2 Undervalued Stocks From the Morningstar Wide Moat Focus Index

Etsy, Salesforce have long-term competitive advantages, and their stocks are attractive.

History has shown that undervalued stocks of companies with the longest-lasting competitive advantages have outperformed over the long term.

Right now, two such stocks are handmade and vintage e-commerce platform Etsy ETSY and customer relationship management software provider Salesforce CRM.

At the Morningstar Investment Conference Tuesday, April 26, Morningstar’s director of equity research for index strategies Andrew Lane took a tour through Morningstar’s process of determining economic moats and highlighted stocks from the Morningstar Wide Moat Focus Index. The index tracks the lowest-priced companies with analyst-assessed competitive advantages expected to last more than 20 years into the future.

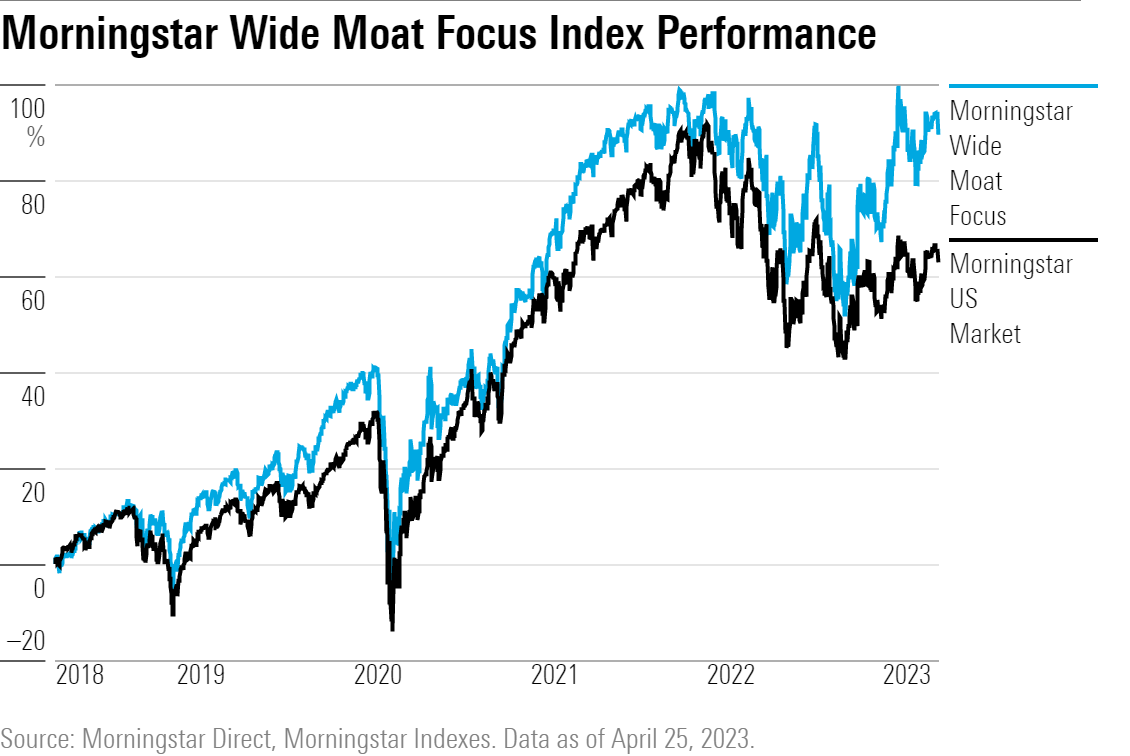

The index has outperformed the broader U.S. equity market over time. Since the index’s inception in 2007, undervalued wide-moat stocks as a group have gained 529.9%, leaps and bounds ahead of the Morningstar US Market Index’s gain of 282.6% during the same period.

“Certainly, undervalued wide-moat companies aren’t going to outperform every month, or even every year,” Lane said, “But for a patient investor, this is very, very compelling.”

For five-year holding periods on a monthly rolling basis since the index’s inception in 2007, undervalued wide-moat companies have outperformed as a group 95% of the time, according to Lane. And over rolling 10-year periods, undervalued wide-moat stocks have outperformed in all 74 periods since inception.

What Makes a Wide-Moat Company?

“Wide-moat companies are very rare,” Lane said, “the designation is for companies within—in our opinion—the cream of the crop in terms of the quality and durability of their business models.”

Morningstar analysts say that companies with wide economic moats can maintain their competitive advantages for more than 20 years. Just 1%—or 500 companies—of the 50,000 companies under Morningstar’s global quantitative equity coverage earn a Morningstar Economic Moat Rating of wide. Within the Morningstar US Market Index, 10%—or 149 companies—earn that rating.

Economic moats reflect the degree to which a company has durable competitive advantages. A company with a moat can fend off competition and earn high returns on capital for many years to come. To determine whether a company has a moat, Morningstar analysts look at network effects, switching costs, intangible assets such as patents and brand identity, cost advantages, and efficient scale. At the conference, Lane gave examples of analyst-covered companies that exemplify each of these moat sources:

- Network effect: Each additional user of the Mastercard MA brand increases its value to others.

- Switching costs: Switching from Salesforce’s tightly integrated software could cause massive disruptions for the organizations that use it.

- Intangible assets: Coca-Cola’s KO secret formula and taste allows it to charge a premium for what is essentially just sugar water.

- Cost advantage: Entering the insulin market requires significant up-front costs, and Novo Nordisk NVO controls more than one fourth of the market.

- Efficient scale: Railway company Canadian National CNI benefits from massive up-front costs and limited demand within its industry, helping it fend off competitors.

Which Wide-Moat Stocks Are Morningstar’s Favorites Right Now?

While all 49 of the stocks in the Morningstar Wide Moat Focus Index are undervalued, Lane highlighted 4-star rated Etsy, “an interesting stock that has grown enormously over time.” Etsy benefits from the network effect, Lane stated, as “the more buyers and consumers use the platform, the more people produce goods to sell there.” At the same time, Lane said, it has intangible assets including homemade products and one-of-a-kind goods. He also gave mention to 4-star Salesforce for its switching costs.

Etsy

- Fair Value Estimate: $167

- Star Rating: 4-stars

- Uncertainty Rating: Very High

- Economic Moat: Wide

“We view a wide-moat rating as appropriate for Etsy, with our research suggesting that the firm’s network has reached critical mass in its key six markets, presenting a nearly insurmountable barrier to success for new, like-minded entrants. While Etsy will continue to compete for sellers with local consignment stores, niche marketplaces, social commerce, and white label (DIY) offerings, we view the firm’s easy-to-use seller services (catering to the firm’s smaller clientele), self-reinforcing marketplace network, and the continuously improving underlying value position as sufficient to defray competitive pressure.

“Etsy is one of the likely winners in a quickly evolving space, with access to a unique, differentiated product suite, strategic investments in the platform experience, and a strengthening marketplace network auguring well for economic value creation through the 20-year period implied by our wide-moat rating.”

—Sean Dunlop, equity analyst

Salesforce

- Fair Value Estimate: $245

- Star Rating: 4-stars

- Uncertainty Rating: High

- Economic Moat: Wide

“For Salesforce overall, we assign a wide moat rating arising primarily from switching costs, with support from a network effect as well.

“We believe customers value Salesforce’s discrete clouds as stand-alone solutions, but the various clouds are highly complementary and are tightly integrated with one another, making the complete set of solutions more compelling. Customers are also looking to consolidate vendors. These factors combine to reinforce our wide moat assertion. As the company offers a wider set of related and best-in-class solutions, we believe it becomes more deeply entrenched in its customers as they adopt multiple clouds.”

—Dan Romanoff, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)