Investors Look Right Past the First Republic Bank Closure

Markets appear confident that bank failures are in the rearview mirror.

Stocks held steady even as San Francisco-based regional bank First Republic FRC became the second-largest bank failure in U.S. history.

The bank, which has been under worsening pressure over the past month, was quickly seized by regulators early Monday morning with a deal to be acquired by JPMorgan Chase JPM. Investors took it in stride.

“The market recognizes—rightly so—that this was a First Republic problem and not a banking-system problem,” says Morningstar equity strategist Eric Compton. “We’re not expecting a major market reaction or a renewed panic in the banking system.”

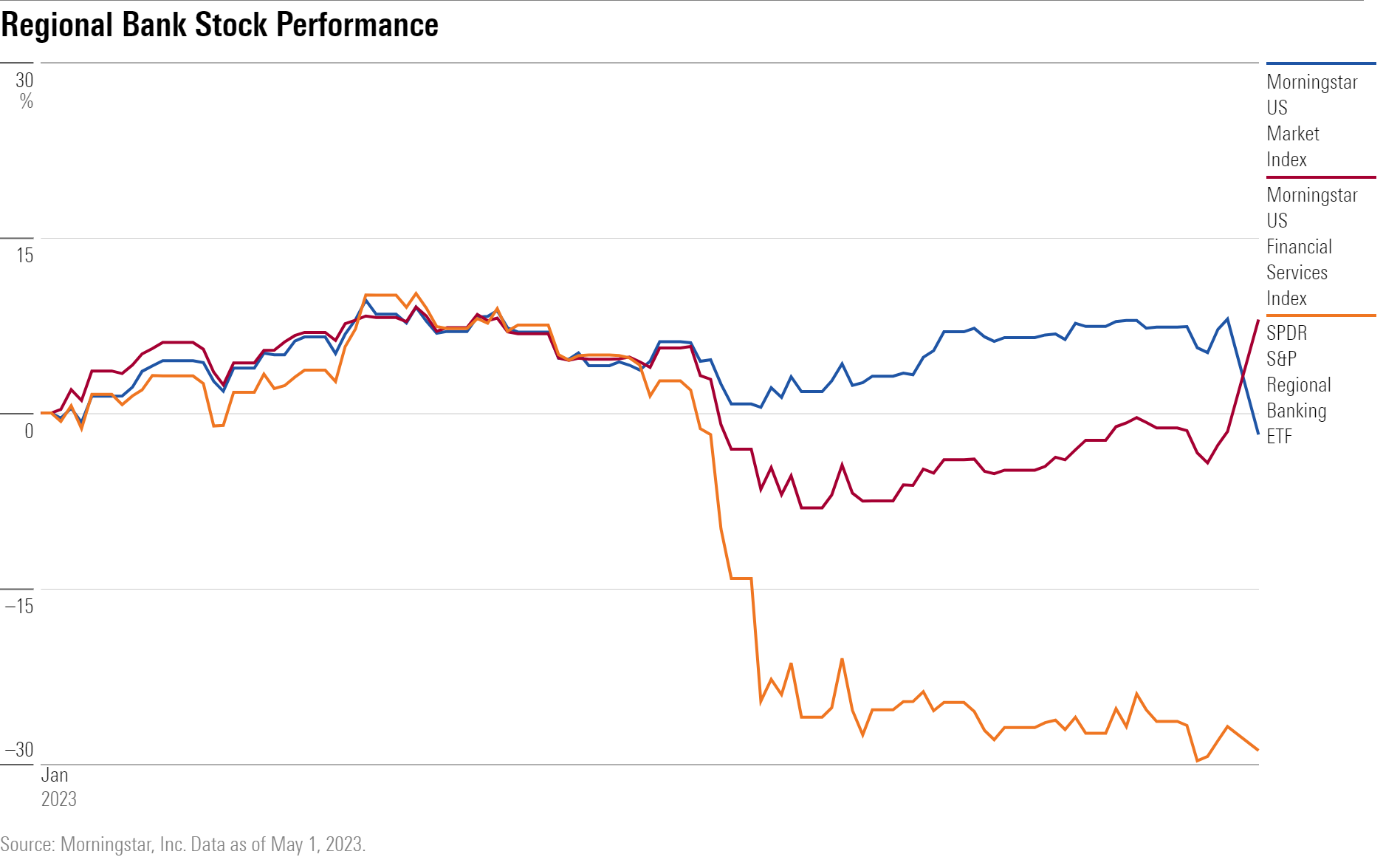

SPDR S&P Regional Banking ETF KRE fell about 2.3% on Monday compared with the 12.2% drop that the exchange-traded fund saw on March 13, 2023, after the seizures of Silicon Valley Bank and Signature Bank.

The impact of First Republic’s closure was even smaller for the Morningstar US Financial Services Index, which fell 0.3%. JPMorgan shares closed the day up 2.1% after the news broke that it would purchase First Republic’s operations. The U.S. market remained flat, falling 0.03%.

First Republic’s Failure Came as No Surprise

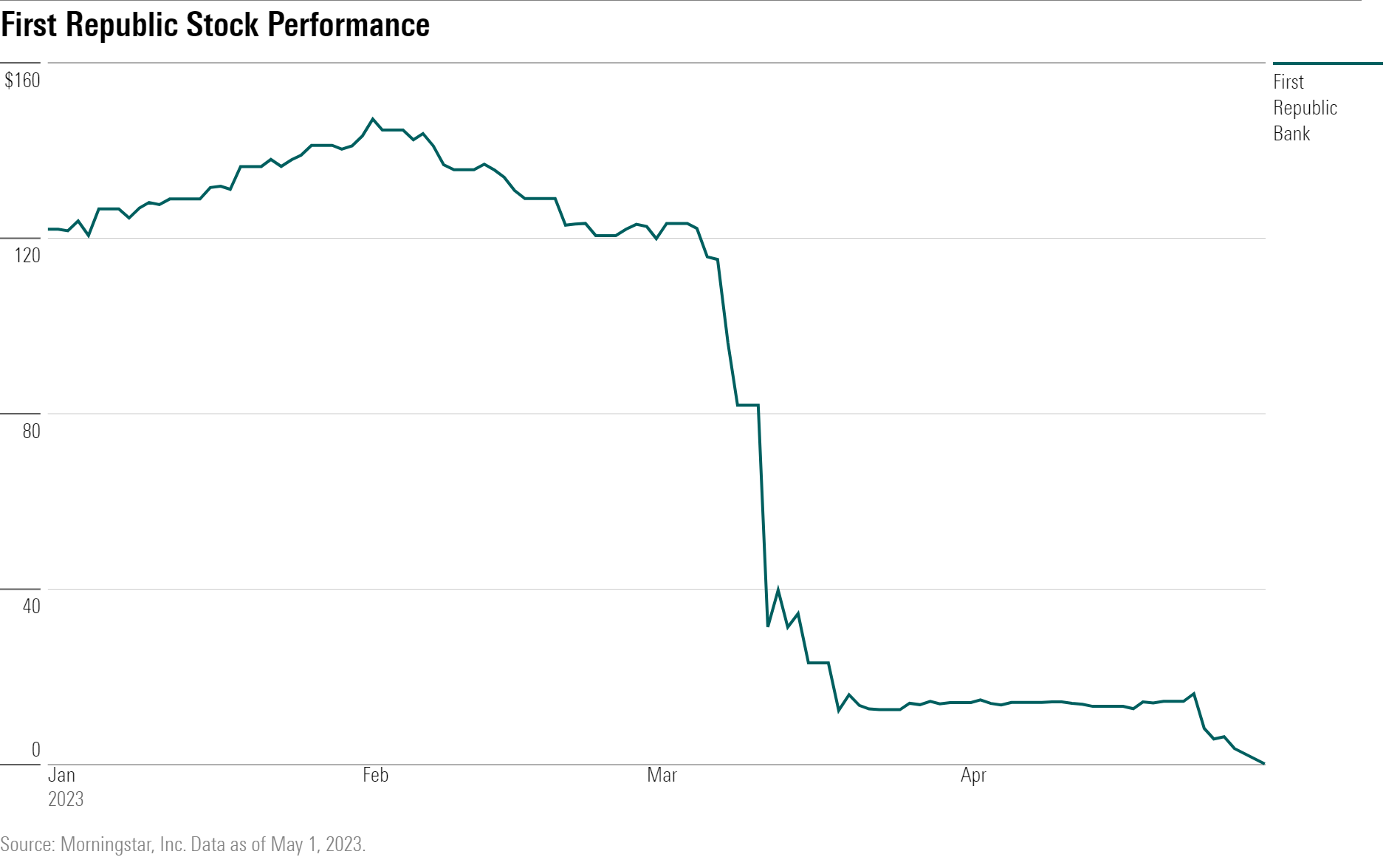

Investors had been viewing First Republic Bank as a ticking time bomb after Silicon Valley Bank and Signature Bank failed in early March.

Fears were centered on the bank’s loan/deposit ratio of 94% at the end of 2022, which was much higher than the 68% average loan/deposit ratio among the banks covered by Morningstar’s Compton.

Compton’s analysis from last month was already showing a very high probability that the shares were worth zero. “We dropped our fair value estimate to $0 last week,” he says. Compton had cited that the bank wouldn’t be able to survive unless its deposits held steady at their December 2022 levels.

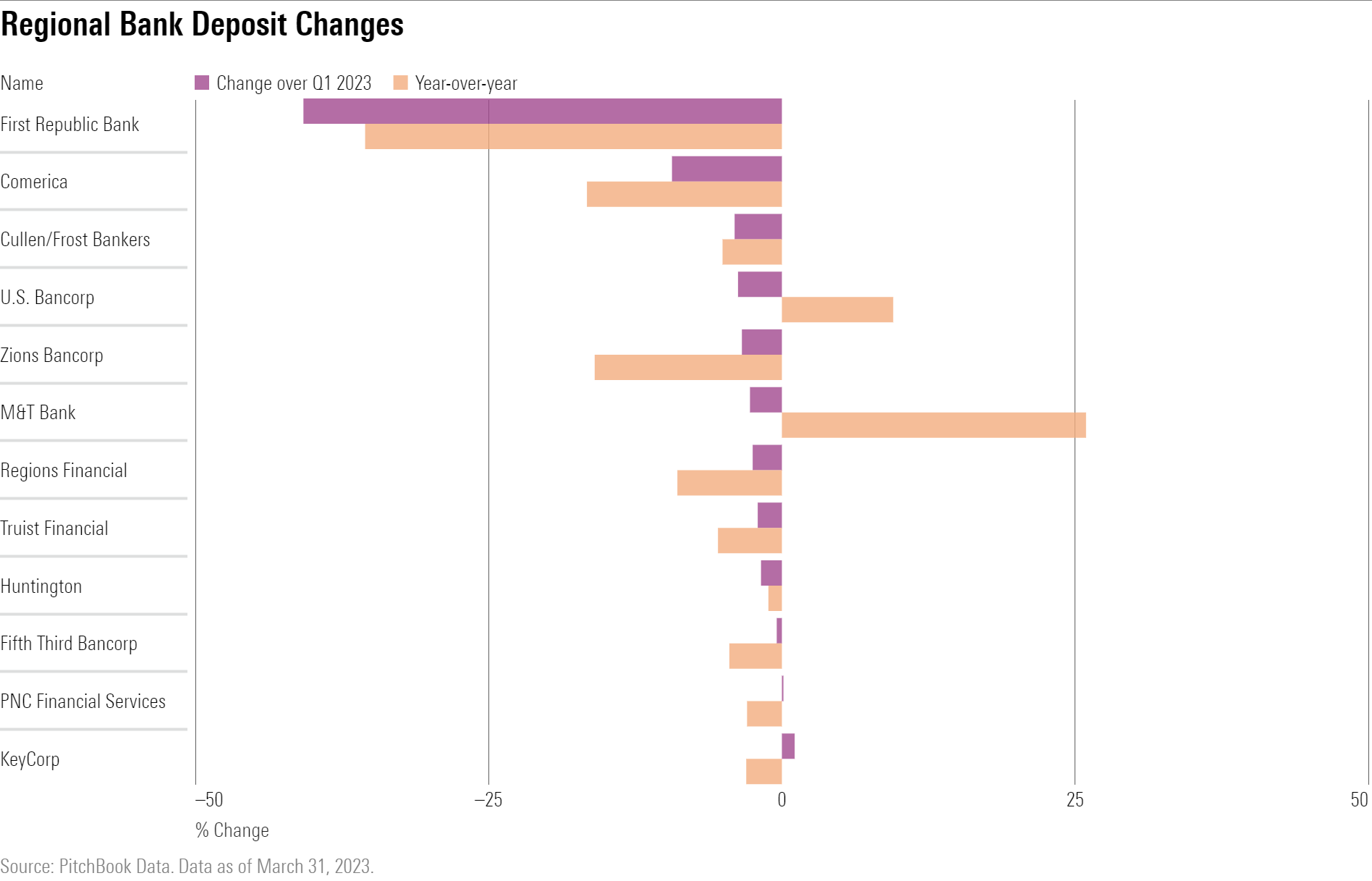

But First Republic’s deposit levels didn’t hold steady: Deposits at the bank slipped 35.5% year over year and 40.8% sequentially during its first-quarter earnings result last week. At that point, the probability of the bank becoming worthless to stockholders won out, and Compton slashed his fair value estimate to zero.

Earnings Results Confirmed Earlier Fears

The fear following First Republic’s quarterly results was that any remaining deposits would likely also be on the way out after seeing the bank’s poor health, and regulators were quick to take over to prevent a repeat of the crisis in early March.

First Republic’s stock had already taken substantial hits over the course of the past several weeks, and as a result, markets’ reactions to Monday’s closure were muted as the risks had already been long priced in.

“The banks with serious issues are known at this point, and the problem seems to be contained to this select few banks,” Compton says.

Among the regional banks that Compton covers, only First Republic had deposits fall more than 10% during the first quarter. The other regional banks that Compton covers have not shown any significant signs of pending failures. “It was only First Republic that was going to blow up,” he says.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)