Starbucks Investors Aren’t Unified on Unionization

Vote on workers’ rights at Starbucks showcases increasing focus on human capital matters.

The annual shareholder meeting at Starbucks SBUX marked a changing of the guard at the top of the coffee company, with Laxman Narasimhan taking over as CEO from founder Howard Schultz.

For sustainability-conscious investors, the meeting was equally significant because of a shareholder resolution on an important social theme. Specifically, the proposal sought an independent review of whether Starbucks’ management was upholding its workers’ rights to form or join a union.

A number of Starbucks’ workers have recently done exactly that. Since a store in Buffalo, New York, became the first Starbucks to unionize toward the end of 2021, more than 7,000 Starbucks workers across almost 300 locations have followed suit. The company has faced allegations of using aggressive tactics to suppress union activity at its stores—allegations that Schultz denied at a hearing on Capitol Hill last Wednesday.

The votes on the Starbucks resolution are important because they show that the rationale behind an asset manager’s vote can be as important as the vote itself. Particularly on resolutions dealing with social themes, understanding the rationale is a critical factor for investors trying to assess whether a manager’s sustainability stance matches their own.

Human Capital Issues Rise Up the Investor Agenda

Investors’ increasing focus on environmental, social, and governance topics is centered more and more on social themes. These include human capital issues like freedom of association and collective bargaining, which have grown important as rising inflation, rising interest rates, and lower job security put additional pressure on workers’ pocketbooks.

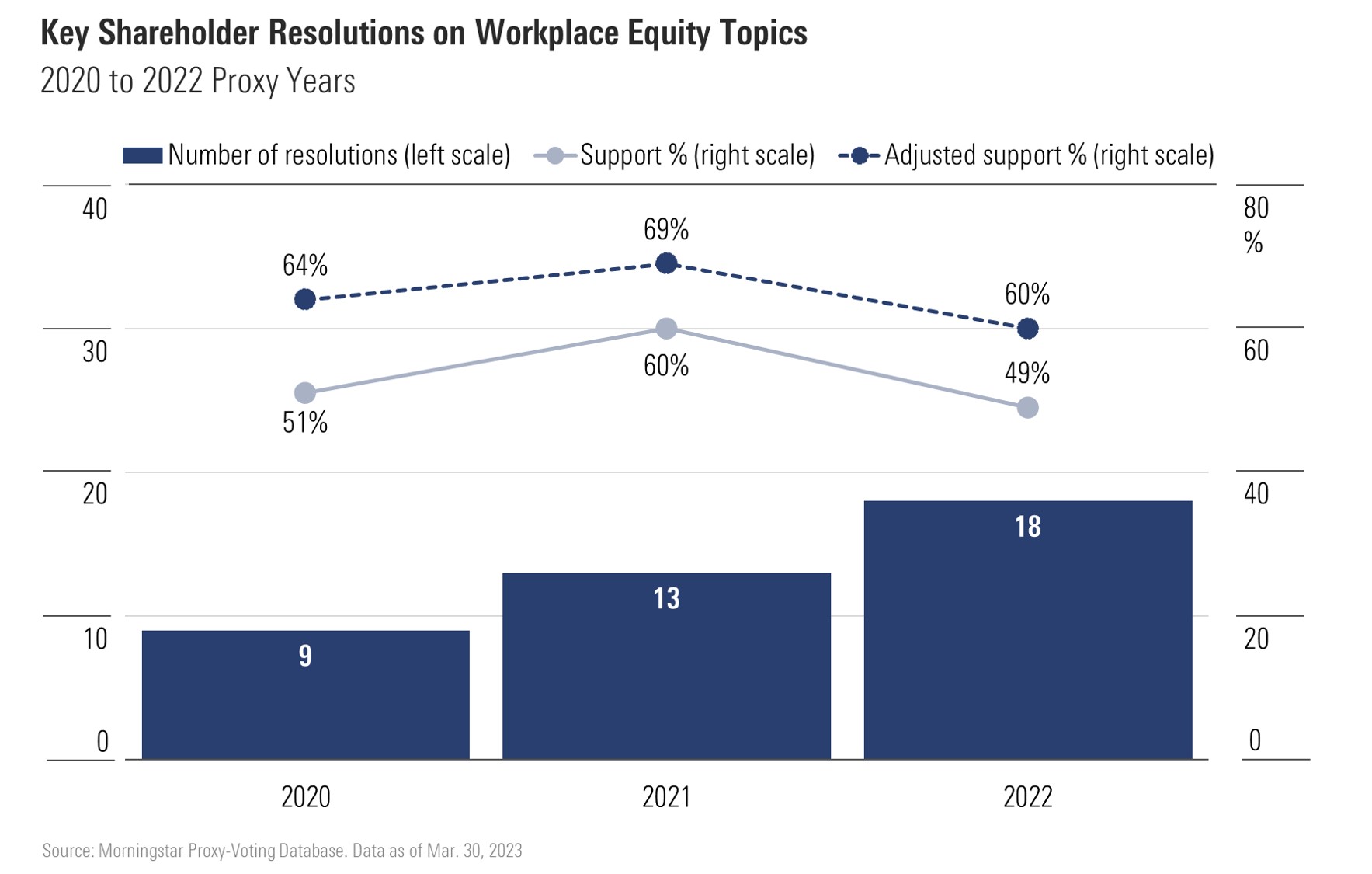

Human capital issues also cover themes such as workforce diversity, pay equity, and antiharassment and discrimination measures. We recently published a research paper on resolutions at U.S. companies that are well supported by independent shareholders, which we call “key resolutions.” Our research showed that the number of proposals on “workplace equity” themes has grown rapidly.

As the chart above shows, there were nine such proposals in the 2020 proxy year, doubling to 18 in the 2022 proxy year. (A proxy year is a 12-month period ended June 30, which aligns with the spring shareholder meeting season.) Over the three years, these shareholder resolutions were supported by a majority of voting shareholders (53%) on average, higher still if votes by company insiders such as directors and founders are excluded (as the adjusted support level indicates).

But why are such matters of interest to investors?

Investors hold a wide range of views, but they all tend to look at human capital issues from at least three perspectives:

- The strategic perspective considers the risk that a business could become unable to attract and retain the workforce it needs to be competitive.

- The compliance perspective considers the risk that a company may suffer penalties—formal sanctions and reputational damage—for failing to comply with relevant employment rules.

- The values-driven perspective is particularly relevant for sustainability-conscious investors and considers whether a company’s treatment of its workforce is aligned with their own views on what “fair treatment” looks like in practice.

Starbucks: Investors Split Down the Middle on Workers’ Rights

The proposal by a Starbucks investor requested “an independent, third-party assessment of Starbucks’ adherence to its stated commitment to workers’ freedom of association and collective bargaining rights” addressing “management non-interference when employees exercise their right to form or join a trade union.”

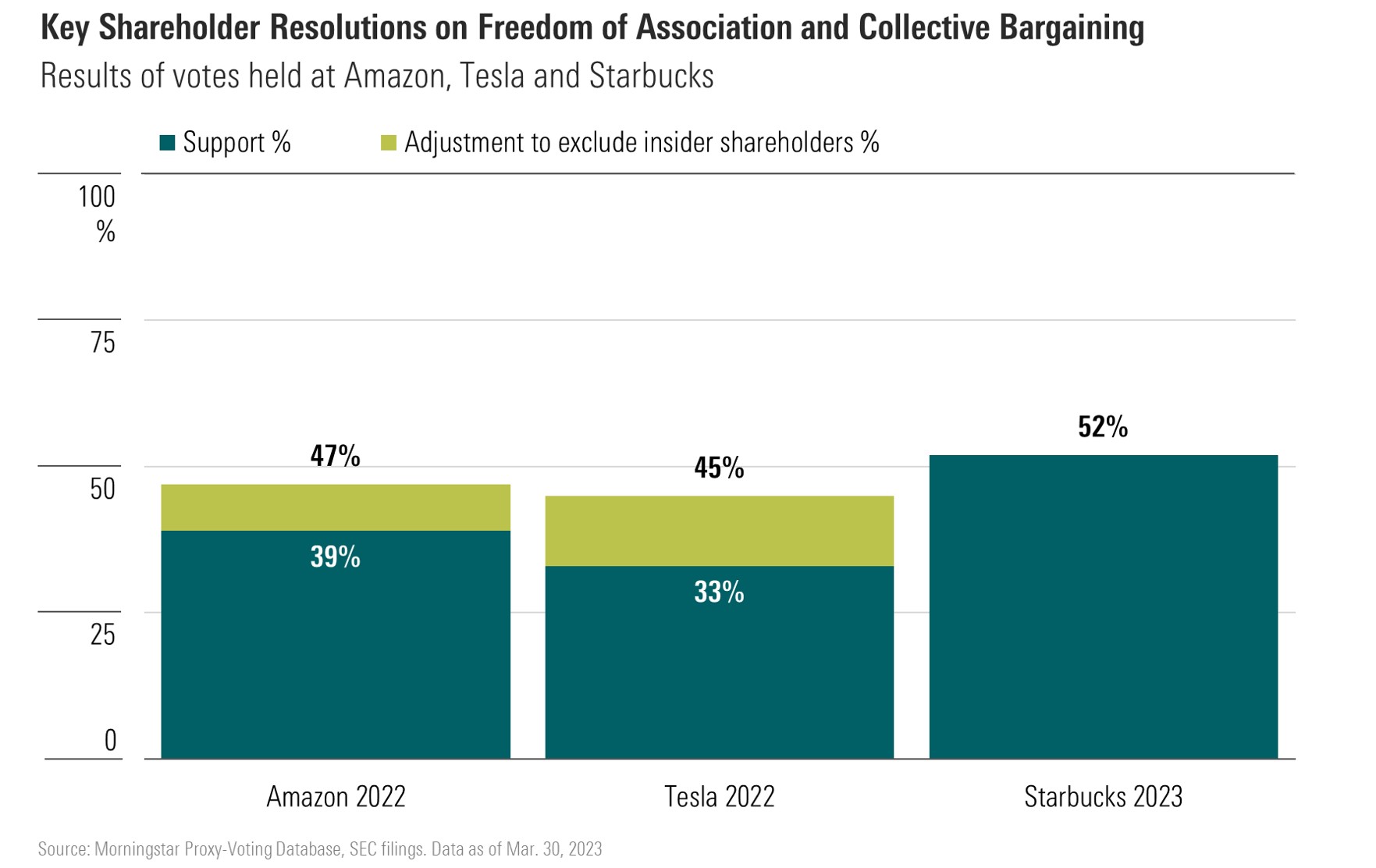

This proposal comes after similar resolutions at Amazon.com AMZN and Tesla TSLA last year, which each gained more than 45% support from independent shareholders. (We adjusted the votes to exclude significant shareholdings by founders and senior management at those companies, such as Jeff Bezos and Elon Musk.) Usually, 30% support for a shareholder resolution is seen as a strong prompt for management action on the topic being addressed.

Shareholder support for the proposal at Starbucks this year was higher at 52%, achieving an outright majority after gaining the backing of several large pension funds and asset managers. Even so, shareholders appear to be split down the middle when it comes to supporting shareholder resolutions on social issues like these.

Support for Social Resolutions: An Increasingly Nuanced Matter

Casting and interpreting voting decisions on sustainability-related themes is becoming an increasingly nuanced matter. These decisions have grown more complex because a growing proportion of ESG shareholder resolutions addresses social rather than environmental themes.

An investor’s decision on whether to support resolutions on emerging topics like unionization, reproductive rights, or other social issues is influenced by many things. This includes their standing voting policy on such issues, existing regulation, progress on engagement with a company, the ethical preferences of their investor base, and, of course, the voter’s perception of what’s in the best interests of investors.

You can see the nuances involved when you read U.K. asset manager LGIM’s rationale for supporting the resolution at Starbucks:

“A vote in favour is applied. This is despite an engagement with the company where the company provided sufficient information to suggest they respect employee’s rights to freedom of association and collective bargaining. The reason for supporting the resolution is because we believe Starbucks will benefit from having an independent assessment being carried out which will either clear them of any wrongdoing or help them to improve on their current practices.”

Similarly, Schroders SHNWF, a U.K. asset manager that predisclosed its intention to vote in favor of the resolution, states:

“Although the company has committed to respecting freedom of association, investors would benefit from greater clarity from an independent party on how this is embedded in the company’s everyday practices. This could provide greater understanding on how the company protects labour rights and minimizes reputational and legal risks, and is important to evaluating the company’s long-term sustainability.”

We are likely to see asset managers making similar finely balanced decisions in the future as the range of social topics addressed by shareholder resolutions widens further.

The proxy-voting landscape is becoming more complex. As a result, we increasingly expect asset managers to explain the thinking behind their voting decisions and to disclose how they voted. This is the only way to ensure that investors can make fully informed decisions on selecting managers with a sustainability stance that matches their own.

Correction: (April 6): An exhibit in a previous version of this article included an incorrect percentage for shareholder support for a proposal to assess Starbucks' commitment to workers' rights to unionize. The graphic has been updated with the correct figure.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)