Even Warren Buffett Thinks Picking Stocks Is Hard

Great investing opportunities are rare, which is why indexing makes sense for most investors.

Warren Buffett is arguably the greatest investor of all time.

In his recent shareholder letter, even he—the Oracle of Omaha—admitted how hard it is to consistently pick winning stocks.

Here’s how Buffett summed up nearly six decades of managing money:

“At this point, a report card from me is appropriate: In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. In some cases, also, bad moves by me have been rescued by very large doses of luck. (Remember our escapes from near-disasters at USAir and Salomon? I certainly do.) Our satisfactory results have been the product of about a dozen truly good decisions—that would be about one every five years—and a sometimes-forgotten advantage that favors long-term investors such as Berkshire.”

Buffett boiled down the lesson for investors:

“The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders.”

A few big winners carry most of the freight in an investing lifetime. In a hypercompetitive world, the idea that important investing decisions need to be made on a daily basis couldn’t be further from the truth.

As Buffett’s partner Charlie Munger is fond of saying, “The big money is not in the buying and selling, but in the waiting.”

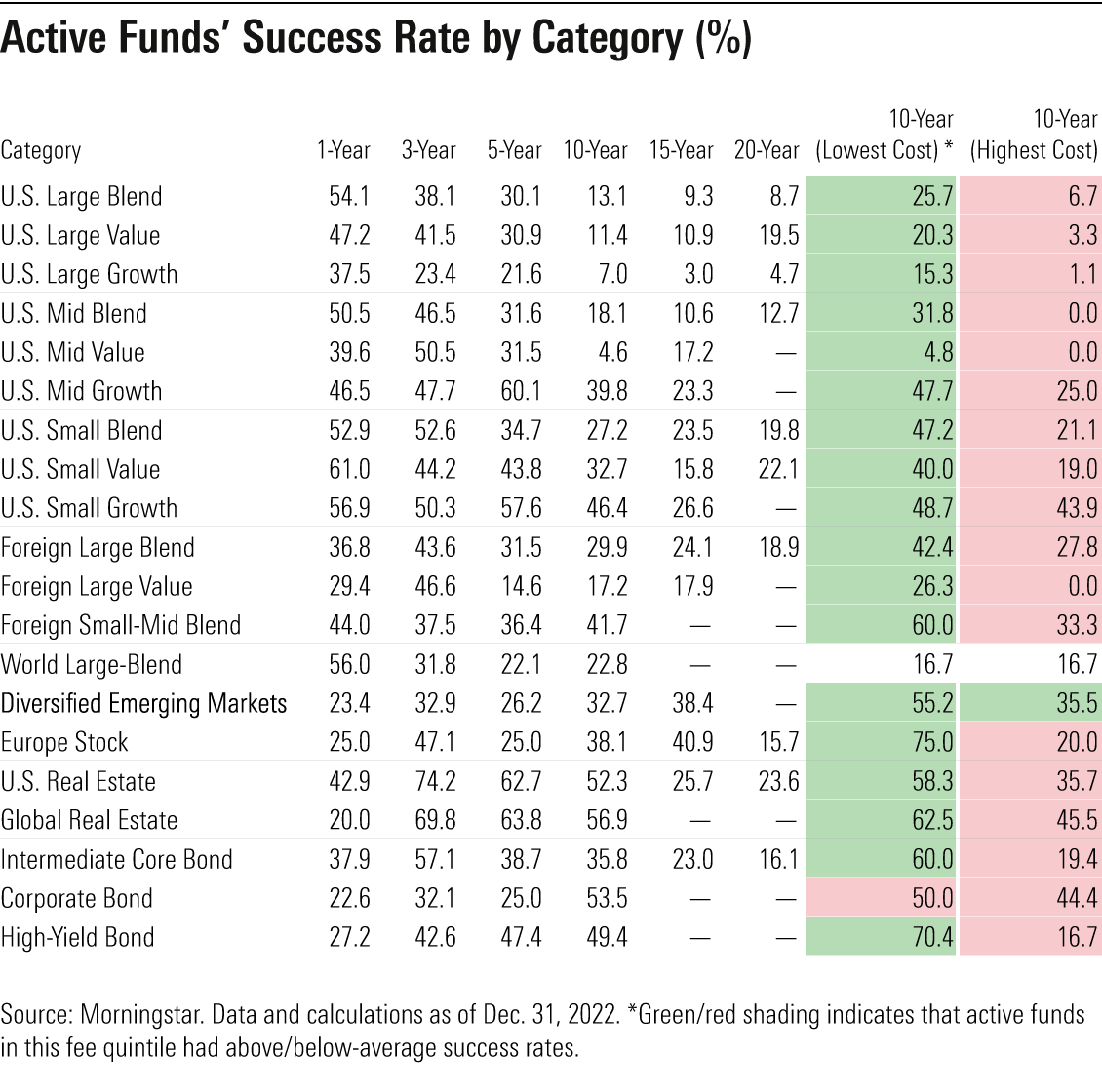

Active Managers Struggle

Using data from Morningstar, look at the returns of active managers in aggregate. Only one asset class (U.S. real estate) has more than 50% of active managers outperforming their benchmarks over the past 10 years.

In short, most active managers struggle to beat their indexes.

It’s Hard to Pick the Few Outperformers

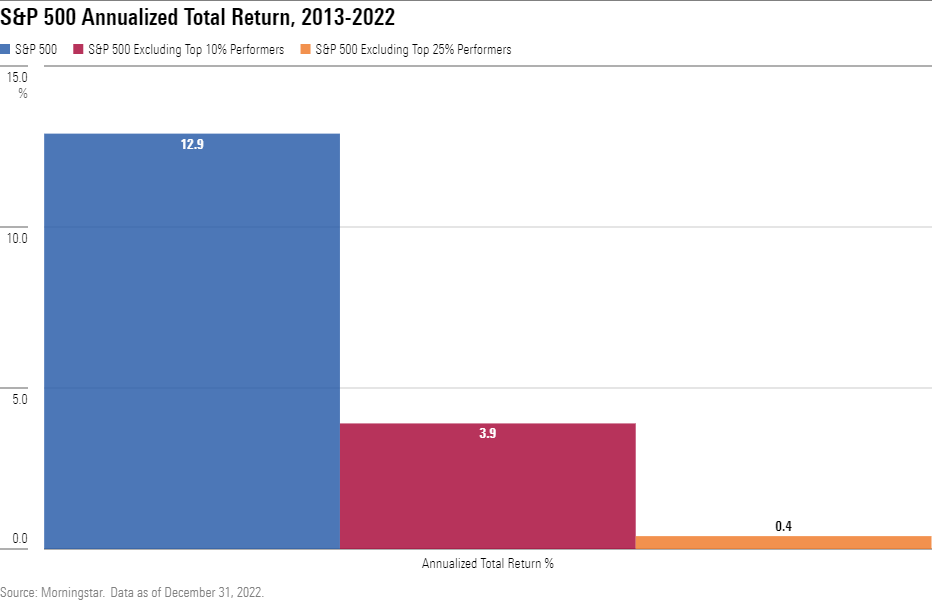

The reason it’s so hard to outperform a benchmark is because the biggest returns come from so few stocks. If you don’t own those few outperformers, there’s little chance to beat the index.

For the decade that ended last year, missing just the top 10% of performers each year in the S&P 500 takes the annualized performance of the index down to 3.9% from 12.6%. And if you remove the top 25% of performers, performance falls to roughly 0%.

Note: The index shown above is unmanaged and not available for direct investment. This study looks at individual stock returns by year and excludes the returns of the top 10% (red) and top 25% (orange) of stocks in the index.

Research from Hendrik Bessembinder, a business professor at Arizona State University, evaluated the lifetime returns of every U.S. common stock traded on U.S. exchanges since 1926. He found a similar result—albeit more extensive—that only 86 stocks accounted for half of the stock market’s total wealth creation over the past 90 years.

Further, all the wealth creation can be attributed to the 1,000 top-performing stocks, while the remaining 96% of stocks collectively matched the return of one-month T-bills.

The lesson is simple: If you don’t own the best-performing stocks, it’s virtually impossible to beat an index.

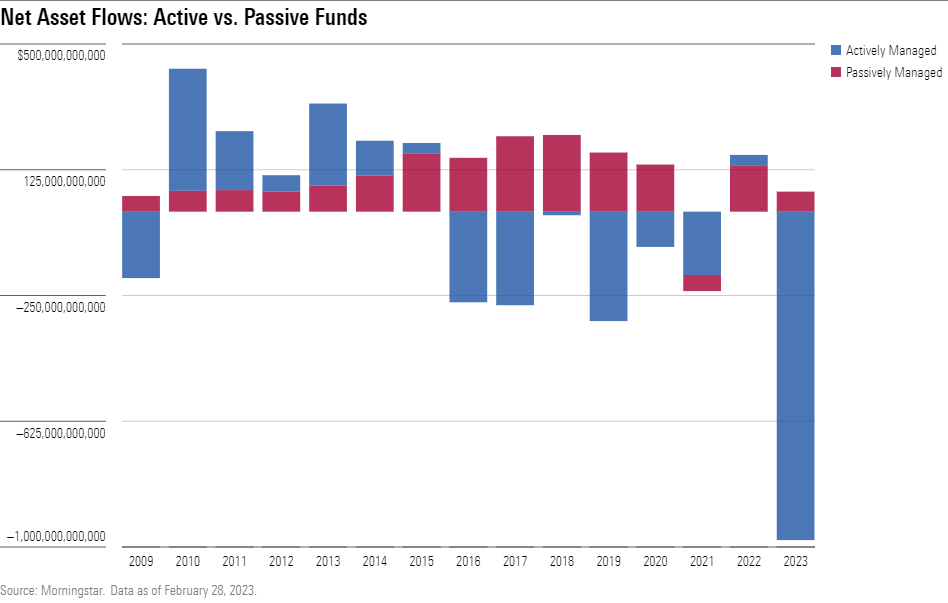

Investors Choose Index Funds

The result? More money is flowing into low-cost index funds.

Since 2014, net flows into passively managed funds (mostly exchange-traded-funds) have outpaced actively managed funds. And the rate of flows into passively managed products continues to accelerate.

During his long investing career, Buffett has internalized most of this data. Which is why his most common advice to investors is one simple tip:

“Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.”

Find the Right Mix of Investments

None of this is to say indexing is perfect or easy. Rather, it’s a good place to start and likely the most practical advice for most investors.

It certainly doesn’t have to be all or nothing; there is room for active and passive in a diversified portfolio. Owning stocks can be fun and rewarding in a way that index funds can’t replicate.

But the point remains, there’s not a new stock to be purchased every day. The truly great opportunities only come around so often. The most important thing is deciding what mix is right for you and sticking with it!

After all, the big money is not made in the buying and selling.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)