Undervalued Utilities Stocks for 2023

Gas and electric stocks such as Duke Energy and NiSource are trading at discount prices.

Utilities stocks held strong through last year’s bear market, rising as nearly all other stock sectors logged double-digit losses. Investors took shelter in these dividend-paying gas and electric stocks, which are known for their defensive qualities and ability to hold steady in times of economic turmoil.

With their safe-haven qualities, the interest from investors drove up valuations on utilities stocks last year into expensive territory last summer. With the worst of the stock market selloff over at least for now, interest in utilities stocks has waned, but Morningstar analysts see the sector as fairly valued.

However, some utilities stocks have retreated into undervalued territory, making for attractive opportunities for long-term investors. Indiana-based regulated gas company NiSource NI and Louisiana-based electric power provider Entergy ETR are among the names trading at discounted prices.

“Utilities are names that will not disappoint. Businesses are very stable and not really subject to the ups and downs of the economy,” Raheel Siddiqui, a senior research analyst and managing director at Neuberger Berman, said late last year. “Utilities also have ‘great earnings quality.’ Earnings quality is insensitive to economic growth, utilities are that, they have all the right characteristics to be doing well in this environment.”

To screen for undervalued utilities stocks, we looked to the Morningstar US Utilities Index, which measures the performance of electric, gas, and water utilities.

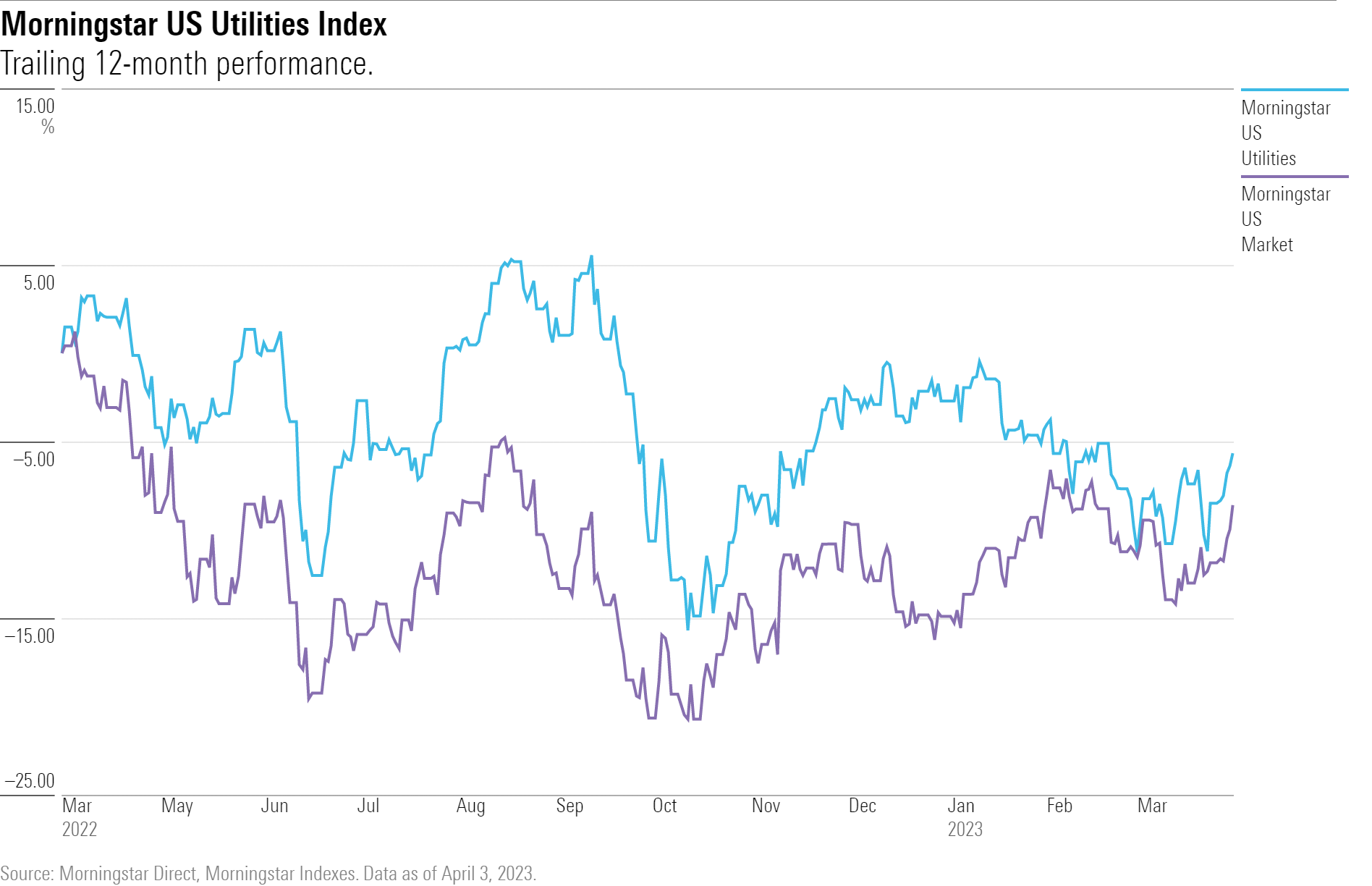

As of April 3, 2023, the index lost 5.7% for the trailing 12-month period, compared with the broader market, which fell 8.6% for the same period as measured by the Morningstar US Market Index. But since the start of 2023, the utilities index is down 3.8% while the stock market is up 7.7%.

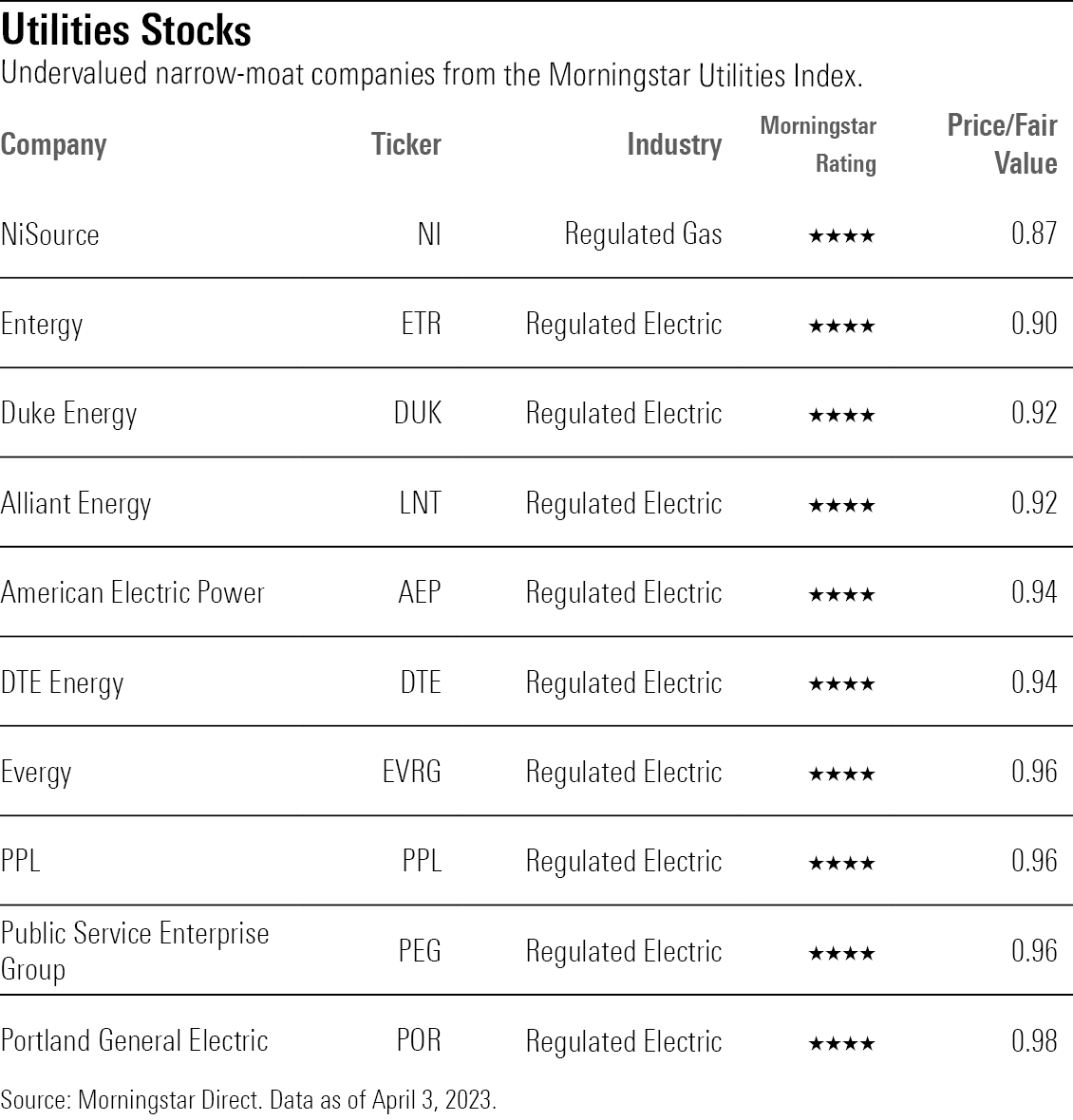

There are 58 stocks in the Morningstar US Utilities Index, 36 of which are covered by Morningstar equity analysts. Of those, 10 were considered undervalued as of April 3.

What’s in the Morningstar US Utilities Index?

The Morningstar US Utilities Index consists of companies from six different utilities industries: diversified, independent power, regulated electric, regulated gas, regulated water, and renewable. NextEra Energy NEE, Southern SO, and Sempra Energy SRE are among the largest companies in this index.

Utilities Stocks to Buy Now

We looked for the most undervalued stocks in the Morningstar US Utilities Index that currently carry a Morningstar Rating of 4 or 5 stars. Then we screened for stocks that have earned a Morningstar Economic Moat Rating of narrow in order to screen for companies with competitive advantages. Historically, undervalued stocks with economic moats have performed better over time than less-profitable and more highly indebted counterparts. They also tend to protect against downturns and be less risky than lower-quality stocks.

These were the 10 most undervalued narrow-moat stocks in the Morningstar US Utilities Index as of April 3:

- NiSource

- Entergy

- Duke Energy DUK

- Alliant Energy LNT

- American Electric Power AEP

- DTE Energy DTE

- Evergy EVRG

- PPL PPL

- Public Service Enterprise Group PEG

- Portland General Electric POR

The most undervalued narrow-moat stock was NiSource, which ended April 3 trading at a 13% discount to its fair value estimate set by Morningstar equity analysts. The least undervalued stock was Portland General Electric, trading at just 2% below its fair value estimate of $50.

NiSource

- Industry: Regulated Gas

- Stock Price: $27.96

- Fair Value Estimate: $32

“NiSource continues to transition away from its roots as a natural gas distribution and midstream company. An increasing focus on electric infrastructure and renewable energy will be a key growth driver in the coming years, creating a more even mix of earnings from its natural gas and electric businesses.”

“That growth could extend beyond 2025 based on electric and gas system infrastructure improvement projects NiSource has identified. Replacing steel and cast-iron pipe with plastic at its natural gas distribution utilities is a key initiative along with investments across the business that reduce greenhouse gases. Almost all of these investments receive favorable regulatory treatment, enhancing NiSource’s cash flow.”—Travis Miller, strategist

Entergy

- Industry: Regulated Electric

- Stock Price: $107.74

- Fair Value Estimate: $120

“In the last few years, Entergy has transformed itself into a mostly regulated utility, similar to many of its peers. It owned the second-largest U.S. nuclear fleet for nearly two decades with six plants in the Northeast and four rate-regulated plants in the Southeast. The plants in the Northeast at their peak earned more than Entergy’s rate-regulated utilities. But they became a financial drag as power prices fell and never rebounded.”

“We expect Entergy’s systemwide retail electric sales growth to top most U.S. utilities’ primarily due to industrial customer growth in the Mississippi Delta. This growth and the region’s increasing demand for renewable energy support our outlook for $5 billion of annual capital investment on average during the next four years.”—Travis Miller, strategist

Duke Energy

- Industry: Regulated Electric

- Stock Price: $96.47

- Fair Value Estimate: $105

“Duke Energy is one of the largest regulated utilities in the United States. Florida is Duke’s most constructive and attractive jurisdiction, with higher-than-average load growth and best-in-class regulation that allows for higher-than-average returns on equity, forward-looking rates, and automatic base-rate adjustments. We expect significant solar growth in the region and storm-hardening investments.”

“Regulatory risk remains the key uncertainty, particularly given Duke’s aggressive investment plans during the next several years. Much of the company’s success hinges on the relationships it has built through years of low power prices and excellent customer service. Duke’s regulatory exposure is diversified due to operations in multiple jurisdictions and its federally regulated transmission projects.”—Andrew Bischof, strategist

Alliant Energy

- Industry: Regulated Electric

- Stock Price: $53.40

- Fair Value Estimate: $58

“Interstate Power and Light, or IP&L, continues to build out renewable energy in Iowa. In addition to its significant wind generation in Iowa, for which the company earns a premium return on equity, the subsidiary now aims to install significant solar generation as well as distributed energy resources. We continue to believe Iowa offers ample renewable energy investment opportunities—both wind and solar—to support the utility’s Clean Energy Blueprint, which plans to eliminate all coal generation by 2040 and achieve net-zero carbon dioxide emissions by 2050.”

“Alliant benefits from operating in what we consider two of the most constructive regulatory jurisdictions. To maintain earned returns near allowed returns during this period of high investment, management has worked to reduced regulatory lag, received above-average allowed returns across its subsidiaries, and aims continue to reduce operating costs for the near term.”—Andrew Bischof, strategist

American Electric Power

- Industry: Regulated Electric

- Stock Price: $90.99

- Fair Value Estimate: $97

“Transmission investment is one of AEP’s most attractive long-term growth opportunities, given federal incentives to improve the efficiency of the U.S. power grid. Moaty transmission and distribution investments account for 65% of AEP’s five-year capital investment plan. We believe AEP is one of the best-positioned transmission developers in the U.S., given its large transmission footprint and history of execution. We think environmental regulations, aging infrastructure, and renewable energy growth support a long runway of growth at the unit.

“Regulators are now embracing renewable energy development across the company’s subsidiaries, providing significant growth opportunities beyond our five-year forecast. AEP expects nearly 50% of generation will come from wind, solar and battery storage by 2032, up from roughly 20% today.”—Andrew Bischof, strategist

DTE Energy

- Industry: Regulated Electric

- Stock Price: $109.54

- Fair Value Estimate: $116

“A decadelong transformation of Michigan’s utility regulation and DTE Energy’s business strategy sets up the company for a long runway of infrastructure growth opportunities.

“Michigan’s utility rate regulation has turned constructive for investors in recent years, resulting in support for earnings growth and investment at DTE Energy’s electric and gas utilities. We expect these narrow-moat utilities to contribute roughly 90% of DTE’s operating earnings after DTE spun off its gas midstream business in July 2021. Developments in DTE’s 2022 electric rate review suggest utility rate regulation in Michigan remains constructive, supporting DTE’s growth investments.”—Travis Miller, strategist

Evergy

- Industry: Regulated Electric

- Stock Price: $61.12

- Fair Value Estimate: $64

“Evergy management said it plans to direct all of Evergy’s growth capital to its regulated utilities at least through 2025. Senior leadership has extensive experience at companies with competitive power businesses, and we wouldn’t be surprised if Evergy directs some capital investment outside of the utilities, perhaps with a partner.

“Evergy has raised the dividend an average 6% annually during the three years since the merger. We expect the dividend to grow in line with earnings for the foreseeable future.”—Travis Miller, strategist

PPL

- Industry: Regulated Electric

- Stock Price: $27.79

- Fair Value Estimate: $29

“We expect PPL to spend more than $15 billion at its U.S. utilities through 2027. These regulated utility growth opportunities support our expectations for 7% annual earnings growth, in line with management’s 6%-8% earnings growth target through 2026.”

“Management allocated the remaining proceeds to additional regulated investment opportunities, strengthening the company’s balance sheet, stock repurchases, and dividend growth. Overall, we believe these capital allocation decisions were in the best interest of shareholders.”

“The company announced a strategic partnership with Elia Energy to provide offshore transmission solutions in the Northeast, with the potential for transmission investment opportunities beyond 2026.”—Andrew Bischof, strategist

Public Service Enterprise Group

- Industry: Regulated Electric

- Stock Price: $62.45

- Fair Value Estimate: $65

“PSEG’s exit from the wholesale power generation business in early 2022 reduces risk, improves its environmental profile, and should attract more income-oriented investors. Even though PSEG still owns three nuclear plants, we expect all of its growth will come from its rate-regulated utility in New Jersey. We expect the company to invest $18 billion in energy infrastructure and clean energy during the next five years, leading to 7% annual earnings growth.”

“State and federal regulators grant PSE&G exclusive rights to charge customers rates that allow it to earn a fair return on and return of the capital it invests to build, operate, and maintain its distribution networks. In exchange for PSE&G’s service territory monopolies, state and federal regulators set returns at levels that aim to minimize customer costs while offering fair returns for capital providers.”—Travis Miller, strategist

Portland General Electric

- Industry: Regulated Electric

- Stock Price: $48.89

- Fair Value Estimate: $50

“PGE’s growth investments show no signs of slowing. PGE has averaged $700 million of capital investment the last three years, a substantial increase from its previous annual run rate of capital investment. Large projects included the $160 million Wheatridge wind-solar-battery project and a $200 million operations center. We expect that investment rate to accelerate to more than $800 million annually and possibly higher if it wins projects like the $415 million Clearwater wind project.”

“Electricity demand growth in the region should reduce regulatory risk as the company transitions away from rate decoupling. PGE also benefits from renewable energy-specific ratemaking, reducing the need for lengthy base rate reviews.”

“Portland General’s ability to expand its rate base and grow earnings depends on its relationship with Oregon regulators as well as access to capital markets. Both of these factors have become more favorable for PGE based on recent regulatory activity.”—Travis Miller, strategist

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)