Basic Materials Stock Outlook: Sector Underperforms, Creating Opportunities Amid Decline

Companies that sell to less-cyclical end markets, such as food and beverage ingredients, should hold up fairly well.

The Morningstar US Basic Materials Index underperformed the broader market during the first quarter of 2023, by 278 basis points. The materials index increased 1.05% during the quarter, while the US Market Index was up 3.83%. We see a significant number of opportunities across the sector with the majority (65%) of the stocks trading in either 5-star or 4-star territory.

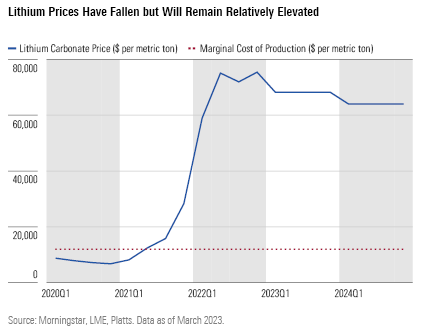

Demand for Lithium Will Only Increase

Lithium demand will more than triple by 2030 from 2022 largely due to increased electric vehicle adoption. Lithium spot prices have fallen 20% during the first quarter of the year, driven by a slowdown in demand growth and new supply. While the market, which was vastly undersupplied in 2022, has moved closer to balance, we see prices remaining high as demand grows throughout the year. As a result, lithium prices should be remaining well above the marginal cost of production, which we estimate to be $12,000 per metric ton. Based on our cross-price elasticity model, we forecast lithium prices will average over $60,000 per metric ton over the next couple of years, which should allow low-cost producers to generate excess returns.

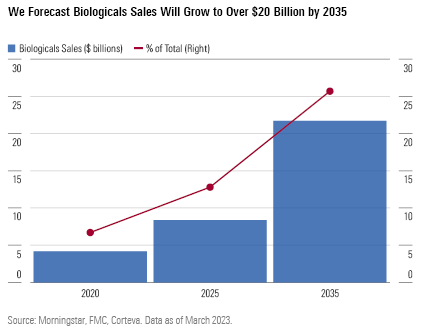

Demand for Biological Crop Protection Also Growing

In agriculture, demand for biological (nonsynthetic) crop protection products will grow rapidly. The increase will be driven by growing pest resistance to traditional products, which requires farmers to turn to new products, and regulations as more synthetic crop chemicals are banned. As a result, we expect the biologicals market will grow more than 5 times by 2035 from 2020 levels. These products will take market share from synthetic crop chemicals, growing to over 25% of the market.

Specialty chemicals producers are at risk to see profits decline in 2023 due to an economic slowdown. However, the impact will differ among companies because of varying end-market exposure. Companies that sell to less-cyclical end markets, such as food and beverage ingredients, should hold up fairly well in an economic slowdown.

Top Basic Materials Stock Picks

Lithium Americas Corp LAC

- Fair Value Estimate (USD): $56.00

- Star Rating: 5 Stars

- Uncertainty Rating: Very High

- Economic Moat Rating: None

No-moat Lithium Americas is our top pick to play higher sustained lithium prices. The stock trades at less than half of our $56 (CAD 88) per share fair value estimate. Lithium Americas does not currently produce any lithium but is developing three lithium resources that should enter production by the end of the decade, with the first resource entering production this year. Once all projects are fully ramped up, we forecast the company will become a top five producer by capacity globally. We reiterate our Very High Uncertainty Rating on the name due to elevated company-specific risk as a result of no projects currently operating. However, for long-term investors who can tolerate the volatility, we see massive upside in the stock and view it as one of the best ways to invest in higher lithium prices and growing EV adoption.

FMC Corp FMC

- Fair Value Estimate (USD): $140.00

- Star Rating: 4 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

Our top pick to invest in growing biologicals crop protection products is narrow-moat FMC. The stock trades at a nearly 15% discount to our $140 per share fair value estimate. FMC is a crop chemicals pure-play company that is investing heavily in the development of new biologicals products. As new biologicals products (which sell at premium prices) take share from traditional crop chemicals, FMC should see mid-single-digit revenue growth and mid- to high-single-digit profit growth as a result.

International Flavors & Fragrances Inc IFF

- Fair Value Estimate (USD): $140.00

- Star Rating: 5 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Wide

Our top specialty chemicals pick is wide-moat International Flavors and Fragrances. The stock trades at roughly a 40% discount to our $140 per share fair value estimate. IFF’s shares plunged following the company’s fourth-quarter earnings call as management guided to a low-single-digit profit decline in 2023, excluding divestitures. However, as IFF sells primarily to the food, beverage, healthcare, and pharmaceutical end markets, we see a lower risk of an economic impact that would lead to a significantly larger decline. Following 2023, we expect the company’s growth investments and cost-reduction plan to drive high-single-digit profit growth from 2024 to 2026.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)