Undervalued Communication Services Stocks

High-quality names including Comcast, Disney, and Alphabet still look cheap.

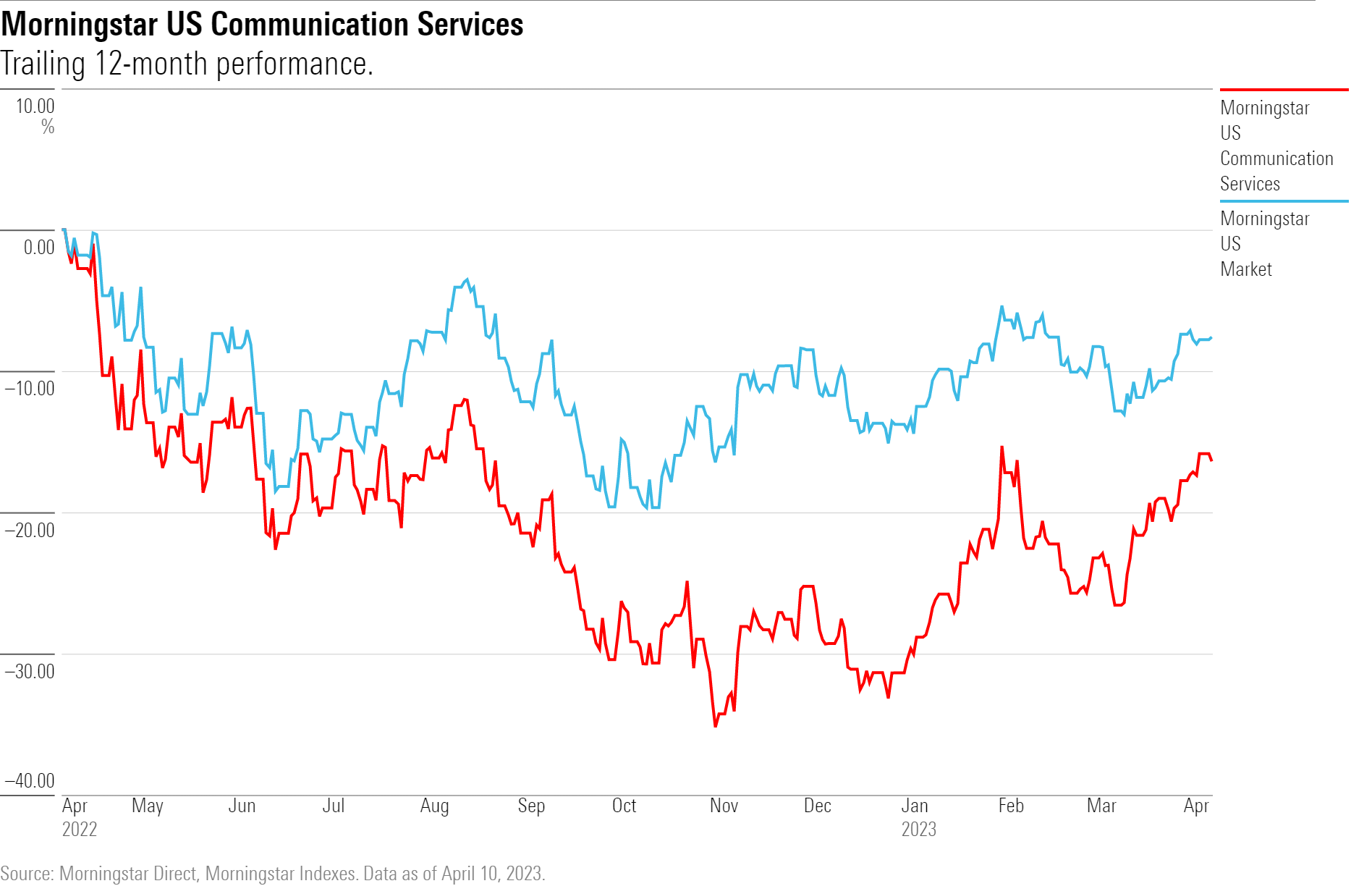

Communication services and telecom stocks are on an upturn after clocking in double- digit losses in 2022. Many of these stocks are trading at discounted prices, including familiar names like Google parent company Alphabet GOOGL and Facebook parent company Meta Platforms META.

To find undervalued communication services stocks, we screened the Morningstar US Communication Services Index, which measures the performance of U.S. companies that provide communication services using fixed-line networks or those that provide wireless access and services.

In 2023, the communication services index gained 21.8% through April 10 compared with the broader stock market, which is up 7.2% as measured by the Morningstar US Market Index. That’s a big reversal from calendar 2022, when the communication services sector index lost 40.9%.

There are 62 stocks in the Morningstar US Communication Services Index, 39 of which are covered by Morningstar analysts. Of those, 29 were considered undervalued as of April 10.

What is in the Morningstar US Communication Services Index?

The Morningstar US Communication Services Index consists of companies from seven different industries: advertising agencies, broadcasting, electronic gaming and multimedia, entertainment, internet content and information, publishing, and telecom services. Alphabet, Meta, and Verizon VZ are among the largest companies in this index.

Communication Services Stocks to Buy Now

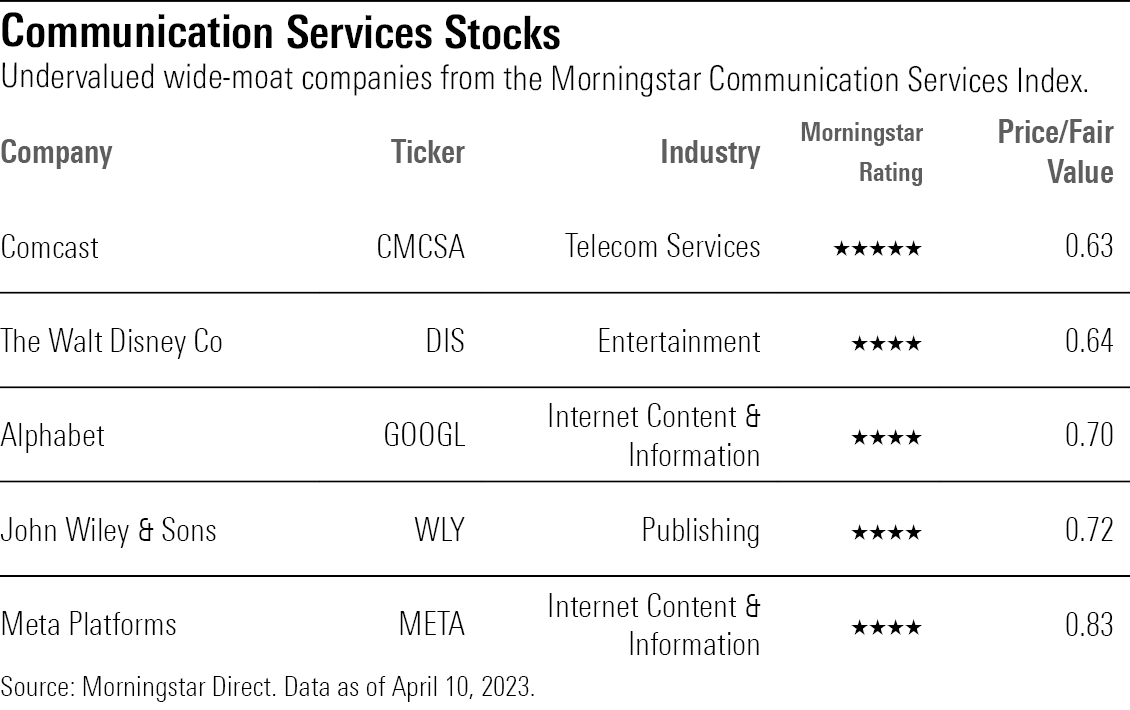

We looked for the most undervalued stocks in the Morningstar US Communication Services Index that currently carry a Morningstar Rating of 4 or 5 stars. Then we screened for stocks that have earned a Morningstar Economic Moat Rating of wide to screen for companies with competitive advantages. Historically, undervalued stocks with economic moats have performed better over time than less-profitable and more highly indebted counterparts. They also tend to protect against downturns and be less risky than lower-quality stocks.

These were the five most undervalued wide-moat stocks in the Morningstar US Communication Services Index as of April 10:

The most undervalued wide-moat stock was Comcast, which was trading at a 37% discount to the fair value estimate set by Morningstar equity analysts as of April 10. The least undervalued was Meta Platforms, which is trading 17% below its fair value estimate of $260.

Comcast

- Fair Value Estimate: $60

- Star Rating: 5

- Uncertainty Rating: Medium

- Economic Moat: Wide

“Comcast’s core cable business enjoys significant competitive advantages but will likely see growth slow as competition for incremental customers heats up. NBCUniversal isn’t as well positioned but holds unique assets, including core content franchises and theme parks, that should help ease the transition away from the traditional television business. Overall, we expect Comcast will deliver modest growth with strong cash flow for the foreseeable future.

“Comcast’s cable business has steadily gained broadband market share over its primary competitors, phone companies like AT&T T and Verizon, as high-quality internet access has become a staple utility.”

“With a network than can be upgraded at modest incremental cost, we expect Comcast will remain the dominant broadband provider in many parts of the country and compete well in areas where the phone companies are building fiber. The high margins on internet access should offset the decline in the traditional television business, where margins have plunged in recent years.”

— Michael Hodel, director

The Walt Disney Co

- Fair Value Estimate: $155

- Star Rating: 4

- Uncertainty Rating: High

- Economic Moat: Wide

“We believe Disney is successfully transforming its business to deal with the ongoing evolution of the media industry.

“The firm’s direct-to-consumer efforts, Disney+, Hotstar, Hulu, and ESPN+ are taking over as the drivers of long-term growth as the firm transitions to a streaming future. Streaming will benefit from the new content being created at Disney and Fox television and film studios as well as their deep franchise libraries. We expect that Disney+ will continue to leverage this content to create a large, valuable subscriber base. The return of Bob Iger as CEO is not likely to derail this streaming-focused future as he helped to design the strategy prior to leaving the firm.”

“Disney’s other components rely on the world-class Disney brand, sought after by children and trusted by parents. Over the past decade, Disney has demonstrated its ability to monetize its characters and franchises across multiple platforms—movies, home video, merchandising, theme parks, and even musicals. This stable of animated franchises will continue to grow as more movies get released by the animated studio and Pixar. Disney also has arranged the Marvel universe to create a series of interconnected films and product tie-ins. With the acquisition of Lucasfilm, the firm has positioned the Star Wars franchise in the same manner. Disney’s theme parks and resorts are almost impossible to replicate, especially considering the tie-ins with its franchises and other business lines. We expect Iger to on focus on fixing the customer complaints that have arisen since the reopening.”

— Neil Macker, senior equity analyst

Alphabet

- Fair Value Estimate: $154

- Star Rating: 4

- Uncertainty Rating: High

- Economic Moat: Wide

“Alphabet dominates the online search market with 80%-plus global share for Google, via which it generates strong revenue growth and cash flow. We expect continuing growth in the firm’s cash flow, as we remain confident that Google will maintain its leadership in search. We foresee YouTube contributing more to the firm’s top and bottom lines, and we view investments of some of that cash in moonshots as attractive. Whether they will generate positive returns remains to be seen, but they do present significant upside.

“Google’s ecosystem strengthens as its products are adopted by more users, making its online advertising services more attractive to advertisers and publishers and resulting in increased online ad revenue, which we think will continue to grow at double-digit rates after the pandemic and during the next five years. The firm utilizes technological innovation to improve the user experience in nearly all its Google offerings, while making the sale and purchase of ads efficient for publishers and advertisers. Adoption and usage of mobile devices has been increasing. The online advertising market has taken notice and is following its target audience onto the mobile platform. We have seen Google partake in this on the back of its Android mobile operating system’s growing market share, helping it drive revenue growth and maintain its leadership in the space.”

“We believe Alphabet holds significant intangible assets related to overall technological expertise in search algorithms and machine learning, as well as access to and accumulation of data that is deemed valuable to advertisers. We also believe that Google’s brand is a significant asset; “Google it” has become eponymous with searching, and regardless of actual technological competency, the firm’s search engine is perceived as being the most advanced in the industry.”

— Ali Mogharabi, senior equity analyst

John Wiley & Sons

- Fair Value Estimate: $53

- Star Rating: 4

- Uncertainty Rating: Medium

- Economic Moat: Wide

“With a journal unit consisting of must-have titles facing little direct competition, as well as deep relationships with academic institutions, researchers, and corporations, we believe Wiley has a wide economic moat. The switching costs inherent in its journal, online degree program management, and corporate learning efforts add to its standing. However, the ongoing shift away from educational books, particularly textbooks, leads us to believe Wiley’s position is deteriorating.”

“The academic and professional learning segment (31% of fiscal 2022 revenue) contains Wiley’s book and reference units, in addition to faster-growing course workflow, test preparation and certification, digital courseware, and corporate learning efforts. Book sales are slowing, particularly in education, where used and rental texts and alternative materials pose stiff competition. Still, we believe the segment’s other businesses leverage Wiley’s content library more durably.”

“In the research publishing and platforms segment (53% of fiscal 2022 revenue), the criticality of many of Wiley’s journal publications has secured the standing of the company’s offerings, while the relatively small audience for each individual title restricts upstarts’ ability to profitably develop a competitor.”

— Erin Lash, senior director

Meta Platforms

- Fair Value Estimate: $260

- Star Rating: 4

- Uncertainty Rating: High

- Economic Moat: Wide

“Meta’s Facebook is the largest social network in the world, with nearly 3 billion monthly active users. The growth in users and user engagement, along with the valuable data that they generate, makes Meta’s platforms attractive to advertisers. The combination of these valuable assets and our expectation that advertisers will continue shift their spending online bodes well for the firm’s top-line growth and cash flow.”

“Meta has attracted users and increased engagement by providing additional features and apps within its ecosystem. With more user interaction among friends and family, the sharing of videos and pictures, and the continuing expansion of the social graph, we believe the firm will steadily compile more data, which Meta and its advertising clients then use to launch online advertising campaigns targeting specific users. While utilization of consumer data is under scrutiny, we think Meta’s large audience size will still attract ad dollars. Growth in Meta’s average ad revenue per user indicates advertisers’ willingness to pay more for ads, as they expect high return on investment from these targeted efforts.

“We believe Meta will continue to benefit from an increased allocation of marketing and advertising dollars toward online advertising, more specifically social network and video ads where Meta is especially well positioned. The firm’s Facebook app, along with Instagram, Messenger, and WhatsApp, is among the world’s most widely used apps on both Android and iPhone smartphones.”

— Ali Mogharabi, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)