Which Will Outperform: U.S. Stocks or International?

Managers debate where to find value.

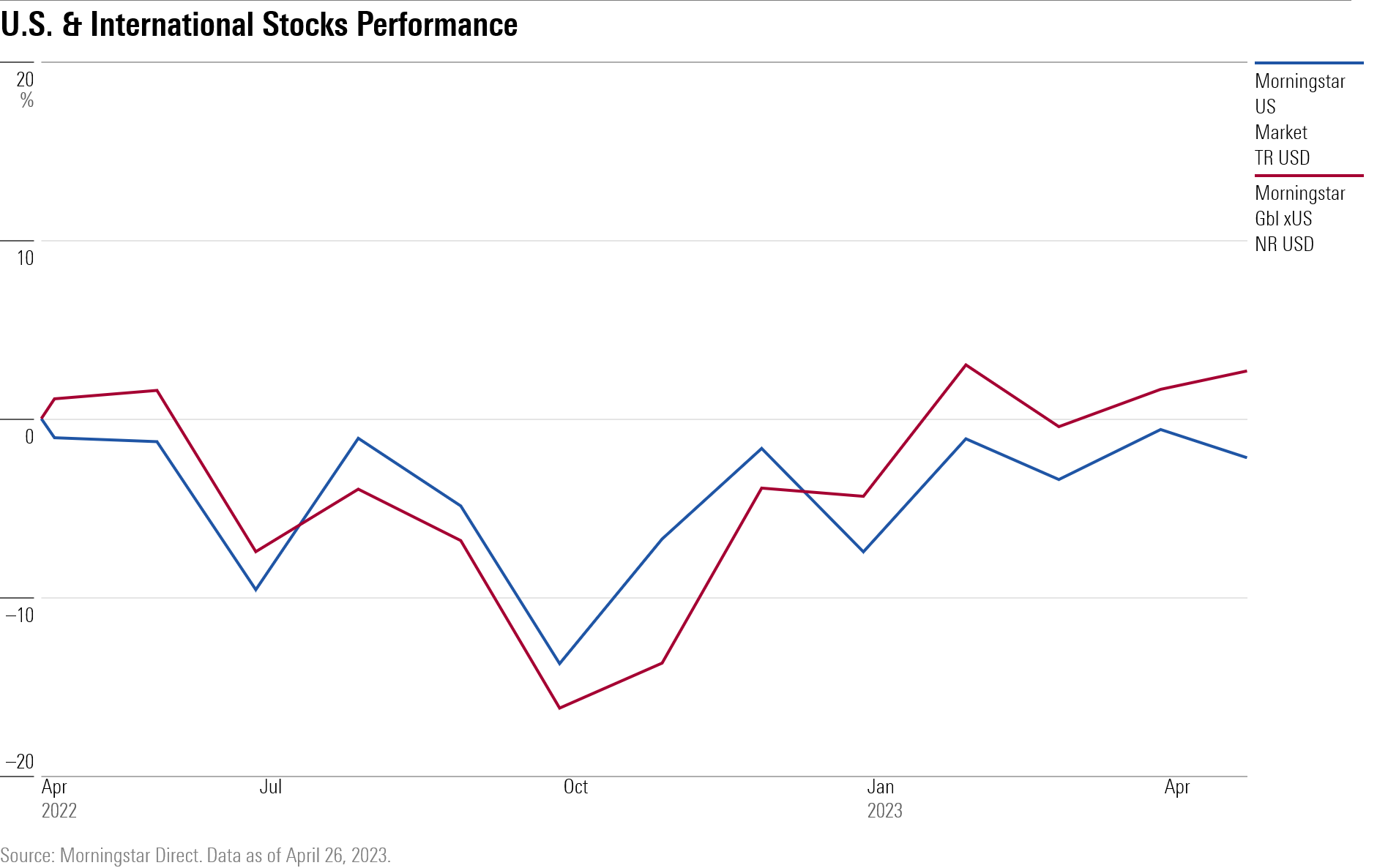

International stocks have roared back with U.S. stocks this year, but the view from the Morningstar Investment Conference is that they’re looking exceptionally cheap relative to U.S. stocks right now.

When managers were asked whether international stocks would outperform U.S. stocks over the next 10 years, the consensus was that international stocks look more likely to post stronger returns thanks to their lower valuations today.

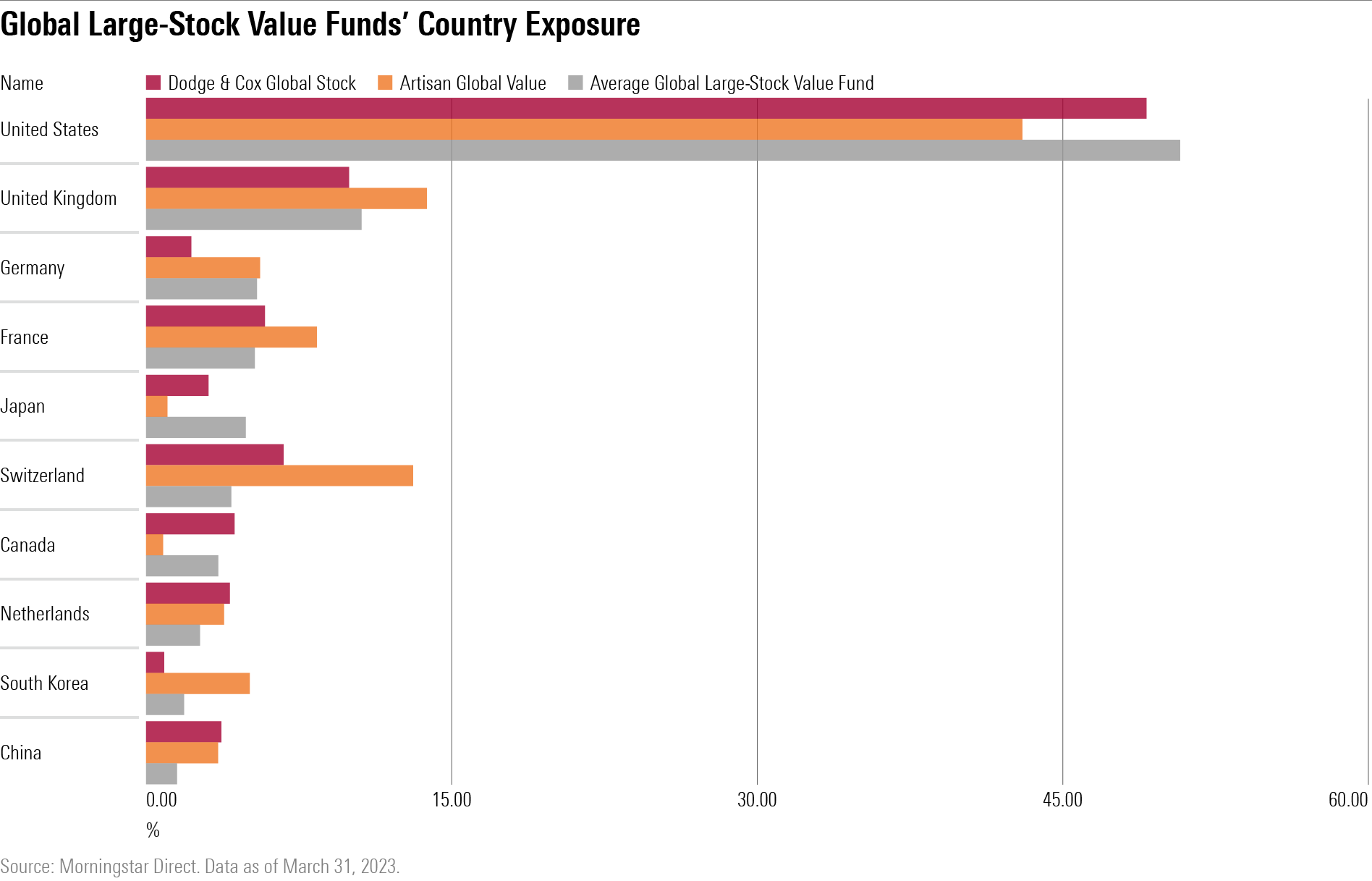

“Your starting point matters” said Lily Beisher, portfolio manager on the $10 billion Dodge & Cox Global Stock DODWX.

One risk for investors with the U.S. market that isn’t as present for international stocks is the degree to which performance of the overall market in the United States is driven by a handful of companies, said Dan O’Keefe, manager on $2.1 billion Artisan Global Value APHGX.

“The U.S. market is driven by eight companies, and most of their price/earnings ratios are very high, while international stocks trade in single-digit price/earnings ratios,” said O’Keefe.

“If you think the U.S. market is going to outperform international equities, which in many cases are at single-digit price/earnings ratios, you have to believe Apple AAPL is going to expand its multiple and grow its earnings, O’Keefe said “I wouldn’t make that bet at all,” he said.

Differing Views on Chinese Companies

When it came to where the opportunities lay, the managers agree they don’t see much opportunity in Japanese companies right now, but they had differing views on China.

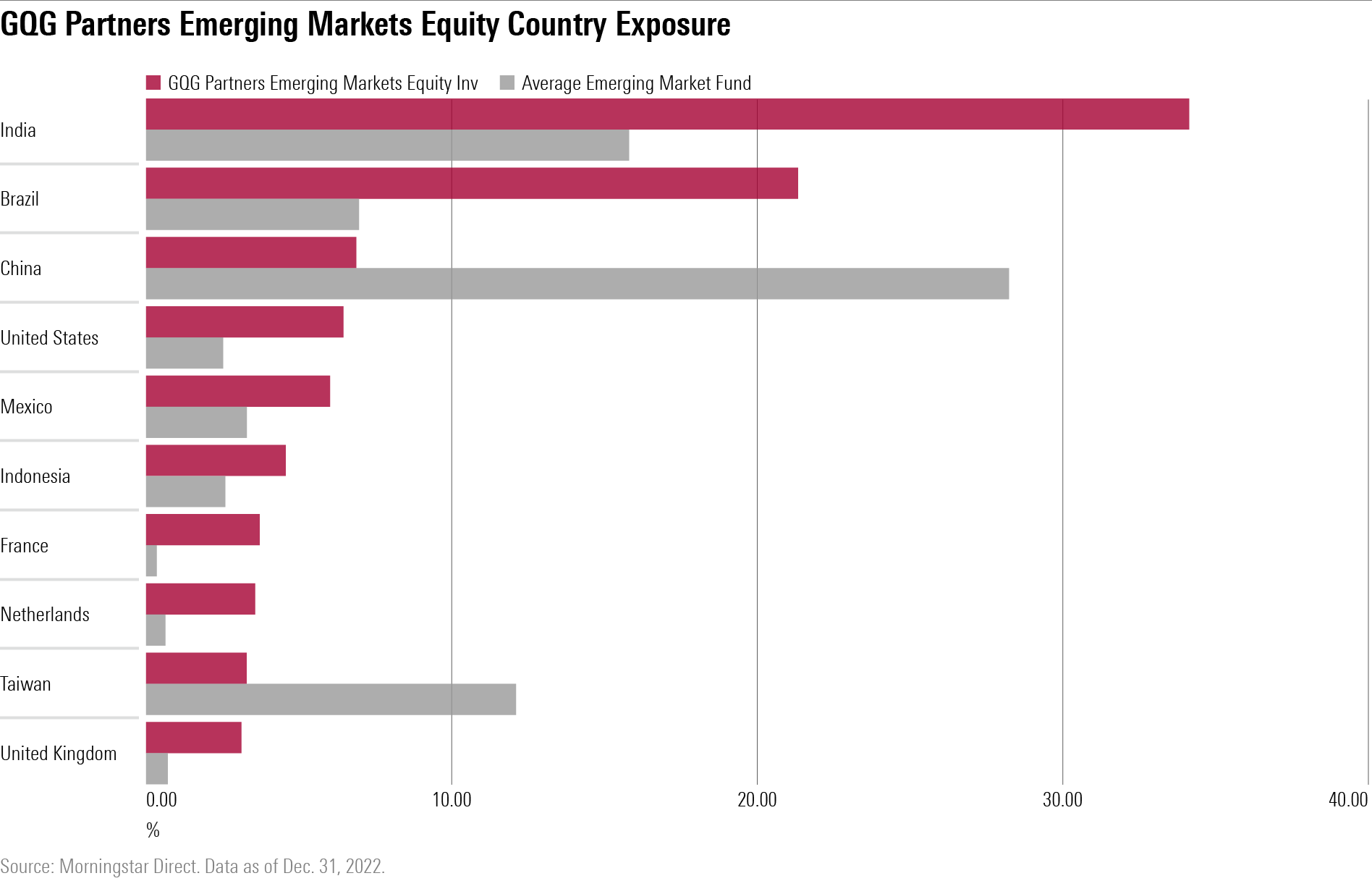

Rajiv Jain, chairman, chief investment officer, and portfolio manager at GQG Partners, said he hasn’t owned Chinese technology equities for the past year and a half. He cites governance issues and the risk of a government takeover as too high. Instead, he finds value in basic materials and energy companies in the country that are already owned in part by the Chinese government.

Chinese companies compose no part of $1.5 billion GQG Global Quality Equity GQRPX and are significantly underweight in $11.7 billion GQG Partners Emerging Market Equity GQGPX.

O’Keefe was also cautious when it came to investing in Chinese companies, but also noted that valuations are lower than in the U.S. market, especially for the technology sector. As of March 31, Alibaba was Artisan Global Value’s only Chinese holding.

Dodge and Cox’s Beisher said the firm is selective where it invests but likes Chinese internet companies. Dodge & Cox Global Stock has held Alibaba BABA since 2019.

Another area she sees value is in European financial companies, pointing to their very low valuations.

GQG Partner’s Jain sees opportunity in European energy companies. “European energy companies are trading at half the valuations of U.S. energy companies.”

The managers on the Morningstar panel noted that multinational companies allow you to get exposure to multiple markets, including the U.S.

“You can get exposure to the U.S. economy through a cheaper entry point through a foreign company,” said O’Keefe. He cited Samsung SSNLF as an example.

Beisher points out that there are international risks and exposure even in U.S. companies. She pointed out that Apple is still exposed to China because of its reliance on China’s semiconductors. “If China shuts down, they cannot operate,” she said.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)