Earth Day 2023: Can’t Plant a Tree? These 2 Lumber Stocks Score High on Sustainability

Forestry REITs Rayonier, Weyerhauser meet sustainable goals and look attractive for long-term investors.

We share Earth with nearly 3 trillion trees, whose benefits are massive. They suck carbon from the atmosphere, provide critical building materials, and even give us shade for a lovely summer walk (although this may be hard to remember in the depths of winter!). Trillions of trees may sound like a massive number, but authors at Nature estimate that this is only half as many as 12,000 years ago, and that we lose some 10 billion trees every year after cutting down 15 billion but only replanting 5 billion.

Earth Day 2023, on April 22, is a reminder for many to plant a tree to help combat climate change, or make a donation to a reforestation nonprofit. This type of charity is a great way to contribute, but it got me wondering: Could investors put their portfolios to work on this issue as well? Could we find stocks of responsible forest owners, that also offer attractive opportunities to earn a suitable rate of return?

Morningstar analysts cover two forestry REITs that fit the bill: Rayonier RYN and Weyerhaeuser WY. Both lumber stocks are well aligned with this mission, and importantly also trade at attractive discounts.

Why Invest in Lumber Stocks for Earth Day 2023?

Wood products are a backbone of our society. Ensuring that forestry land owners operate responsibly can help provide lumber for houses, pulp for paper, and fuel for cooking and heating, while also helping to preserve the environmental benefits of timberland.

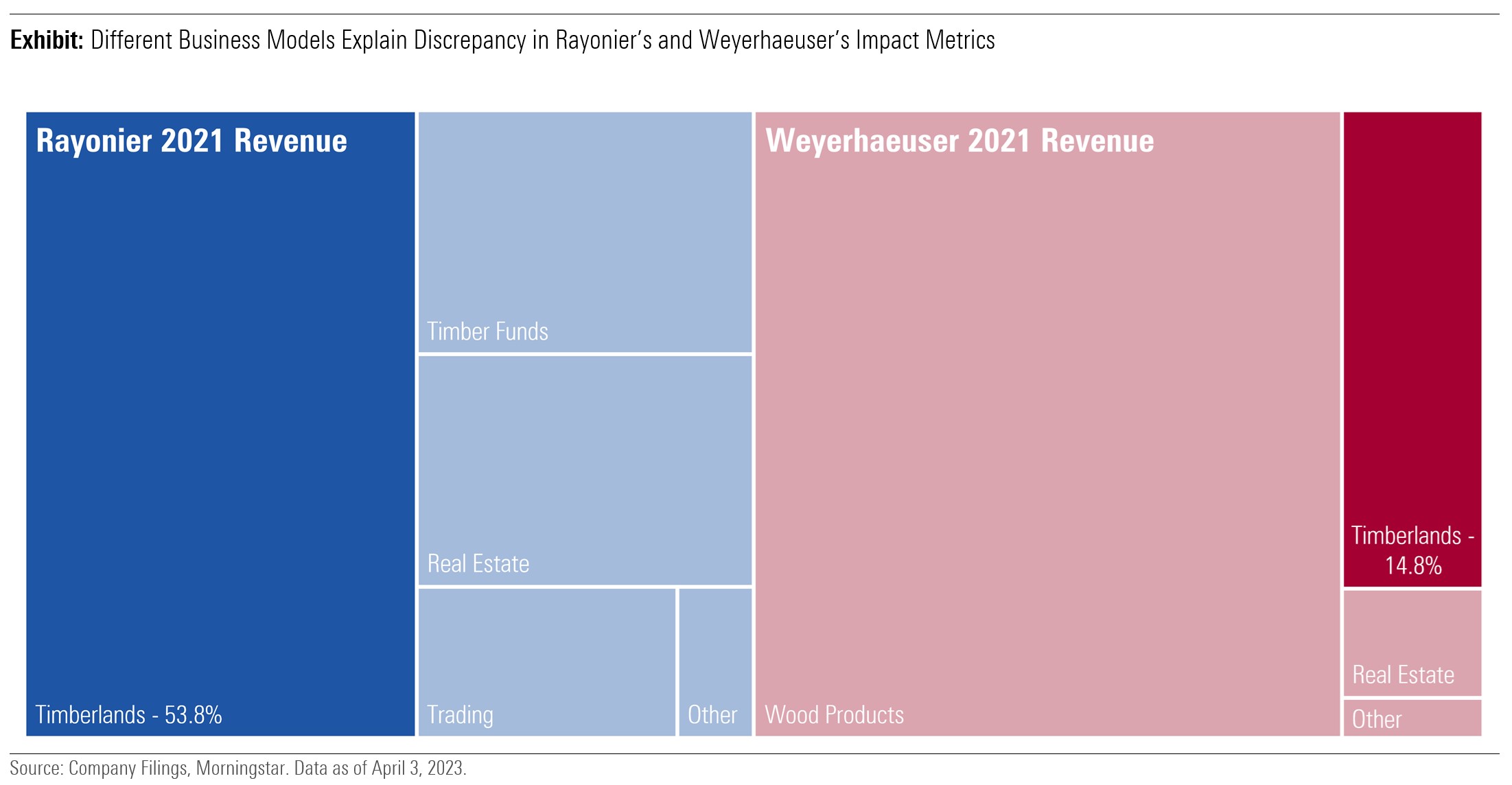

For investors seeking to focus their portfolios to companies driving positive impact, Sustainalytics estimates that each of Rayonier’s and Weyerhaeuser’s forestry businesses are well aligned with the Impact Themes of Resource Security and Healthy Ecosystems. Weyerhaeuser is estimated to have 14.8% of its 2021 revenue tied to activities that are aligned with these themes, while Rayonier’s aligned revenue is estimated to be even higher, at 51.7%.

While the headline numbers suggest a wide variance, the gap stems not from a measure of underlying sustainable quality, but the differences in the two companies’ business models. Both firms have other segments that contribute to the top line (such as real estate development for Rayonier, and engineered wood products for Weyerhaeuser), which aren’t relevant to the discussion of forestry sustainability. Sustainalytics estimates that all of Weyerhaeuser’s timberlands revenue in 2021 and the vast majority of Rayonier’s meet a sustainability criteria, but as the exhibit below shows, these segments contribute markedly different amounts to each company’s total revenue.

Supporting this sustainability measurement, both companies have received third-party certification for nearly all of their forestry practices, from the Sustainable Forestry Initiative for their North American acreage, and Forest Stewardship Council and Programme for the Endorsement of Forest Certification for Rayonier’s New Zealand forests. These certifications outline standards for conservation, water usage, pesticide usage, and biodiversity. Importantly, Rayonier and Weyerhaeuser both harvest only a low-single-digit percentage of their forests each year, helping to ensure their timberlands will remain long-lived assets.

Finally, while a focus on impact alignment may meet the preferences of some investors, it’s also important to point out neither company faces outsize environmental, social, or governance risk in our opinion. Rayonier is rated as facing Negligible ESG Risk by Sustainalytics, and Weyerhaeuser is assigned a Low ESG Risk Rating.

Rayonier and Weyerhaeuser Lumber Stocks Look Undervalued

On their investment merits, both Rayonier and Weyerhaeuser screen as attractive, trading at substantial discounts to our fair value estimates.

Weyerhaeuser is less directly tied to forestry assets than Rayonier, and faces greater macroeconomic sensitivity because its wood products division is tied to housing and construction. But this exposure could also drive higher medium-term earnings growth for the company as economic conditions rebound. Morningstar’s outlook reflects this. We forecast operating income for Weyerhaeuser growing at an annual rate of 8.7% from 2024-29, about 1 percentage point higher than our 7.6% yearly growth forecast for Rayonier over the same period.

In addition, Weyerhaeuser shares look slightly more attractive. While both companies trade substantially below our fair value estimate, the 21% discount for Weyerhaeuser offers a greater margin of safety than Rayonier’s 13% gap.

There Are Near-Term Risks, but Also Potential Upside From Carbon Capture

One caveat: both Rayonier and Weyerhaeuser operate in a commoditized industry. While timberlands can be immensely profitable when demand is strong, neither company has durable cost advantages that can protect profit margins in slower economic periods.

We’re entering one of those slower periods now, with our analysts expecting new home construction in the U.S. to decline materially in 2023. But we see the discount in each firm’s share price reflecting this near-term weakness.

More upside may come from the capture and control of carbon dioxide emissions. Historically, the most profitable use of forestry acres has been the sale of timber, and leases of the land for recreational or industrial purposes. But a relatively new revenue stream has captured the attention of investors: permanent carbon sequestration.

Carbon sequestration involves capturing carbon dioxide that is produced in industrial activities and storing it underground. Importantly, the carbon has no effect on the forest above it. In 2022, Weyerhaeuser announced agreements with Occidental OXY and Denbury DEN for the potential developments of carbon sequestration sites. These are some of the first agreements of their type, and will likely take some time to develop, so we don’t yet include any financial impact of these activities in our valuations. But longer term, carbon sequestration could be an attractive opportunity for both Weyerhaeuser and Rayonier to increase the environmental benefits of their timberlands, while creating value for shareholders beyond what we already estimate.

Convinced Investing in Lumber Stocks This Earth Day Is a Good Idea?

The forestry revenue of both Rayonier and Weyerhaeuser is well aligned with the mission of fighting climate change while also generating profits for shareholders, and the names trade at attractive discounts. Carbon capture projects could lend more juice to the stocks. While our analysts don’t believe either company has carved an economic moat, the current economic slowdown offers an opportunity for long-term-focused investors, in our view.

There are of course risks. In particular, our analysts expect housing starts will begin to rebound in 2024 as lower mortgage rates and home prices improve affordability and entice buyers back into the market, but this may prove too optimistic. However, with a sizable margin of safety to our fair value estimates, we see this risk as largely priced in at current prices.

Spencer Liberman, equity analyst, contributed to this piece.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)