Converting Mutual Funds to ETFs: What to Make of the Trend

So far, a handful of converted funds have dominated the discussion.

Converting mutual funds to exchange-traded funds has become a growing trend in the investment industry over the past two years. More than three dozen of these conversions have popped up since early 2021, and more are on the way.

Conversions are one avenue that fund providers are taking to enter the ETF market and offer more tax-efficient investments, and they’re generally a step in the right direction for investors. Generally speaking, relatively little effort is required from the affected investors. The conversion is a tax-free event, and they get a more tax-efficient investment once the conversion is completed.

Despite the benefits to investors and the interest from fund providers, the process can be difficult, and it isn’t a one-size-fits-all solution to enter the ETF market. So far, the evidence suggests that switching to the ETF structure alone isn’t enough to guarantee that a fund will attract new investors.

How It Works

Most of the work to convert a mutual fund to an ETF falls on the shoulders of fund providers. A fund company should reach out to affected investors if it’s planning to convert a mutual fund to an ETF. In some instances, the mutual fund’s investors may have to cast a vote to approve the conversion, but that doesn’t apply to every situation. And investors without a brokerage account may have to open one to hold the subsequent ETF.

The conversion may come with unexpected changes. Investors can trade fractions of a mutual fund share, but they typically can’t do the same with an ETF. That means any partial shares may be returned to them as cash, which slightly reduces the size of their investment. Investors must also trade ETFs in a different way from mutual funds. ETF transactions are executed during the day rather than after markets close, but the process isn’t that difficult if investors follow some best practices.

The Right Stuff

While the process sounds straightforward for an investor, there is a considerable amount of work taking place behind the scenes. Asset managers have to file documents, get them approved, and make sure the fund’s investors have a brokerage account set up to handle the subsequent ETF position. They may also have to adapt their workflow and plug in to the primary markets that allow ETFs to trade throughout the day.

Given those hurdles, it’s worth understanding why asset managers would take on a potentially difficult endeavor. One major reason is that it makes a fund look more attractive to new investors. Mutual funds with tax-sensitive investors are among the most likely conversion candidates because the primary advantage of an ETF is its potential to reduce, if not eliminate, capital gains distributions and the associated taxes.

Access to mutual funds and the associated fees are another roadblock. Some investors use a third-party platform to tap into mutual funds rather than go directly through a mutual fund provider. Reaching investors through these channels comes with costs, and some mutual funds charge investors an annual 12b-1 fee to cover those expenses. Mutual funds that rely on 12b-1 fees to reach investors aren’t likely to be among those switching to the ETF format because that established network of providers is incentivized to keep it in the mutual fund structure. Likewise, funds that reach investors through a 401(k) program face some logistical hurdles, so they probably won’t be among those converting to an ETF. At present, most 401(k) plans use mutual funds or collective investment trusts to deliver investment portfolios to employees.

Accessing ETFs is somewhat easier and cheaper. They’re available to just about every investor with a brokerage account, and they typically don’t levy 12b-1 fees. Smaller mutual funds likely have more to gain from the greater accessibility as it could help struggling funds grow larger, increasing the likelihood that they stick around. Smaller funds are also less likely to be those offered through 401(k) plans.

Mutual fund providers have some trade-offs to consider when moving to the ETF structure, whether that’s through a conversion or some other means. Mutual funds provide managers with a way to ward off threats to a fund’s capacity, or the amount of money they can handle without ruining their performance edge. They can turn down new investors as a fund grows bigger and its ability to outperform a benchmark erodes. Converting to an ETF forfeits that option because ETFs don’t possess a mechanism to prevent new money from entering. Mutual funds that hold a wide universe of stocks, bonds, or other assets can handle larger sums of money, strengthening their case for conversion to an ETF.

Mutual funds offer another small advantage to some active managers. ETFs must disclose their holdings every day, while mutual funds show their cards only once per quarter. Some active managers may not be comfortable disclosing their positions daily, so they may opt to stay with the mutual fund structure. Nontransparent ETFs are a potential route around daily disclosures, but none of the converted ETFs have chosen to go down that road.

That framework helps inform the reasoning behind many of the ETF conversions from the past two years. Dimensional earns king-of-the-hill status for most funds and dollars converted. It converted seven mutual funds between mid-2021 and mid-2022 that collectively represented more than $44 billion. All seven were tax-managed mutual funds aimed at taxable accounts, so switching to a more tax-efficient vehicle made sense. All of these mutual funds were among the most broadly diversified in their respective Morningstar Category, meaning they can put new money to work in a wide range of stocks without threatening their long-term edge. Dimensional also works exclusively with a close-knit network of advisors and institutions to reach their clients, so none of these funds charged 12b-1 fees. Given this unique set of circumstances, Dimensional’s seven mutual funds were ideal candidates.

Four mutual funds from J.P. Morgan, with a combined $8.3 billion in assets, slotted in second place behind Dimensional. Unlike Dimensional’s mutual funds, all of the J.P. Morgan funds had share classes that charged 12b-1 fees, which they dropped after adopting the ETF structure. J.P. Morgan uses these funds as part of its SmartRetirement target-date series, so the firm has more control over the assets in these funds compared with others that are distributed across a wider investor base.

Outside of those 11 funds, Morningstar has confirmed an additional 28 mutual funds that have successfully made the jump to the ETF structure. They come from a variety of fund providers across a wide range of strategies. All are actively managed, and most are smaller in terms of the amount of money they oversee. The median size of these 28 remaining funds was about $40 million at the time they converted.

A Harsh Reality

Shedding the mutual fund structure for the tax efficiency and broad accessibility of an ETF sounds like an easy way to attract new investors. But mutual funds undertaking this transformation have stepped into one of the most competitive areas in the asset-management business.

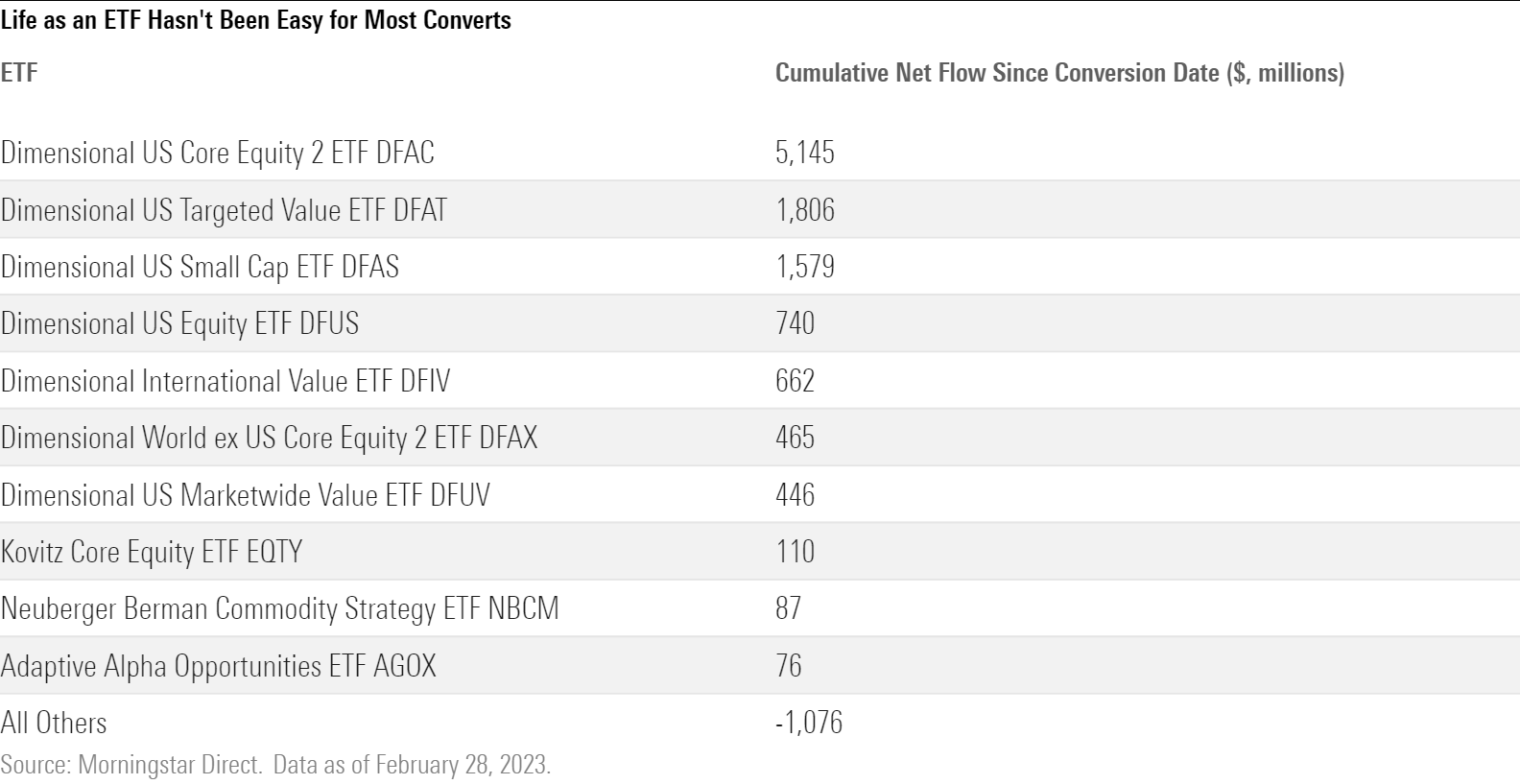

Net flows are one way to gauge interest in a fund and its success in attracting new investors. Morningstar Direct has net flows for 38 of the 39 funds that have converted. The table below shows the top 10 ETFs by cumulative net flows from their conversion date through the end of February 2023. Dimensional took the crown yet again. Its seven converted ETFs collectively hauled in just shy of $11 billion, pushing them to the top of the leaderboard.

The rest of the field has struggled. The bottom 28 funds collectively lost about $1 billion, with 16 of the 38 (42%) reporting outflows. One ETF, Cannabis Growth ETF, shut its doors in late April 2022 only seven months after converting. Switching to the ETF structure may improve tax efficiency, but it by no means guarantees that a fund will bring in new investors, let alone ensure its long-term viability.

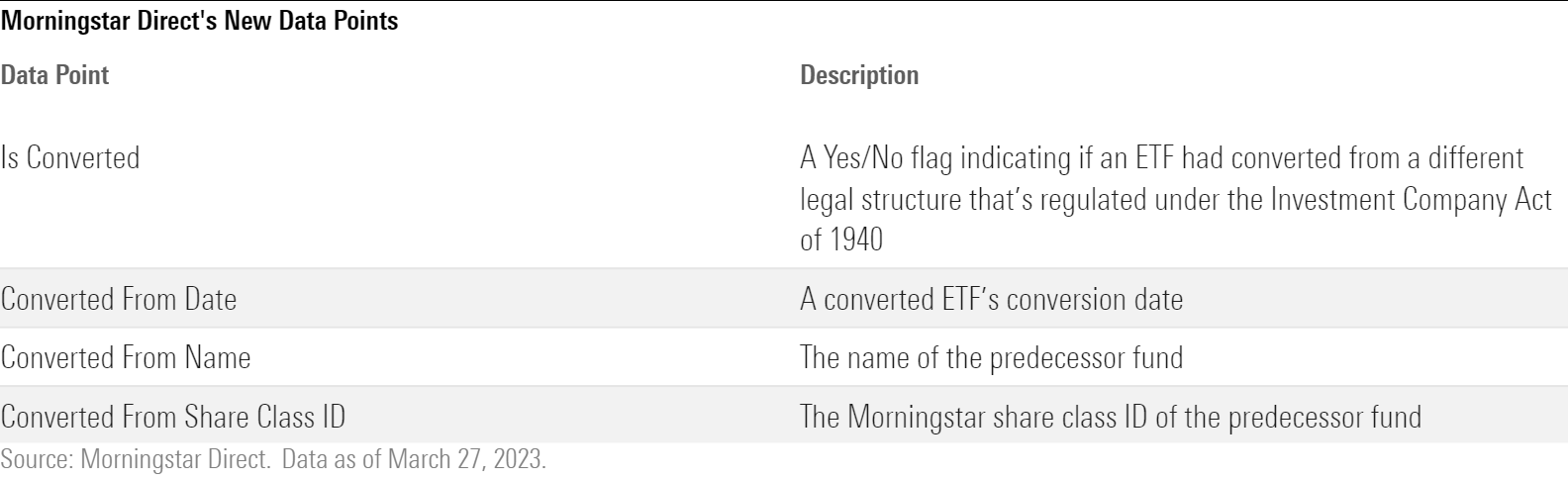

These 39 converted funds aren’t the end of the story. About 20 more mutual funds have stated their intention to convert to an ETF later this year, including some from major asset managers like Fidelity, J.P. Morgan, and Franklin. Morningstar Direct users have some new tools to identify converted funds and analyze their trends. Four new data points, shown in the table below, were recently added to aid the effort, and all can be used as search criteria. ETFs tagged as converted funds in Morningstar’s database are subject to verification through the appropriate SEC filings.

The limited success of these funds in gathering new assets speaks to the intense competition of the current ETF market. Part of the reason that Dimensional has proved more successful likely rests with the tight connection to its advisor-dominated client base. Its ETFs also have lower fees than many actively managed funds, and most are among the most diversified in their respective category, meaning they’re more appealing to a wider range of investors than many other ETFs and mutual funds available.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)