Investors Flood Money Market Funds in Search of Yield, Not Just Bank Worries

Money market funds see biggest influx of cash since the pandemic onset.

Investors have been pouring cash into money market funds, but unlike previous episodes, it doesn’t appear to be a signal of rampant fears about the outlook for the stock or bond markets.

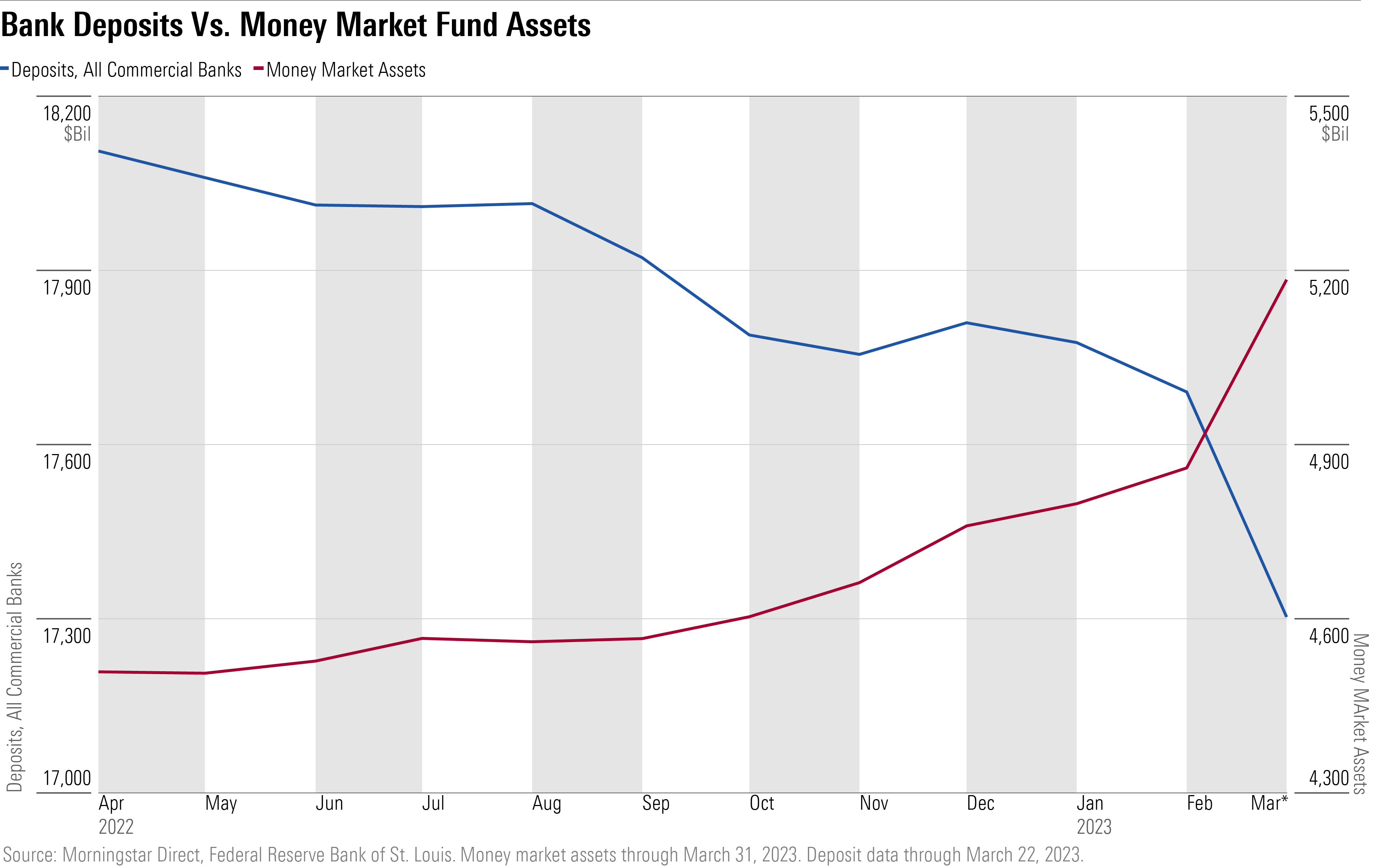

Instead, investors are moving cash out of lower-yielding bank accounts, a trend that was building even before the regional banking crisis spurred concerns among large depositors over the safety of their money.

However, the collapse of Silicon Valley Bank in early March, and growing pressure on other regional banks, gave the shift away from bank vaults and into money market mutual funds a significant boost.

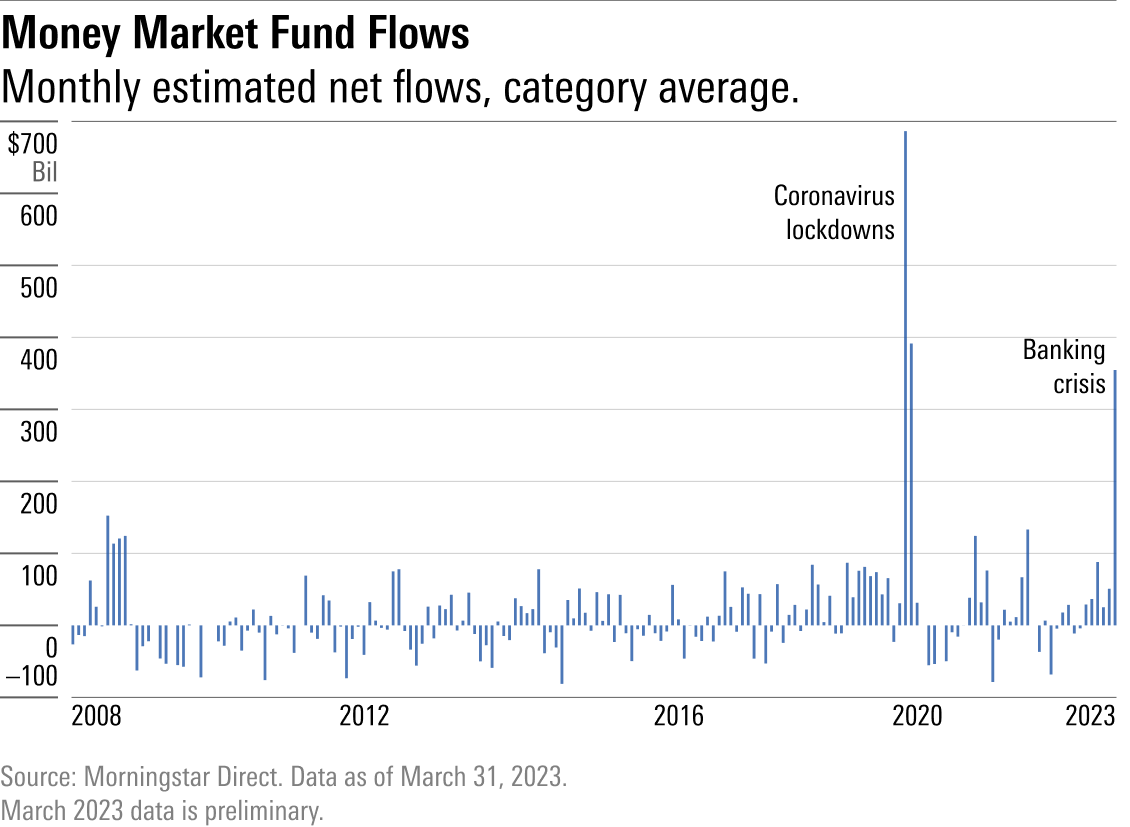

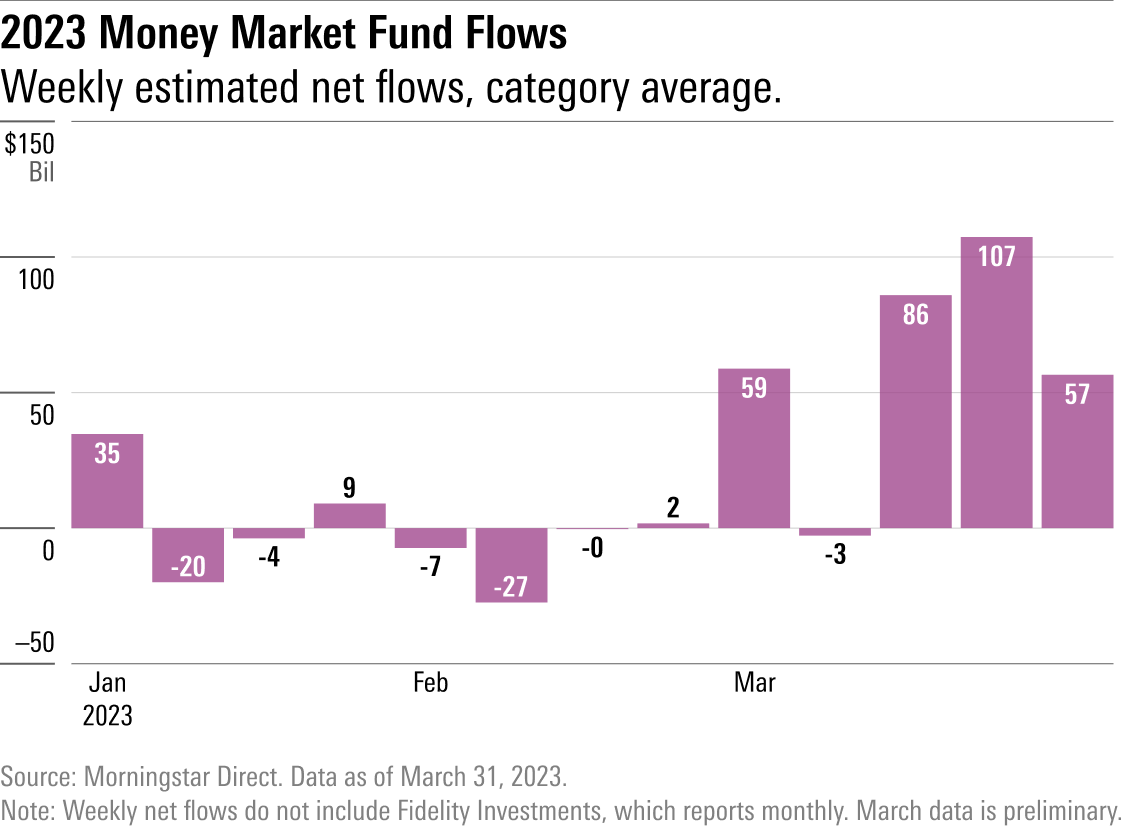

During March, investors moved roughly $355 billion into money market mutual funds, according to Morningstar Direct. In the first three months of 2023, investors shifted more than $430 billion into money market funds, the second-largest quarterly influx of cash to the group since 2007.

It is “impossible to tell for sure the psychology behind each withdrawal, but it seems pretty fair to say that recent events at least caused people and companies to take a harder look at their deposits,” says Morningstar equity strategist Eric Compton, who follows bank stocks.

The March jump in money market fund flows is largest monthly move into money market funds since the market turmoil that accompanied the start of the coronavirus pandemic.

In March 2020, $686 billion poured into money market funds, and in April of that year, investors moved $392 billion into money market funds. During that time the stock market fell sharply into a bear market and trading in many parts of the bond market became frozen.

Higher Yields Attracting Savers to Money Market Funds

It’s a different story today. While investors are worried about the economic outlook, and the regional banking crisis has caused jitters, the markets have been orderly. In fact, the stock market was able to move higher despite the pressures on regional banks.

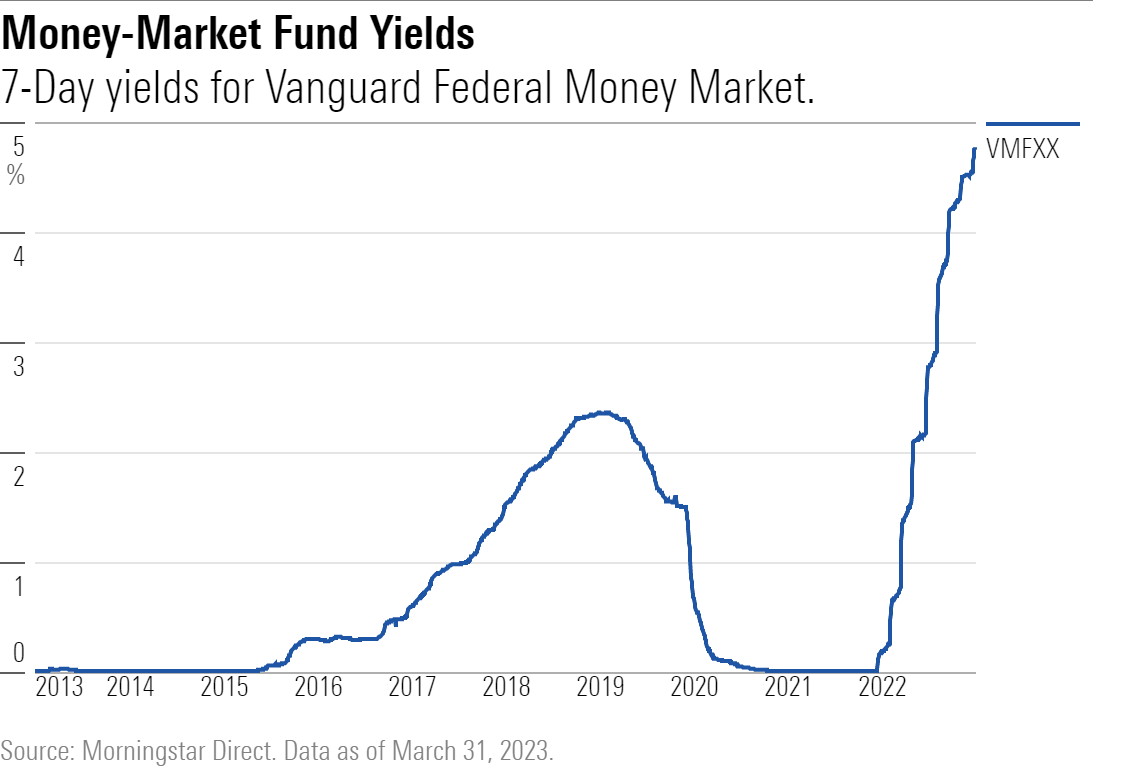

Instead, the shift into money funds appears to be fueled in part by savers hunting for higher yields.

“People are engaging in ‘cash sorting’ where they’re increasingly moving their cash from low-yielding accounts into higher-yielding accounts or financial products,” says Michael Wong, direct of equity research for financial services at Morningstar.

“With the average savings account yielding less than 0.5%, individuals can increase the yield on their cash by several hundred basis points by putting cash into CDs, U.S. Treasuries, or money market funds with the one-month Treasury bill rate at about 4.75%,” Wong says.

The previous record for money market fund flows came during the 2008 global financial crisis. That flight to money markets came amid investor panic as global stock markets plunged, and giant Wall Street firms and banks teetered, including Lehman Brothers, which collapsed in September of that year.

In 2008 investors moved $589 billion into the safety of money market funds. Measured on a so-called organic growth rate basis—the change as compared with the previous period’s assets—that equaled an increase of nearly 23%.

On that basis, the move into money funds in 2023 is relatively small at 9%. (Money market assets and flows are based on 963 of 1032 funds in existence and reporting as of the article date, representing $5.2 trillion in total assets.)

Still, given that money fund flows were essentially flat in 2022, the swing this year is notable. And the first-quarter organic growth rate still made for the fourth-largest quarterly inflows since 2007.

A Pre-Banking Crisis Move to Money Market Funds

The move to money market funds began even before the regional banking crisis made headlines in early March. At the end of last year, almost $90 billion flowed into money market funds in December. In January, inflows were $25 billion, and nearly $52 billion in February.

These flows reflected the gravitational pull of higher yields. Take the Vanguard Federal Money Market Fund VMFXX. In March 22, the yield on the fund was essentially zero. By mid-December it was approaching 4%. The $229 billion fund—which has taken in $12 billion this year—is yielding around 4.8%

“You had money market yields rising along, but this banking crisis appears to have turbocharged the trend,” into money market funds, says Eric Jacobson, director of manager research at Morningstar.

“There’s a natural dynamic happening here,” says Jacobson. “When short-term interest rates are super super-low and you can’t make a lot of money in money markets, there’s generally a preference for bank deposits over money markets at that point.” The reason: Bank deposits are considered safer because of the FDIC, which guarantees bank accounts up to $250,000.

“If money market yields are almost nothing and bank interest is almost nothing, then no reason to move out of bank accounts,” says Jacobson. “But when interest rates go up, as long as a money market fund is relatively cheap (in terms of expenses), you’re going to earn a little more in a money market fund than you will in a bank deposit. And when money market yields are going up pretty quickly, they become more attractive in general. Bank interest rates don’t often jump the way that money market yields do. Money market yields are more generous.”

With the collapse of Silicon Valley Bank, when clients of the bank were threatened with the loss of deposits in accounts above the FDIC limit, that sent a scare through the ranks of regional bank clients.

Morningstar’s Wong offers reassurance to savers. “Most depositors have little to fear, as they’re under the $250,000 limit for individuals or $500,000 for couples or joint accounts,” he says. “For clients of wealth management firms and brokerages, depending on the firm’s policies, an individual may be FDIC-insured for significantly more than $250,000, as the wealth management firm or brokerage distributes clients’ cash among multiple banks. For example, Charles Schwab has three bank subsidiaries, so an individual with Charles Schwab can have up to $750,000 of cash protected by the FDIC.”

Still, Compton notes that the banking industry has lost roughly $500 billion in deposits from December through March 22, or roughly 3%. “So, it’s something, but not a true run on the entire banking sector. It’s there but it appears to be manageable.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)