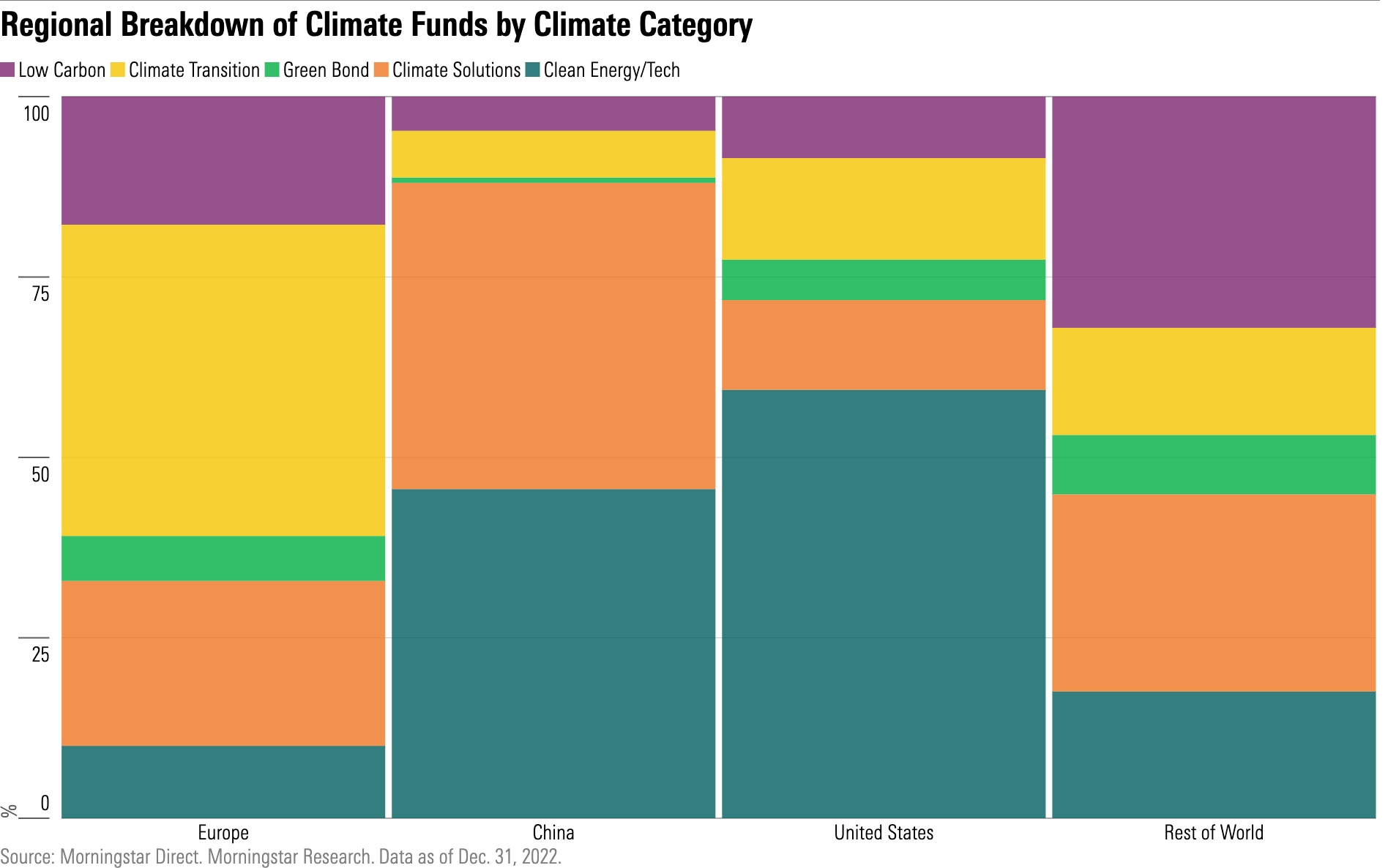

However, a breakdown of assets by climate category reveals significant differences in investor preferences across regions.

European investors tend to favor decarbonization strategies and funds focused on both risk and opportunities over those that exclusively offer access to opportunities. This is illustrated by the dominance of climate transition funds in the landscape. At the end of 2022, these strategies accounted for 43% of European climate fund assets compared with 23% for climate solutions funds and 10% for clean energy/tech funds.

By contrast, Chinese and U.S. investors have a strong preference for strategies focused on climate opportunities. Combined, climate solutions and clean energy/tech funds accounted for 88% and 71% of total climate fund assets in China and the U.S., respectively. And while Chinese investors have an almost equal liking for the two strategy types, U.S. investors exhibit a clear bias toward clean energy/tech funds, which accounted for 60% of total U.S. climate fund assets.

U.S. Climate Funds Struggled in 2022, but There May Be New Offerings in 2023

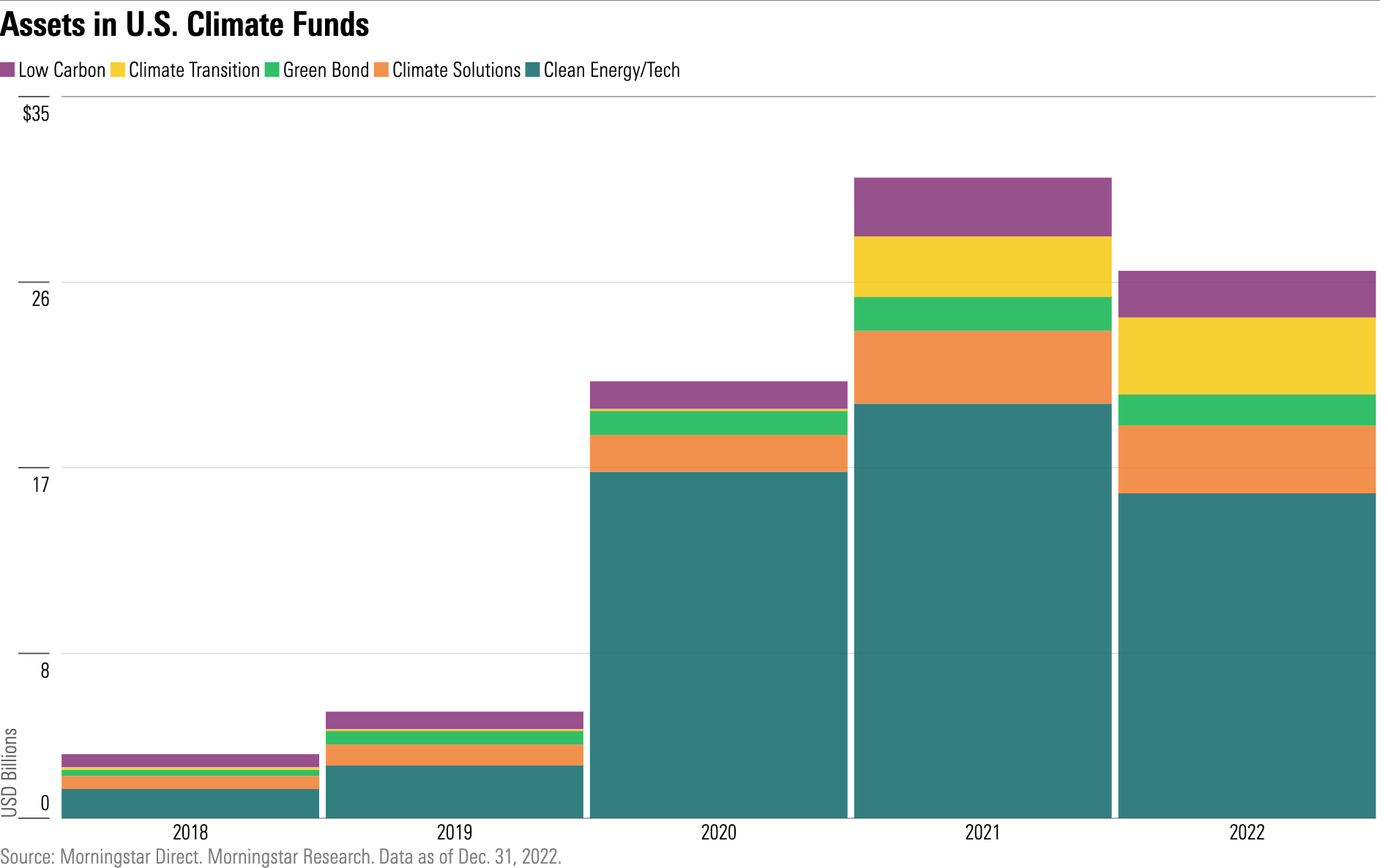

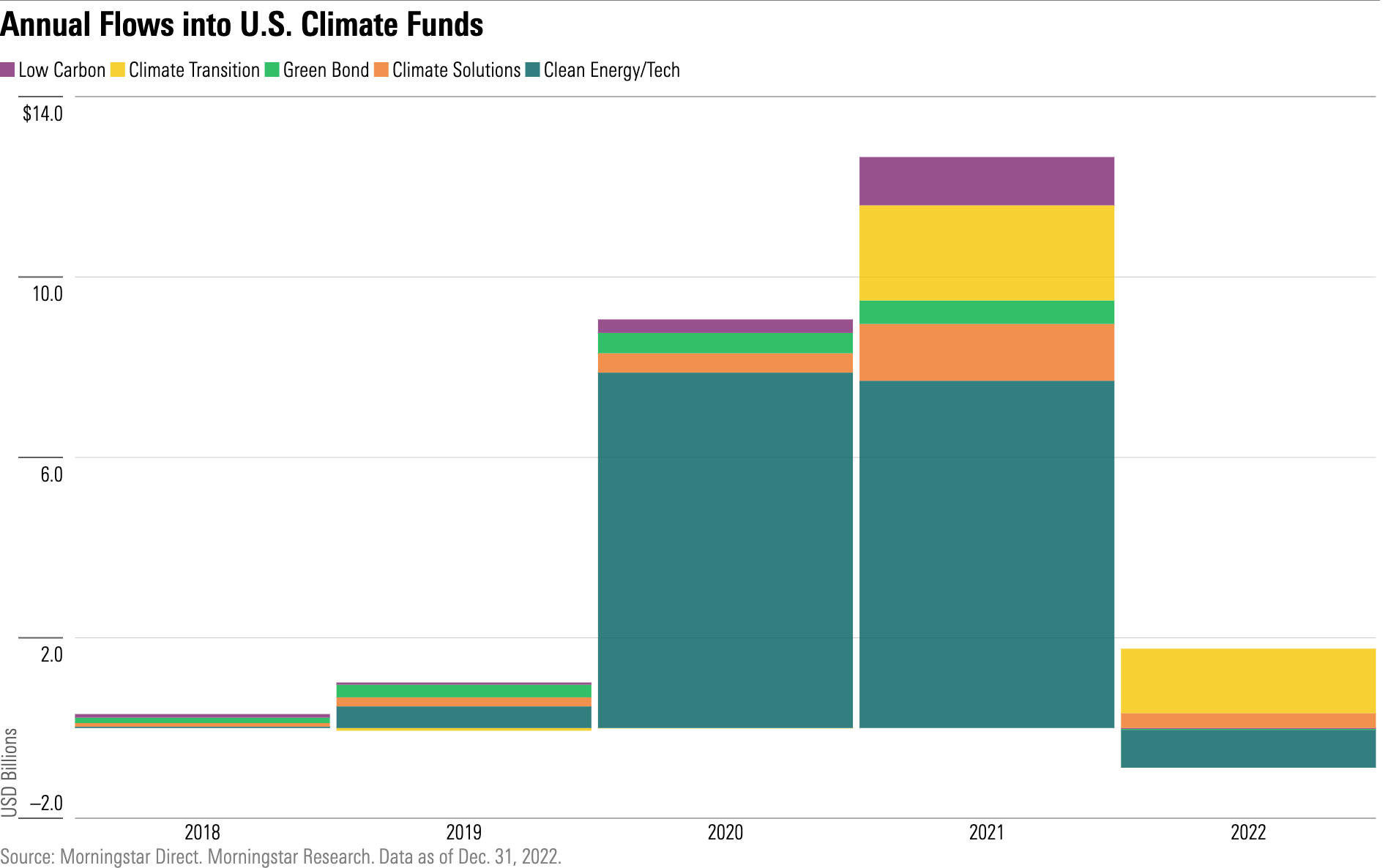

Last year’s challenging market conditions hit the U.S. hard, as U.S. climate funds saw their assets drop 15% to $26.5 billion.

Assets in the most popular category, clean energy/tech, were 22% lower at the end of 2022, at $15.8 billion, because of falling market valuations. In comparison, the S&P Global Clean Energy and Nasdaq Clean Edge Green Energy indexes, which are tracked by the two largest clean energy ETFs, dropped by 4.8% and 30.0%, respectively.

Compounding the lower price effect, clean energy/tech funds bled $840 million in 2022 as U.S. investors continued to see those as overvalued and favored traditional energy companies amid record oil and gas prices. In comparison, clean energy/tech funds registered $7.7 billion of inflows in 2021.

While clean energy/tech funds retained the majority (60%) of U.S. climate fund assets, other categories continued to gain ground. Climate transition fund assets grew by 28% to $3.8 billion at the end of 2022.

Meanwhile, product development activity slowed down, with only 21 new climate-themed products last year, compared with 34 in 2021. Nevertheless, investors can expect more new offerings to come to market in 2023 because of the Inflation Reduction Act, which was signed into law by President Joe Biden in August 2022. The landmark climate legislation is designed to spur investment in clean energy and electric vehicles.

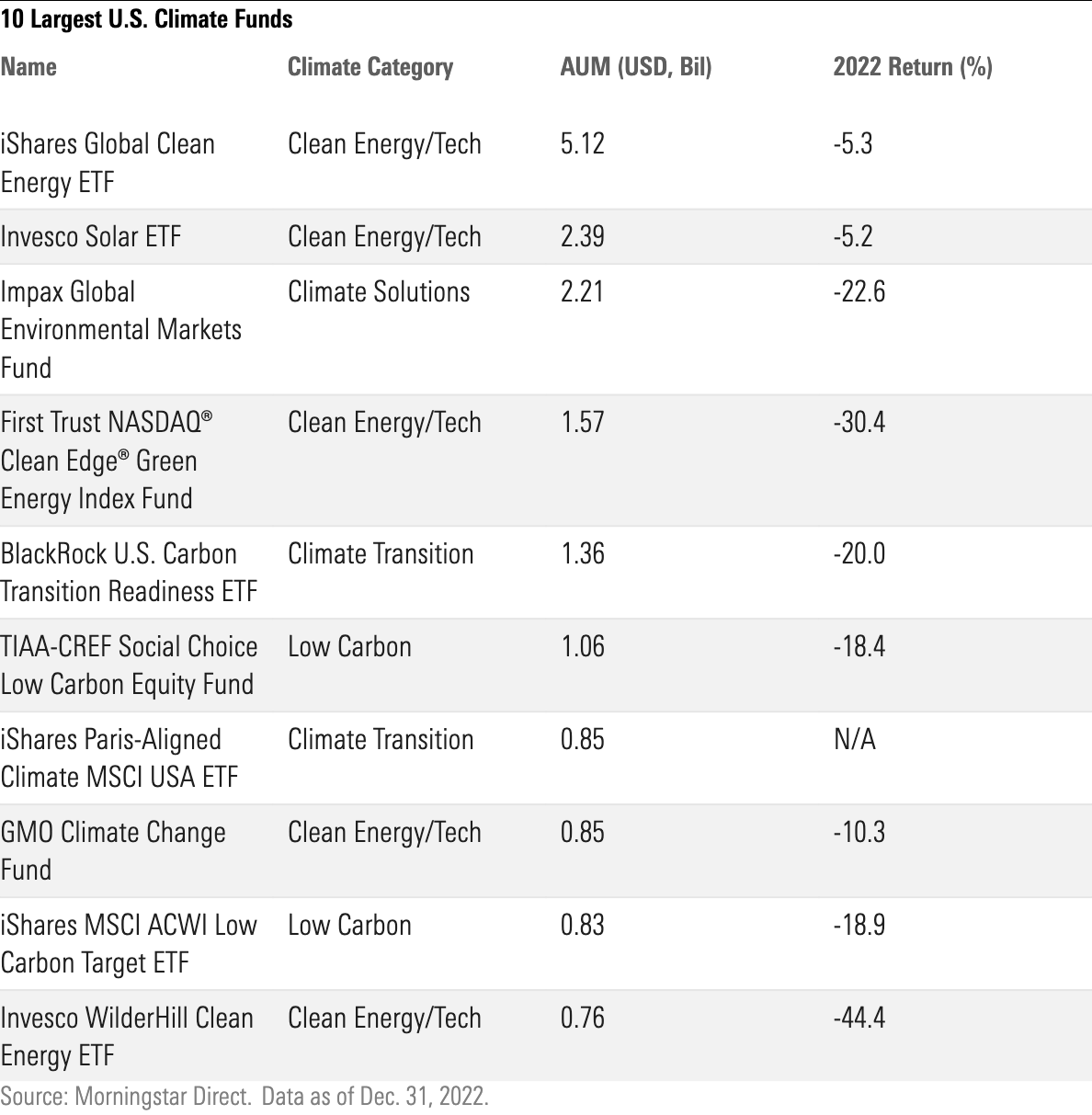

The exhibit below shows the 10 largest climate funds in the U.S. at the end of 2022.

Investors Play a Key Role in the Fight for Climate Action

Despite the tremendous growth seen in climate investing and net-zero commitments over the past few years, it is increasingly clear that we need to see faster and more widespread action. Worldwide emissions must fall by half by 2030 and reach net zero by 2050 to have any chance at keeping the global temperature rise under 1.5 degrees Celsius. Ultimately, global cooperation between governments is required to address the full scope of this threat, but the private sector and investors can be part of the transition, too.

On the one hand, climate change represents an investment risk that ought to be accounted for in portfolios. On the other hand, investors increasingly have access to innovative climate solutions through opportunity-seeking climate funds. Last but not least, on behalf of investors, asset managers should engage with companies via active ownership and proxy voting to advocate for robust climate strategies.

In this rapidly evolving space, it is even more important that investors do their homework. Because many climate funds have a relatively short history, with most launched in the past couple of years, their performance can be hard to assess. Still, investors should understand the funds’ investment objectives, portfolio construction processes, and expected outcomes.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)