2023 Proxy Season: What to Expect for Climate Resolutions

During proxy season, every week is Earth Week.

The third week of April may be known as Earth Week, but it also coincides with the start of proxy season. Shareholder meetings for thousands of companies will take place around the world over the coming weeks, and investors will make important voting decisions on a range of governance and sustainability themes.

This year, as in previous years, climate change features high on the agenda.

As the Global Temperature Rises, So Does Investor Scrutiny

Scientists continue to warn that time is running out to reduce greenhouse gas emissions to limit the effects of global warming. Naturally, investors see a warming planet as a major investment risk, so they are demanding better disclosure on what the risks are and how companies are taking action to mitigate them.

As a result, we’ve seen rapid growth in the number of resolutions on climate at shareholder meetings.

Regulatory standards that determine how companies inform investors about climate risk are still being established, both in the United States and internationally. Without those standards, shareholder resolutions are key to helping investors access the information they need to assess climate risk in their portfolios.

Investors selecting funds can also analyze asset managers’ voting decisions on climate matters to determine which managers’ sustainability stance is best aligned with their own.

The Rapid Rise of Shareholder Resolutions on Climate

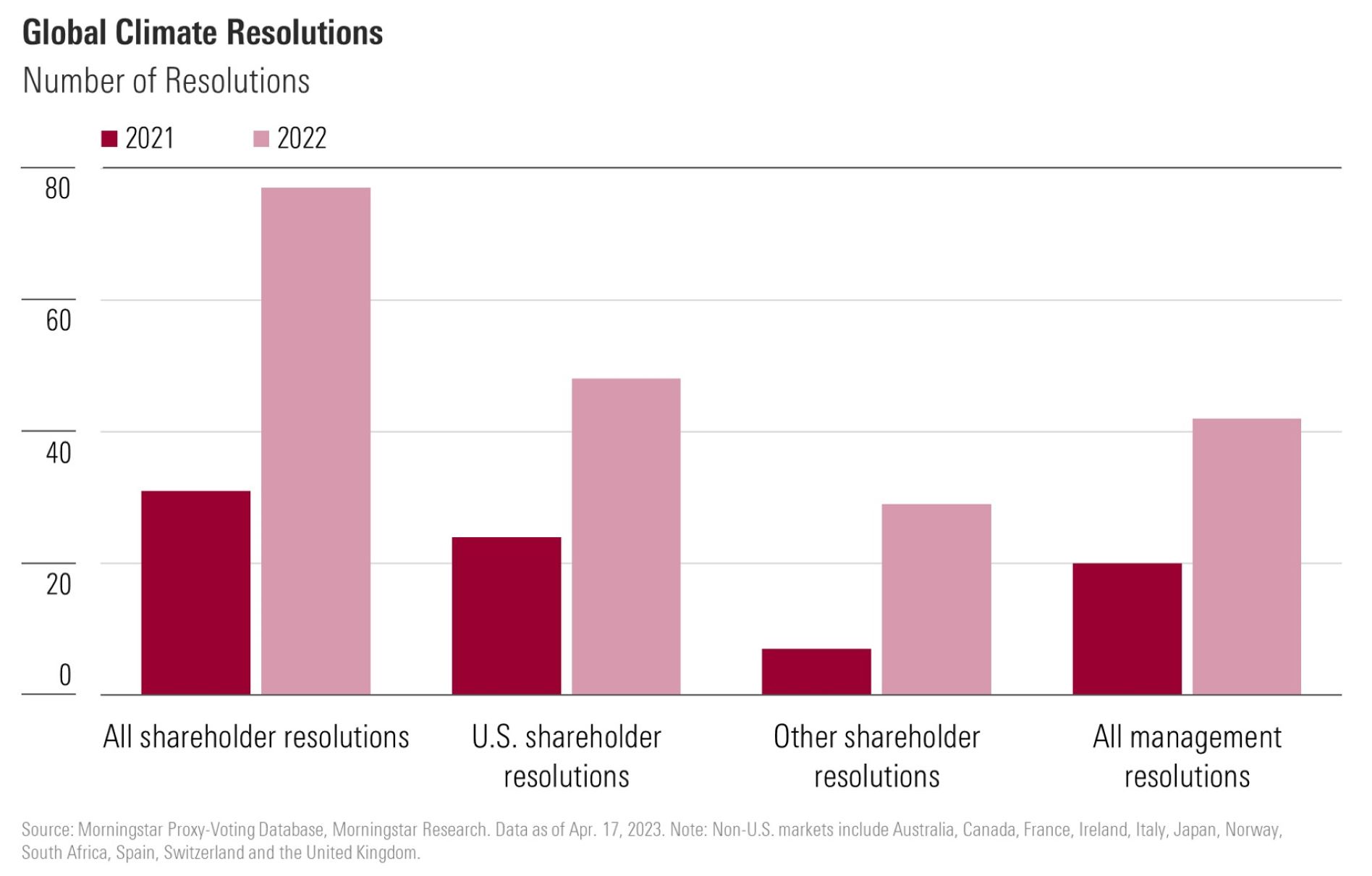

As the chart below shows, shareholder resolutions on climate started appearing in earnest in 2021, when 31 such resolutions were voted on. This number more than doubled to 77 in 2022.

Most shareholder resolutions globally are filed in the United States and climate resolutions are no exception. However, we noted 29 such resolutions in major markets outside the U.S. in 2022, a steep rise from seven the previous year.

For the most part, these shareholder resolutions request that companies set targets for reducing greenhouse gas emissions and implement governance structures and reporting processes that allow investors to evaluate climate-related risks and opportunities.

Still, shareholder resolutions are not the whole story. Our analysis tracked 62 “say-on-climate” resolutions over the last two years, 42 of which were voted on in 2022. These resolutions are filed by management and request shareholder approval of companies’ climate strategy and reporting. Unlike shareholder resolutions, most management resolutions on climate are filed outside the U.S. To date, only two U.S. companies—Moody’s MCO and S&P Global SPGI—have submitted their climate plans to a shareholder vote.

Higher Expectations, Lower Support for Climate Resolutions in 2022

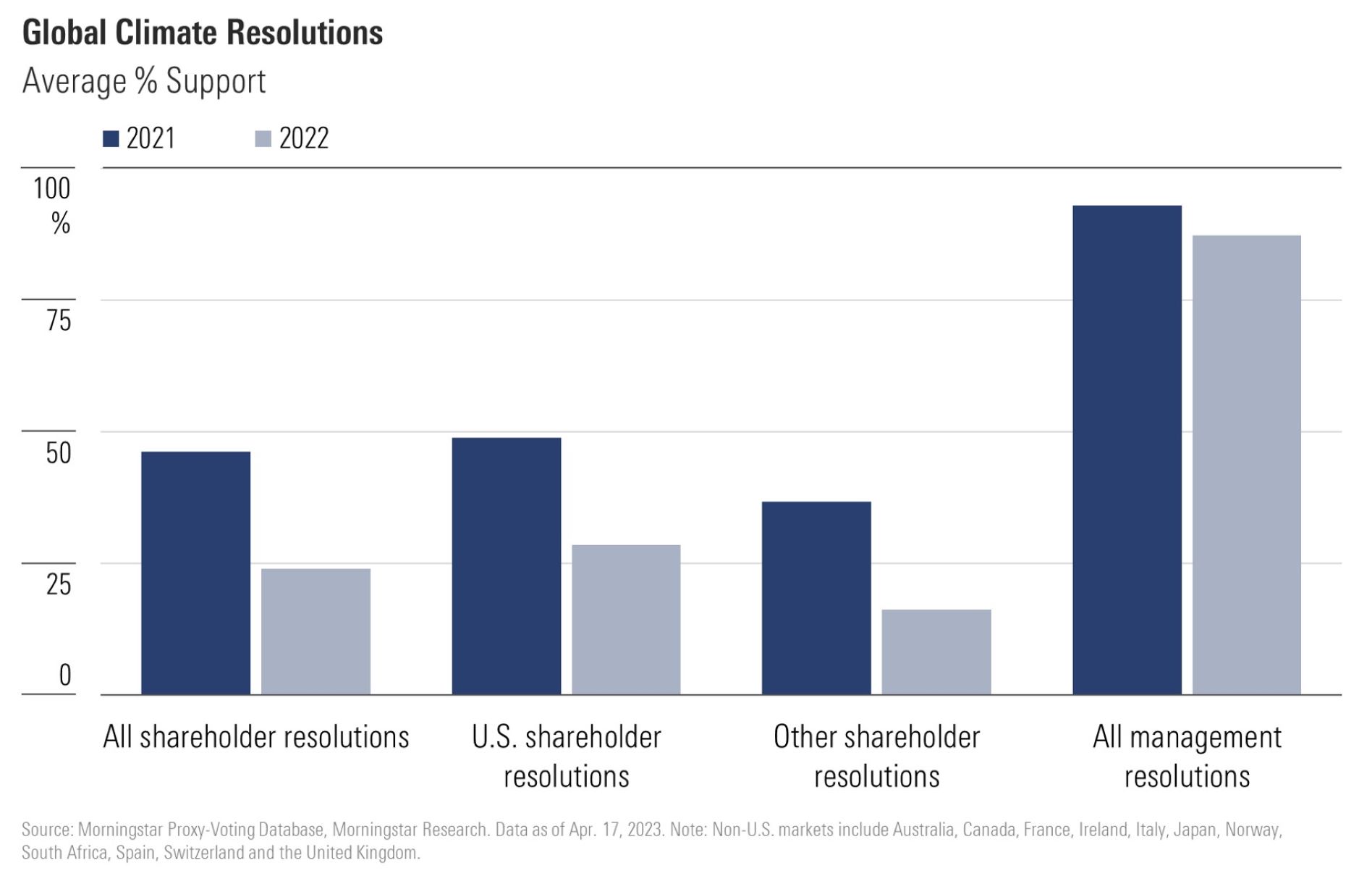

Amid significant growth in the volume of proposals, support for both management resolutions and shareholder resolutions on climate fell in 2022.

As the chart above shows, the average support for shareholder resolutions on climate fell to 24% in 2022 from 46% in 2021. The fall was attributable to a change in the nature and volume of such shareholder requests in 2022, which prompted shareholders to vote against them in larger numbers.

Namely, in 2021, most climate resolutions requested general target setting and reporting on climate matters, which many asset managers were comfortable with. However, in 2022, many more shareholder proposals requested very specific management actions of a strategic nature, including requests to quickly cease investment or financing for new fossil fuel assets. Many asset managers balked at such proposals, believing them to be unduly prescriptive and not in the interests of company shareholders. These proposals, of which there were 14, gained the support of only around 10% of shareholders in 2022 on average.

There was also lower support for management “say-on-climate” resolutions in 2022. With management proposals usually gaining well above 90% support from shareholders, the fall in support for these climate resolutions from 93% to 87% is significant.

These trends beg the question: Are asset managers softening their stance on climate change?

Diverging Investor Opinions on the Definition of ‘Good’

The short answer is no, but the landscape is becoming increasingly complicated. Asset managers have different ideas of what “good” looks like when it comes to action and disclosure on climate change, so clear communication has become more important than ever.

For example, an asset manager who votes against a management “say-on-climate” resolution is signaling that they want the company to do more—yet it’s not always clear exactly what. It could mean the manager is dissatisfied with the company’s climate strategy, or its reporting, or the governance and assurance around these matters, or all of the above.

Alternatively, a manager may decide to support a company’s climate plan even if they believe significant improvements are needed, taking the view that a barely adequate plan is better than nothing.

Without further explanation, it’s hard to say what message is being sent to the company by such voting decisions. That’s why it’s vitally important that asset managers disclose their rationale behind such votes.

Shareholder resolutions are also evolving in nature as we head into the 2023 proxy season, with some aiming to tackle different climate-related risks to those previously examined. For example, pending resolutions at Exxon Mobil XOM and Marathon Petroleum MPC seek more granular information on the costs borne by energy companies when they retire fossil fuel assets at the end of their useful lives.

Also, upcoming resolutions at BP BP, Shell SHEL, Chevron CVX, and TotalEnergies TTE, alongside Exxon Mobil, seek further action on scope 3 greenhouse gas emissions, which relate to emissions by businesses in these companies’ supply chains. This is an area in which asset managers hold a range of opinions, as scope 3 emissions are outside the direct control of company management by definition. U.S. managers are broadly more skeptical than European ones on the need for such reporting. It remains to be seen whether investors will back such calls or add them to the list of resolutions considered too prescriptive to support.

As proposals on climate and the environment continue to grow in number and complexity, it will be Earth Week every week this proxy season. But what comes of the increased emphasis on climate action remains to be seen.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3J75DKCBIZCTJMRFWSSJSHHCJ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)